Millennials are Committed to Paying Off Their Debt Payment Plans. Not So Much for Gen Z

About Anouare

Anouare is a seasoned writer, editor and content strategist who started her career as a lifestyle journalist before stepping into leadership roles at publications such as AskMen and Goalcast. From editorial strategy to content marketing and project-management, she has tackled various challenges in digital media and discovered her passion for mentoring others in the process. She loves a good money mindset book and believes you can create your dream lifestyle by being yourself.

Read full bio

At a Glance

Remember the infamous article that criticized Millennials for buying overpriced avocado toast instead of saving up for a home? Have you ever rolled your eyes at travel photos thinking that the Millennials you follow must be living paycheck-to-paycheck or racking up debt to afford those Insta-perfect adventures? Well, despite all the clichés, Millennials are doing quite well when it comes to paying off debt. In fact, they are better at committing to debt payoff plans than Gen Z (though they seem to have an advantage if they are married with dependents.) Their methods vary, and they don’t necessarily feel amazing about their debt, but they are steadily working on decreasing it.

Key takeaway on debt payoff methods 2021:

- 29% of Millennials are in between various debt repayment methods but it’s working for them.

- 20% of Gen Z don’t have any plan in mind to deal with their debts compared to 14% of Gen X and Millennials.

- 20% of single people don’t have a plan for dealing with their debt, whereas only 10% of married people don’t have a plan.

- 39% of married people have a plan in mind to deal with debts but have not executed it yet

Millennials are Committed To Their Debt Payoff Plan

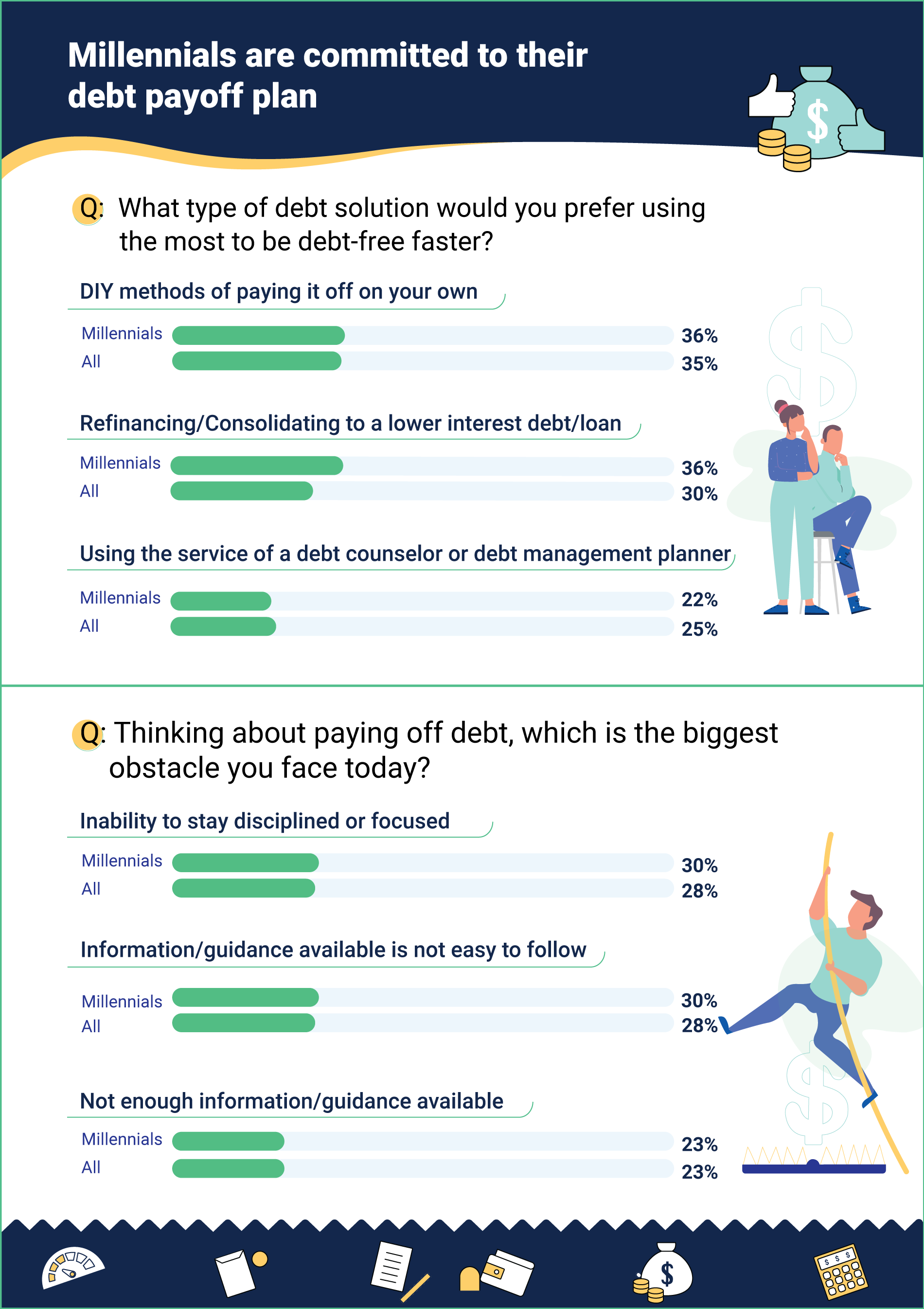

In a 2021 Credello survey of 1000 Americans of all ages, Millennials embraced various debt payment approaches. Thirty-six percent of Millennials favored DIY methods of paying off debt over any other debt payment solutions, and another 36% refinanced/consolidated debt to a lower-interest loan or credit card.

However, despite their dedication to paying off debt, Millennials sometimes feel ill-equipped to understand their options. 22% of them reported facing difficulties due to lack of proper guidance or information of debt repayment strategy in their debt payoff journey. And only 18% of Millennials are aware of a plan or debt repayment strategy, with 46% of respondents referring to an online source or turning to someone they know for advice. Financial advisors were one of the least popular sources of guidance, with only 21% of Millennials using one for debt repayment planning.

Child-free Millennials Are Less Concerned Than Their Parent Peers When it Comes to Paying Off Their Debt Faster

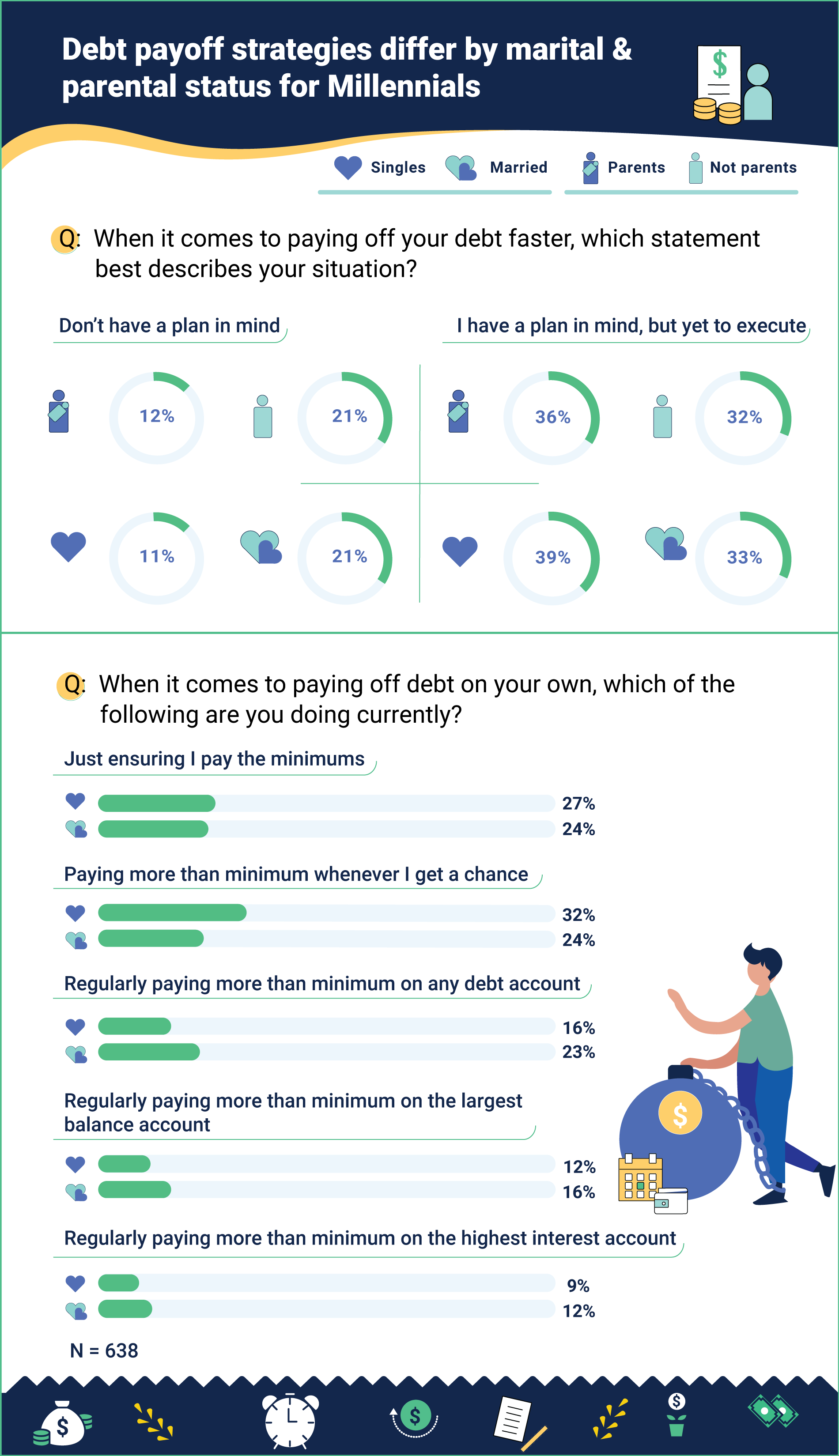

Unsurprisingly, having children ramps up the stakes when it comes to paying off debt. Child-free respondents are a whole lot less concerned than parents: Only 12% of people with children don’t have a plan for paying off their debt, the majority of which are new parents or parents of a single child, whereas that number jumps to 21% for people with no children.

The differences between single and married Millennials are also glaring when it comes to paying off debt. Twenty percent of single people don’t have a plan for dealing with their debt compared to 10% of married people without a debt repayment plan. And most married people have had conversations about how to tackle their debt, even if they haven’t taken action on their chosen strategy yet: 39% of married people have a plan in mind to deal with debts but have not executed it yet.

Married people are also more aggressive when tackling their monthly debt payments. Nearly 50% of married respondents pay their minimum payments, and 50% are paying more than minimum payments whenever they get a chance.

So how do singles fare in comparison? Thirty-two percent of single respondents pay off more than the minimum installment whenever they get the chance, and 26% are covering only the minimums.

Which Sources Do Millennials Prefer When it Comes to Paying Off Their Debt?

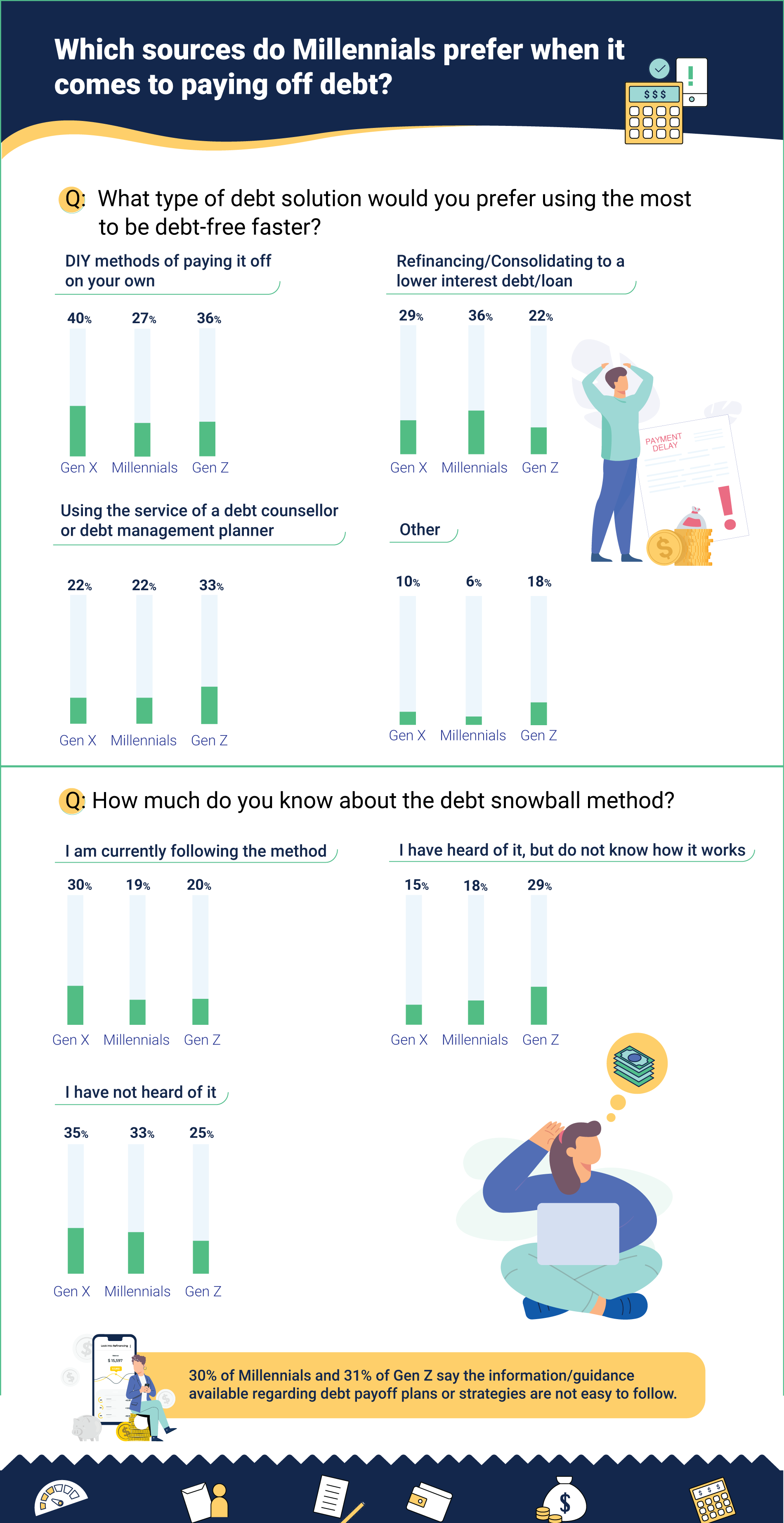

While Millennials didn’t turn to financial advisors as much for advice on paying off their debt, the majority of Gen Z respondents were all about using the services of a debt counselor or debt management planner for paying off their debt – nearly 33% of them did. As discussed previously, Millennials mostly go one of two ways: DIY debt repayment planning or debt consolidation/refinancing strategies.

One popular strategy is the debt snowball method. Some Millennials swear by it, others have never heard of it or are not quite sure what it entails. Thirty-three percent of Millennials are not aware of the debt snowball method and have never heard of it. And 28% of Millennials are aware but lack knowledge to implement it.

If you’re wondering how that compares to other age groups and demographic segments, 30% of Gen X are currently following the debt snowball method, whereas there are only 18% of Millennials who follow it. It’s more popular among married respondents too, with 38% of married people embracing it versus 5% of single people.

Finally, regardless of their different preferences for debt repayment, both Millennials and Gen Z find the information available on the topic equally confusing: 30% of Millennials and 31% of Gen Z say the information/guidance available regarding debt payoff plans or strategies are not easy to follow.

Related: The 10 Financial Commandments for Millennials

Minimum Blues: 33% of Millennials Face Difficulty In Paying More Than Minimum Monthly

Regardless of their age group or marital status, people who embrace the debt snowball method are onto something when it comes to avoiding the pitfalls of only sticking to minimum payments. For one, it affects your credit score. And it also makes you pay more interest in the long run.

The debt snowball method is effective because you pay off smaller debts first, but you do so aggressively, countering those pitfalls. It works by paying off the smallest one of your debts as quickly as possible, then tackling the second smallest, and so on.

But with 33% of Millennials facing difficulty in paying more than minimum monthly payments and 40% of them finding it difficult to be consistent doing so, it’s fair to say that despite their best intentions and commitment to paying off debt, some Millennials are struggling to keep up with that kind of more aggressive plan.

Parents find it difficult to cover more than the minimum too, with 35% of parents facing difficulty doing so compared to 20% of the child-free population.

Related: Millennials and Taxes Survey

The Debt Snowball Method Works for Those Who Use it

But the debt snowball method does work for those who are able to use it and stick to it:

- 88% of Millennials find debt snowball very effective for paying off their debts

- No Millennial respondents have reported the debt snowball method to be ineffective.

- 48% Gen X finds it very effective, while 41% have experienced some positive results and find it somewhat effective.

- 73% of married people find debt snowballing very effective, while 23% have experienced some positive results and find it somewhat effective.

- 72% of parents find debt snowballing to be very effective, while 19% have experienced some positive results and find it somewhat effective.

Related: Debt Snowball Method Examples

The Honest Truth: How Millennials Really Feel About Their Debt and Paying it Off”

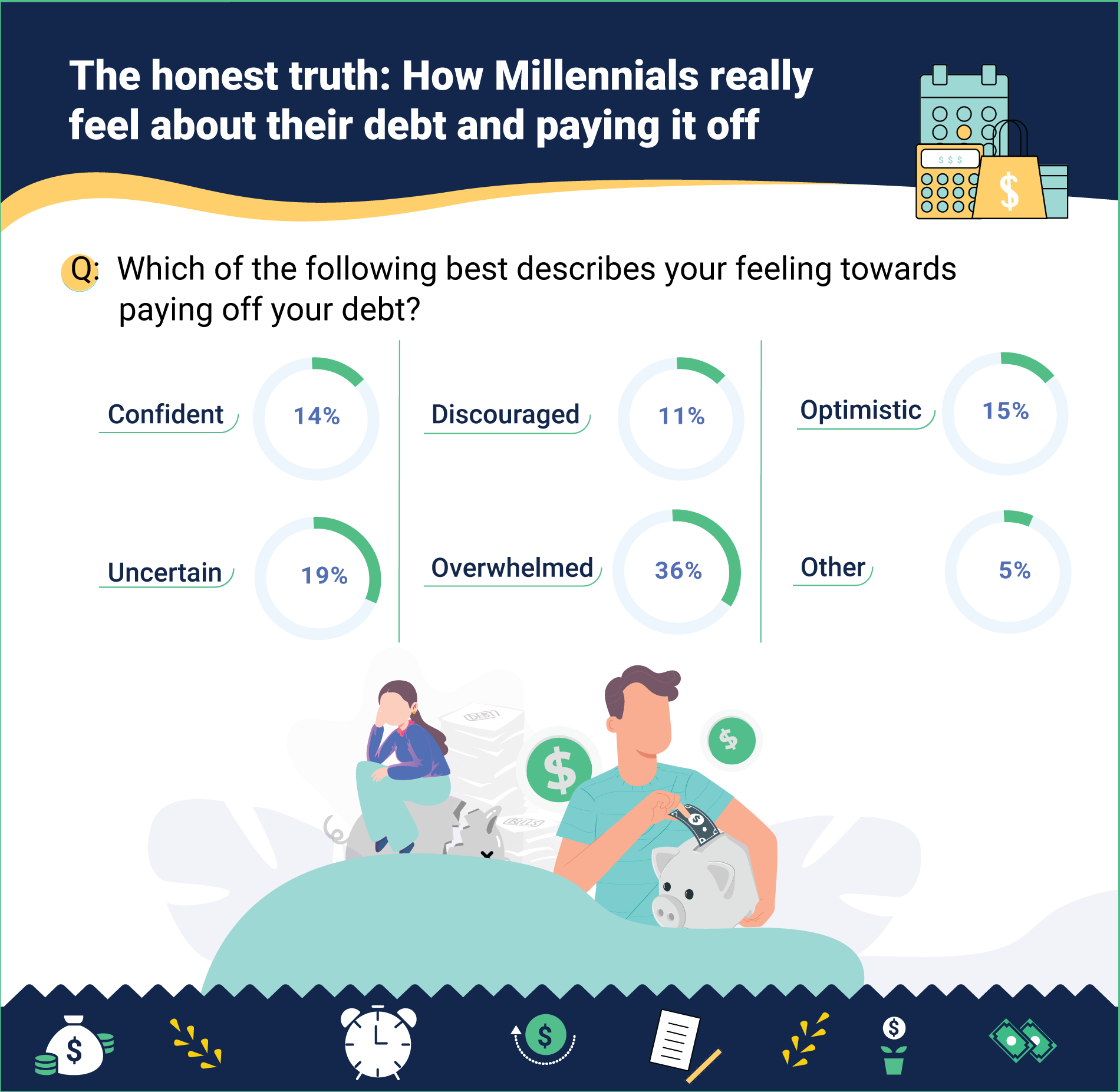

At the end of the day, making efforts to pay off debt is one thing, but how you feel about it is another story. 36% of Millennials reported feeling overwhelmed due to their debt situation. And only 14% of Millennials feel confident about their debt payoff plan.

You would think that being married would help as far as feeling like a team and supporting each other, but 33% of married people feel overwhelmed due to their debt situation, and 21% are uncertain of their debt payoff plan.

Related: How Young Americans Really Feel About the State of Their Finances In 2022