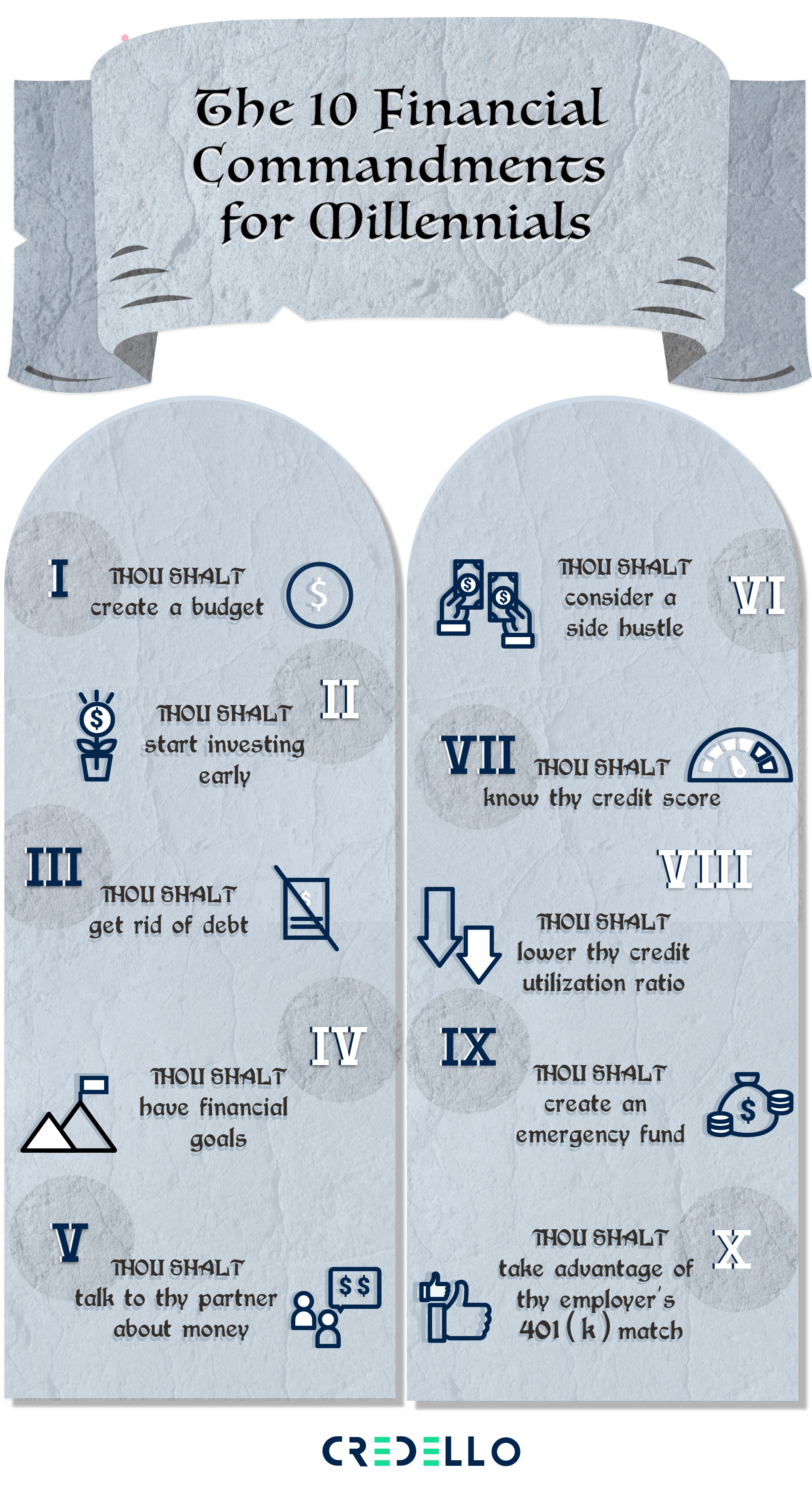

The 10 Financial Commandments for Millennials

About Stefanie

Stefanie began her career as a journalist, reporting on options, futures, and pension funds, and most recently worked as a writer and SEO content strategist at a digital marketing agency. In her free time, she enjoys teaching Pilates and spending time with her daughter and Siberian Husky.

Read full bio

Millennials are so much more than an amalgamation of avocado toast, side parts, skinny jeans, and the word “doggo.” They’re also looking to fund savvy investments, become homeowners, and make the best of not one, but two recessions.

That’s why we’ve created the unofficial 10 financial commandments for millennials. So those of us aged 25-40 years old can make fiscally sound decisions, instead of having to hunt around for bad credit debt consolidation loans. Like Moses parting the Red Sea, these rules will clear the way for a financially secure future and debt-free living.

Financial commandments for millennials

1. Thou shalt create a budget

Creating and following a budget can help you avoid wasting money on discretionary items. To make a budget, do a comparison of your post-tax income against your average monthly spending. See what you can cut out to help you save more each month. Do you really need to buy flat whites every morning?

2. Thou shalt start investing early

The earlier you start investing, the more money you’ll make, thanks to the beauty of compound interest. Reaping the benefits of compound interest is especially important to battle inflation. Inflation refers to the decrease in purchasing power of money over a period of time—the cash you make with compound interest can help negate these effects.

3. Thou shalt get rid of debt

Getting out of debt should be one of your biggest financial goals. The interest you accumulate on bills owed can trap you in a debt cycle, causing you to owe more and more money. Selecting a debt payoff method—such as the debt snowball or debt avalanche—can help you establish a plan for kissing debt goodbye.

4. Thou shalt have financial goals

Things like budgeting and bill paying can get onerous after a while. That’s why keeping your financial goals top of mind is important. Whether you want to buy your own home or go on a dream vacation, knowing your ‘why’ can help you stick with good financial habits.

Related: Millennials Share Their Financial Resolutions of 2021

5. Thou shalt talk to thy partner about money

Having the money talk with your partner is important for a successful relationship. From discussing who pays for what to how your childhood shaped the ways you view finances, talking about cash can bring you closer together and help avoid conflict later.

6. Thou shalt consider a side hustle

If you need some extra money, taking on a side hustle like driving for a ride-share service or selling gently used clothing online can help you save. There are also countless ways to make money online.

7. Thou shalt know thy credit score

Monitoring your credit score and practicing good credit habits are important if you want to take out a loan. Paying your bills on time and in full are two ways you can give your score a boost.

8. Thou shalt lower thy credit utilization ratio

Your credit utilization ratio is a comparison of the amount of debt you’re using compared to the total amount available. Be sure not to use too much of your available credit at any one time as lenders like to see this number below 30%.

9. Thou shalt create an emergency fund

Creating an emergency fund to cover 3-6 months of living expenses (though a year is preferred) can help you if you suddenly faced unexpected bills, e.g. high medical costs or car maintenance.

10. Thou shalt take advantage of thy employer’s 401(k) match

If your employer offers a matching contribution, you should take the max amount. By taking advantage of your employer’s match, you’re saving more for your retirement and increasing your earnings.

These rules may not be etched in marble or divinely inspired, but they can help you level up your finances. Go forth and create thy bounty—you got this.