The Pros and Cons of Debt Consolidation

About Casey

Casey is a reformed sports journalist tackling a new game of financial services writing. Mike Francesa once called her a “great girl.”

Read full bio

At a Glance

Debt consolidation is one of the best ways to pay off your debt more quickly by streamlining it into one monthly payment with a lower interest rate. But debt consolidation isn’t a one-size-fits-all solution. There are different approaches depending on what kind of debt you’re trying to consolidate, what rate you’ll qualify for, and other factors. Understanding the pros and cons of each method will give you a better idea of which tactic will work best for you.

In this article you will learn about:

Like most things in life, debt consolidation has advantages and disadvantages. Debt consolidation isn’t necessarily good or bad (it’s not like free food), but depending on your financial situation, this approach to debt repayment may or may not be possible. And for certain people, the benefits of debt consolidation will be greater than the risks.

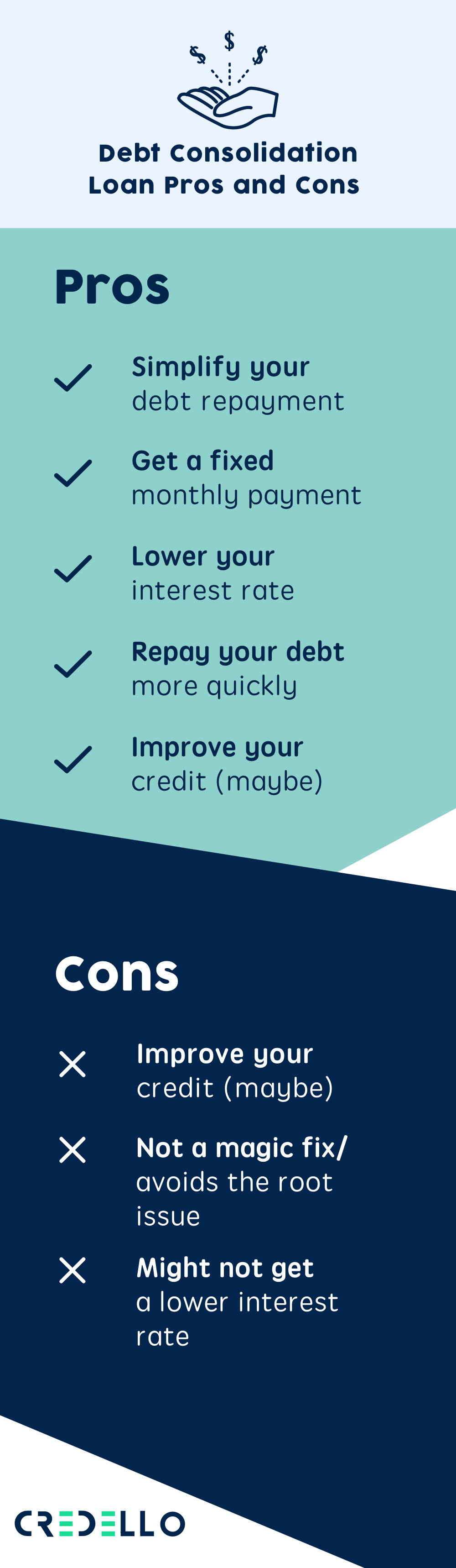

Pros and cons of debt consolidation

Debt consolidation can be a good option for those who have several high-interest debts as it can help you simplify your payments, save money on interest, and pay off your debt faster. However, there are some downsides to consolidating debt and it’s not the right option for everyone.

Related: What is debt consolidation

Benefits of debt consolidation

1. Simplify your debt repayment

If you have multiple debts, trying to keep track of how much you owe each month and when your payments are due can be like trying to keep track of your friends’ birthdays without Facebook reminding you. I know, Gen Z, no one’s on Facebook anymore. But y’all get the point. (What do you use to remember birthdays, by the way?)

2. Get a fixed monthly payment

A fixed monthly payment gives you a definitive timeline for when you’ll have your debt paid off completely, which can be a nice change of pace if you’re someone with a lot of revolving debt, like credit cards, where your payment changes from month to month.

3. Lower your interest rate

You may be able to get a better interest rate depending on the type of debt you’re consolidating.

For example, credit cards tend to have higher interest rates than personal loans. The average credit card APR in 2024 was 22.63%, according to the Federal Reserve, while the average 24-month personal loan APR was 12.49%. Debt consolidation loan rates vary, but odds are you’ll be able to find one with a better rate.

4. Repay your debt more quickly

Nobody wants to be in debt long-term, or at all for that matter. Debt consolidation loans offer a way to save money on interest, which means paying less toward debt, thus speeding up the debt repayment process.

Use a debt payoff calculator to get an idea of when you could have your debt paid off.

What debt do you want to consolidate?

Select all that apply

Others does not include mortgage

Debt Consolidation requires more than one debt account. Please select at least two debt types above.

5. Improve your credit (maybe)

So, you’re telling me there’s a chance. Yes, indeed. With a single monthly payment, you’re less likely to stumble and miss a payment. Late payments are one of the biggest contributing factors to your credit score, which means making on-time payments can help your score. You can also reduce your credit utilization ratio and lengthen your credit history, both of which can contribute to raising your credit score.

Disadvantages of debt consolidation

1. Might not get a better interest rate

OK, I know I said you might be able to get a better interest rate, but might is the key word there. Your interest rate depends on the amount of the loan, loan term, and your credit score. If you don’t have the best credit score, that will hurt your chances of getting a lower interest rate.

2. Potential fees

Debt consolidation loans can come with a barrage of fees both upfront and on the back end, including origination fees, prepayment penalties, late fees, and returned payment fees. Make sure you read the fine print before committing to a loan. If you’re paying more in fees than your potential interest savings, it’s like trying to talk politics with that one uncle of yours—just not worth it.

3. Doesn’t solve underlying financial issues

Look, I know all about avoidance. It took me until my late 20s to finally go to therapy. (Might I also recommend therapy to everyone who’s able?) Debt consolidation can be great, but it’s kind of like when you lose 20 pounds after trying a fad diet then gain 30 over the next couple of years. Both weight loss and ridding yourself of debt require lifestyle changes—not a quick fix.

If you want to get to the root of the problem, consider making a budget and sticking to it. If you already have a budget but you’ve been ignoring it like DMs from a perv, break it back out and see if there are opportunities to cut costs. Ultimately, you want to make sure you’re spending less than you’re making.

Creating or adding to an emergency fund also can be a good step to combat the dreaded debt cycle. Experts generally recommend setting aside three- to six-months’ worth of living expenses. If you budget wisely, you should be able to come up with a debt repayment plan while also saving. You really can have it all (except maybe your parents’ approval—don’t worry, you’ll explore that further in therapy).

4. Risk of missing payments

Even though you’re decreasing the number of payments you have when you consolidate debt, it’s still a payment you have to keep track of and ensure you pay on time each month. You may be charged late fees if you miss a payment, and your credit score will also take a major hit. Take advantage of any tools, such as autopay, to help you avoid missed payments.

5. May encourage increased spending

Now that you’ve consolidated debt and are paying off those credit cards and multiple lines of credit, it can be easy to feel like you have more money than you actually do. When this happens, you’re paying off your debt but also begin spending more, so your debt balances start to increase again. Make sure you create a budget to reduce your spending, especially while you’re paying everything off, to avoid racking up even more debt.

6. May pay more in interest over time

Even if you are able to get a lower interest rate, you could end up paying more in interest over the life of the new loan. When you consolidate, the repayment timeline starts from that day and can extend over a few years; while your monthly payment may be lower than what you were paying before, the interest will now accrue for a longer period of time.

You can avoid this issue by paying more than the minimum loan payment if possible.

When should you consolidate debt?

Consider consolidating debt if:

- You have a large amount of high-interest debt. This should be more than you can pay off in a year. Otherwise, it might not be worth the fees and credit impact.

- You evaluate your spending and create a budget. Consolidating your debt isn’t going to do much good if you don’t change your financial habits and continue to rack up debt. Make sure you evaluate your spending and come up with a plan to get everything under control.

- You have a good to excellent credit score. This will ensure you qualify for a rate that’s lower than your current rates, and you can save money on interest over time.

- Loan payments fit into your budget. Only consolidate if you have enough income to cover the new monthly payment. Missed payments can mean fees and serious impact to your credit.

How to get a debt consolidation loan?

1. Check your credit score. This will help you better understand what loans you may qualify for. Be sure to correct any errors that could be negatively affecting your score. Depending on your score, you may want to take time to improve it before applying for a loan.

2. Gather your documents. Be prepared for the application process with documents like recent pay stubs, W-2s, bank statements, tax returns, and others.

3. Get prequalified for a unique estimate of your interest rate and monthly payment based on the loan amount and term you choose.

4. Compare lenders based on factors like interest rates, terms, minimum loan amounts and credit score requirements, and customer service reviews.

5. Apply.

Compare: Best Debt Consolidation Loans

FAQs

If your credit score makes heads turn and you’re disciplined enough to repay your debt within the 0% intro APR timeframe, a balance transfer card is probably your best option. If not, a credit card debt consolidation loan is probably the way to go. There are alternative debt consolidation services, like home equity loans and home equity lines of credit (HELOC), which—you guessed it—have pros and cons of their own.

This depends – if you have good to excellent credit, a steady income, and are borrowing a relatively small amount of money, it can be easy to get approved. If you have poor credit, low income, and/or are applying for a large loan, it may be more difficult. Before applying, try to improve your credit score (if necessary) and ensure you have a steady income.

While there are obviously pros and cons of consolidating debt, it may be a good idea as long as you can qualify for a better interest rate than your existing debt. This can help save you money. You should also consider consolidation if you have multiple debts or different types of debt, as simplifying them to one payment can make them easier to repay. Debt consolidation can help you take control over your finances and get out of debt faster.

Debt consolidation can simplify your debt payments, reduce your interest rates which can save you money, help you pay off debt faster, and even improve your credit score. As long as your credit score qualifies you for a lower interest rate than your existing debt, debt consolidation may be worth it. Debt consolidation loan pros and cons should be weighed based on your own individual situation.

Learn more: Is Debt Consolidation a Good Idea?

There are several debt consolidation loan pros and cons to consider, including:

Pros:

- Lower interest rates

- Fixed, predictable monthly payments

- One monthly payment instead of multiple

- Potential boost in credit score

Cons:

- Borrowers with a poor credit score may not qualify for a lower interest rate

- Fees

- Won’t change the existing habits that got you into debt in the first place

Even though debt consolidation makes sense in a lot of situations, there are some risks to be aware of as well. For instance, even though you may get lower interest rates, it may not mean you’re saving money depending on the term of the original debt vs. the new loan. Another risk is that consolidating doesn’t always help your credit or solve the problem, because if you don’t stop using your credit cards or taking out additional financing, you’re going to increase your debt instead of eliminating it.

Learn more: Risks of Debt Consolidation

Qualifications and requirements for debt consolidation can vary by lender, but a few things they look at or require include:

- Credit score

- Credit history

- Debt-to-income ratio

- Equity

- Age

- Proof of residence

- Proof of income

- Financial stability

Learn more: Requirements for a Debt Consolidation Loan