How to Find the Best Debt Consolidation Loan Rates

About Stefanie

Stefanie began her career as a journalist, reporting on options, futures, and pension funds, and most recently worked as a writer and SEO content strategist at a digital marketing agency. In her free time, she enjoys teaching Pilates and spending time with her daughter and Siberian Husky.

Read full bio

At a Glance

When looking into debt consolidation loans to help pay off debt, it can initially seem tempting to pick whichever one has the lowest interest rate. However, a low rate is just one factor that you should consider.

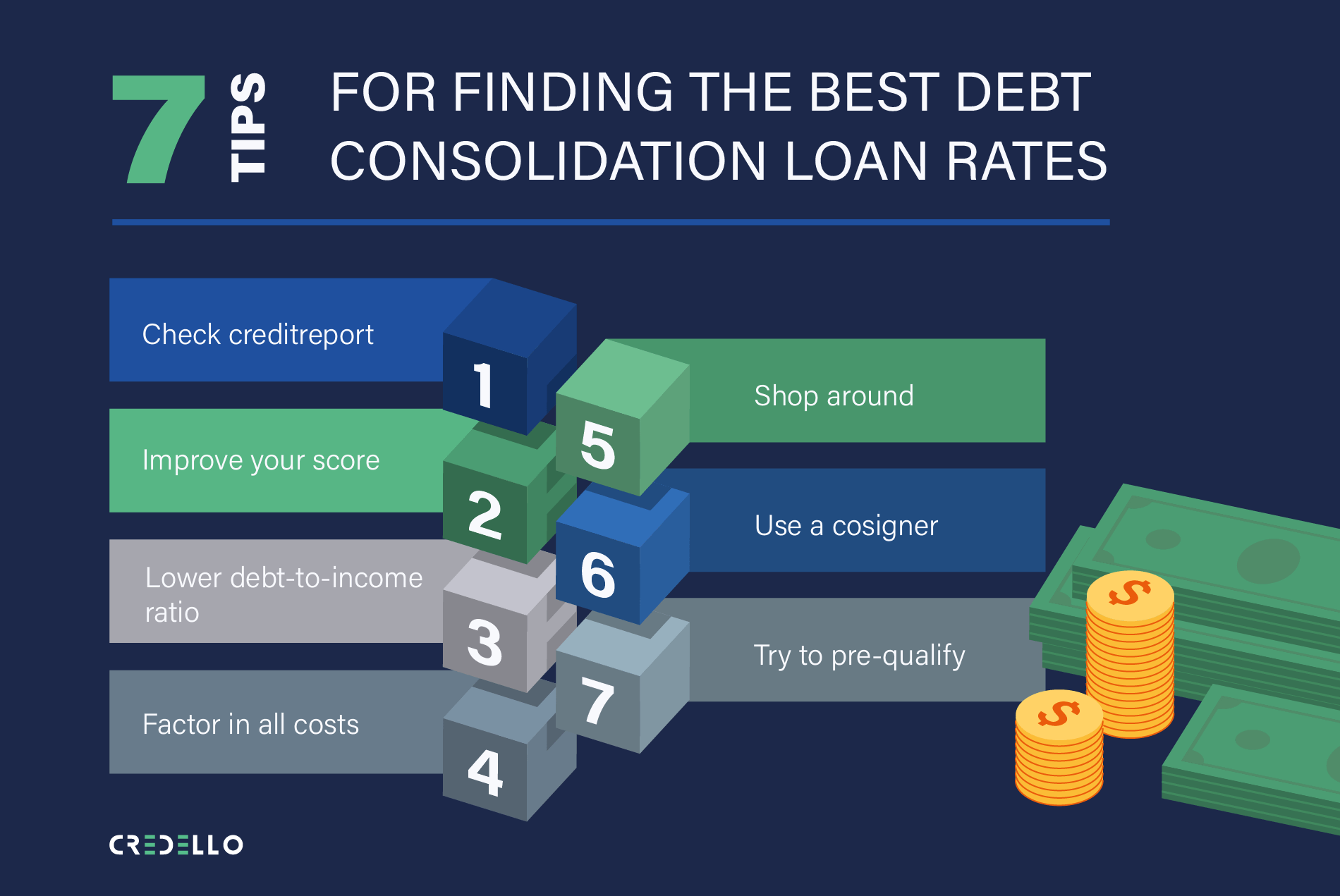

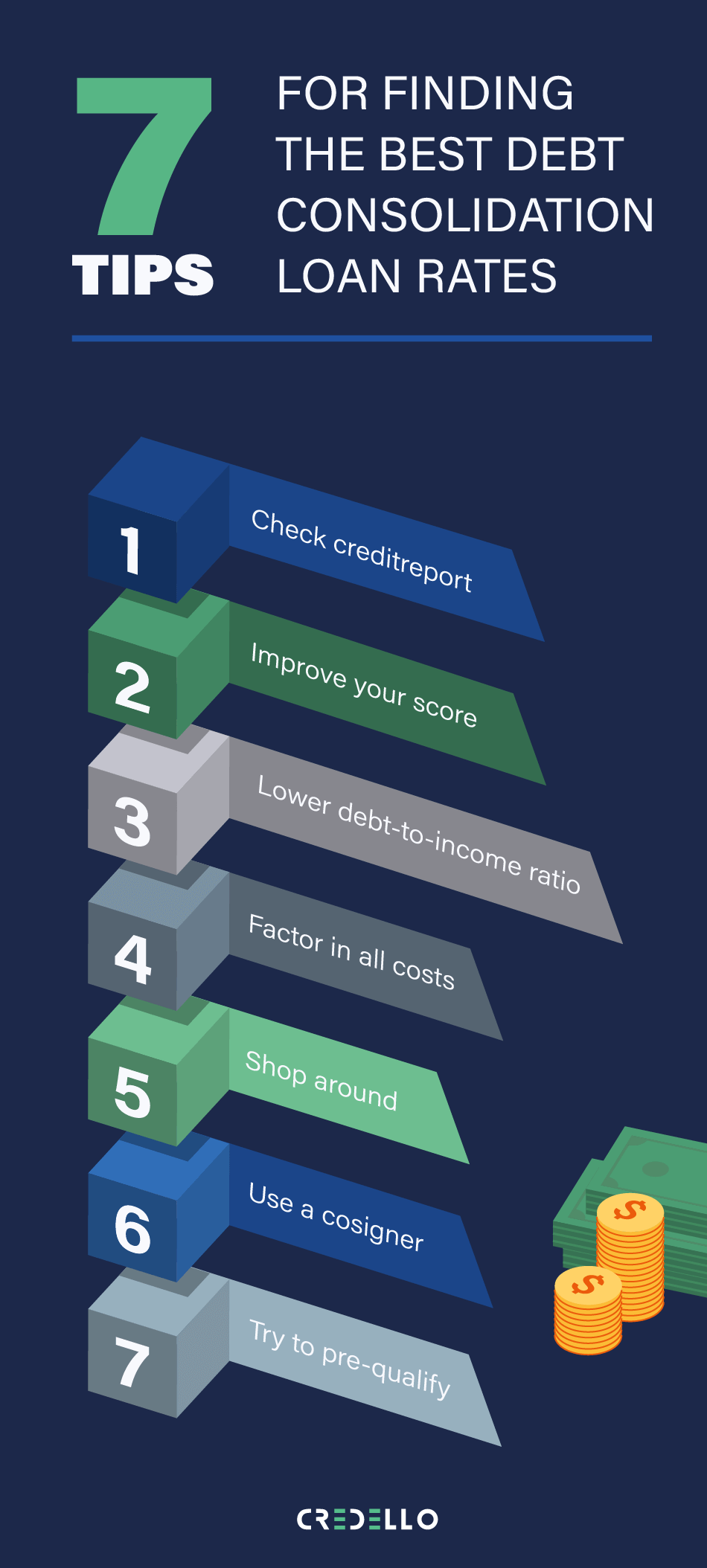

Learn about how to find the best debt consolidation loan rates, including these 7 great tips:

In this article, you’ll learn:

- Check your credit report

- Boost your score for lower rates

- Lower your debt-to-income ratio

- Factor in extra fees

- Shop around for multiple quotes

- Get a cosigner

- See if you pre-qualify

What is a Debt Consolidation Loan?

A debt consolidation loan allows for multiple debts to be streamlined into one payment. This can allow for multiple, high-interest debts to be paid off at once, often with better interest fees. You will pay the lender monthly for a predetermined period of time. Debt consolidation loans are offered by credit unions, banks, and online lenders.

How Debt Consolidation Rates are Determined

Lenders typically determine debt consolidation rates by looking at your credit score. Having excellent credit will help you get the lowest interest rates. If you have bad to fair credit you might still be able to qualify, but your interest rate will most likely be higher.

Other factors that go into determining rates include:

- Debt-to-income ratio of no more than 36% (lower is better)

- Steady employment history, to show lenders that you’ll be able to pay them back

- Solid payment history, since your ability to back on time is a big determinant in how trustworthy you’ll seem to lenders

Why Debt Consolidation Can Seem High

Debt consolidation rates usually have higher interest rates than other types of debt. This is due to a few reasons:

-

- Borrowers who use debt consolidation loans usually have large amounts of debt. This can often result in high credit balances, which negatively impact credit scores, thus resulting in a higher rate.

- Debt consolidation loans are often unsecured. This means they don’t have any collateral backing the loan, such as a house or car, making this type of loan a bigger risk for lenders.

- Debt consolidation loans don’t get rid of debt. They just roll several existing high-interest debts into a new, larger one.

Compare More Than Just the Interest Rate

Before you take on a loan from its interest rate alone, make sure you understand other fees that might go into it. You may realize that the potential amount you’d be saving with a debt consolidation loan will be wiped out by associated fees, such as:

- Early termination fee: fee for ending the loan early

- Late fees: how much you’ll have to pay if you’re late with your bill

- Prepayment penalties: you could get charged for trying to pay off your loan ahead of time

- Initiation fees: many lenders will charge initiation fees that can be anywhere from 1%-5% of the loan’s amount

Note: If you extend your loan term out too long, you could wind up paying more interest than if you hadn’t taken on a debt consolidation loan at all. In addition, some lenders will charge more for long payback periods.

7 Tips for Finding The Best Debt Consolidation Loan Rates

1. Check credit report

Check your report to make sure that there aren’t any mistakes. Errors could drag down your entire score and result in a higher loan rate.

2. Improve your score

Improving your score, even slightly, can help you save money on your interest rate (tips for how to improve score below).

3. Lower debt-to-income ratio

Your debt-to-income ratio shows the amount that you owe each month to the amount that you make.

4. Factor in all costs

Make sure to factor in the total costs of taking out the loan, not just how much the interest rate will cost you.

5. Shop around

Don’t just automatically get a loan from your bank because you have a relationship there. Shop around for the best rate and get multiple quotes.

6. Use a cosigner

Some lenders might be more likely to offer a debt consolidation loan if you have a cosigner. A cosigner agrees to pay back the lender should you default on your loan.

7. Try to pre-qualify

Pre-qualifying can give you an idea of whether or not you’ll actually qualify for the loan without impacting your credit score.

How to Improve Your Credit Score

Bad credit can hurt your chances of securing a good loan rate. Here are a few ways you can improve your credit score:

- Check credit regularly: Check your score at least once a quarter to make sure there aren’t any mistakes. Consider signing up for a credit monitoring service.

- Dispute inaccuracies: If you find any mistakes, report them to the credit bureaus immediately.

- Pay on time: Your payment history is the biggest factor that makes up your credit score. If you have trouble paying bills on time, try signing up for reminders from your credit card company or automatic payments.

- Don’t close old accounts: Closing old accounts can lower your score as it will negatively affect your credit utilization rate. This measures the amount of credit you’re using against the amount of credit available.

- Mix of credit: Demonstrating that you can manage a mix of credit can help your score. Once you’ve reduced your debt, think about adding another type of credit to your portfolio.

Get the best debt consolidation options for your needs

We provide solutions you're likely to get approved for.