Debt Snowball Method to Payoff Debt

The debt snowball method helps you repay debt by eliminating your debts one by one, from smallest to largest

At a Glance

The debt snowball method can help you gain payoff momentum and confidence as you eliminate your debts one by one. You’ll start by paying your smallest debt off first (while still paying minimums on your other debts), the next smallest debt off second, and so on. You can picture each amount paid off as a snowball gaining more and more momentum down a slope.

The debt snowball calculator can help you create a roadmap to achieve debt-free freedom.

In this article, you’ll learn:

What is the debt snowball method?

The debt snowball method is a strategy to reduce debt. It focuses on paying off debts in order of smallest to largest. The name comes from the idea that you gain momentum (like a snowball) as you knock your debts off one at a time. You’ll focus on paying off your smallest debt first while continuing to make minimum payments on your other balances.

Once the smallest balance is paid off, you’ll take the money you were allocating to that debt and put it toward the next smallest balance. The cycle repeats until all debt is paid in full.

How does debt snowball work?

- Make a list of all of your debts from smallest to largest. Don’t include your mortgage as one of your debts and don’t factor in interest rates.

- Begin making minimum payments on all of your balances except for the smallest one.

- Pay the maximum amount you can towards the smallest debt.

- Once the smallest debt is paid off, get ready to focus on paying off the next smallest one.

- Continue the cycle until you’re debt-free.

How should I use debt snowball to pay off my debts?

Perhaps the most important part of using the debt snowball method successfully is having a strict budget. After all, you’ll need extra money each month to put toward your smallest-balance debt—so, that money can either be from extra savings/savvy budgeting or additional income. Cut unnecessary expenses (i.e., cancel subscriptions you don’t use or eat out less often) so you can put that extra dough toward paying off your debt. Read More

Pay the minimum payments on all your debts but focus the extra money on one debt at a time. Once you’ve paid off your smallest balance, move on to the next smallest.

Related: How to Snowball Debt?

What should I include in my debt snowball?

When listing out your debts for the snowball strategy, be sure to include your credit cards, personal loans, medical bills, and auto loans. If you have a second mortgage that is less than 50% of your annual income, you can also include that. Otherwise, you can leave your mortgage out.

When am I ready to start the debt snowball?

Once you’ve got your debts plotted out in order from smallest balance to largest—and you’ve figured out a way to put extra money toward the smallest debt each month—you’re ready to begin your debt snowball journey. Before you start, make sure it’s something you can keep up with until the end. Read More

It’s also important to have emergency savings set aside just in case something unexpected happens. This is a good practice in general, not just for the snowball strategy.

Related: 7 Debt Snowball Mistakes (and How to Avoid Them)

How do I start my debt snowball?

You’ve established at least $1,000 of emergency savings and you’re fully committed to paying off your debts, one by one. Here’s how to start a debt snowball:

- List out your debts from smallest to largest balance

- Make minimum payments on each

- Put extra money toward the smallest balance every month until it’s fully paid off

- Do the same with the next smallest balance

- Enjoy a debt-free life

How can I pay my debt fast using a snowball calculator?

Our snowball calculator can help you predict monthly payments, how much you can save, and your potential debt-free date. Of course, that’s if you stick to your debt snowball plan and see it through. The idea is, with predictable payments and a light at the end of the tunnel, you’ll be more motivated to knock out your debts and dig yourself out the hole. Ah, the beauty of the debt snowball effect. Read More

There’s also the chance you might see your potential savings if you used the debt avalanche method—which typically helps you save more on interest in the long run—and decide that’s your better option.

Estimate your savings with this debt snowball calculator

How Many Debt Accounts Do You Have?

Include credit cards and all loans except mortgage. Snowball method is applicable if you have at least two of these.

Keep your credit and loan statements handy to fill in balance, payment and rate details.

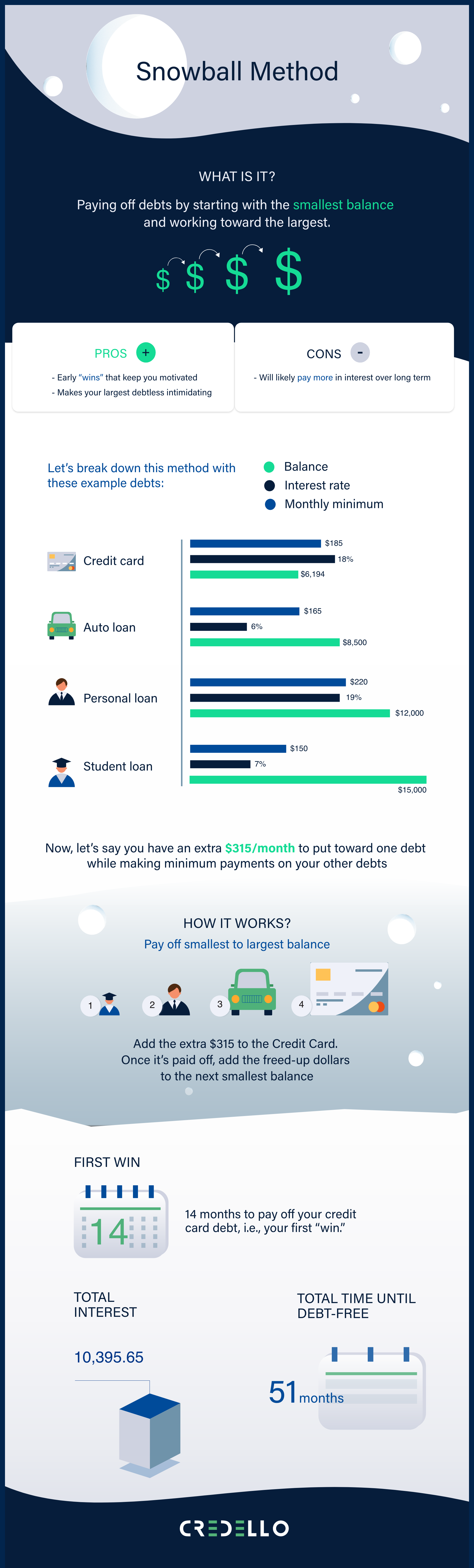

Debt snowball example

Here is an example of how the debt snowball method would be put to practice. Let’s say you have a total debt of $48,200, broken down as follows:

- Auto loan: $20,000, 5% APR, $400 minimum monthly payment

- Credit card: $6,200, 18%, $185

- Personal loan: $12,000, 19%, $220

- Student loan: $10,000, 7%, $100

You would start focusing on paying off the lowest balance first, so putting as much toward the credit card balance of $6,200 as possible, while paying minimums on your other debts. Then the cycle would continue with the student loan balance, personal loan balance, and finally, the auto loan balance. Let’s say you are able to put an extra $300/month toward debt repayment. You would be debt-free in 50 months and pay a total of $11,564.24 in interest.

| Debts | Balance | APR | Minimum Payment |

|---|---|---|---|

| Credit card | $6,200 | 18% | $185 |

| Student loan | $10,000 | 7% | $100 |

| Personal loan | $12,000 | 19% | $220 |

| Auto loan | $20,000 | 5% | $400 |

| TOTAL | $48,200 | — | $905/month |

Related: Real-Life Debt Snowball Examples

Debt snowball method alternatives

Alternatives to the debt snowball method and debt snowball calculator include:

-

Debt avalanche method and calculator:

The debt avalanche method focuses on making payments on the debt with the highest interest-rate first, followed by the debt with the second highest interest-rate, etc. See below for more information on the debt avalanche method.

-

Hybrid payoff method:

If debt snowball and debt avalanche don’t tickle your fancy, we have some good news: those are only two DIY payoff methods. You can take another approach entirely or use a hybrid of the two:

- Treat small and large debts differently. Prioritize smaller balances for debts under a certain amount, and prioritize higher interest rates for debts over that threshold.

- Change strategy based on type of debt. Pay down credit cards with the snowball strategy, and then switch to avalanche for loan debt.

- Prioritize by debt-to-interest ratio. Divide your account balance by current interest rate for each account. Then start by paying off the balance with the lowest debt-to-interest ratio and work your way up.

-

Debt consolidation:

With debt consolidation, you take out a loan for the total amount of debt you’d like to pay. You’re essentially borrowing money to pay off all of your existing loans, and then focusing on repaying a new loan. It simplifies payments since you only have one balance and one interest rate to worry about each month.

-

Debt management plan:

In a debt management plan, a non-profit agency that specializes in credit counseling can help you create a repayment plan with a lower interest rate.

Snowball vs. Avalanche

Because the debt avalanche method works to eliminate debts in order of highest to lowest interest-rate, it can save you money in the long run. So while the debt avalanche method may not be as motivating as the debt snowball method, you might save more money. Ultimately, the best debt payment strategy is the one you’ll stick with. Pick the repayment strategy that you think you’ll be most likely to follow and discover when you’ll pay off your debt once and for all.

Related: Snowball vs. Avalanche Repayment Methods

Debt Snowball vs. Debt Consolidation

Debt consolidation makes more sense if:

- You have a stable income and a plan to improve spending habits

- You’re currently making minimum payments on multiple cards or loans

- Your credit score is good enough to qualify for a low-interest loan or 0% APR balance transfer card

The debt snowball strategy makes more sense if:

- You need motivation to start paying off your debt

- You can pay off your debt within 1-2 years

- Your credit score isn’t high enough to get a favorable interest rate

Related: How to Start a Debt Snowball?

Pros & cons of debt snowball method

Debt snowball pros

The main advantages of the debt snowball method are:

- Encouraging and motivating

- Allows you to focus on one debt at a time

- Not taking on another loan

- Can do it with poor credit

Debt snowball cons

The main disadvantages of the debt snowball method are:

- Other repayment strategies (i.e., debt avalanche) can help you save more on interest

- You’ll need to find extra money every month either through budgeting or additional income

- Requires full commitment to the strategy (though, you can pause your snowball if necessary)

Debt snowball best practices

Here are a few best practices to keep in mind as you begin the method:

- Find a side hustle. Try making extra money any way you can, whether that be hosting a garage sale or taking on a side job.

- Don’t take on any new debts, as this will only set you back farther in your goal.

- See what expenses you can cut back on, such as making coffee at home instead of buying it out.

How to stay out of debt?

Once you’ve paid off your debt, here are a few strategies to help you stay out of debt for good:

Request alerts from your credit card company

Spending alerts can tell you when charges are made to your account, keeping you informed, accountable, and less likely to overspend in the future. Read More

Pay with cash and debit

Making purchases with cash or debit keeps you more aware of how much money is coming out of your account. Credit cards can cause you to spend more than you would otherwise, sometimes money you don’t really have.

Create a budget

Budgeting helps prioritize your necessary expenses and avoid unnecessary purchases that could land you in debt. Keep track of income and expenses, live within your means, and stay debt-free.

FAQs

Yes, the debt snowball method really works. But unlike debt relief options like debt consolidation loans or debt management plans, you may wind up paying more over a longer period of time. But the motivational concept helps consumers stay motivated to pay off debt.

If you’re the kind of person who likes to-do lists—and especially enjoys crossing things off said to-do lists—the debt snowball method can be a solid, rewarding approach. If you’re more in the mindset of dollars and cents, you may want to consider the debt avalanche approach. Either way, you may want to use our debt payoff calculator to evaluate all of your options.

If you’re using the debt snowball method, you’ll want to pay off your smallest balance first. You do this by paying the minimums on all your debts but putting extra money toward the one with the smallest balance. If you’re looking to save on interest in the long run, you might consider another method like debt avalanche, which would prioritize paying off your highest-interest debt first.

Depending on your goals and financial situation, either strategy can work for you. The debt snowball effect helps you get quick victories by prioritizing your smallest balances, while debt avalanche helps you save on interest by focusing on the highest interest rates first. Both are great ways to dig yourself out of debt, but we’d give the slight edge to avalanche because we’re all about the big picture.

Ideally, you’ll be able to do both. To start your debt snowball (or other payoff plan), you’ll want to have savings set aside for emergencies ahead of time. Once you knock out a few of your debts, you might want to take some of that extra money and add to your savings—especially if you can accrue interest on those savings that amounts to more than the interest you’ll owe on your debt.

As mentioned before, the debt avalanche method usually saves you the most in interest payments because you still pay the minimums on all your debts, but you put extra money toward the account with the highest interest rate first. This way, you’ll owe less in interest than if you’d prioritized your smallest balance, as you would with the debt snowball method.

You should put as much as you are able to afford toward your monthly payments, but ideally at least the minimum. Review your budget and see how much you can realistically put toward your debt. Paying more than the minimum, even if just barely, will help you lower your balance, save on interest, and pay off your debt more quickly.

Related: How to Pay Off Debt Fast?

Debt snowball calculatorEstimate your savings and debt-free date

Loan payoff calculatorCompare payoff methods by savings & more