How to Snowball Debt

About Ryan

Ryan is a seasoned copywriter whose clients have included big banks, credit card companies, and financial services firms. In his spare time, he writes fiction and roams around looking for dogs to pet.

At a Glance

The debt snowball method is a popular DIY method to pay off debt, starting by paying off your smallest balance and working your way up to the largest. In this article, you’ll find out the following:

- How to use the debt snowball method

- 5 steps of the debt snowball method

When you use the debt snowball method to pay off your debt, you pay the minimum on all your balances and put extra money toward the smallest one until it’s fully paid off. Once you’ve eliminated one of your debts, you move on and repeat the process with the next smallest balance.

Related: How to Start a Debt Snowball

How to use the debt snowball method

The snowball method of paying down debt is perfect for you if you need to see instant results. By prioritizing your lowest balance first, you’ll be able to build confidence and momentum through quick, early wins. And, with one of your debts out of the way, that extra money should fuel your continued success.

If you’re more of a numbers person, try our debt snowball calculator to see how your repayment would play out as you snowball your way out of debt. By entering your balances, interest rates, and monthly payments, you can estimate when you’ll be debt-free and how much you’ll save on interest.

Debt avalanche is another payoff method. With this strategy, you still make the minimum payments on all your debts, but you prioritize making extra payments toward the account with the highest interest rate. Overall, the avalanche method can help you save more on interest in the long run, though you won’t see the quick wins you would with the snowball method.

Related: Snowball vs. Avalanche Repayment Methods

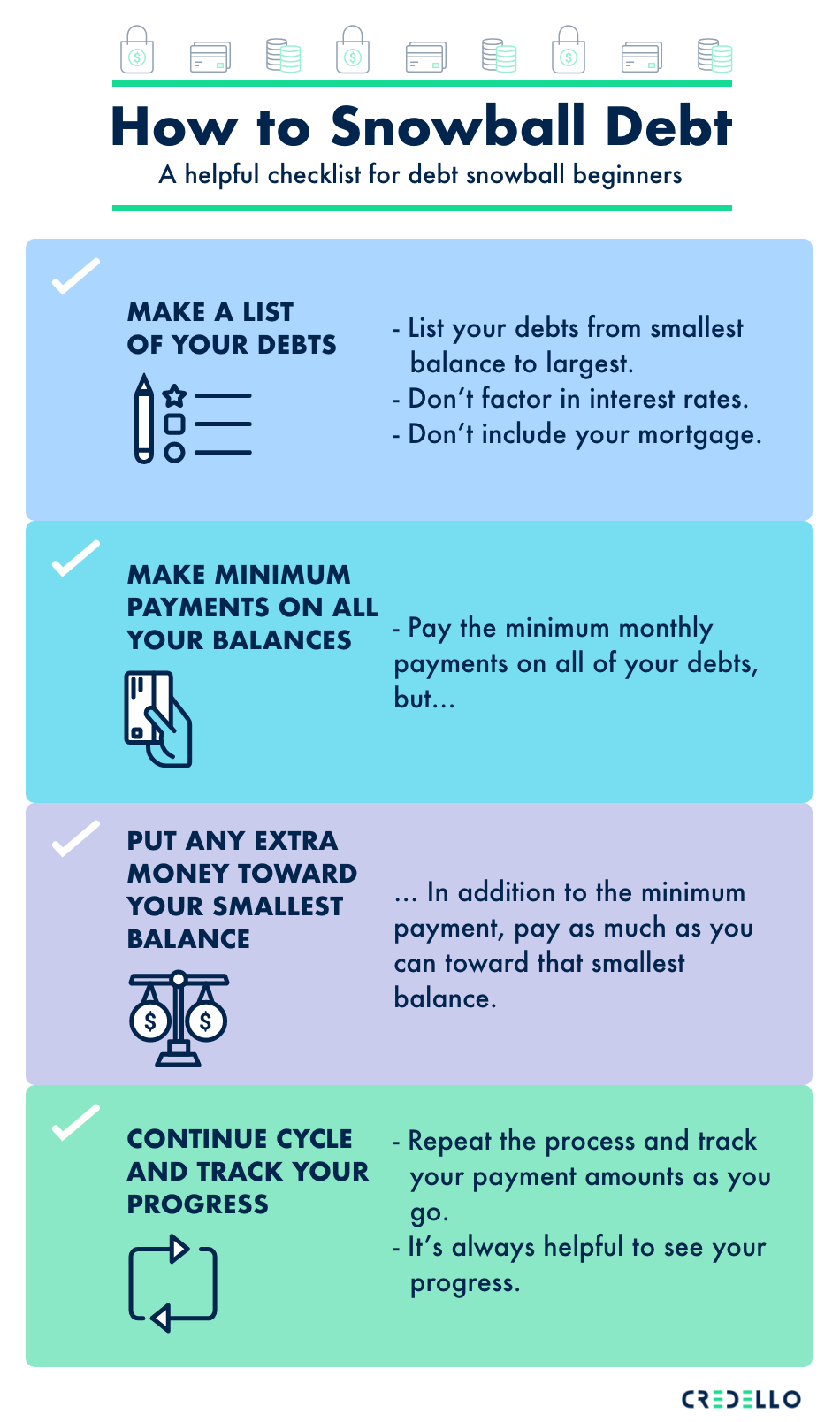

5 steps of the debt snowball method

Before you start using the snowball method of paying debt, you’ll want to be sure of two things: a) Are you up to date on all your bills? And b) Do you have at least $1,000 stashed away for emergencies?

If you can answer yes to both of those questions, you’re ready to snowball your way out of debt. Here’s how it’s done.

1. Make a list of your debts

Create a list and order your debts from smallest to largest balance. Don’t factor in interest rates (the debt avalanche method focuses on interest rates). Also, if you own a home, do not include your mortgage on this list.

2. Make minimum payments on all your balances

Begin or continue making minimum payments on all of your debts, including the one with the smallest balance.

3. Put any extra money toward your smallest balance

In addition to the minimum payment, put any extra money you have toward that smallest balance.

4. Once smallest is paid off, move on to next smallest

After you’ve fully repaid your smallest debt, move on to the next smallest balance and repeat the process.

5. Continue cycle and track your progress

Keep up the momentum until all of your debts are paid off and you’re completely debt-free. As you progress, track your payment amounts and cross debts off your list as you repay them. (It’s cathartic—trust us.)

Related: Real-Life Debt Snowball Examples and Success Stories