Debt Snowball vs. Debt Consolidation: Which Is Right for You?

About Stefanie

Stefanie began her career as a journalist, reporting on options, futures, and pension funds, and most recently worked as a writer and SEO content strategist at a digital marketing agency. In her free time, she enjoys teaching Pilates and spending time with her daughter and Siberian Husky.

Read full bio

At a Glance

The debt snowball and debt consolidation methods are two popular ways of paying off debt. This article will discuss each method in detail and help you decide which one might be the best fit for your financial needs.

- Debt snowball vs consolidation

- What’s debt consolidation?

- What’s the debt snowball method?

- Debt consolidation vs snowball: the bottom line

So, there are way too many options to pay off debt smartly. That’s where Credello comes in. Take this quiz to figure out what could be right for you!

Take Our Quiz: Debt Snowball vs. Debt Consolidation

Paying off debt can feel overwhelming, especially if you’re facing a mountain of unpaid bills. Shoving them into a closet might make you feel better for a couple of hours, but unfortunately that doesn’t count as a way to actually eliminate debt.

Debt snowball vs. consolidation

Selecting a repayment strategy can help you tackle your debt and achieve financial freedom. But which strategy is the best choice for you? In this article, we’ll discuss the debt consolidation loan vs. debt snowball methods.

What’s debt consolidation?

Debt consolidation is when you combine multiple debt payments into just one monthly bill. There are two ways to do it:

- Get a balance transfer card with 0% interest promotional period: You’ll move all of your debts onto the card and pay the entire balance during the card’s 0% APR promo period. Note that once the promotional period is over, the regular interest rate will kick in.

- Get a debt consolidation loan: You’ll use a fixed-rate debt consolidation loan to pay off your debt, and then pay the loan back in installments.

Pros of debt consolidation

Advantages of debt consolidation include the fact that it simplifies how you pay your bills since you only need to make one payment each month. It can also save you money since you’re hopefully securing a lower interest rate.

Cons of debt consolidation

Disadvantages of debt consolidation include that securing a lower interest rate isn’t guaranteed. Plus, consolidating your bills often lengthens the term of your loan, meaning you might wind up paying more in the long run. If you don’t have good financial habits, you could actually end up in deeper debt with debt consolidation. After all, it isn’t eliminating your debt as much as restructuring it.

Related: Breaking Down the Pros and Cons of Debt Consolidation

Is debt consolidation a good fit for you?

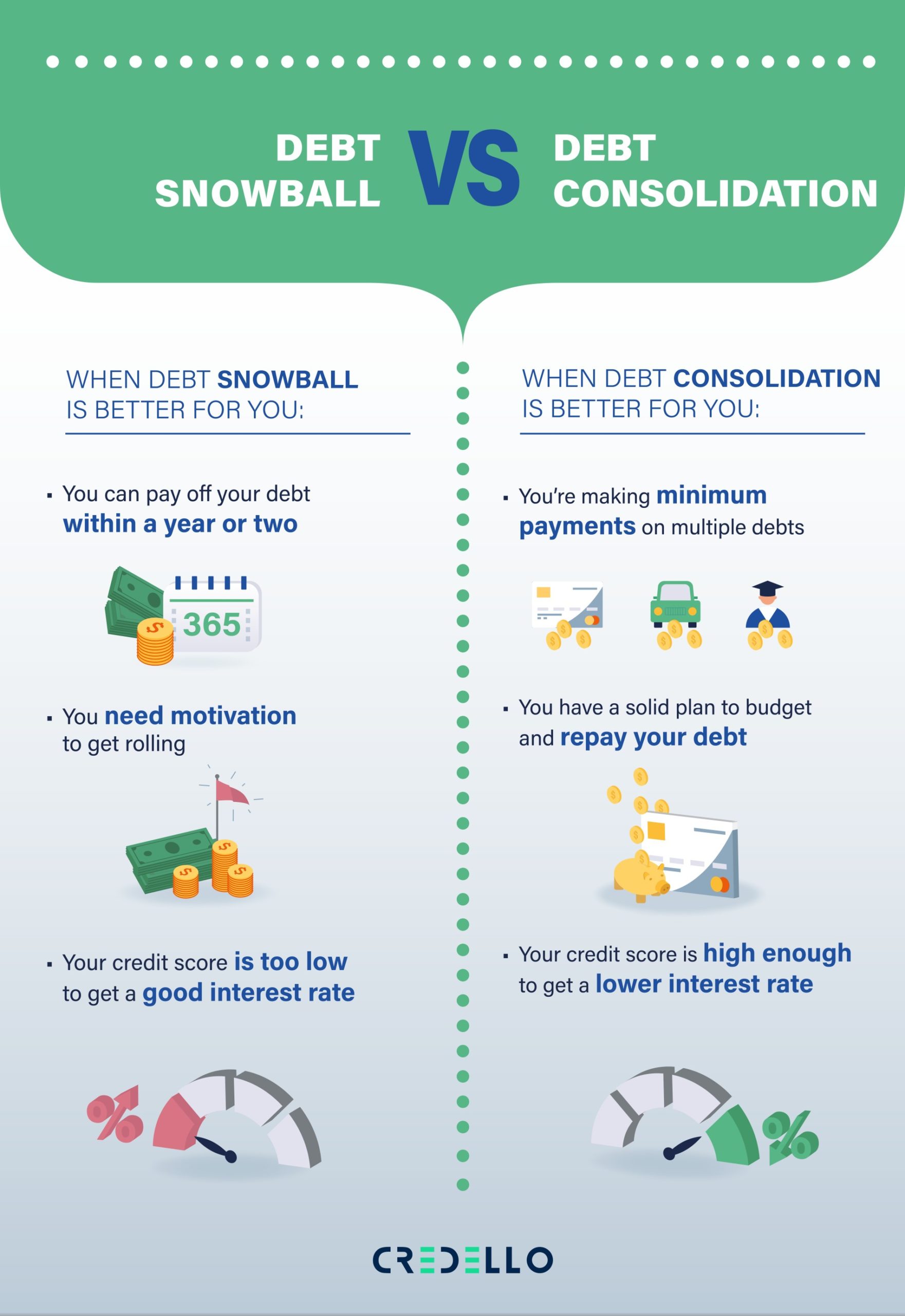

Debt consolidation might be a good fit for you if:

- You’re currently making minimum payments on multiple credit cards or loans

- You have good credit to qualify for a low-interest loan or 0% APR balance transfer card

- You have a plan in place to improve your financial habits.

Related: Is Consolidating Your Debt a Good Idea?

What’s the debt snowball method?

The snowball method is a debt repayment plan in which you make the minimum payments on all of your loans but put extra money toward the loan with the lowest balance. Once that loan is fully paid off, you’ll put extra money toward the loan with the next lowest balance, and so on.

Related: How to Snowball Debt

Pros of the snowball method

The major advantage of the snowball method is that it gives you an extra dose of motivation to pay off your debt. Knocking off payments can give tangible evidence of your repayment success and keep you on track with your financial goals.

Cons of the snowball method

The biggest downside of the snowball method is that it won’t help you save on interest. Since your main focus is on the debt with the smallest balance, you’ll still be paying interest on your largest balances.

Is debt snowball a good fit for you?

The snowball method might be right for you if you lack motivation to pay off your debt. Quick wins can keep you on track for repayment success, as long as you track your progress, which a tool like a debt snowball calculator can help with.

Related: How to Start a Debt Snowball

Debt consolidation vs. snowball: The bottom line

Debt consolidation and the debt snowball method can both help you with your debt. If you have a stable income and a plan to better your spending habits, debt consolidation might work for you. If you need more motivation to get started with paying off debt, you may want to go with the snowball method.

Recommended: 7 Debt Snowball Mistakes (and How to Avoid Them)