Cash Stuffing Survey: 1 in 3 People Say it’s Very Effective for Saving Towards a Goal

About Harrison

Harrison Pierce is a writer and a digital nomad, specializing in personal finance with a focus on credit cards. He is a graduate of the University of North Carolina at Chapel Hill with a major in sociology and is currently traveling the world.

Read full bio

At a Glance

Cash stuffing is a viral trend made popular by TikTok that encourages healthy personal finance practices by stuffing cash into envelopes that are labeled for their use. This can range for anything from paying off debt to eating out. Cash stuffing was popular before the rise of technology, but has seen a huge spike in popularity with Gen Z and Millennials after blowing up on TikTok. Credello conducted an online survey recently and found that among 600 adults that were using or had used cash stuffing, more than half (60.83%) regularly use cash stuffing. Is this how young adults will manage their money from now on? For more information on cash stuffing, check out our biggest tips and tricks.

Here are some key takeaways from Credello’s 2022 survey on cash stuffing:

- Nearly 61% of respondents use cash stuffing to manage their finances.

- Close to 45% use the cash stuffing method when they receive their paychecks.

- 1 in 3 adults say the cash stuffing budgeting method is very effective for saving towards a goal.

- 28.26% of Millennials and Gen Zers use cash stuffing for everyday purchases.

- More than half of adults still use credit cards in addition to cash stuffing.

Cash stuffing for budgeting: increasingly popular

Cash stuffing videos on TikTok get hundreds of thousands of views and lots of comments. Not only is it entertaining to watch, but viewers constantly hear about success stories using the method. Some people have been able to pay off thousands of dollars worth of debt over time using this budgeting technique, while others can take that dream vacation that they could never afford.

Respondents from our survey found out about cash stuffing from many different sources, showing just how pervasive the technique is becoming. Though Gen Zers are completely inundated in the world of TikTok, friends and family still beat out social media at 36.44% versus 29.48%. Word of mouth still counts for something! Thirty percent said the pressure of inflation led them to look for more budgeting tools like cash stuffing and 33.42% turned to cash stuffing to curb their overspending. If you are looking for other budgeting hacks in this time of high inflation check this out.

Cash stuffing as a debt payoff method

Interestingly, some people view cash stuffing as a method or system to deal with debt. Twenty-four percent said they used cash stuffing to help them pay off debt and 23% said they turned to cash stuffing because they were in credit card debt. One of the benefits people see with cash stuffing is that you aren’t using a credit card therefore you can’t go into more high interest credit card debt. Of course, not using credit cards can also impact your credit score but if you do have debts and need help, check out MyCredello. A financial wellness platform that allows you to track all of your debts in one place so you never miss a payment again.

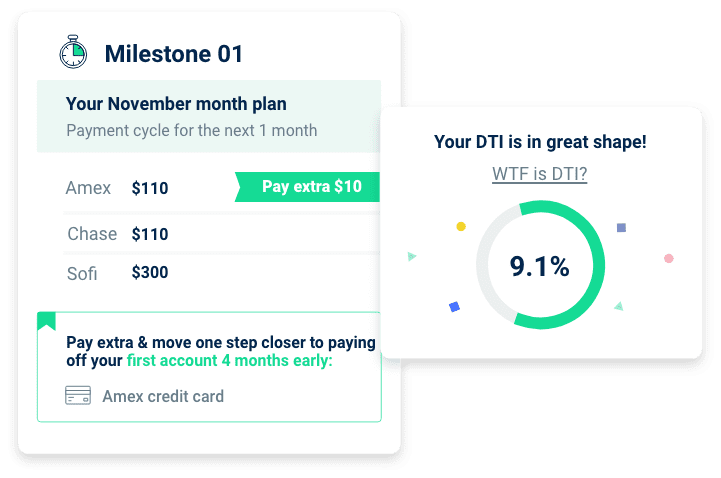

Payoff your debts faster

Easily add other loans & credit cards to track & effectively manage all your debts in one place

Not the only budgeting tool people use

More than half of people are still using credit cards in addition to cash stuffing. This budgeting tool can be helpful when saving for a specific goal or trying to cut down on spending, but many people still enjoy the ease of using their credit card when shopping online or traveling. Respondents mainly use cash stuffing to save for a large purchase, to pay off debt, and for everyday expenses. Other expenses, like rent, utilities, and car payments are all made electronically.

Budgeting is not a one size fits all solution, so when people learn of a new technique, they adapt it to fit their specific needs. Some people love cash stuffing to monitor every aspect of their spending, while others use it for specific goals that they want to accomplish.

The biggest drawbacks to cash stuffing

Almost one-third of respondents (29%) were primarily concerned about theft when it came to cash stuffing. This is a major drawback and is unique to this type of budgeting, as everything is tangible. However, make sure you keep your envelopes in a safe place, especially if you are living with roommates. Invest in a safe or hide your cash in a closet when you are out of the house to keep your money protected.

Some respondents were also concerned about building or maintaining a credit score and not earning points or interest on money spent and held. These are valid concerns and are the main drawbacks of using the cash stuffing method. This is likely why we still see many people using credit cards in addition to cash, so they can save and budget but still earn points and interest.

Credello is here for you

Credello is a personal finance resource that harnesses the power of data and technology to help users make smarter, more personalized decisions around their finances. Whether it is debt consolidation, selecting the right credit card, or taking out a personal loan, Credello helps navigate the intricacies with ease.

This survey was conducted online in partnership with a third-party platform, Pollfish. The total sample size was 600 adults in the United States aged 18 to 41. The results have been weighted to balance responses to census statistics on the dimensions of age and gender. Generations mentioned in the survey results are categorized as:

Gen Z: Age 18-25

Millennials: Age 26-41

For complete survey methodology, please contact support@credello.com.