Best Mobile Banking Apps

About Caitlyn

Caitlyn is a freelance writer from the Cincinnati area with clients ranging from digital marketing agencies, insurance/finance companies, and healthcare organizations to travel and technology blogs. She loves reading, traveling, and camping—and hanging with her dogs Coco and Hamilton.

Read full bio

At a Glance

Mobile banking has come a long way in the last several years, boasting not only security but also a variety of features and functionality to make banking easier. Not only can you do the basics like digitally deposit checks and pay bills, but you may also be able to turn your divide into a digital wallet, track accounts from different financial institutions, and take advantage of budgeting and investing tools to help you grow your wealth.

It’s estimated that the households using mobile banking in the U.S. is about 43%. But with so many options, it can be tricky to know which one is the best.

Comparing the best mobile banking apps

Mobile banking is continuing to become more and more popular, to the point where it’s an almost essential tool. Not only can you access your funds and accounts from anywhere, these apps provide a variety of tools to help make banking and managing your finances easier.

Whether you’re new to mobile banking or are looking to switch, we’ve put together a list of the top eight mobile banking apps to help you get started:

| App | Annual Percentage Yield | Fees | Availability |

|---|---|---|---|

| Ally | 3.85% |

|

|

| Discover | 3.90% |

|

|

| Chase | 0.01% |

|

|

| Capital One | 360 Checking: 0.10%360 Performance Savings: 4.0%

MONEY Teen Checking: 0.10% Kids Savings: 0.30% |

|

|

| Bank of America | Base: 0.01%

Preferred Rewards Program: up to 0.04% |

|

|

| Chime | 2.00% |

|

|

| Wells Fargo | 0.15% |

|

|

| PNC | Standard rates: 0.01%

Relationship Rates with PNC checking account: 0.02% (less than $2,499.99 balance); 0.03% ($2,500+ balance) |

|

|

Featured Checking Accounts from our partners

A closer look at the top banking apps for mobile phones

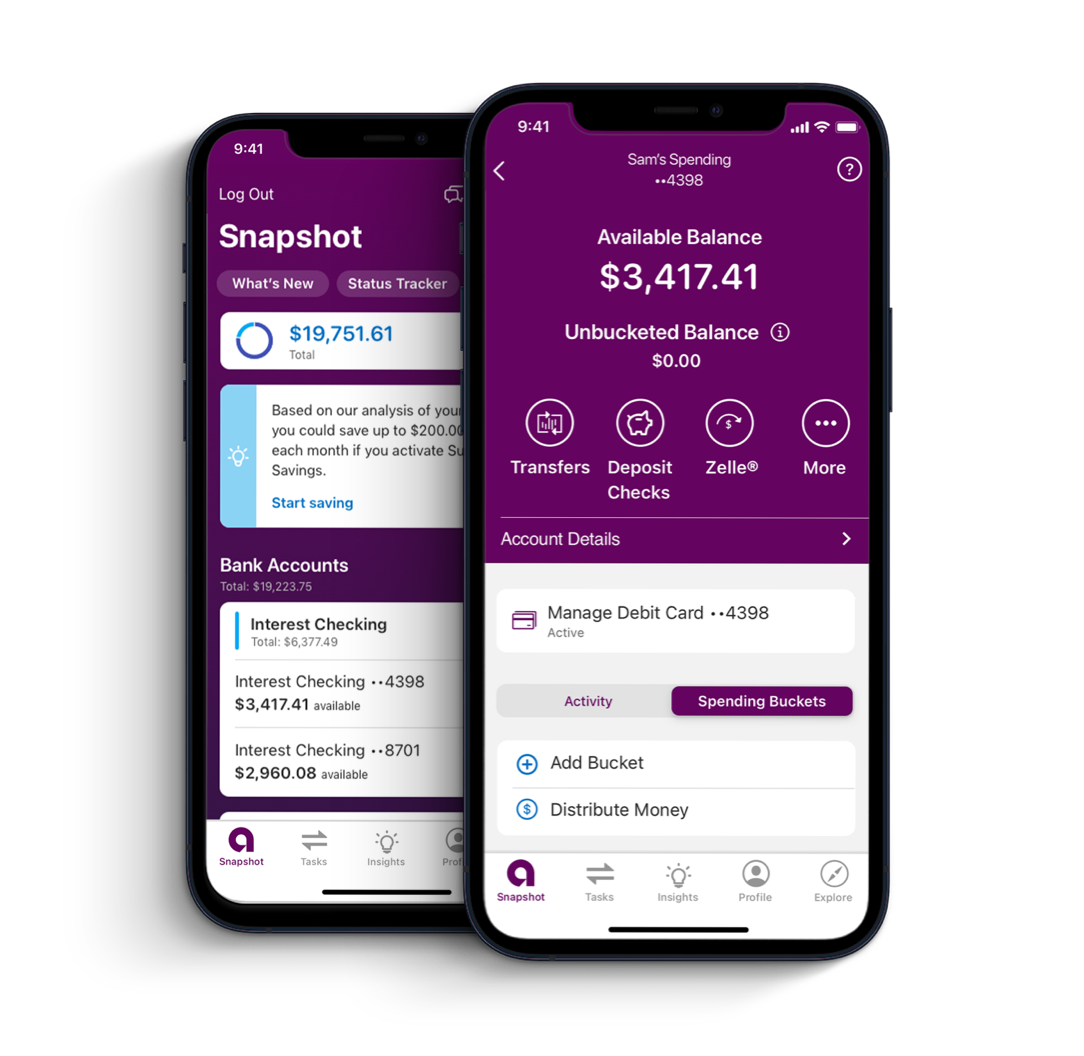

Ally Bank

Annual percentage yield: 3.85%

Fees:

- Excessive transactions fee: $10 per transaction

- Expedited delivery: $15

- Outgoing domestic wires: $20

- Account research fee: $25 per hour

Minimum deposit: $0

Key features:

- App includes mobile check deposit, free money transfers, online bill pay, transaction and balance histories, and an ATM locator.

- Offers savings, money market, interest checking, high-yield CD, raise your rate CD, and no penalty CD accounts.

- No monthly maintenance fees or minimum balance requirements

- Interest is compounded daily

- Boosters can optimize and maximize your savings.

- Access to Zelle.

- Debit card customizations.

- Round up debit card purchases to the nearest dollar and have spare change automatically moved to your savings accounts.

- “Savings buckets” for individual savings goals.

Security measures:

- 2-step authentication.

- Anti-virus and anti-malware protection and software.

- Firewalls.

- Transport layer security (TLS) encryption.

- Online and mobile security guarantee.

- Credential confidentiality.

- Automatic logout.

- Account monitoring.

- Site and app reviews.

Apple Store rating: 4.7/5 stars

Google Play rating: 3.7/5 stars

Our verdict: If you’re looking for a mobile banking app that helps your money work for you, Ally may be the right choice. Not only is the APY one of the highest at 3.85%, but the app also offers a variety of savings features such as boosters, savings buckets, and the ability to round up debit card purchases for extra savings. No monthly maintenance fees and no minimum balance requirements, along with a variety of security measures add to the benefits.

However, Android users may have a less-than-ideal experience compared to Apple based on the app ratings.

| Pros | Cons |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

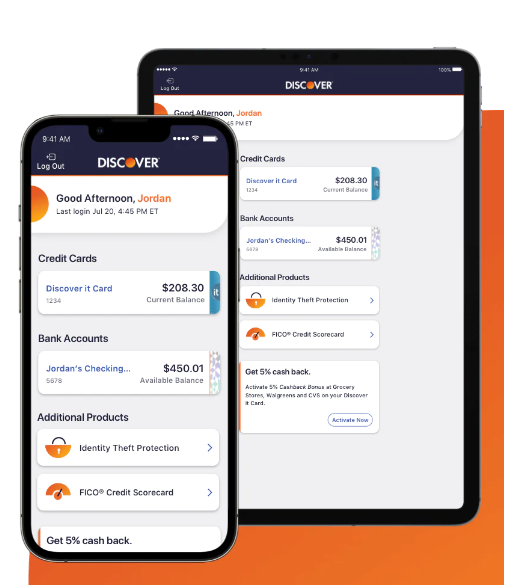

Discover

Annual percentage yield: 3.90%

Fees:

- No account-related fees.

- Outgoing wire transfer service charge: $30

Minimum deposit: $0

Key features:

- No fees for monthly maintenance, official bank check, excessive withdrawals, expedited delivery, deposited item returned, stop payment order, insufficient funds, or account closure.

- Checking, savings, money market, and retirement accounts and CDs

- Discover Deals, an in-app marketplace that offers deals on the latest brands.

- Redeem credit card rewards through the app.

- Check your FICO score for free, apply for new accounts, and pay bills.

- iPhone users can add Discover cards to their Apple Pay Wallet.

Security measures:

- Secure Socket Layer (SSL) technology to encrypt your personal and account information online.

- Alerts for real-time oversight of your account.

- Freeze and unfreeze your debit cards within seconds.

- Fraud protection for unauthorized purchases.

- Proactive fraud monitoring.

- FDIC insured.

- Enhanced account verification.

Apple Store rating: 4.9/5 stars

Google Play rating: 4.7/5 stars

Our verdict: Discover mobile banking also helps your money work for you with an even higher APY of 3.9%, and it’s great for rewards. No account-related fees and no minimum deposit keep dollars in your pocket. And since Discover also offers credit cards and other financial accounts, you’re able to manage them all within one app. Plus, access Discover Deals for cash back or redeem rewards through the app. And, app store ratings are high for both Apple and Android.

| Pros | Cons |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

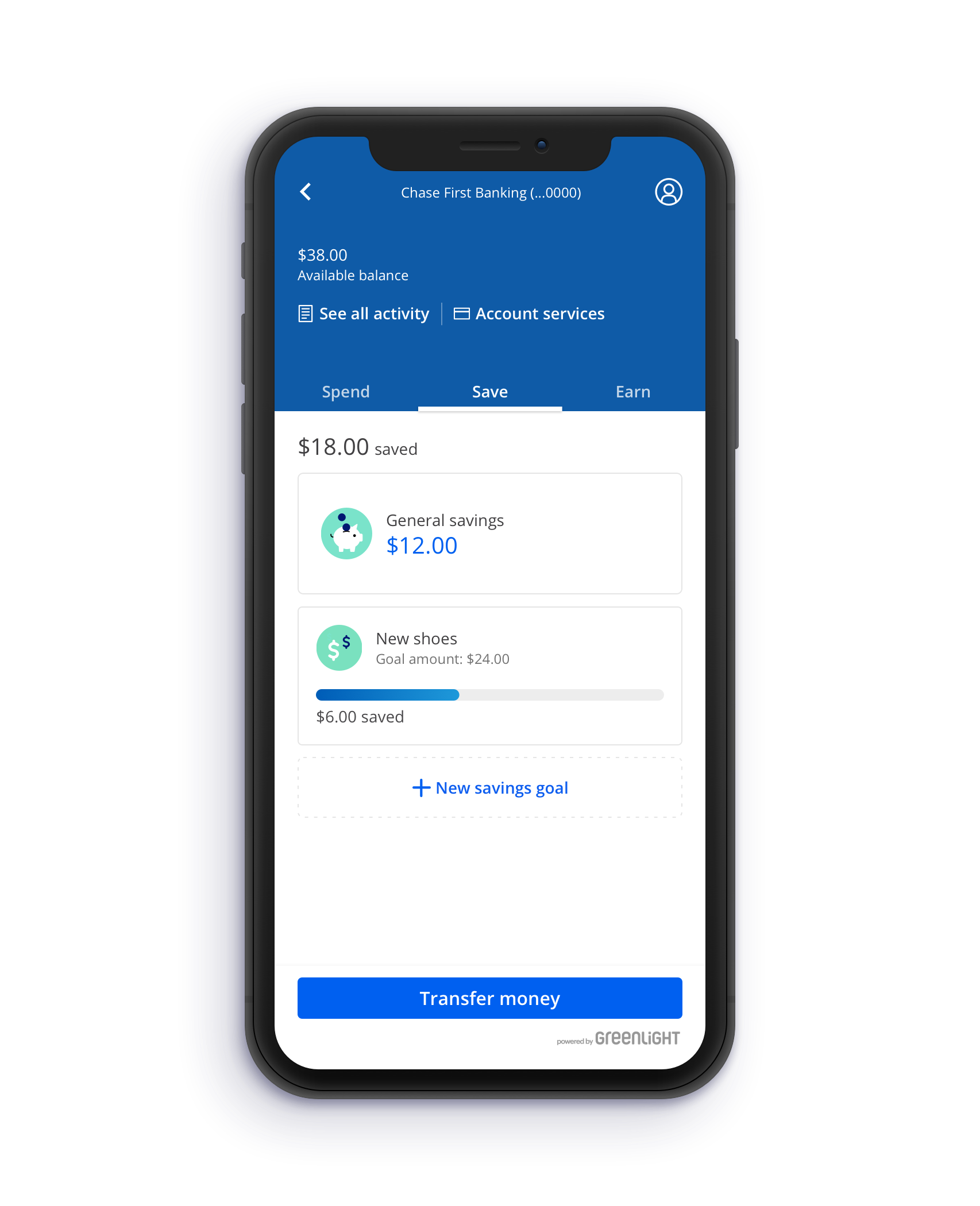

Chase

Annual percentage yield: 0.01%

Fees:

- $5 monthly service fee OR $0 with one of the following (each monthly statement period):

- A balance at the beginning of each day of $300 or more,

- OR $25 or more in total Autosafe or other repeating automatic transfers from your personal Chase checking account,

- OR a Chase College Checking account linked to this account for Overdraft Protection,

- OR an account owner who is an individual younger than 18,

- OR a linked Chase Premier Plus Checking, Chase Sapphire Checking, or Chase Private Client Checking account

- Non-Chase ATM fee: $3 to $5

- Wire transfer fee: $0 to $50

- Money order: $5 per check

Minimum deposit: $0

Key features:

- Services like checking accounts, savings accounts, CDs, credit cards, mortgages, home equity line of credit, auto financing, planning and investing support, business banking, and more are available.

- Send and receive money instantly with no fees though Zelle.

- My Chase Plan allows you to break up debit card purchases into more budget-friendly payments with no interest; fixed monthly fee applies (1.72% of the amount of each eligible purchase transaction).

- Chase QuickDeposit allows for check deposits via mobile app.

- Chase Offers gives shopping deals within the app.

- Opportunity to earn rewards.

- Budget planning, credit journey monitoring, autosave transfers.

- Investment tools and availability to experts with J.P. Morgan Wealth Management.

Security measures:

- Apple’s Touch ID and Face ID, Android’s Fingerprint Login.

- Fraud and suspicious activity monitoring.

- Multi-authentication checks.

- Encryption technology for username, password, and other personal account information.

Apple Store rating: 4.8/5 stars

Google Play rating: 4.4/5 stars

Our verdict: Even though Chase has one of the lowest APYs (0.01%) and several fees, there are ways you can avoid some of the fees and protect your wallet. You can easily manage all of your financial accounts including checking accounts, savings accounts, CDs, credit cards, mortgages, home equity line of credit, auto financing, planning and investing support, business banking, and more.

Chase QuickDeposit, Chase Offers, and My Chase Plan also help you with budgeting and earning rewards. And, stay on top of your credit score with free access to your TransUnion information in the app.

| Pros | Cons |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

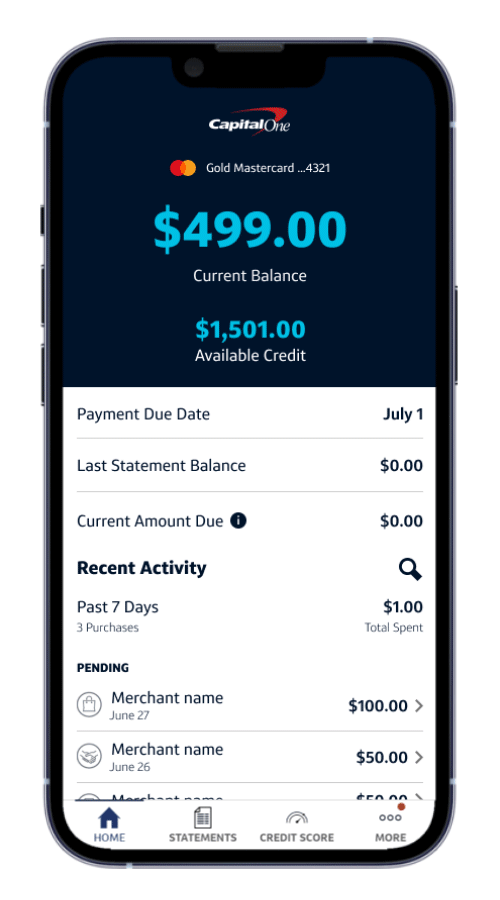

Capital One

Annual percentage yield:

- 360 Checking: 0.10%

- 360 Performance Savings: 4.0%

- MONEY Teen Checking: 0.10%

- Kids Savings: 0.30%

Fees: None

Minimum deposit: None

Key features:

- 70,000+ fee-free ATMs.

- Access to Capital One Cafes.

- Mobile check deposit.

- Make transfers or send money via Zelle.

- CreditWise from Capital One allows access to your credit score and report any time; can also use CreditWise Simulator to see how financial moves can affect your credit score.

- Can view all accounts, including home and auto loans, checking and savings accounts, and credit card accounts.

- Set up push notifications to keep track of purchase and credit history.

- Large mobile footprint (such as being able to access accounts via an Apple Watch).

- Credit card customers can view and redeem rewards via the mobile app.

Security measures:

- Secure login.

- Real time fraud alerts.

- Card lock/unlock.

- $0 liability for unauthorized charges.

Apple Store rating: 4.9/5 stars

Google Play rating: 4.6/5 stars

Our verdict: Ranked the top banking mobile app by J.D. Power in 2022 and consistently at the top of the J.D. Power “Highest in Customer Satisfaction Among Mobile Banking Apps” survey, the Capital One mobile app has a lot to offer. Depending on which type of Capital One account you choose, you could earn an APY up to 4%, the highest on our list. However, the standard is 0.10%, which is lower compared to some others, though you can earn interest on funds in a checking account, which isn’t standard.

No fees and no minimum deposit help make up for that, as does access to more than 70,000 fee-free ATMs, the ability to view and manage a number of different types of accounts (including your credit card), and the in-app virtual assistant for customer service support make this app stand out.

| Pros | Cons |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

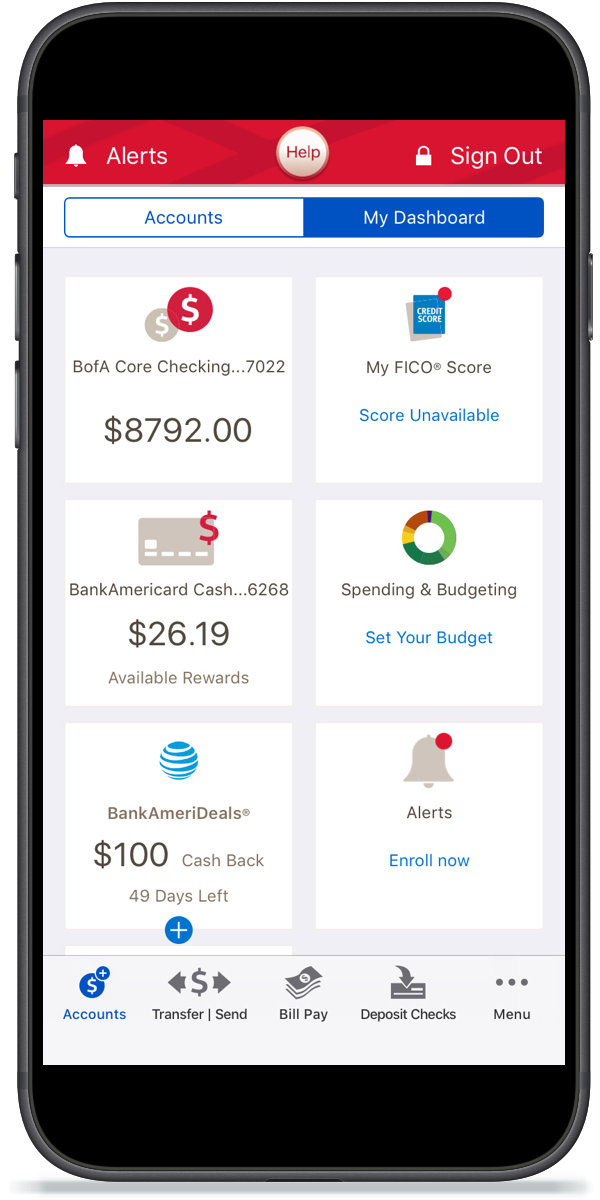

Bank of America

Annual percentage yield:

- Base: 0.01%

- Preferred Rewards Program: up to 0.04%

Fees:

- $8 monthly maintenance fee unless you:

- Maintain a minimum daily balance of at least $500,

- OR link your Bank of America Advance Savings account to your Bank of America Advantage Relationship Banking account,

- OR when you’re a Bank of America Preferred Rewards member,

- OR an account owner is under age 18,

- OR an account owner is under age 25 and qualifies as a student

- $10 fee for withdrawals or transfers exceeding 6 in a monthly statement cycle.

- Non-Bank of America ATM fee: $2.50

Minimum deposit:$100

Key features:

- Securely send money using Zelle.

- Erica, the virtual financial assistant within the app, can help with transactions, checking savings and checking account balances, and even provide insights on spending.

- Mobile check deposit.

- Get your FICO score without impacting your credit.

- Digital wallet to pay through your phone.

- Browse cash back deals with BankAmeriDeals and redeem credit card rewards.

- The Spending and Budgeting tool helps you stay on course and take control of your spending.

- Access to all Bank of America, Member FDIC, and Merrill Edge accounts.

Security measures:

- Set up unusual activity alerts.

- Set your own privacy choices for marketing and sharing of information.

- Customize your alerts.

- Security meter to help you track actions you take to help protect your accounts against fraud.

- Lock and unlock debit card through the app.

- Touch ID and Face ID enabled.

Apple Store rating: 4.8/5 stars

Google Play rating: 4.6/5 stars

Our verdict:Also ranked high in the 2022 mobile app satisfaction study from J.D. Power (4th with a score of 840/1,000), the Bank of America app consistently rates highly as the best for security. You can set up a variety of customized alerts and privacy choices, and there’s a security meter to help you track actions you take to protect yourself against fraud. Other features like the ability to redeem credit card rewards, spending and budgeting tools, and a virtual assistant within the app make this one relatively user friendly.

| Pros | Cons |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

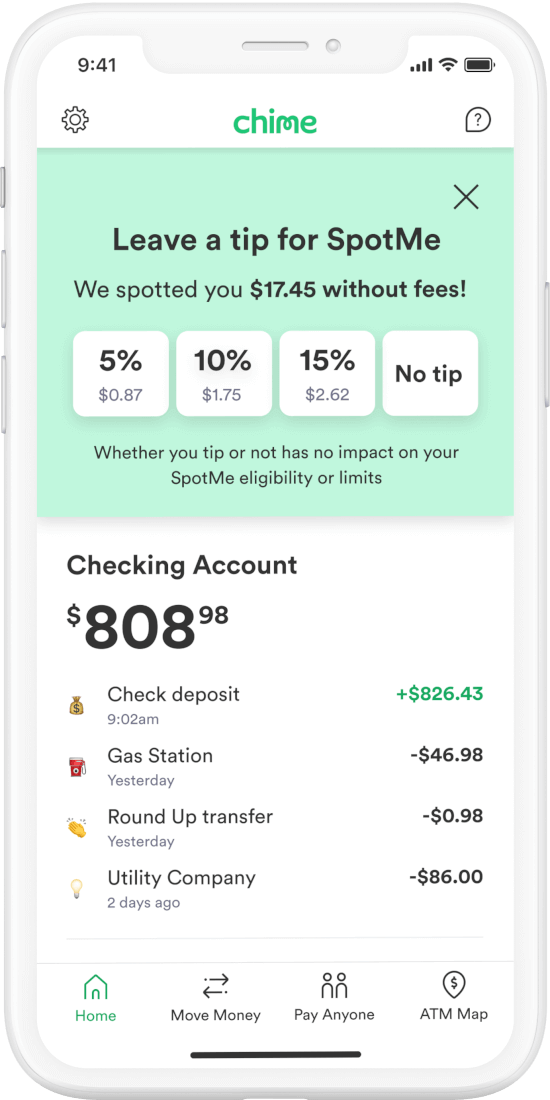

Chime

Annual percentage yield:2.00%

Fees:

- No account fees.

- Over the counter or out-of-network ATM withdrawal: $2.50

Minimum deposit: None

Key features:

- 2.00% APY with no maximum interest earned.

- No monthly fees.

- Get paid up to 2 days early with direct deposit.

- More than 60,000 fee-free ATMs.

- Fee-free overdraft up to $200.

- 24/7 live support.

- Credit builder visa card available.

- Round Ups let you save change on every purchase.

- When I Get Paid helps automatically save a percentage of each paycheck.

- Money transfers are instant and fee-free.

- App supports mobile payment platforms, including Apple Pay, Google Wallet, and Samsung Pay.

Security measures:

- FDIC insured.

- Instant transaction alerts.

- Freeze/unfreeze card in the app.

- Two-factor and fingerprint authentication.

- Encryption of data.

Apple Store rating: 4.8/5 stars

Google Play rating: 4.6/5 stars

Our verdict: Chime was designed to be one of the top mobile banking apps. While the APY isn’t as high as others on our list (2.0%), it is better than you can find elsewhere. It helps that there are no account fees, you get access to more than 60,000 fee-free ATMs, and they offer fee-free overdraft protection.

If you’re looking for little ways to save, this app is great for you. With the Round Ups and When I Get Paid programs you can easily put a little money aside at a time. And, not only can you check your credit score for free, Chime offers a secured credit card to help users build credit.

The downside is Chime is 100% online only and some services are limited, but they do provide 24/7 live customer support.

| Pros | Cons |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

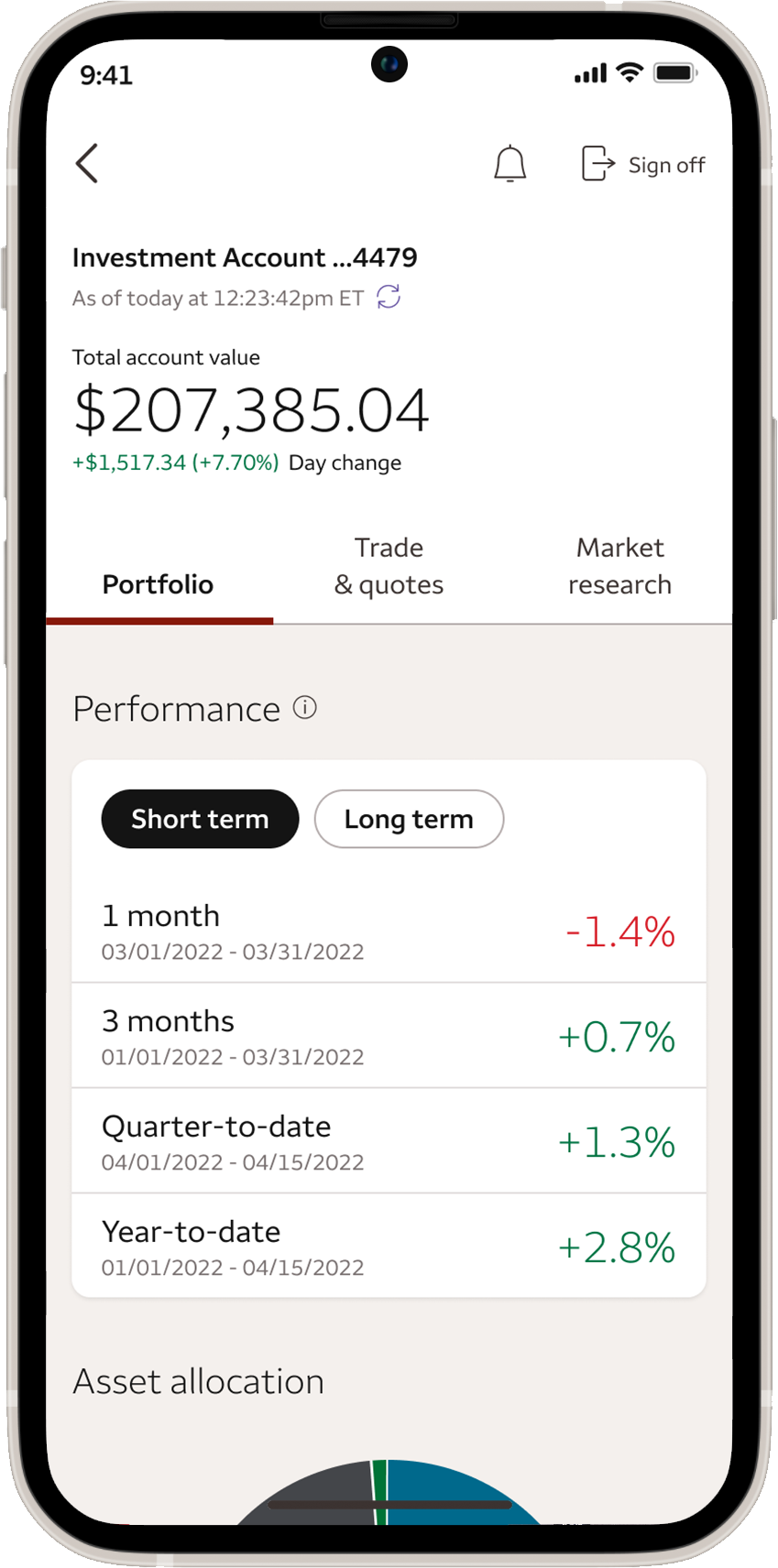

Wells Fargo

Annual percentage yield: 0.15%

Fees:

- Monthly service fee: $5 unless one of the following each fee period:

- $300 minimum daily balance,

- OR 1 automatic transfer each fee period of $25 or more from a linked Wells Fargo checking account,

- OR 1 automatic transfer each business day within the fee period of $1 or more from a linked Wells Fargo checking account,

- OR 1 or more Save As You Go transfers from a linked Wells Fargo checking account,

- OR primary account owner is 24 years or younger.

- Other fees may apply.

Minimum deposit: $25

Key features:

- Monitor balances and transactions.

- Set up account alerts.

- Send money with Zelle.

- Deposit checks within the app.

- Digital wallet integrations.

- Access your investments and open orders for your Wells Fargo Advisors and Wells Trade Accounts.

- Real-time quotes, market data, and graphics to help with investment decisions.

- Cardless ATM access option.

Security measures:

- 24/7 fraud monitoring.

- Encryption and browser requirements.

- Automatic sign out.

- Advanced access code required for certain transactions or charges.

- 2-step verification available.

- Zero liability protection.

Apple Store rating: 4.8/5 stars

Google Play rating: 4.8/5 stars

Our verdict: If you want a mobile banking app that also makes it easy to track and manage investments, Wells Fargo is a great option. In addition to checking and savings accounts, you can access your investments and open orders, get real-time quotes and market data, and more to help with investment decisions. Plus, there are digital wallet integrations and cardless ATM access options.

The primary downsides are there are monthly service fees and a minimum deposit is required and the APY is relatively low (0.15%), however, it was ranked third by the J.D. Power 2022 mobile app customer satisfaction survey,

| Pros | Cons |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

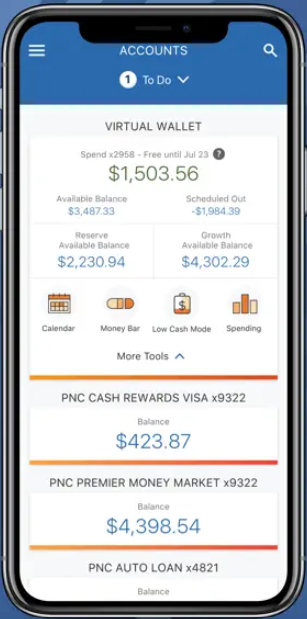

PNC

Annual percentage yield:

- Standard rates: 0.01%

- Relationship Rates with PNC checking account: 0.02% (less than $2,499.99 balance); 0.03% ($2,500+ balance)

Fees: $5 monthly service fee unless one of the following is met:

- Average monthly balance of $300

- Linked to a select PNC checking account

- Set up an Auto Savings transfer of $25 or more each statement period from your PNC Checking account to Savings account.

- You’re under 18 years old.

Minimum deposit: $0; $1 minimum to earn interest

Key features:

- Deposit checks on the go.

- Can access money faster (with a fee) using PNC Express Funds.

- Send and receive money with Zelle.

- Can be linked to a mobile wallet.

- The Purchase Payback program offers customized rewards based on your spending habits. Can earth cash or points.

- Card-free ATM access.

- Get available balance and last 5 transactions via text.

- PNC Voice banking provides immediate access to a variety of PNC Bank account-related information.

- Low Cash Mode ($0 non-sufficient funds fee, maximum one $26 overdraft item fee per day, customized alerts, 24 hours minimum extra time to bring balance to at least $0).

- Scheduled Out feature allows you to enter the number of bills/expenses you owe each month and the app automatically subtracts what you owe from balance.

- Set savings goals.

Security measures:

- View list of merchants where you’ve shared your card information for purchases or recurring transactions.

- Lock your card in real time.

- Account and security alerts.

- Encryption provides an extra layer of security.

- Two-step verification.

Apple Store rating: 4.8/5 stars

Google Play rating: 4.5/5 stars

Our verdict: This app is great if you don’t like to carry your card around with you, or often forget it at home. Within this app, access your credit, debit, and SmartAccess prepaid cards as well as card-free ATM access. The Purchase Payback program provides debit card rewards. Low Cash Mode can help protect your balance, and Scheduled Out features are great for help with budgeting and managing your accounts.

| Pros | Cons |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tips for selecting a mobile banking app

Even in today’s digital age, consumers are still cautious when it comes to using mobile banking apps. And, with so many options available from both online-only banks and traditional banks, it can be difficult to know which is right for you. A few questions to either research about the bank and app or to ask include:

- What tasks does the app provide? Is there anything missing that’s important to me? Does it offer all of the budgeting, investing, and savings tools I want?

- Does it provide access to other accounts, such as credit card accounts, investment accounts, and others? Is that important to me?

- How secure is the app? What security features does it have?

- How reliable is the app? Does it regularly have glitches or bugs? How often is it down for maintenance?

- Is the app easy to navigate?

- Can I reach customer service easily?

- What features/tools make this app better than the others?

Here are additional some tips you can follow to help you choose:

1. Be sure the app is offered by a reputable and well-known bank. Even if the bank is online-only, like Chime, this can help ensure your personal and financial information is safe, secure, and protected.

2. Choose one that’s user-friendly. It’s not worth choosing a mobile banking app if it’s difficult or confusing to use or navigate. You should be able to easily find all of the services you need, and the app should be reliable and secure. Check the app store ratings for reviews from other customers on how it works.

3. Check the features. Make a quick list of features that are important to you, such as:

- Mobile check deposit

- Digital wallet

- Budgeting or investing tools

- The ability to send money to friends and family

- Scheduling online bill payments

- Transferring funds

- Accessing ATMs

- Bank alerts and other security measures

- And more

Choose an app that offers all of the features you need.

4. Read customer service reviews. First determine if it’s important to you to be able to have in-person assistance at a physical location, because not all banks offer this option. Some apps offer in-app support such as live chat, while others you may have to send an email, submit a ticket, or make a phone call. Poor customer service can make using the app and banking with that institution difficult, so choose one that’s rated highly.

5. Understand the fees. ATM transaction fees, overdraft fees, monthly fees, and others can not only be frustrating, but they can add up quickly. Consider which fees may impact you the most and find a mobile banking app with low or no fees.

6. Be comfortable with the security. Trusting your bank account and personal information online can be scary, but a mobile banking app should have several security features designed to protect your information and money. Check for features like encryption, fraud monitoring, customized alerts, and Face ID/Fingerprint ID. Also make sure the bank is FDIC-insured.

FAQs

Generally, yes. Mobile banking has come a long way in the last few years and has become much more secure as they prioritize cybersecurity and protecting your information and money. There are often several security features in place, including encryption, two-factor authentication, fraud monitoring, and more. However, no bank anywhere is100% secure, so make sure you set and protect your password and add a passcode or Face ID to your phone.

Pros:

- Advanced and improved customer experience

- Easy to use

- Pay bills, transfer money, etc. through autopay so you neer miss a deadline

- Receive paychecks faster

- 24/7 access to your account

- High-level security and fraud alerts

- Access to a range of other services (such as investments and budgeting tools)

- Easily monitor transactions and manage your funds

Cons:

- Nothing is 100% secure, and fraud could still happen if you’re not careful

- Mobile banking can often be interrupted with bugs and other tech issues

- Fees

For the most part, both an app and browser provide about the same security. To protect yourself, download the app directly from your financial institutions website. Don’t get on public Wi-Fi to complete any transactions. If on a browser, make sure it’s secure with the lock icon in the URL. And always set strong and protect your passwords.

If using your own Wi-Fi at home that’s password protected, yes, banking apps are safe to use. However, try to avoid using public wi-fi networks as they are not secure and your sensitive information could be more easily hacked.