How to Break the Paycheck to Paycheck Cycle

About Anouare

Anouare is a seasoned writer, editor and content strategist who started her career as a lifestyle journalist before stepping into leadership roles at publications such as AskMen and Goalcast. From editorial strategy to content marketing and project-management, she has tackled various challenges in digital media and discovered her passion for mentoring others in the process. She loves a good money mindset book and believes you can create your dream lifestyle by being yourself.

Read full bio

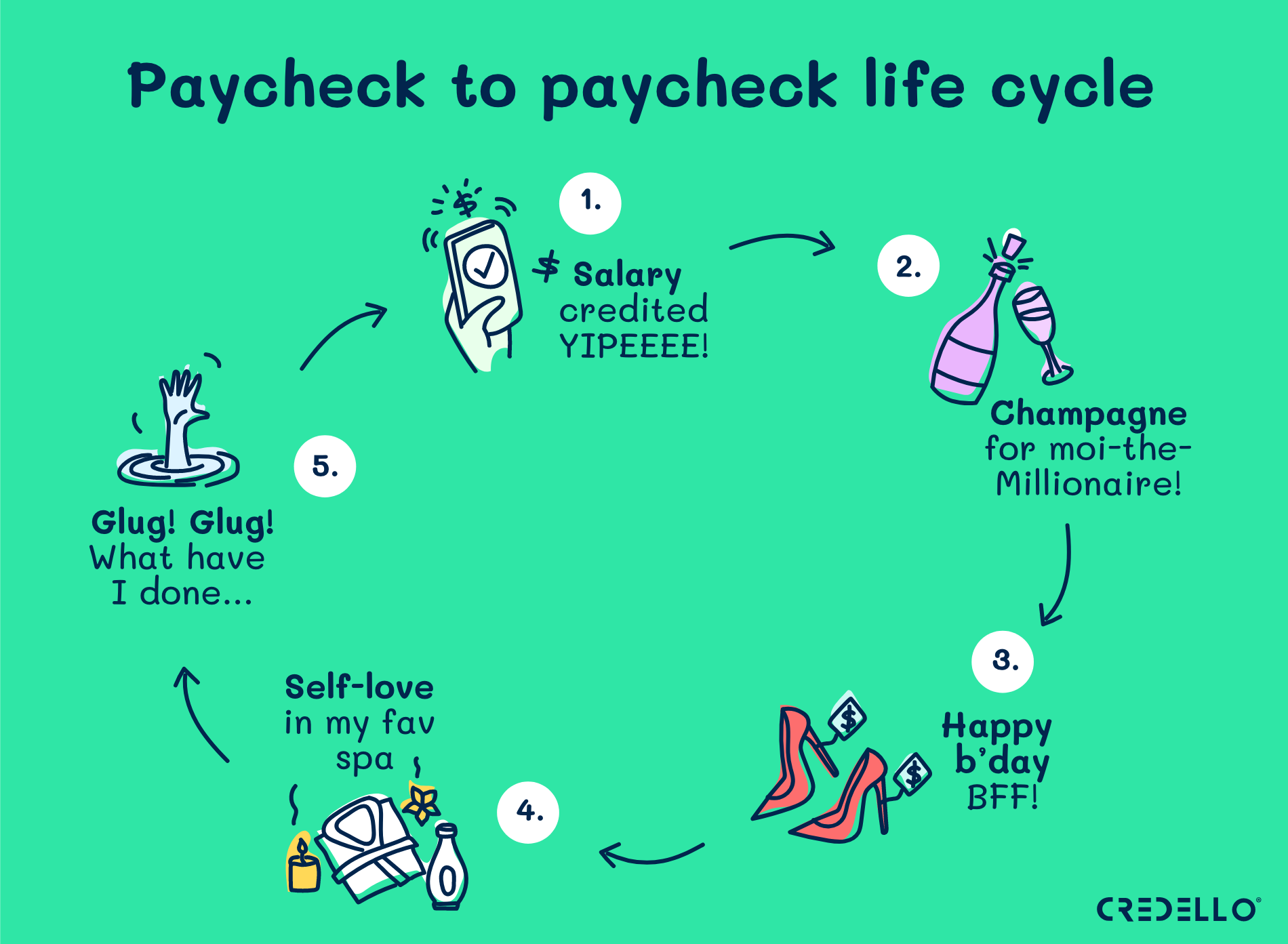

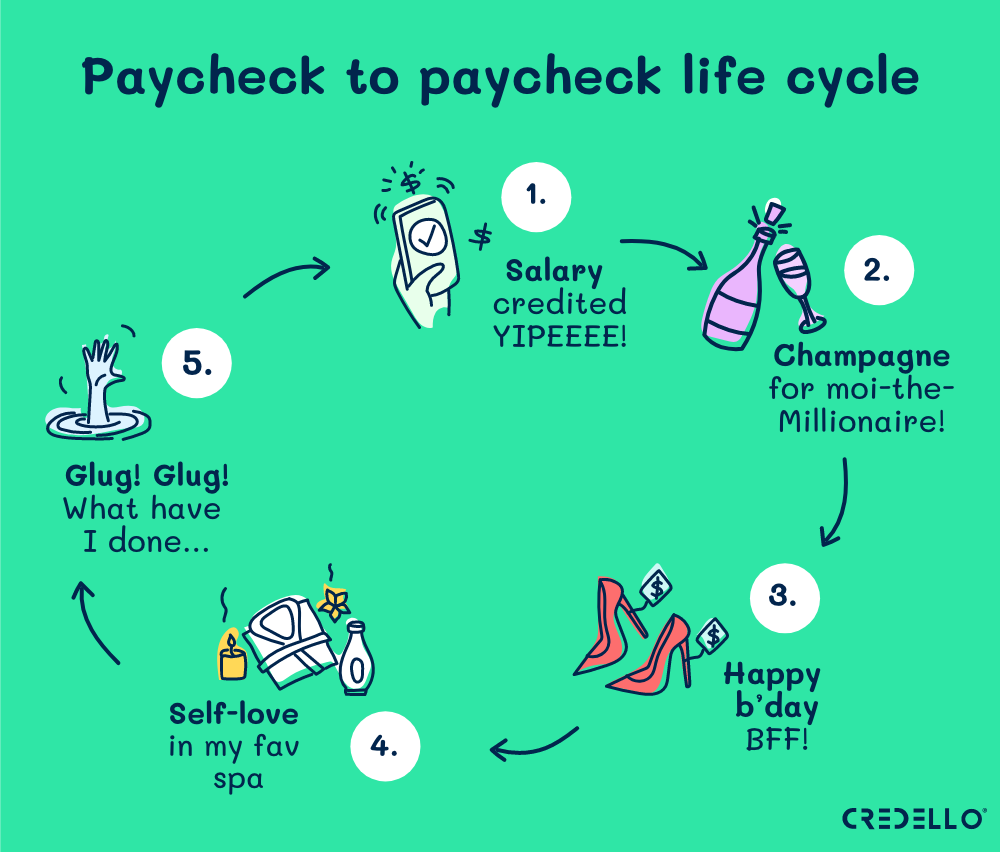

If it feels like your paycheck goes into your bank account and right out of it without much money left, you’re not alone. About 63% of Americans are living paycheck to paycheck, according to a 2022 LendingClub report. Even higher-income consumers are feeling the financial strain of barely making ends meet – 28% of consumers earning more than $200,000 are stuck in a paycheck-to-paycheck cycle, according to LendingClub data.

Current economic conditions are to blame. “Despite inflation beginning to level off, we’re still living in an era of rising prices. And while the job market is also in flux in fear of a looming recession, without getting salary raises that, at minimum, meet the interest rate, consumers across the board have essentially gotten a pay cut,” according to Natalia Brown, Chief Client Operations Officer at National Debt Relief. “These conditions send a shock to household budgets, leaving them to live paycheck to paycheck, and can take time before they’re able to recalibrate.”

Wondering how to get out of this vicious cycle when it feels you can barely afford to stay afloat and pay your monthly bills? It’s tricky, but there are steps you can take to feel more in control of your finances.

If you are really struggling with debt, you have options. Get your debt under control.

What debt do you want to consolidate?

Select all that apply

Others does not include mortgage

Debt Consolidation requires more than one debt account. Please select at least two debt types above.

Curb your spending and set up an emergency fund

“Living paycheck to paycheck is not easy and doesn’t leave room for surprise or emergency expenses. The biggest tip to break this cycle is to create a budget and account for dollars being set aside into a savings account,” says Brown. “Building a rainy-day fund is crucial to help offset unforeseen expenses without taking on more debt.”

It’s tempting to bury your head in the sand, but you’ll want to sit down and subtract all your expenses from your total income to see how much is left at the end of each billing cycle. “If your expenses total more than your income, your current income isn’t enough to support your lifestyle,” adds Brown.

This means that you’ll need to look for ways to curb your spending, from couponing to canceling subscriptions and even looking into moving to a less expensive area. Other inflation hacks include being super intentional at the grocery store and cooking more budget-friendly meals, driving less, using apps to find the cheapest deals around or get cashback, and swapping clothes with your friends instead of buying new ones. Drinking less? Not a bad idea. A financial cleanse is in order.

Step away from social media and BNPL

A digital detox may be in order, too. “Aside from the economy, culturally it’s never been so easy to spend money impulsively via social media. Between Instagram ads, influencers, and the latest TikTok craze, consumers are able to easily ‘add to cart’ throughout the two and half hours, on average, they’re spending on social media per day, without giving it much thought, which easily leads to overspending and blowing through your monthly budget,” according to Brown.

Avoid using Buy Now, Pay Later services to offset the fact that money is tight – it makes it way too easy to spend money you don’t have.

Increase your income

Increasing your income is another way to break the paycheck-to-paycheck cycle. From driving Uber to nannying or bartending, consider a side hustle that you can fit into your current schedule. Stay disciplined about putting any extra earnings aside instead of increasing your monthly expenses along with your new income.

Consider debt settlement arrangements

“Becoming debt-free is another effective way to free up some of your money monthly so you have a bit more cushion between pay periods,” says Brown. “When you’re already living paycheck to paycheck, are in debt, and have an unexpected bill like a car repair or medical emergency, you can end up in further debt, further stretching your income and a vicious cycle ensues.”

In these situations, Brown recommends considering a debt settlement company such as National Debt Relief to help negotiate with your creditors to lower the overall amount that you owe and put you on a plan to tackle what’s left. While these strategies do affect your credit score, they can be helpful when it comes to rebuilding a sustainable financial foundation.

Bottom line

With the rising cost of living, many people are stuck living paycheck to paycheck. If you’re one of them, you’re not alone. It’s important to do whatever you can to break the cycle and make sure you have a cushion in the event of emergencies. Make a strict budget, reduce your expenses, increase your income if you can, and consider different avenues to tackle your debt.