10 Best Personal Finance Apps for Millennials in 2021

About Stefanie

Stefanie began her career as a journalist, reporting on options, futures, and pension funds, and most recently worked as a writer and SEO content strategist at a digital marketing agency. In her free time, she enjoys teaching Pilates and spending time with her daughter and Siberian Husky.

Read full bio

At a Glance

Financial wellness doesn’t have to be a mystery, thanks to these apps that can help you make the most of your money. From helping you pay your bills to selecting investments, we’ve reviewed the best finance apps for you to use in the new year. Here are our top picks for the best personal finance apps for millennials in 2021—and what they’re most useful for.

Best free personal finance apps

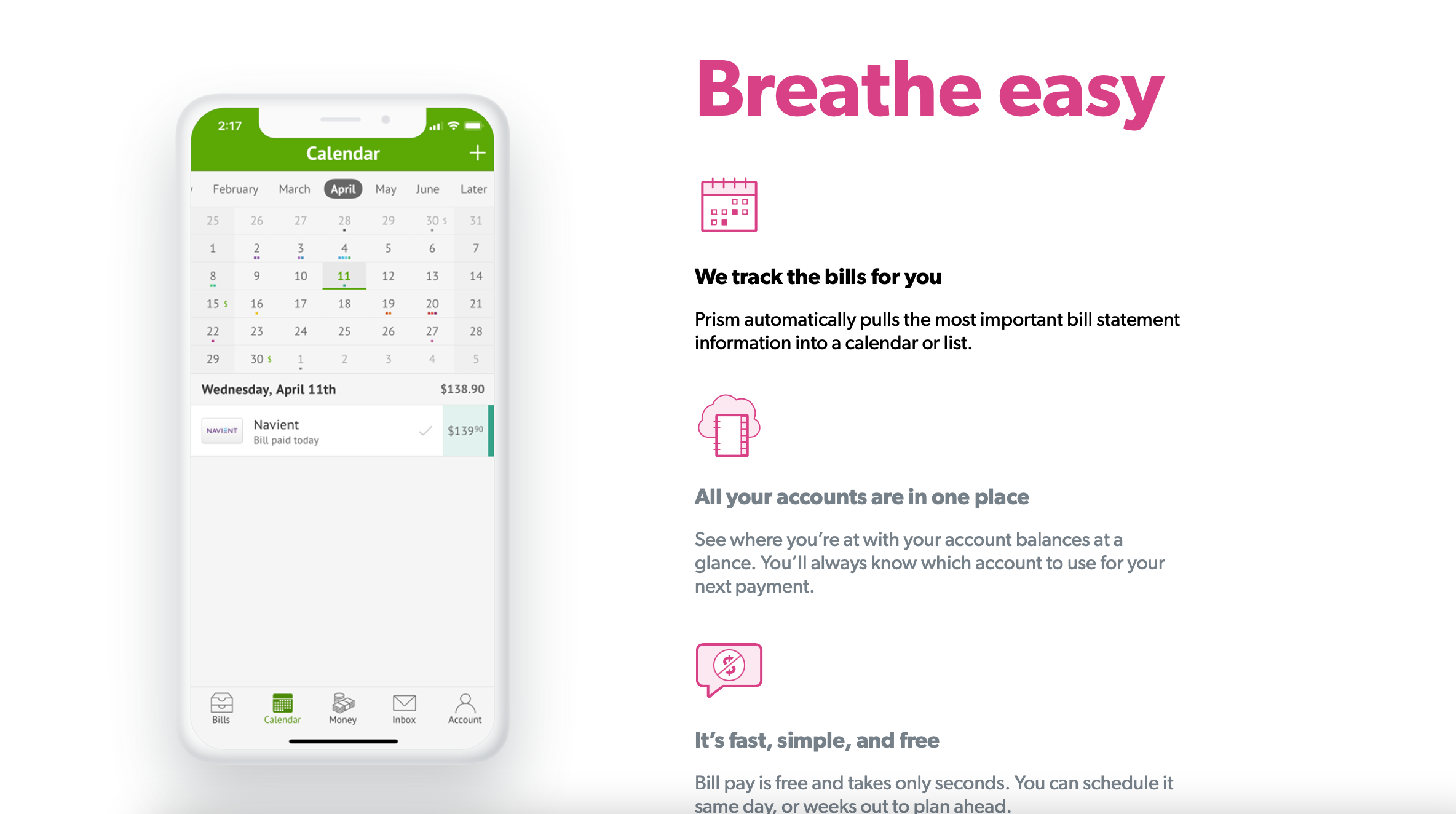

Best for paying bills: Prism

Price: Free

OS Supported: iOS and Android

Top Features:

- Schedule bill pay for the same day or weeks out

- Ability to check account balances at a glance

- Receive reminders about upcoming bill due dates

Prism simplifies bill paying. The app tracks your bills and sends you alerts when they’re due. You’ll also be able to quickly check your expenses and balances, as well as control when you’d like to schedule your payments.

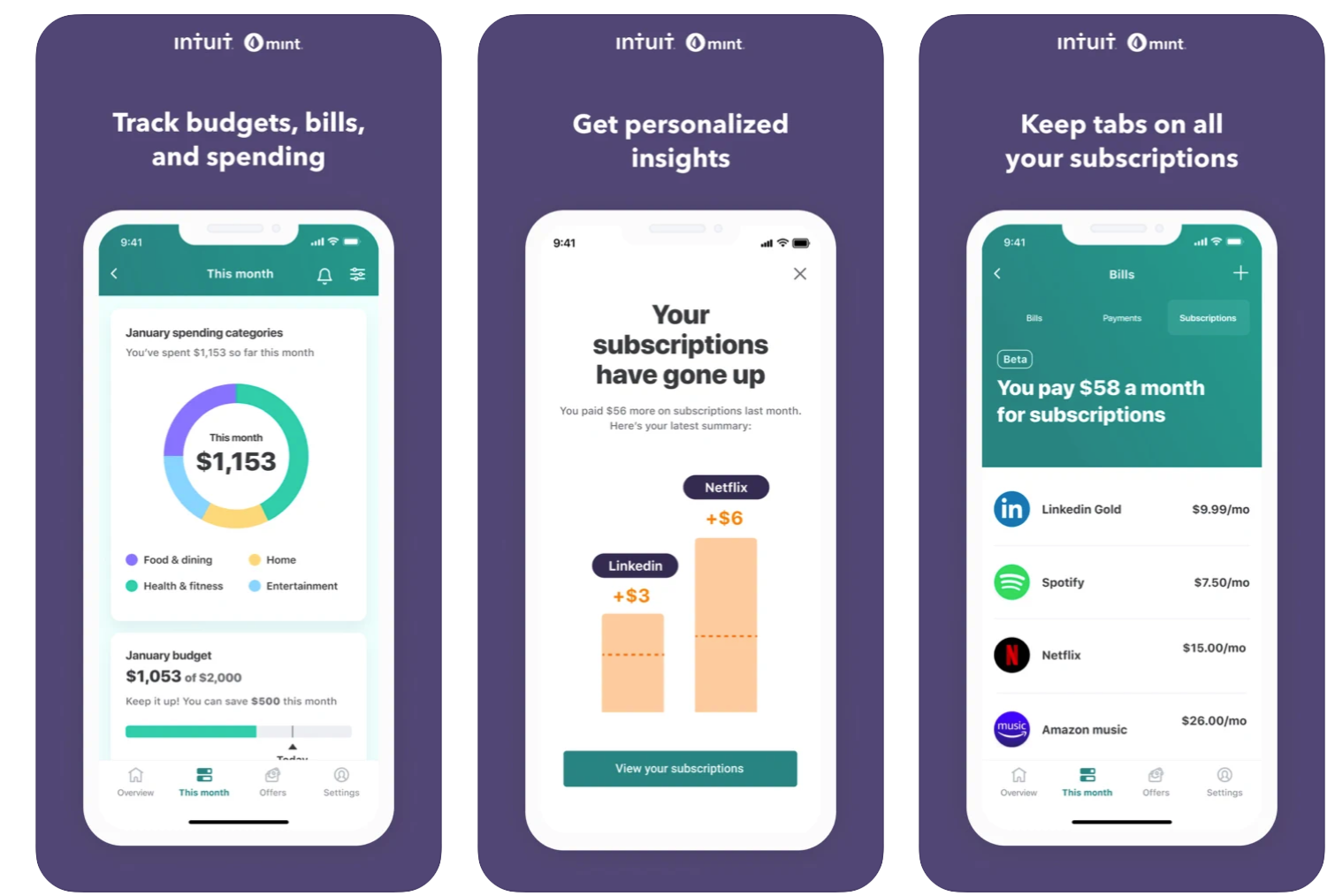

Best for overall money management: Mint

Price: Free

OS Supported: Web, iOS, and Android

Top Features:

- Ability to add all of your accounts (investments, cash, credit cards )

- Personalized Mintsights™ can automatically find savings you missed

- Custom goals can help you improve spending habits

Mint is a great tool for personal finance management. Once you connect your bank accounts and cards, you’ll be able to create a budget, view all your bills and set push notification reminders, and view your transactions and balances. You can also get tips on financial best practices, like how you can boost your credit score.

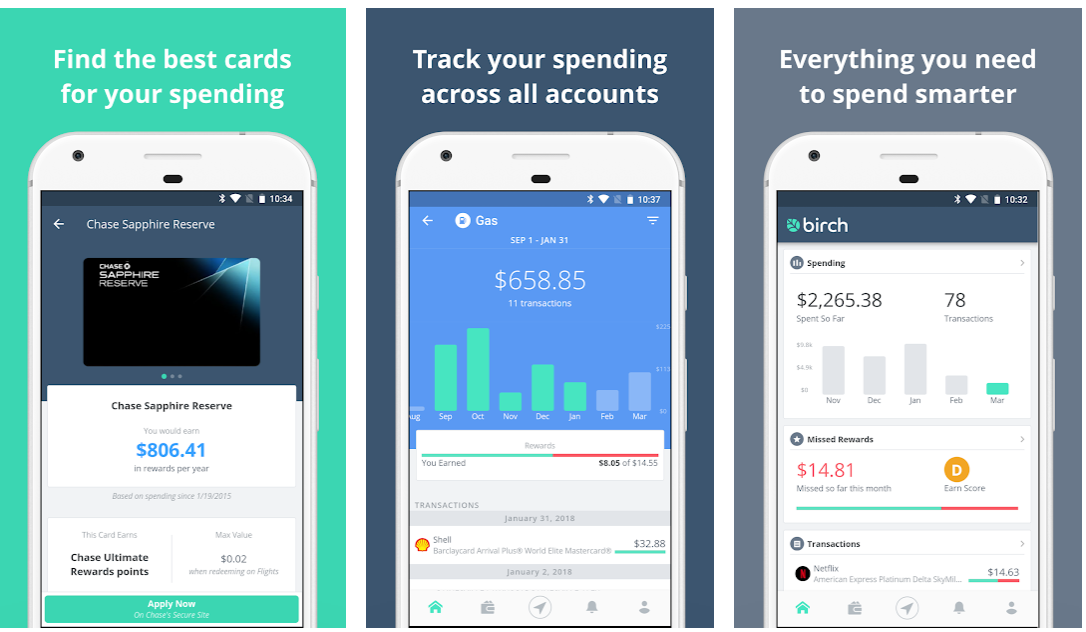

Best for rewards: Birch Finance

Price: Free

OS Supported: Web, iOS, and Android

Top Features:

- Real-time recommendation tool can help you earn more rewards

- See how you spend with subscription tracking for over 500 services

- Receive recommendations for credit cards that match your spending habits

Once you download the app and login with your banking credentials, Birch Finance takes a look at your spending history and habits to give you advice on how to earn the best rewards with the cards you’re currently using. You can also inform the app about rewards you’d like to receive, and it’ll guide you on which cards to apply for.

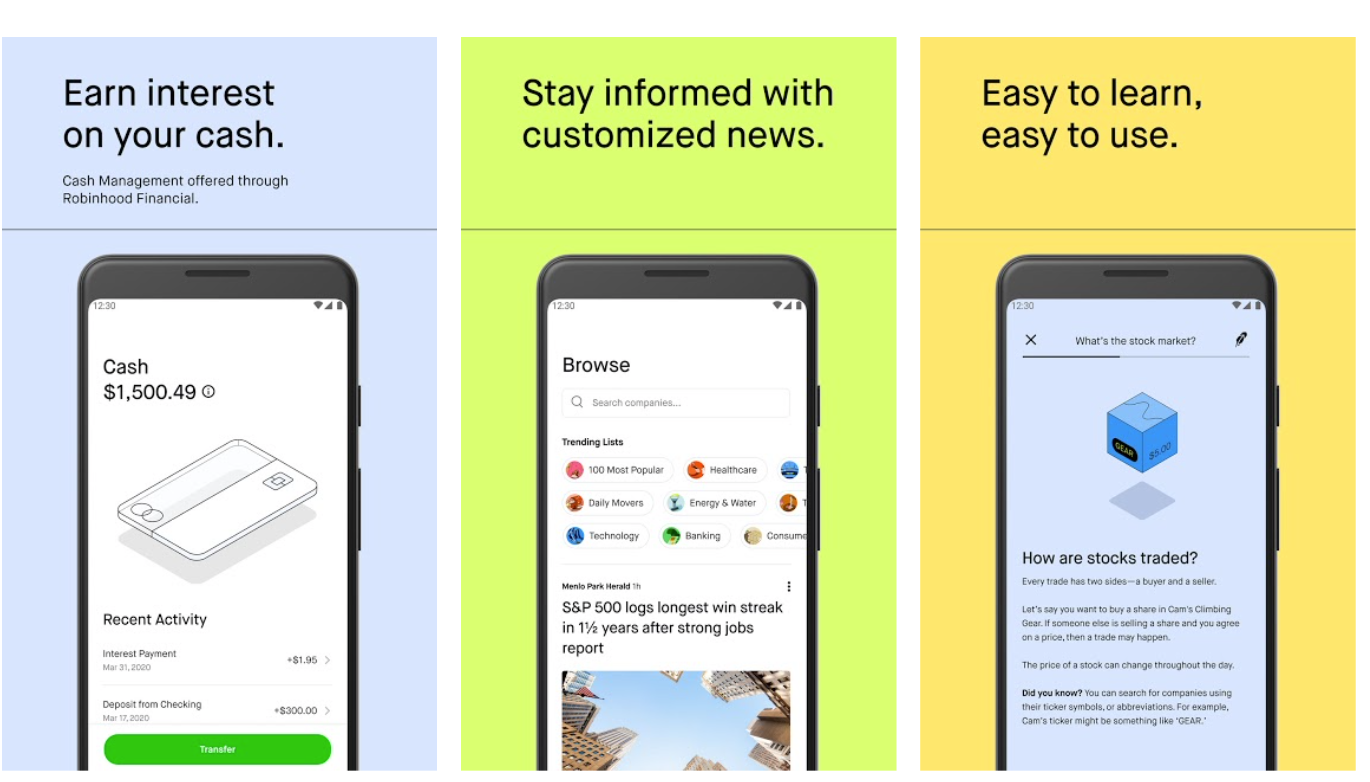

Best for commission-free investing: Robinhood

Price: Free

OS Supported: Web, iOS, and Android

Top Features:

- Trades are commission-free

- You can invest any amount you want

- Ability to fully customize your portfolio with pieces of different companies

Robinhood is a zero-frills app that allows you to invest in companies without having to pay commission or a minimum deposit. It doesn’t have much in the way of education, but you’ll be able to trade any ETF or stock that’s listed on U.S. stock exchanges.

Best freemium personal finance apps

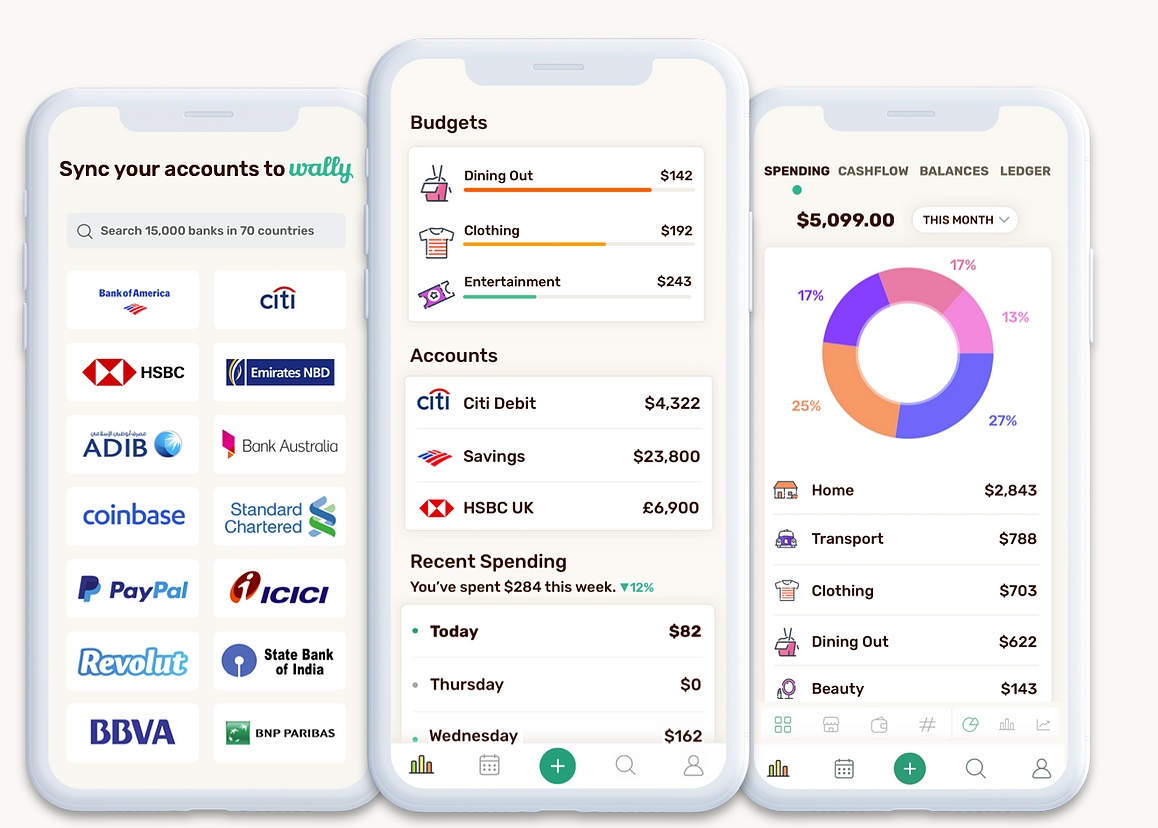

Best for tracking expenses: Wally

Price: Free for basic access; Wally Gold costs $4.49/month, $35.99/ year, or $47.99 for lifetime access.

OS Supported: iOS and Android

Top Features:

- Support for basically all foreign currencies

- Avoid overspending by viewing your remaining budget

- Ability to upload photos of receipts to track expenses

Wally helps you track your expenses by drawing up charts of your financial habits and syncing all your accounts in one place so you can easily get a snapshot of the state of your finances. It saves the locations of shops you frequent so you can quickly enter purchases, and you’ll have the choice of either manually entering your expenses or uploading photos of your receipts.

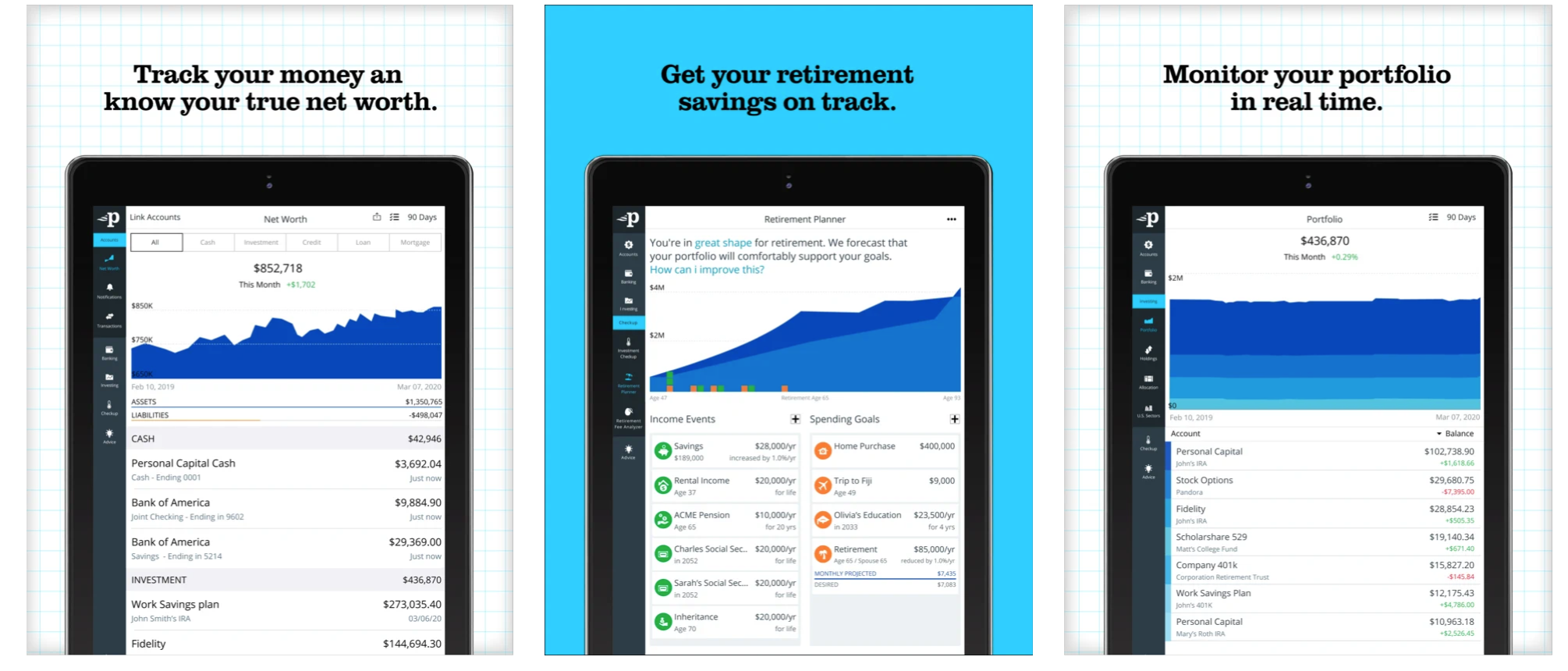

Best for present and future financial decisions: Personal Capital

Price: Tools are free; you’ll pay 0.49% to 0.89% if you want access to a human advisor (and you’ll need a minimum balance of $100,000).

OS Supported: Web, iOS, and Android

Top Features:

- Receive personalized retirement plans

- View allyour accounts, including 401Ks and IRAs, in one place

- Option to speak with a financial advisor

Personal Capital can help you manage your investments with online tools to guide your financial decisions, including a financial dashboard, net worth calculator, investment checkup tool, and a retirement planner. So, not only can you monitor your cash flow—you’ll also be able to evaluate your net worth and plan for the future.

Best paid personal finance apps

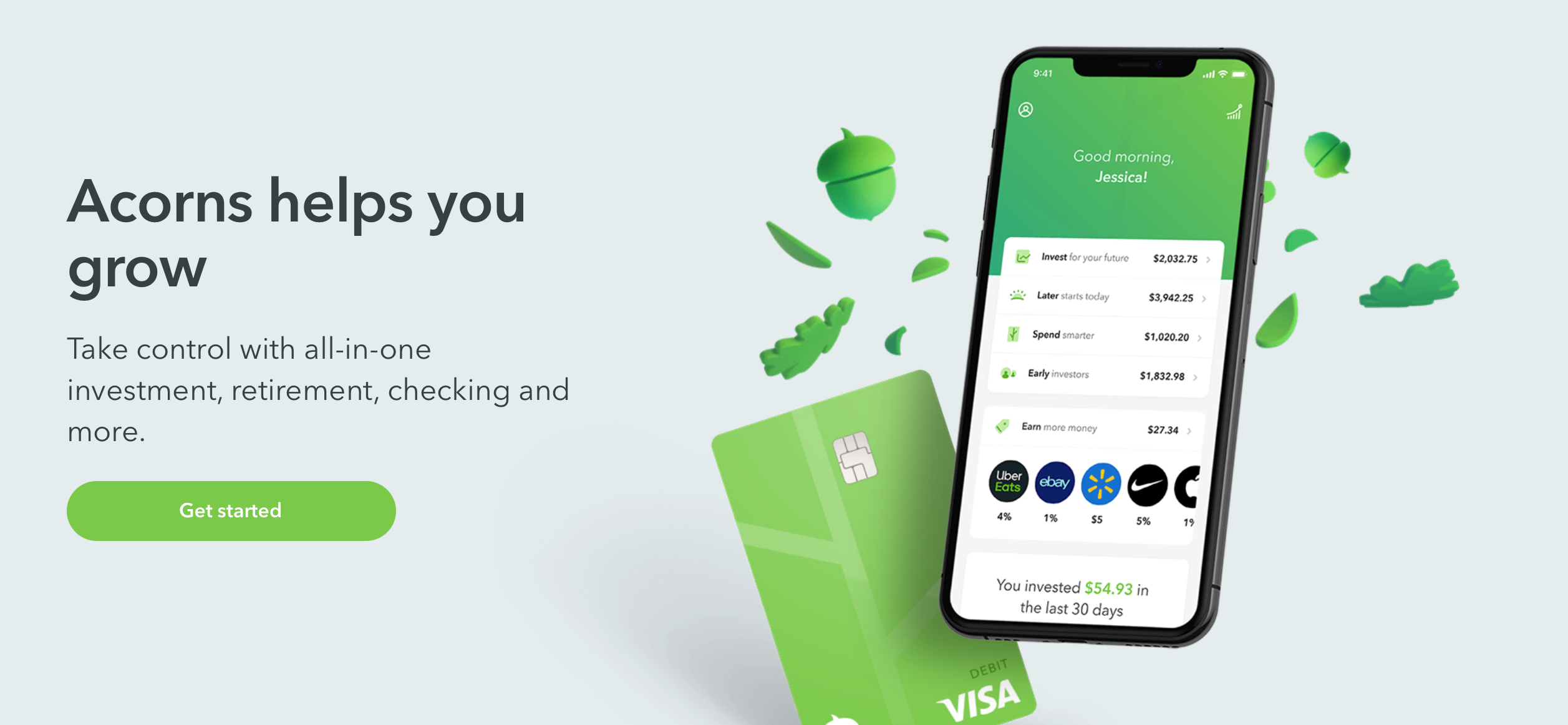

Best for automatic saving: Acorns

Price: $1-$5/month

OS Supported: Web, iOS, and Android

Top Features:

- Helpful instructional content for new investors

- Invest spare change/set aside paycheck money

- Can access smart portfolios that adjust automatically

With Acorns, you can automatically save money by rounding up on purchases or allocating spare change via linked credit/debit cards. Your money is then placed into an investment portfolio. You’ll be saving and investing money without having to lift a finger, and you can increase your financial literacy with videos and articles from financial experts.

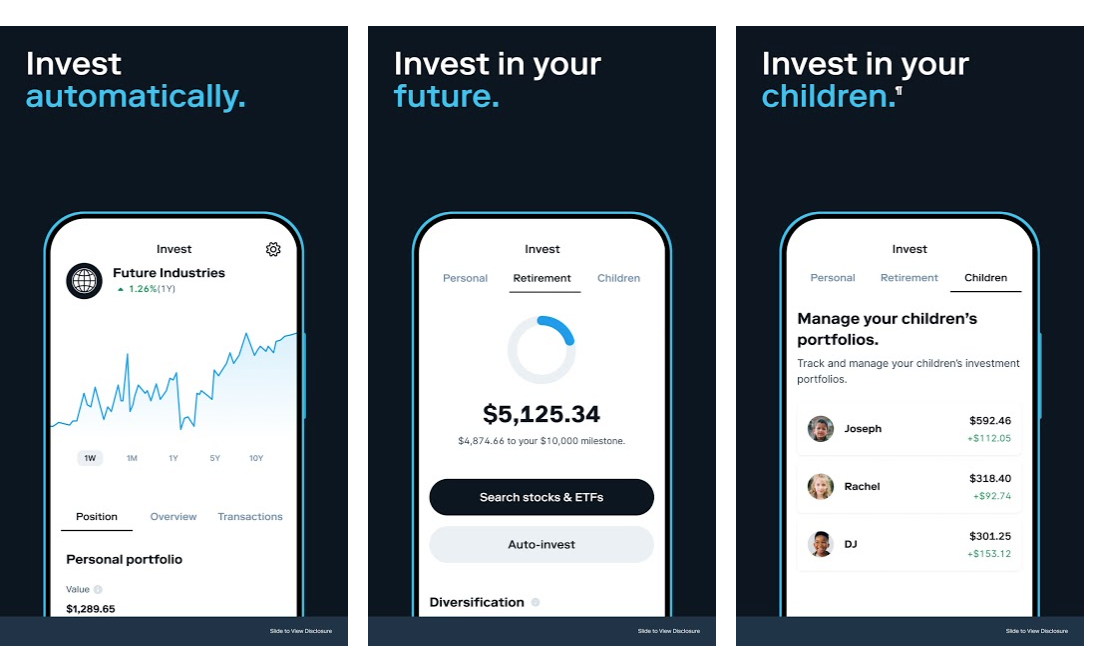

Best for investment selection: Stash

Price: $1-$9/month account management fee; $0 account minimum

OS Supported: Web, iOS, and Android

Top Features:

- You can buy fractional shares

- Get help selecting investments and analyzing your portfolio

- Earn stock from your spending

Stash offers help in selecting investments—specifically ETFs and stocks—for beginners. When you download the app, it asks you questions to assess your goals and risk tolerance. It then gives a list of ETFs it thinks will be a good fit for you, with details like which investments should take up the most of your asset allocation. While you are ultimately responsible for your choices, your Stash Coach will gently alert you if they think you could benefit from a little more diversification. Stash offers fractional investing, so you’ll be able to buy portions of stocks/funds.

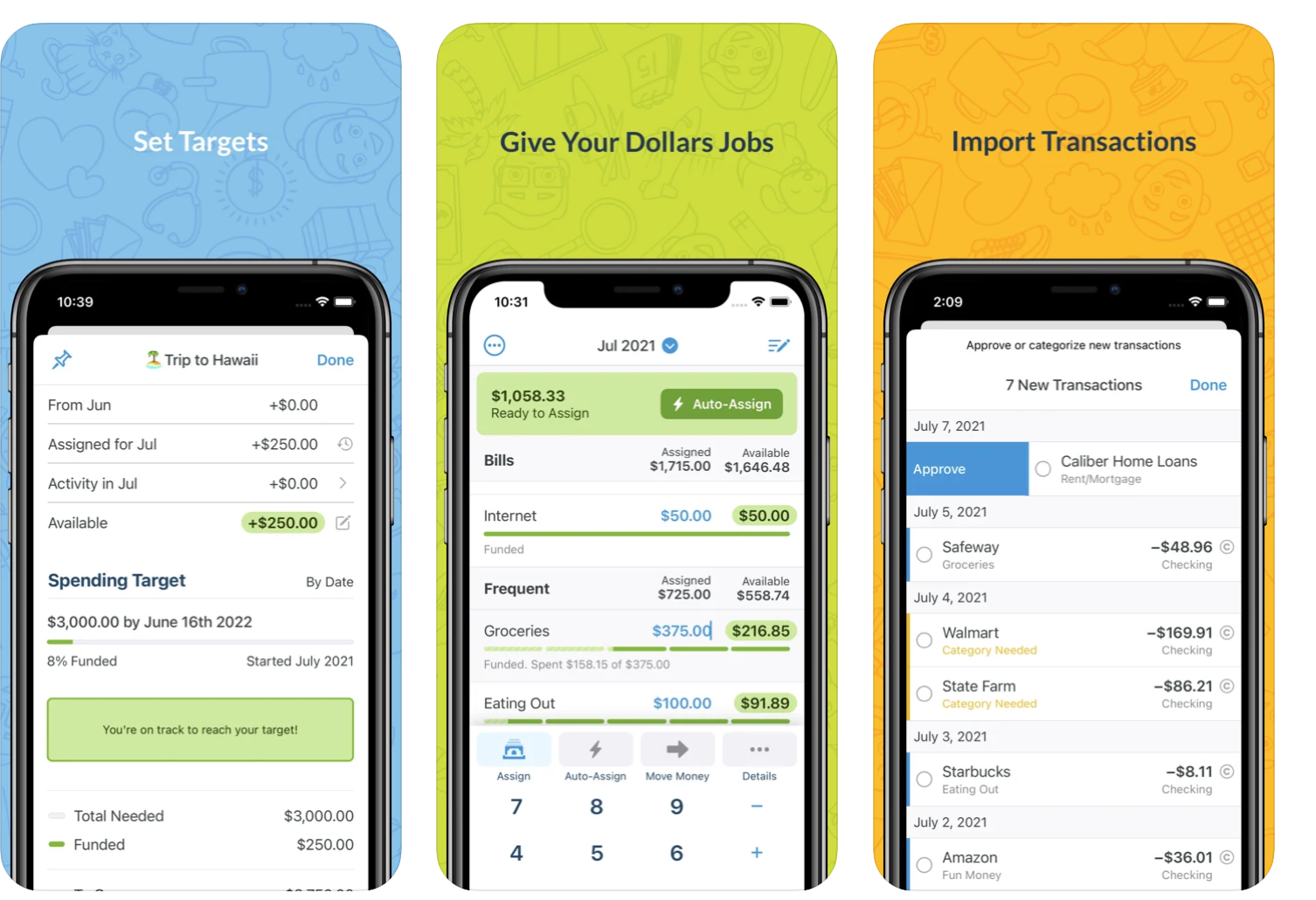

Best for debt payoff: YNAB

Price: $83.99/year

OS Supported: Web, iOS, and Android

Top Features:

- Create a budget based on your income

- Easily share finances with your partner

- Check out 100+ live online workshops every week

You Need a Budget (YNAB) offers tons of support and education about the best ways to pay off debt, including videos, podcasts, and workshops. It connects all your accounts in one place and helps you create and analyze your budget. After you enter in all your expenses and income, you’ll get a realistic picture of how much debt you can pay off monthly.

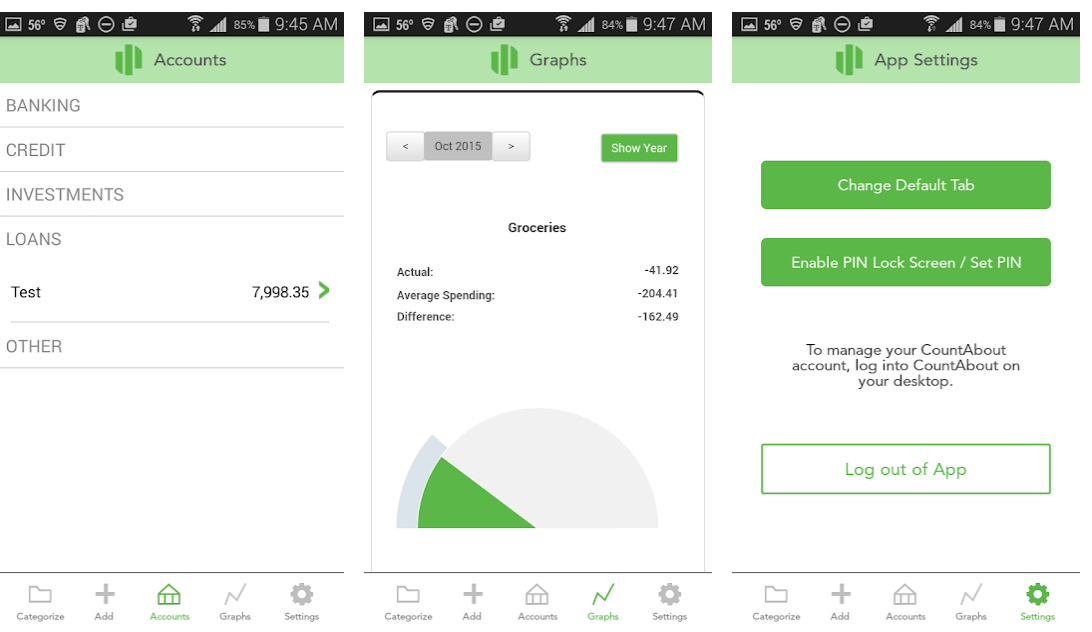

Best for budgeting if you use Mint or Quicken: CountAbout

Price: $10- $60/year

OS Supported: Web, iOS, and Android

Top Features:

- Easily import data from Mint or Quicken

- Automatic transaction downloads

- Attachment capability for receipts and images

CountAbout is a budgeting app that syncs with your financial information, including your 401(k)—with no manual entry required. The app registers all your recent transactions, not just the ones that have cleared the bank, so you’ll always have an up-to-date picture of your spending. Reporting is very comprehensive, and you can import data from Mint or Quicken. Easily create budgets and invoices, run reports, and access detailed graphics to give you a visual of how you’re spending.

The bottom line

These apps can help you manage your expenses and maximize your spending potential, but the best personal finance app for you is the one that you’ll be motivated to use often. Pick the one that best fits your lifestyle and spending goals, and make 2021 the best year yet for your financial wellness.