Should You Use a Home Equity Loan For Debt Consolidation?

About

Stefanie began her career as a journalist, reporting on options, futures, and pension funds, and most recently worked as a writer and SEO content strategist at a digital marketing agency. In her free time, she enjoys teaching Pilates and spending time with her daughter and Siberian Husky.

About Stefanie

Stefanie began her career as a journalist, reporting on options, futures, and pension funds, and most recently worked as a writer and SEO content strategist at a digital marketing agency. In her free time, she enjoys teaching Pilates and spending time with her daughter and Siberian Husky.

Read full bio

At a Glance

Owning a home is a process. Most home buyers don’t pay cash for their homes, so they need to take out a mortgage and make payments for several years before they can say they own it outright. Each of those payments helps to build equity, which is the percentage of the total value of the home that the buyer controls. That equity is an asset.

A home equity loan is a secured loan where the collateral is the equity that the home buyer has built up over time. Home equity loans are often taken out to do home improvements or to get through difficult economic circumstances. They can also be used for debt consolidation. In this article, we’ll explain how that works and whether it’s a good idea.

- Are home equity loans good for debt consolidation?

- Pros of using a home equity loan for debt consolidation

- Cons of using a home equity loan for debt consolidation

- Who is eligible for a home equity loan?

- When a home equity loan makes sense

- When a home equity loan isn’t a good idea

- Qualifying for a home equity loan

- Steps to apply for a home equity loan for debt consolidation

- Home equity loan vs personal loan for debt consolidation

- HELOC for Debt Consolidation

- Should I use a home equity loan or a HELOC?

- Alternatives to consolidate debt

- FAQs

Are home equity loans good for debt consolidation?

Debt consolidation is all about lowering interest rates. Credit card interest rates are high. Home equity loan interest rates are typically lower, because they are secured loans, than other loan products, and the interest payments may be tax deductible. That makes this type of loan a good choice for consolidating high interest credit card debt and streamlining expenses.

There are certainly benefits, but it’s also important to understand the risks. Borrowing against your home puts the home in danger of foreclosure if you fail to make your payments. Careful financial planning should precede any attempt to take out a home equity loan. An unsecured personal loan might be a better option, even if interest rates are higher.

Another danger with home equity loans is that property values could drop during the life of the loan. This might result in the homeowner being “upside down” and owing more than the home is worth. Repayment terms on home equity loans can be ten years or longer, so property values are likely to change. Look at market projections before you act to see if they’re likely to go up.

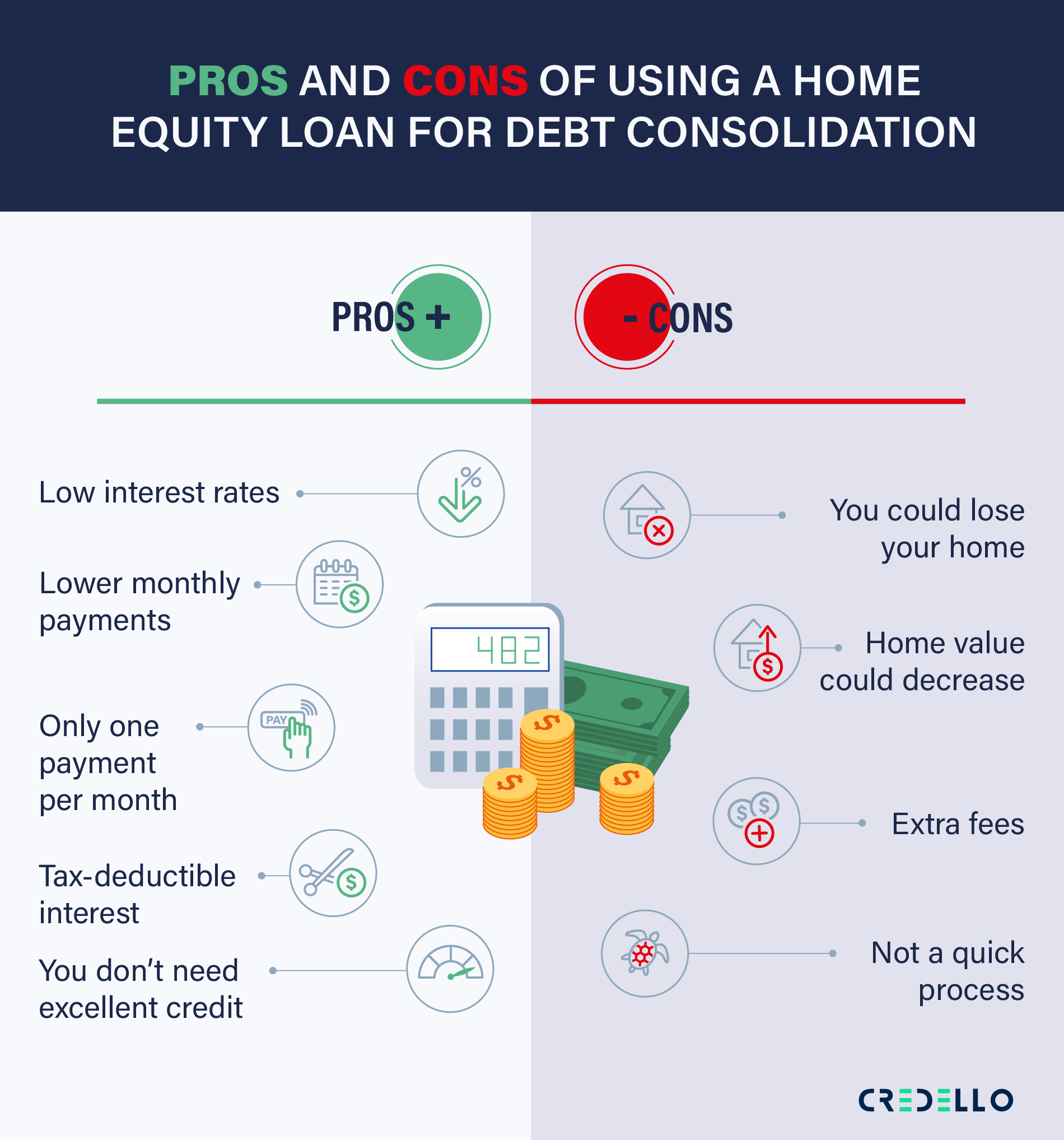

Pros of using a home equity loan for debt consolidation:

Low interest rates:

Interest rates on home equity loans are much lower than other types of debt, such as credit cards. This is because home equity loans are secured loans, meaning that you’re offering collateral to the lender.

Lower monthly payments:

Home equity loans typically have longer repayment periods than other types of loans, so your monthly payments could be lowered.

Only one payment per month:

Instead of worrying about due dates and payments for multiple bills, you’ll only have to worry about paying one per month.

Tax-deductible interest:

Your interest can be tax deductible if your loan is being used to improve your home’s value i.e. building an addition or renovating the kitchen. Anything else the loan is used for won’t be deductible.

You don’t need excellent credit:

Because you’re offering your home as collateral to the lender, you pose less risk to the lender and typically don’t need a super high credit score to qualify. However, higher scores will generally allow for better interest rates.

Cons of using a home equity loan for debt consolidation:

Cons of using a home equity loan include:

You could lose your home:

Your home will be used as collateral for the loan. If you miss payments, your house could go into foreclosure.

Home value could decrease:

if your home value goes down, and you suddenly owe more money that your home is worth, you could be forced to forfeit your property to the bank.

Extra fees:

You might have to pay for extra expenses like a home appraisal and closing costs.

Not a quick process:

It can take 30 days or even longer to get the paperwork for your home equity loan, so if you’re in a rush to consolidate this may not be the best option for you.

Increasing your debt load:

One major downside to a home equity loan is that you are simply adding to your debt load. Should you find yourself already overloaded and unable to meet payments, adding additional debt on top is only going to hurt your finances.

Checkout the personal loan consolidation options that meet your needs.

Use the filters below to refine your search

Sorry, we didn’t find any options that meet your requirements. Please try modifying your preferences.

Congratulations! You’re close to seeing your offers!

Please take a second to review the details you shared earlier

Sorry, we didn’t find any options that meet your requirements. Please try modifying your preferences.

Who is eligible for a home equity loan?

You can only get a home equity loan if you have equity in your loan, though in some cases, you can get a home equity loan soon after you purchase your home. How much you can borrow depends on the lender and the type of loan, as well as how much equity is eligible to borrow. Typically, you must have at least 15% to 20% equity in your home.

Additionally, lenders want borrowers to have good credit (at least 660, though 700 or higher is preferred), low debt-to-income ratio (below 43%), sufficient income, and a reliable payment history on your credit report.

Because requirements vary by lender, check with your particular lender for more information and to learn if you qualify.

When a home equity loan makes sense?

Using a home equity loan makes sense if:

- Consolidating your debts will save you money: check and make sure that your new interest rate and repayment period will be saving you money.

- Your debt isn’t too extreme: home equity loans work best for moderate debt. If your debt is so deep that a home equity loan won’t get you out of it, you may want to consider other debt relief options such as bankruptcy.

When a home equity loan isn’t a good idea?

You should probably consider another method of debt consolidation if:

- Your spending habits are the real problem: using a home equity loan to pay off your debt doesn’t make the debt disappear. If your spending habits are the reason you’re in debt and you continue to mismanage your credit card use, you’ll just have additional debt on top of your home equity loan.

- There’s a chance you can’t pay back the loan: a home equity loan is not a good choice if there’s any chance you won’t be able to pay back your loan as you could lose your home.

Qualifying for a home equity loan

The requirements to qualify for a home equity loan vary from provider to provider, but here are a few common points they may look at:

- Your Credit Score: For the best chance at getting approved, aim to have a credit score at least in the good territory or above 675.

- Debt-to-Income: This ratio is the percentage of pre-tax income that goes towards your mortgage and any debt. You don’t want your debt to vastly shadow your income if you want a chance at being approved.

- Overall Equity: Naturally, a home equity loan requires having some equity in the first place.

Steps to apply for a home equity loan for debt consolidation

Home equity loans are available from most banks, credit unions, online lenders, and mortgage brokers. The best place to apply is usually the institution where your original mortgage is being held, but you should check interest rates elsewhere before you do that. Your credit score may have improved since you bought your home, so better deals could be available.

Before applying for a home equity loan, make sure to:

- Calculate your home’s equity: Home equity is your home’s current market value minus the amount you still owe. Check how much your debts amount to and make sure that your home equity will be sufficient to cover the cost.

- Obtain your credit score: While your credit score doesn’t need to be sky-high to qualify for a home equity loan, you probably won’t qualify if it’s poor (you’ll likely need at least a 620). Credit score minimums vary with lenders. Learn how to get a home equity loan with bad credit.

- Compare lenders: Compare interest rates, terms, and fees when deciding which lender to use.

Home equity loan vs personal loan for debt consolidation

When evaluating a home equity loan vs personal loan for debt consolidation, consider the risks involved. Home equity loans offer lower interest rates because they’re secured, but that security is your home. Do you want to put that at risk to pay off your credit cards? Personal loans are unsecured, so your consequence for default is collections, not foreclosure.

The average interest rate on personal loans is just under 10%. The median credit card interest in the United States is over 19%. That means that using a personal loan for debt consolidation will save you a significant amount of money, without risking your home. Do the math on home equity loans, but it would be wise to consider a personal loan as an alternative.

Home equity loans are essentially a second mortgage on your home. You get the money in one lump sum payment, and you can use it for whatever you like. Obviously, in this case, that would be debt consolidation. Here are the advantages of doing that:

- Home equity loans usually offer a low, fixed interest rate. That’s more cost effective than the higher variable rates typically seen on credit cards.

- Home equity loans offer fixed monthly payments. These are easier to budget and more affordable than minimum monthly credit card payments.

- Borrowers know the exact payoff date when they take out a home equity loan.

- According to the IRS, interest payments on home equity loans are deductible if you use at least a portion of the loan to “substantially improve” your home.

HELOC for Debt Consolidation

As outlined, a HELOC is a home equity line of credit. It differs from a home equity loan because the borrower doesn’t take a fixed amount. They can borrow up to an approved limit. HELOCs also come with variable interest rates, not fixed rates like home equity loans. This is another option for debt consolidation, one that you should speak with your lender about.

Pros:

- Interest rates are typically lower on HELOCs than they are on credit cards, which means you could potentially save money

- The interest you pay on HELOC products may actually be tax deductible

Cons:

- Your home equity is up as collateral

- Credit card debt is easier to get discharged

- If your home’s value drops, there’s the chance you will owe more than your home is actually worth

Should I use a home equity loan or a HELOC?

There are four main differences between home equity loans and HELOCs that you should be aware of when deciding which is better for you.

Home equity loans pay out in a lump sum, while a HELOC allows you to withdraw money as you need it.

Home equity loans charge interest at a fixed-rate, so you’ll have a clear and definite repayment schedule. HELOCs charge variable interest rates, so the rates are based on the standard index (meaning that they are subject to change based on the U.S. economy).

Home equity loans don’t carry annual fees, while some HELOCs have transaction fees, as well as annual fees during the repayment period.

Since home equity loans come in lump sums, you pay interest on everything, even if you don’t wind up using the full amount. With HELOCs, you only pay interest on the money you actually need.

Related: Home Equity Loans vs. HELOC

Alternatives to consolidate debt

There are several alternatives to home equity loans for debt consolidation. We’ve already talked about personal loans. You’ll pay slightly more in interest for them, but you won’t need to put your home at risk. Other options to look at include the following:

1. Personal Loan: Personal loan funds can be used for just about anything, including consolidating debt. If you’re able to get a personal loan with a lower interest rate than your current debt, you can use the funds to pay off your high-interest debt and then only have one lower payment on the new loan. This will help you pay off your debt faster and save money on interest.

Compare: Best Personal Loans

2. Balance transfer credit cards: Credit card companies sometimes offer a 0% interest introductory period for balance transfers. This can be an option for debt consolidation if you only have a few accounts and the balances are small.

Related: How to Transfer Credit Card Balance

3. Cash-out refinancing: Cash-out refinancing is like a home equity loan, but the borrower takes a larger loan to pay off the existing mortgage balance and the amount of debt consolidation money needed. Lenders prefer this because it involves less risk for them and doesn’t create a second mortgage for the homeowner.

4. 401(k) loans: If you have an employer-sponsored 401(k) plan, you may be able to take out a loan from it to consolidate your credit card debt. It’s your money, so you’re borrowing from yourself, but it’s also your retirement nest egg, so put the money back in as soon as you can if you choose this option.

5. Debt management plan: One of the best alternatives to consolidating debt is to build a debt management plan that addresses all your sources of debt. Outline what credit issuers you owe and the amounts you own. From there, consider adopting a debt management strategy such as the debt snowball technique to slowly work on your repayments one at a time.

Looking for the next step?

Let’s do it. We can match you with consolidation options based on your goals and debt info.

FAQs

According to the IRS, interest payments on home equity loans are deductible if you use at least a portion of the loan to “substantially improve” your home.

Learn more: Are Home Equity Loans Tax Deductible?

If you have bad credit, home equity loans are easier to get than personal loans. A home equity loan is secured by the equity in your home, so lenders are more lenient on credit score requirements.

Learn more: Getting a Home Equity Loan with Bad Credit

Taking on equity to pay off debt can be a confusing concept, leading some to wonder if refinancing is the better option. If your sole goal is achieving a debt consolidation mortgage, then taking on a home equity loan is the better option. However, if you are simply trying to get a better deal on your mortgage, refinancing is the better strategy.

When receiving an equity loan for debt, the amount you can take our varies from lender to lender. However, an amount as high as 85% of the equity in your home is not uncommon.

A home equity loan’s interest rate is fixed and will not change over the years. Additionally, payments are fixed as well.

Yes, a home equity loan is considered a revolving line of credit where amounts can be taken from the loan as needed, so that only minimum payments are due each period.

Your credit score is only seriously impacted by late payments or a lack of payment where the amount does not meet the minimum required. While a hard inquiry into your credit when applying for the loan may temporarily lower your credit score, it should bounce back up quickly with good credit habits.

The amount of time to repay a HELOC varies from lender to lender, but common timeframes range from five to twenty years.

The only factor regarding the closure of a HELOC that can hurt your credit score is the fact that you now have less credit overall. It is not the action of completing all your payments itself that causes the decrease.