Planning to Borrow from your 401(k)? Here’s What to Know

About

Kevin is a former fintech coach and financial services professional. When not on the golf course, he can be found traveling with his wife or spending time with their eight wonderful grandchildren and two cats.

About Kevin

Kevin is a former fintech coach and financial services professional. When not on the golf course, he can be found traveling with his wife or spending time with their eight wonderful grandchildren and two cats.

Read full bio

At a Glance

Carrying too much debt is a problem that can affect you in several other areas of life. At first glance, using funds from your 401(k) plan to pay off that debt may seem like a good idea, particularly if you have high-interest credit cards. It’s your money. Why not use it? That’s the question we’ll attempt to answer for you today. Here’s what we’ll cover:

What is a 401(k) loan?

A 401(k) loan allows you to borrow money from your retirement savings and pay it back to yourself over time, plus interest. You can typically borrow up to 50% of your balance for up to five years, for a maximum of $50,000.

The interest rate is typically the current prime rate plus 1%. Once you sign the paperwork, you’ll have access to the funds within a few days. Then, the loan payments and the interest get paid back into your account.

Not every plan lets you do this, and how much you’re able to borrow, how often, and repayment terms are dependent on what your employer’s plan allows. The plan may also have rules on a maximum number of loans you may have outstanding on your plan. Note that if you leave your current job, you may have to repay the loan in full very quickly. Or, if you default, you’ll owe both taxes and a penalty if you’re under age 59 ½-years-old.

Should you use a 401(k) loan to pay off debt?

Whether you should take out a 401(k) loan depends on several factors, such as:

- How much you want to borrow

- The rate of return you expect on your investments

- The interest rate you’ll pay on the loan

- How long it will take you to pay off the loan

- How many years it will be until you retire.

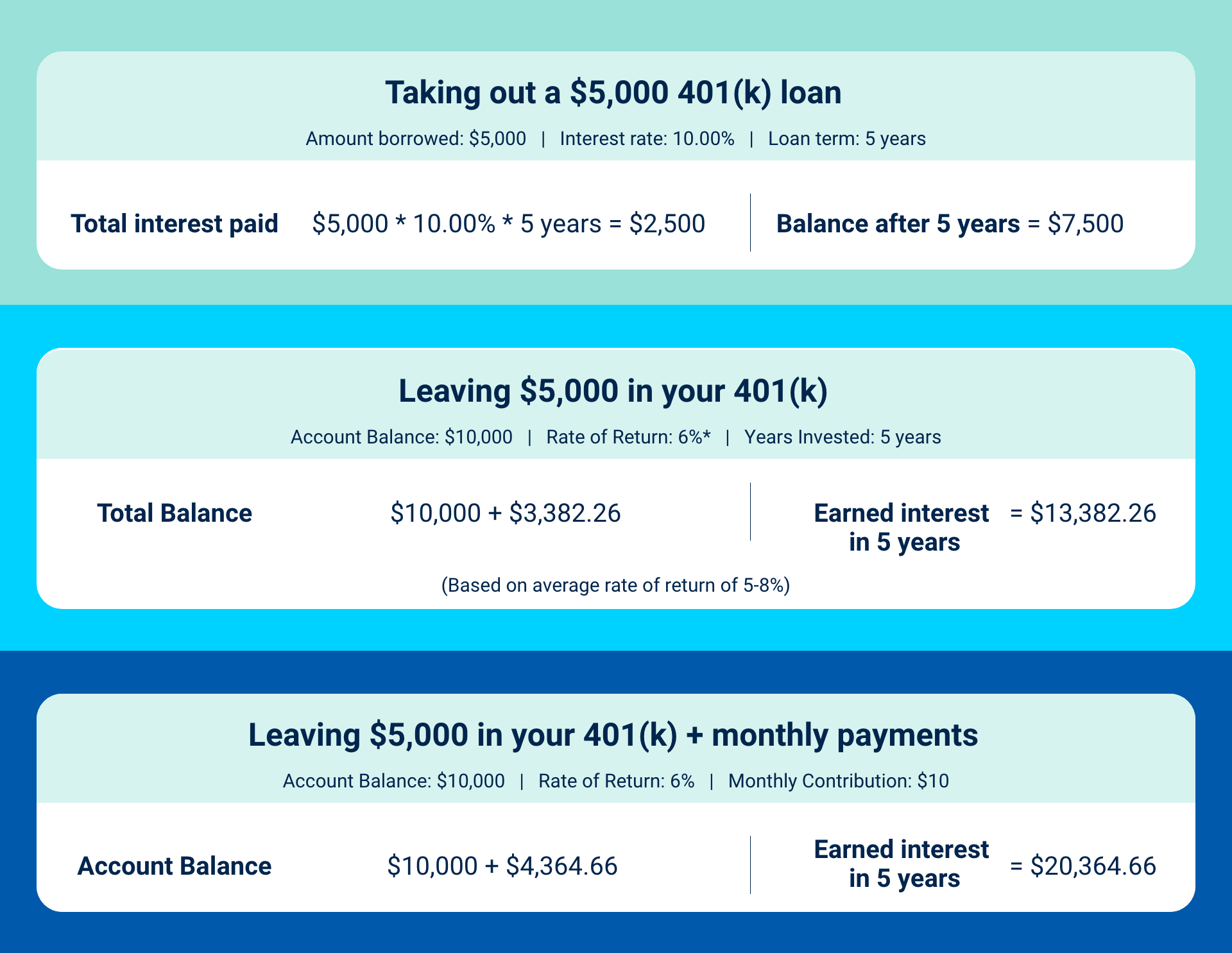

You can decide whether to take out a 401(k) loan or not with the help of this example:

There are a number of reasons you may consider borrowing from your 401(k), including to pay off debt. Whether you should use a 401(k) loan to pay off your debt depends on factors like:

- How much debt you have

- What type of debt it is (such as loans or credit cards)

- The interest rate on your current debt

- Your credit score

- Your employment situation

In some cases, it can make sense to use these funds to pay off high-interest debt, like credit cards. It’s best practice to first explore other options for debt repayment, but if those are ruled out, a 401(k) loan might be an acceptable choice. Using a 401(k) loan to pay off your high-interest debt can help save you money and help you pay off your debt faster.

Expert tip from Thomas Brock: I am not an advocate of borrowing money from a 401(k) plan. Doing so can impair your ability to save for retirement, and in some cases, the opportunity cost is significant. Borrowing from your 401(k) should only be considered in emergency situations, after all other borrowing avenues have been exhausted.

Pros and cons of a 401(k) loan to pay off debt

| Pros | Cons |

|---|---|

| Can pay off debt faster and save on interest | Risk of job loss and fast repayment |

| Flexible repayment options | Could lose investment return (depending on your holdings) |

| Low interest rates and fees | Defaulted loans are subject to taxes and penalties |

| May not have huge impact on retirement savings | May not be able to contribute to 401(k) while you have a loan balance |

Pros

1. Can pay off debt faster and save on interest

As we mentioned above, taking out a loan from your 401(k) plan is essentially borrowing your own money. You won’t need to go through an approval process with a lender to borrow the money. If you set up online access, there’s likely an option on the website to do this quickly and conveniently. That’s both good and bad, but we’ll keep it in the “pro” category.

2. Flexible repayment options

Fund administrators want you to pay back your 401(k) loan quickly and painlessly, so they offer flexible repayment options. There are no early repayment fees, and you can set up direct debits to ensure you don’t miss a payment.

3. Low or non-existent lending costs

You may be charged a small origination fee and there might be an administrative charge, but 401(k) loans are the lowest cost lending vehicle you’ll find. If you must borrow to pay off debt, this is likely the best option.

4. Neutral impact on retirement

A common misconception is that borrowing from your 401(k) will have a negative impact on your retirement fund. However, this only happens if you do so during a “bull market,” which is when the market is consistently rising. Otherwise, the impact is closer to neutral, because you pay the money back with interest.

Cons

1. Risk of job loss and quick repayment

No job is guaranteed to be secure. If you lose your job while you still owe money on a 401(k) loan, the IRS requires you to pay off the remaining balance within sixty days. Failing to do that will reclassify the loan as an early withdrawal and you’ll be subject to a 10% fee and income taxes.

2. Could lose investment return

The timing for a 401(k) loan should be carefully considered, especially, if you invest in stock indexes, such as the S&P 500. For example, in 2023, the S&P 500 is up nearly 10%. So, taking funds from your retirement account may not be the best option.

3. Defaulted loans are subject to taxes and penalties

If the loan is not repaid on time, you may owe taxes on the amount you withdrew and a 10% early withdrawal penalty. Unlike the interest repaid on a 401(k) loan, these fees and penalties would not go back into your account. This can quickly add to your debt.

4. May not be able to contribute

In some cases, you may not be able to contribute to your 401(k) while you have the loan out. Not only does this mean missed opportunity for earnings on investment, but you’ll also miss out on any contribution matches provided by your employer. If you repay your loan quickly you won’t lose much, but it could be a disadvantage.

Ways to pay off debt without taking out a 401(k) loan

When considering your financial situation and needs, a 401(k) loan may be an option. However, there are other alternatives that should be considered as well. The top two include personal loans and balance transfer credit cards.

1. Personal loans

Personal loans are a type of loan you can borrow from a bank, credit union, or online lender. Loan funds can be used for just about any reason, making them a good option for well-qualified borrowers who need financing. Terms and interest rates vary based on lender, your credit score and history, and other factors, but borrowers with good to excellent credit typically qualify for lower interest rates.

These loans are usually unsecured, meaning they don’t have to be backed by collateral, and have fixed terms and rates, so you can quickly and easily calculate your monthly payments, how much the loan will cost over time, and when you’ll have it paid off.

Give yourself options

Use the filters below to refine your search

Sorry, we didn’t find any options that meet your requirements. Please try modifying your preferences.

Congratulations! You’re close to seeing your offers!

Please take a second to review the details you shared earlier

Sorry, we didn’t find any options that meet your requirements. Please try modifying your preferences.

2. Balance transfer credit cards

You can use a balance transfer credit card to move an existing high-interest credit card balance to a lower-interest card. Doing this will help save you money on interest, especially because many balance transfer cards come with no annual fee and a 0% introductory APR, meaning you don’t have to pay interest for a certain period. Transferring your balance will not only save you money, but it can also help you pay off your credit card debt faster.

The downside is these cards sometimes come with balance transfer fees, transfer limits, and credit score requirements, so a poor credit score may mean you have trouble getting approved. Plus, you should be sure to repay the balance before the intro period is up or face higher interest rates on the outstanding balance.

Learn more: Balance Transfer Credit Cards

Bottom line

Overall, using a 401(k) loan to consolidate your credit card debt is a huge risk. If you’ve exhausted all other options, you might consider it. However, you risk paying unnecessary taxes and fees should you default, and you sacrifice your retirement savings and peace of mind in the process. Plus, 401(k) loans do not help you stay out of debt because they don’t address the reason you may be in debt in the first place.

FAQs

No, there’s no credit check to qualify for a 401(k) loan, and credit reporting agencies don’t use your retirement savings as a variable when they calculate your credit score.

In most circumstances, a 401(k) loan will not affect your tax return. If you lose your job and can’t repay the loan, the IRS may reclassify it as an early withdrawal and tax you on it.

It’s your money. No one will charge you a fee to borrow it, as long as you pay it back.

No. In most cases, it’s a good idea to take a 401(k) loan to pay off debt because it’s the lowest-cost lending option you’ll find, and you can typically use it to pay off debt fast. Just don’t do it during a bull market or if you think you’ll lose your job soon.

Most plans have a borrowing limit of $50,000 or 50% of the account funds, whichever is less. Plans also typically have a limit on how many loans you can take out at one time.

Though 401(k) loans can come with lower interest rates and no credit checks, they put you at a high risk of paying unnecessary taxes and penalties, not to mention cutting into your retirement savings. Learn about other debt consolidation methods.

If you need the money fast for a short-term expense and can pay back the loan on time, borrowing from your 401(k) is fine. It can be especially effective for your retirement savings if you take out the loan while the stock market is weak. We would not recommend a 401(k) loan for debt consolidation, though.