Tori Dunlap Saved $100K by Age 25 and This is the Secret to Paying Off Debt

About Anouare

Anouare is a seasoned writer, editor and content strategist who started her career as a lifestyle journalist before stepping into leadership roles at publications such as AskMen and Goalcast. From editorial strategy to content marketing and project-management, she has tackled various challenges in digital media and discovered her passion for mentoring others in the process. She loves a good money mindset book and believes you can create your dream lifestyle by being yourself.

Read full bio

At a Glance

When you hear the words TikTok finance expert, some of you may run for the hills. And some of you may say ‘That’s an oxymoron.’ But you haven’t met Tori Dunlap. By the time she was 25 Tori Dunlap had saved $100,000 and was able to quit her corporate marketing job. “I realized in my own life that when I had money, I had choices. I could be in situations I wanted to be in rather than situations I had to be in,” she says.

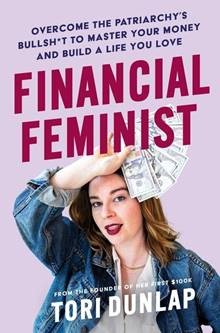

And she isn’t gatekeeping her secrets. The now 28-year-old and founder of Her First $100K, a financial advice platform for her 3 million (mostly female) followers provides tips on saving, budgeting, paying off debt, and all those other important things. She was just named Forbes 30 Under 30 in the Media Category for 2023 and on December 27th her first book Financial Feminist: Overcome the Patriarchy’s Bullsh*t to Master Your Money and Build a Life You Love comes out.

Credello caught up with Dunlap to learn more about her thoughts on finances. From breaking money taboos to paying down your debt, let the six tips below inspire you on your own journey to financial empowerment.

Pay high-interest debt first

So, if you have debt, consider this your permission to drop the shame. Curious about strategies such as the debt snowball or debt avalanche method? Dunlap has a straightforward answer: Mathematically, you want to focus on paying down high-interest debt first.

“You don’t want to split your extra money. Pay your payments, but put any extra money that you have towards the high-interest debt,” she says. Paying down that principal – the amount of money you originally took out outside of the interest – is especially important if you want to get rid of debt fast.

You don't want to split your extra money. Pay your payments, but put any extra money that you have towards the high-interest debt.

she says. Paying down that principal – the amount of money you originally took out outside of the interest – is especially important if you want to get rid of debt fast.

Getting rid of a small amount of debt even though it’s not the highest-interest one can sometimes be helpful for your mindset. “Ultimately, if you have a smaller piece of debt and you feel that you need to see this gone in order to keep the momentum going, do whatever you need to do,” adds Dunlap.

Talk about money

Women are more likely to discuss topics like sex and death than talk about money – and this needs to change, says Dunlap: “This narrative that it’s impolite, taboo or wrong is perpetuated by the patriarchy. Because if you don’t talk about it, or don’t feel that you can be transparent about it, then you have no idea that Chad, who got hired two years after you, is making 20% more. Or you have no idea that other people have debt and also feel alone, lost and ashamed.”

Talk about money with your friends. Have transparent conversations with your partner. Learn how to become more comfortable having these conversations because it’s one of the most important things you can do for your financial freedom.

Get in financial shape

Talking about money and being transparent is one of the first steps on your financial wellness journey

Talking about money and being transparent is one of the first steps on your financial wellness journey

Transcend financial shame

For many people, money is a source of shame. And it doesn’t help that some popular personal finance experts perpetuate that shame instead of making you feel supported. Shame is counterproductive though. Instead of beating yourself up for your financial past or present situation, why not educate yourself and take one step at a time to feel more confident about your finances? Dig into your relationship with money with a lot of grace and self-compassion to create lasting change.

“The truth is, you can’t make an actual lasting change in your money if you don’t understand what sort of narratives and emotions are going to come up. For example, you may make a budget but end up self-sabotaging it. We have to talk about the way you grew up around money – the vast majority of financial habits are cemented by age seven,” according to Dunlap.

Be weary of loan terms

According to her, one of the top reasons women end up in debt is confusion about their loan terms. The fine print is not always obvious, so you’ll want to be weary of what taking a loan out entails before deciding.

Dunlap says that it’s important to know the interest rates, understand how interest will accrue, as well as be aware of the amount of time you will have to repay back the loan.

Forget cash-stuffing

Though cash stuffing is all the rage on TikTok and in Credello’s original survey on the trend 1 in 3 adults said the cash stuffing budgeting method was very effective for saving towards a goal, Tori is not the biggest proponent. She says you’re missing out on credit card rewards with cash stuffing. “I put everything on a credit card and I just pay it off on time and in full. If you can manage your credit card responsibly, that’s what you should be doing because you get miles and points,” she says.

Then, there’s also the fact that it’s not very safe to keep cash on you or at home. If you really want to give cash stuffing a shot, use it as “training wheels.” Get to the point where you have built healthy financial habits and are feeling more confident, then switch to other ways of managing your money.

Make yourself recession-resistant

As Dunlap puts it, money is 20% personal choices and 80% circumstances. When asked whether you can make yourself recession-proof in the face of today’s economic climate, she said that at best, you can aim to make yourself more “recession-resistant.”

Start by building a robust emergency fund: Three months of living expenses in a high-yield savings account. Make sure that it reflects inflation. “One of the many things I see now is that people locked down their funds in 2020/2021 but life is way more expensive now, so you’ll want to make sure your emergency fund reflects 2023 living expenses,” recommends Dunlap.

Diversifying your income is also key if you’re able to. If you only have one source of income, do everything in your power to increase it – ask for a raise or find a better paying job – and then save the extra money that comes in. Finally, you’ll want to think of contingency plans.

“The big thing I am thinking about, both as a business owner and as someone who is trying to navigate the world, is having plan A through D,” adds Dunlap. The former is what you do when things are going well financially, and the latter is your “zombie apocalypse” plan. It’s about being prepared.

“The ‘ostrich effect’ is so real – burying your head in the sand and pretending like your problems don’t exist. During times when money is especially scary, it’s easy to want to avoid dealing with it. But, the truth is, if you can get honest with your money and make a plan, it’s going to save you a lot of desperation and terror later,” she says.