6 Major Money Red Flags You Need to Watch Out for When Dating

About Anouare

Anouare is a seasoned writer, editor and content strategist who started her career as a lifestyle journalist before stepping into leadership roles at publications such as AskMen and Goalcast. From editorial strategy to content marketing and project-management, she has tackled various challenges in digital media and discovered her passion for mentoring others in the process. She loves a good money mindset book and believes you can create your dream lifestyle by being yourself.

Read full bio

In the fiery hellpit that is modern dating in America, if you are lucky enough to find someone you are compatible with, you feel like you have won some sort of great battle. And then suddenly you are in love and walking around with a blank smile on your face in a state of utter bliss. But as the relationship progresses you start to notice a few things in regards to how your partner handles money. Some things that just rub you the wrong way. Maybe they spend a lot on gifts and meals but then don’t have a headboard for their bed. Or they are way too happy to always split the bill or let you pay for it.

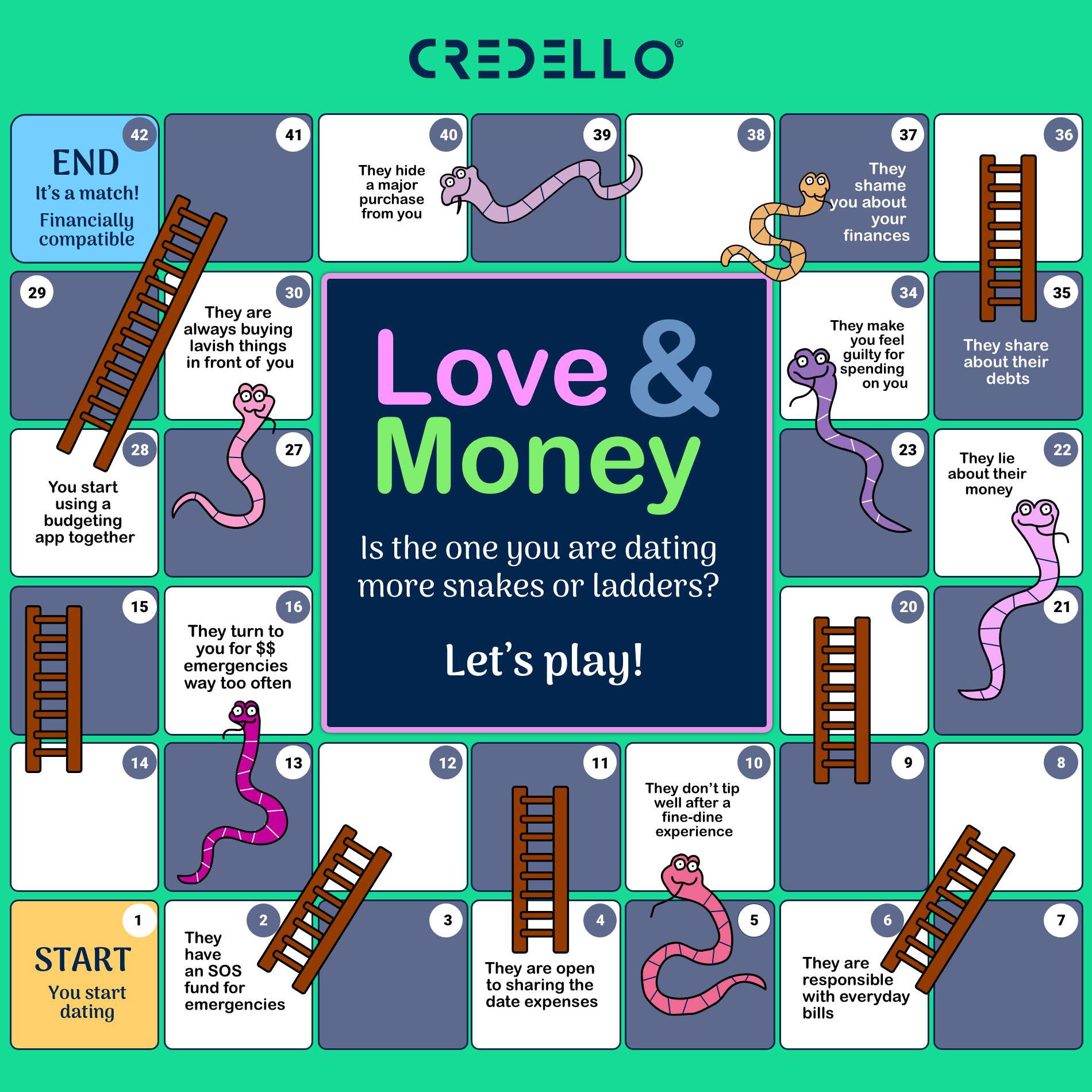

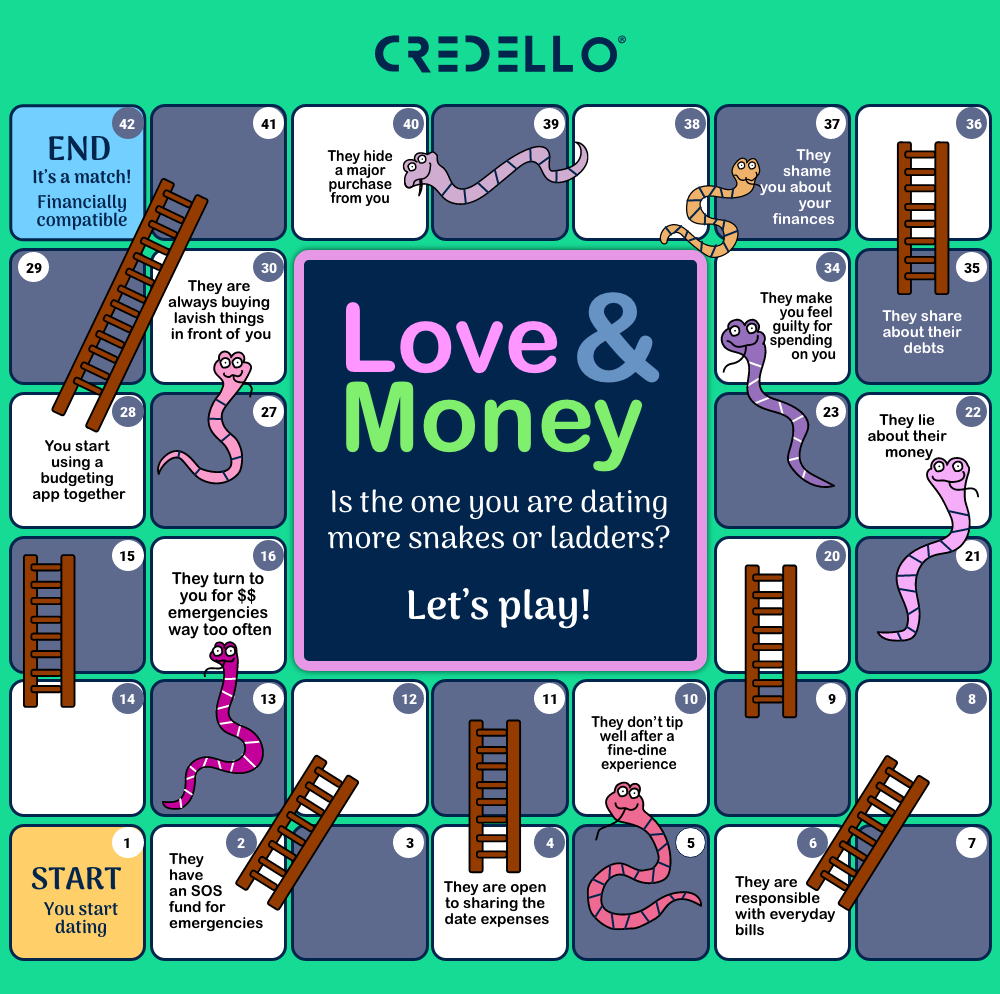

There is such a thing as financial compatibility, and it can make or break your romance. So, as you date and meet people, do keep love as a top priority, but don’t ignore money red flags because you’re looking at your date through rose-colored glasses.

“Money red flags are so important to look out for because you want to work out early on whether your approaches to money are too different to make a relationship work. You don’t want to discover after months or years of dating that you have to break up because you disagree on a fundamental level about finances,” says Jessica Alderson, relationship expert and cofounder of So Syncd.

To help you prevent heartbreak down the line, Alderson shared the biggest financial red flags to look out for while dating – along with tips on what to do if you spot them in someone you’re interested in (it’s not always a dealbreaker!).

1. Dishonesty around money

Financial transparency is crucial. Almost 50% of respondents in Credello’s Love and Money survey believe that you should start talking about money within the first six months of dating. Your date probably won’t share that they’re looking for a debt consolidation loan on a first date. But if they straight-up hide things, it’s not good. Being dishonest about finances is the biggest money red flag when dating, according to Alderson:

“Honesty is essential for building trust in a relationship so when someone is deceitful about money, it often causes much bigger issues. This could involve your partner hiding the extent of their debt or not being open about their spending habits.”

2. Refusing to talk about finances

Perhaps your date is not hiding credit card debt per se. But they seem standoffish the minute that you try to mention money. That’s a red flag too.

“Communication is key in any relationship, and if your partner avoids talking about finances, it could be a sign that something isn’t quite right. Avoiding conversations about money isn’t quite as serious as being outright dishonest, but it’s certainly a red flag.”

If your partner is in major debt tell them about debt consolidation loans. They have options.

Find and compare the best debt consolidation loan options.

Use the filters below to refine your search

Sorry, we didn’t find any options that meet your requirements. Please try modifying your preferences.

Congratulations! You’re close to seeing your offers!

Please take a second to review the details you shared earlier

Sorry, we didn’t find any options that meet your requirements. Please try modifying your preferences.

3. Spending beyond their means

Your new partner always suggests fancy restaurants. They treat you to lavish gifts. This may look like a good thing on paper, but if it doesn’t line up with what they do for a living, it could also be a sign of overspending.

“If your date spends more than they can afford, this is a red flag. Overspending is usually a sign of underlying issues such as low self-esteem or a lack of impulse control. If your partner has a spending problem, they can end up in serious debt, which has the potential to majorly impact your life too, if you are in a relationship. You have to ask yourself if this is the kind of financial future you want,” adds Alderson.

4. Not repaying borrowed money

Let’s say that your date asks you to foot the bill and mentions they’ll repay you. You never hear about it or see your money again. If this happens more than once, consider it a warning sign.

“It’s a major red flag if your partner often borrows money but doesn’t pay you back. It can be a sign of irresponsible financial management or it can indicate that they are using you for money,” according to Alderson. As she puts it, neither of these scenarios are desirable and you should be wary of anyone who borrows funds without repaying you. “If it happens now and again, it could be that they forgot, but if it’s a repeated issue, it’s concerning.”

It's a major red flag if your partner often borrows money but doesn't pay you back. It can be a sign of irresponsible financial management or it can indicate that they are using you for money.

5. Being stingy

Being stingy is more than a possible turnoff. It can be a sign that they’re just not that into you. “If your date is stingy when it comes to paying for things or always tries to get a ‘free ride’ from you, it’s a red flag. It can indicate a sense of entitlement, or it could be a sign that they don’t see a future with you,” according to Alderson.

Ouch. That’s right – if your romantic prospect isn’t willing to reciprocate on a financial level, it can be a signal that they don’t value you. “Alternatively, it could be how they are around money in general. If this is the case, you need to decide whether it’s a dealbreaker for you,” she adds.

6. Talking about money too much

Some red flags are more subtle than others. While a lack of communication about money is concerning, talking about money too much can be just as worrying. “More subtle, underrated warning signs to look out for are things like how your date talks about financial topics, how they prioritize money in their life, and what their overall attitude to money is like,” says Alderson.

For example, if your date excessively talks about their expensive car or salary, it shows that material success is a big priority for them. That’s not necessarily a downside, but it can clash with your own life vision if you’re looking to prioritize other things over money, such as family, friends and experiences.

Telling you how to spend your money

Another subtle financial red flag is when someone tries to tell you how to spend your money, says Alderson.This can look like a throwaway comment suggesting what you should do with your paycheck or trying to influence a big purchase. But it should not be taken lightly.

“This can be an early sign of controlling behavior and should be taken seriously. Controlling behavior almost always gets worse with time, so you should take note of seemingly subtle signs,” she says.

How to address financial red flags while dating?

So you’ve spotted a financial red flag. What now? Should you instantly break up? Bring it up? It depends on the context, says Alderson: “How quickly you make a decision about a red flag depends on how extreme it is and how much it means to you. If the red flag is glaringly obvious, it’s much better to cut things off quickly rather than end up in a relationship that isn’t right. It’s better not to waste time and energy if it’s obvious it’s a dealbreaker.”

“On the other hand, if the red flag isn’t as serious or if it’s something that you can discuss and work out, you should continue to observe how they deal with money to better understand it’s something you can accept in the long run.”

Plus, depending on what kind of financial red flag it is, it can be worth having a conversation with the person that you are dating. This opens up the lines of communication around money, turning a red flag into an opportunity to understand each other on a deeper level and find common ground.

There’s another caveat: A person’s past experiences with love and money can affect how they show up in a new relationship. “It’s also worth noting that some people act differently with money during the early stages of dating, so financial behavior can change as a relationship progresses,” says Alderson. “For example, if someone feels that their previous partner used them for money, they may be less generous with their finances at the start of a new relationship until they feel that you can be trusted. Ideally, they will communicate why they are feeling this way so you can understand where their actions are coming from.”

Bottom line

Financial red flags aren’t always dealbreakers. Some can be worked through. But it’s important to be aware of them and listen to your instincts – they are not to be ignored.