5 Things Billionaires Do Differently with Their Money

About Anouare

Anouare is a seasoned writer, editor and content strategist who started her career as a lifestyle journalist before stepping into leadership roles at publications such as AskMen and Goalcast. From editorial strategy to content marketing and project-management, she has tackled various challenges in digital media and discovered her passion for mentoring others in the process. She loves a good money mindset book and believes you can create your dream lifestyle by being yourself.

Read full bio

At a Glance

Billionaires…they’re not just like us. In fact, they do things quite differently when it comes to money. While it’s essential to raise awareness about wealth inequality and question why some people are billionaires in the first place while others struggle every day, it’s interesting to unpack the financial habits of the ultra-wealthy.

Are there habits that the average person can take a cue from? Could you benefit from embracing million-dollar mindsets and approaches on a regular budget? The answer is yes and yes – some of the things that billionaires do differently don’t require millions in the bank, and those things contributed to their financial success.

Here are five things the uber-rich do differently with their money to inspire your own personal finance journey.

They know cash is king

Yes, increasing your net worth (assets minus liabilities) is a smart goal. That being said, if all your net worth is tied into your mortgage, you have a blind spot: cashflow. Liquidity is super important for getting ahead financially. Wealthy people understand that and focus on growing their monthly cash flow to a healthy place.

Everyday tip: Build an emergency fund for a rainy day. Once you’ve reached your target, aim to always keep a certain amount of cash in your bank account.

They focus on the big picture

“I think people spend way too much time agonizing over small money decisions and not nearly enough time on big decisions,” shared Ramit Sethi, author of the New York Times bestseller “I Will Teach You To Be Rich” on Twitter.

According to him, small $3 questions include whether you should spend money on coffee, dessert or the price of an Uber. But the good questions, the ones billionaires tend to ask themselves, gravitate around the bigger picture: “Buying vs. renting, debt payoff, negotiating salary, savings rate, asset allocation,” added Sethi.

I think people spend way too much time agonizing over small money decisions and not nearly enough time on big decisions

Small $3 questions: Coffee, dessert, price of an Uber

$30,000+ questions: Buying vs. renting, debt payoff, negotiating salary, savings rate, asset allocation

— Ramit Sethi (@ramit) October 17, 2022

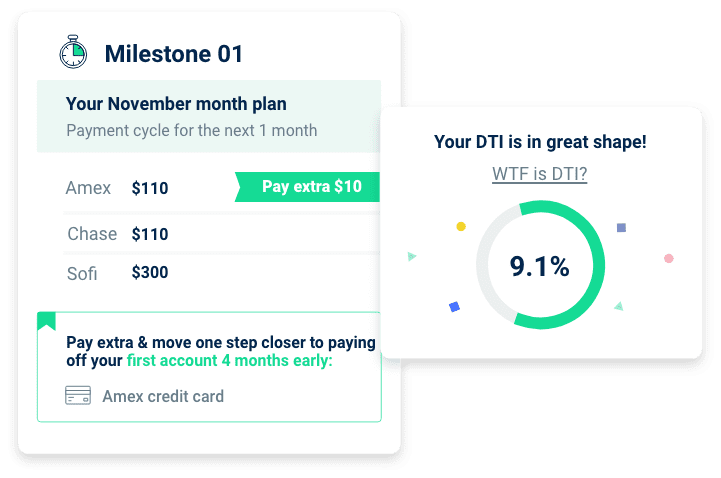

Everyday tip: Take a moment to reflect. What are some big areas of focus and strategic moves that can make a difference for you financially in the years to come? MyCredello can help you answer those questions.

Start your journey to debt freedom today

Even if someone is helping you, you are in control of your debt journey. Start tracking your success today.

They make their money work for them

Financial planner, accountant and author Tom Corley spent five years exploring how the world’s wealthiest people think about their money. He interviewed 225 millionaires and uncovered interesting trends. “88% of the millionaires I interviewed said that saving in particular was critical to their long-term financial success,” he wrote in a CNBC article. “It took the average millionaire in my study between 12 to 32 years to accumulate a net worth of anywhere from $3 million to $7 million.”

That’s because those people made their money work for them through compound gains. Corley identified a few different profiles among the millionaires he interviewed, one of them being the Saver-Investor type.

12 - 32

is the average amount of years a millionaire takes to acquire their wealth.

Saver-Investors who became millionaires automatically saved 20% of their monthly income for years – 10% went to retirement accounts, and 10% to investments. The people who became rich through entrepreneurial dreams and used all their capital to fund their business ventures instead didn’t adopt the same tactic, but the minute they had enough cashflow to do so, they pivoted to investing earnings to build their wealth.

Everyday tip: Even if you can’t afford to save 20% monthly, set aside a percentage of your income into a savings account and always pay yourself first. Once a month, transfer that money into an investment account.

They play the long game

There is a famous Warren Buffett quote about the fact many people don’t want to get rich slowly. He played the long game when it came to building wealth, while a lot of people don’t have the patience to stay consistent and are looking for a quick breakthrough.

Just like Buffett, billionaires tend to think long-term. And what this means is that they don’t act out of fear. When the economy takes a downturn, they don’t panic and sell all their stocks. They know that it’s important to avoid making impulsive decisions when it comes to their money.

Speaking of stocks, if you’re wondering where the wealthiest people keep their money, its stocks and mutual funds, private equity funds, venture capital, real estate and alternative investments.

Everyday tip: Don’t spend all your savings on NFTs, but do start learning about different investment types and their level of risk so you can choose one or two that work well for you.

They leverage taxes to get richer

It’s no secret that billionaires find all sorts of legal ways to avoid paying taxes. A study showed that yearly reported income actually doesn’t reflect wealth all that much.

“This evidence from linked estate and income tax records strongly suggests that the decision to realize income—particularly taxable income—is very much a choice for wealthy people, and not one that especially reflects underlying assets,” concluded the authors. Tax reform is a whole other topic, but the average American can still aim to make the most out of tax rules.

Everyday tip: Take advantage of the tax credits that are available to you and work with a good accountant to make sure you’re not leaving money on the table when filing your income tax return.

The Bottom Line

No need to be rich to make a few billionaire-worthy money moves. Be patient and consistent and think of your financial big picture to stay on track.