Online Debt Consolidation: Benefits and How It Works

About

Caitlyn is a freelance writer from the Cincinnati area with clients ranging from digital marketing agencies, insurance/finance companies, and healthcare organizations to travel and technology blogs. She loves reading, traveling, and camping—and hanging with her dogs Coco and Hamilton.

About Caitlyn

Caitlyn is a freelance writer from the Cincinnati area with clients ranging from digital marketing agencies, insurance/finance companies, and healthcare organizations to travel and technology blogs. She loves reading, traveling, and camping—and hanging with her dogs Coco and Hamilton.

Read full bio

At a Glance

Consolidating your debt means taking out a single loan to pay off multiple unsecured loans, such as credit cards, personal loans, auto loans, student loans, and others. Debt consolidation can help you pay off your loans faster and could lower your total payments. To find the best online debt consolidation loans, you should know what they are and how to get one.

In this article, you’ll learn about:

- Is online debt consolidation right for you?

- Online vs. traditional debt consolidation

- Learn online debt consolidation process

- Benefits of online debt consolidation

- Downsides to online debt consolidation

- How to consolidate your debt online?

- How to choose an online debt consolidation loan?

- How to apply for a debt consolidation loan online?

- Choosing an online debt consolidation company

- How to avoid scams while consolidating debt online?

- FAQs

Is online debt consolidation right for you?

Online debt consolidation may be right for you if your monthly debt payments don’t exceed 50% of your monthly gross income, you have a decent credit score and can qualify for a low or 0% APR, you have a consistent cash flow and can continue to make monthly payments, and you can pay off the consolidation loan within five years.

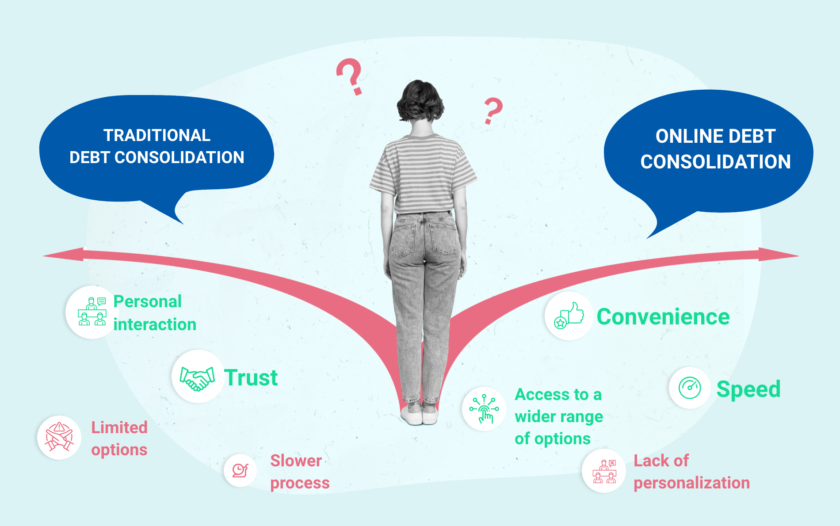

Online vs. traditional debt consolidation

Online consolidation loans are a new form of traditional debt consolidation. At the end of the day, both types of consolidation loan companies do the exact same job. However, getting a personal debt consolidation loan online affords you the flexibility to research different lenders from the comfort of your couch and compare different offers side-by-side.

Otherwise, you would be forced to drive around town to different lenders while writing down the various offers they have available to you. An added benefit of getting a credit card consolidation loan online is that you can likely see if you’re preapproved for the loan instantly without having to take the time to wait for the decision.

Learn online debt consolidation process

The debt consolidation online process will consist of a few primary steps. First and foremost, you will need to conduct research on the different debt consolidation lenders in your area to see what type of offerings are available. After seeing the different lenders in your area, you will need to gather some of the following information:

- Desired consolidation loan amount: Add up the totals of all forms of debt you are wishing to consolidate into a single loan in order to determine how much to request.

- View your credit score: Look at your current credit score to determine which lenders will approve your loan.

- Gather personal and financial information: Your current address, income streams, any dependents, potential co-signers, and more are all examples of information you will need in order to apply.

After choosing your lender and applying with the above information, the lender will make a decision on whether or not to approve you for the loan.

Find the Best Debt Consolidation Loan for You

Answer these simple questions to find solutions you're likely to get approved for

What debt do you want to consolidate?

Select all that apply

Others does not include mortgage

Debt Consolidation requires more than one debt account. Please select at least two debt types above.

Benefits of online debt consolidation

Online debt consolidation means you’re doing the entire process of consolidating your debt online. This can make securing a debt consolidation loan faster and easier than ever. The primary benefits of consolidating your debt online include:

- Online shopping. You can compare lenders, interest rates, eligibility criteria, repayment details, and more without having to step foot in a bank or credit union location or even make a phone call. There are a number of websites that have already compiled the top options, most of which offer ways to sort and filter those that meet your needs. Or, you can use internet searches to find your own options and compare information.

- Online application. Once you find the lender and option that you want, you can take care of the entire application process online. These online applications will ask the same questions and request the same information you’d need at a bank or credit union, which you can fill out or upload right from your computer. These applications can be completed at your own pace, wherever you are, and submitted when complete.

- Better tools. Free online tools such as debt consolidation calculators can help you decide if debt consolidation is right for you, even providing potential savings in interest, monthly payments, and estimated debt-free timelines. Some consolidation companies also offer live messaging or texting, so it’s quick and easy to chat with debt counselors and get a plan recommendation.

Additionally, most online tools are data-driven. This means you can share information about your specific circumstances and calculate a solution based on the data you’ve provided.

Downsides to online debt consolidation

If you are just exploring options for paying off your debt, you may not be sure if debt consolidation is right for you, especially because there are some risks.

Because online debt consolidation means you likely don’t ever have to talk to a person, it may not be the best option for those who:

- Would prefer to talk to a person rather than conduct their own research.

- Don’t have access to the internet or a computer.

- Need more help understanding their options.

Another downside is that some online debt consolidation companies are scams. For example, they may charge for their services. This could be a percentage of the amount of your original debt, or a percentage of the amount you’ve agreed to pay. In this case, it’s better to go through a bank or credit union, but take advantage of the online services they offer.

They may also compromise your personal information, or significantly affect your credit score. Be sure to read all of the fine print and ask about any fees the lender may charge, and keep an eye out for any red flags.

Related: How debt consolidation can go wrong?

How to consolidate your debt online?

The first step in online debt consolidation is to do your research. Start by using a debt consolidation calculator to better understand if debt consolidation is the right way to go. Ask yourself questions and prepare information such as:

- How much debt you want to consolidate.

- Current loan/debt terms, interest rates, totals, and details.

- Your annual income.

- Current credit score.

Then, search online for things like “best debt consolidation loans,” “debt consolidation options,” and “best debt consolidation companies.” Use comparison websites, or make your own spreadsheet, to track things like:

- Loan amounts

- Loan terms

- Interest rates

- Eligibility criteria

- Minimum payments

Online lenders often work with borrowers with all types of credit and needs, and let you pre-qualify so you can get the most personalized rates and terms without impacting your credit score.

Get the best debt consolidation options for your needs

We provide solutions you're likely to get approved for

How to choose an online debt consolidation loan?

When determining which debt consolidation loan is right for you, there are a few factors to pay attention to in addition to eligibility:

- Choose the loan offering with the lowest possible annual percentage rate (APR).

- Choose a lender offering zero to very few fees.

- Consider added features such as lenders who will handle the repayment of all your debt being consolidated on your behalf.

- Don’t take out a loan you are unable to meet the obligations for over the life of the loan.

- Consider lenders with flexible repayment options such as online payments, phone payment, in-person payments, and more.

- Review past customer ratings to see if the lender has a reputable history.

How to apply for a debt consolidation loan online?

Once you’ve finished researching and chosen a lender, you’re ready to apply for the loan. Gather documents such as:

- Proof of identity

- Proof of address

- Proof of employment

- Income verification

- Education history

- Social security number

Be sure to take your time reading the fine print and details of the application. Look out for extra fees, prepayment penalties, and whether the lender reports payments to credit bureaus. Also at this point, determine whether you need a cosigner with good credit to qualify for the loan.

When you’re complete with the application, submit it and wait to be notified that you’re approved for the loan you want. When you’re approved, the lender will either:

- Offer direct payment. This means the lender will pay off your old debts directly to the creditors expecting repayment. Those accounts will then have a $0 balance and be completely paid off. Going forward, you’ll only need to pay your new lender.

- Deposit the new loan funds into your bank account. You’ll use those funds to repay each debt individually. In this case, repay those old debts as soon as possible to avoid paying additional interest, and to eliminate the temptation to spend the funds on something else. You’ll then make your first payment to the new consolidation loan within 30 days.

Choosing an online debt consolidation company

Most online debt consolidation companies offer a variety of tools for personalized debt relief. When choosing the best company for you, there are a few things to consider:

- Make sure the company can lower your interest. One reason to consolidate debt is to get a lower interest rate, decrease your monthly payment and eliminate your debt faster. Consider something different if the company can’t lower your rate or comes with some fees.

- Customer service should be excellent. Your debt consolidation strategy should be tailored to your needs. Research customer service ratings and reviews and ensure the company always puts their customers’ needs first.

- Choose a company you trust. Check the track record for any company you’re considering – find information like how long they’ve been in business if their counselors are accredited, what their ratings are on sites like the Better Business Bureau, and if their overall online presence gives you a sense of trust.

- Prioritize transparency. An online debt consolidation company should be able and willing to answer your questions and provide information about their customer service, programs offered, costs, and similar information. All of this should be easy to find on their website.

Finding the best online consolidation company can help ensure you get a tailored, customized payment plan and stay out of debt in the future.

How to avoid scams while consolidating debt online?

As with any type of loan, your goal should be to avoid losing money to a scam. Fortunately, there are a few key ways you can avoid falling into this trip:

- Verify the lender using previous customer reviews.

- Read the terms of your contract to ensure you are not receiving a payday loan.

- Avoid lenders who refuse to share information with you or are too pushy.

- Avoid lenders who promise to reduce your total debt–this is impossible with a debt consolidation loan.

- You receive unsolicited offers from the company.

Learn more: How to avoid debt consolidation scams?

FAQs

Yes, some debt consolidation companies offer loans to people with poor credit. The downside is you may only qualify for a loan with a higher APR, or less favorable loan terms or amounts. If you have a bad credit score, take steps now to try and improve it before applying for a consolidation loan.

Taking out a debt consolidation loan may initially lower your credit score due to the hard credit check, but over time, consolidating debt will help your credit score. This is because you will lower your credit utilization ratio, which measures how much credit you’re using, and it may also improve your payment history.

Learn more: Does Debt Consolidation Hurt Your Credit Score?

If you have multiple student loans, you may be able to combine them into one loan with a fixed interest rate. If you have federal loans, they can be consolidated using a federal consolidation loan. This process can take place online. If you have private loans, you can also consolidate these with a private consolidation loan. The process for applying would be the same as if you had other types of debt.

One reason to consolidate debt is to get a lower interest rate than your current debts, so you’re paying less in interest on your new loan than you were previously. However, if you have poor credit, you may not be offered a lower rate. Make sure your credit score is good or excellent for the best rates.

Yes. If you consolidate your debt with a debt consolidation loan with a lower interest rate, you will pay the lower rate on the new loan instead of the higher rates on your old debt. Lower interest rates and better loan terms mean you’ll be able to save money.

This can depend on your debt consolidation method, but in most cases, you can consolidate debt such as credit cards, unsecured personal loans, and medical debts. You may not be able to consolidate home loans, auto loans, or student loans (if they are federal student loans).

No, you do not have to consolidate all of your debt. Some debt consolidation companies have a minimum/maximum for their debt consolidation loans, but you can decide what is most important to you. Choosing your debts with the highest interest rates is best to save the most money and pay off your debt the fastest.