Best Debt Consolidation by Credit Score

About Casey

Casey is a reformed sports journalist tackling a new game of financial services writing. Mike Francesa once called her a “great girl.”

Read full bio

Debt consolidation loans can help consumers merge multiple debts into one payment. Debt consolidation typically is easier if you have at least a good credit score. But getting a debt consolidation loan with a low credit score is doable. We’ll break down the best debt consolidation lenders for each credit score.

How to choose the right debt consolidation loan

Do the math

Figure out how much a debt consolidation loan is going to cost you compared with your other debt. Depending on the length of the loan terms, you could wind up paying more in interest over the course of the loan than what you’ll save by consolidating debt. Use our debt consolidation calculator to run the numbers.

Related: What is debt consolidation

Think about what types of debt you want to consolidate

If you’re consolidating student loan debt, that’s typically done separately than other types of debt. With a debt consolidation loan, you’re likely working with your credit card, auto loan, medical debt, etc.

Research other types of loans

Decide if a debt consolidation loan is the right move for you. There are other ways to consolidate debt. Home equity loans, home equity lines of credit (HELOCs), balance transfer credit cards, and personal lines of credit are some options.

Are you applying for a secured or unsecured loan?

If you’re applying for a secured loan, your home or car will act as collateral if you’re unable to make payments. Unsecured loans don’t need collateral but tend to have higher interest rates. Think about which makes the most sense for you.

What to look for in a debt consolidation loan

The criteria you’ll want in a debt consolidation loan will depend on your individual financial situation. These are the factors to consider.

- Loan amount: What are the maximum and minimum? Do these amounts fit your needs?

- Repayment terms: While a longer-term loan will mean a lower monthly payment, a shorter term will mean paying less interest overall.

- Pre-approval: Are you able to get an estimate of your loan amount and interest rate by getting pre-approved? This will allow you to get the information with a soft credit check, which doesn’t affect your credit score.

- Origination and/or pre-payment fee: Consider the fees involved. Do you have to pay a fee when you take out the loan, i.e., an origination fee? Will you face a fee if you pay off the loan early?

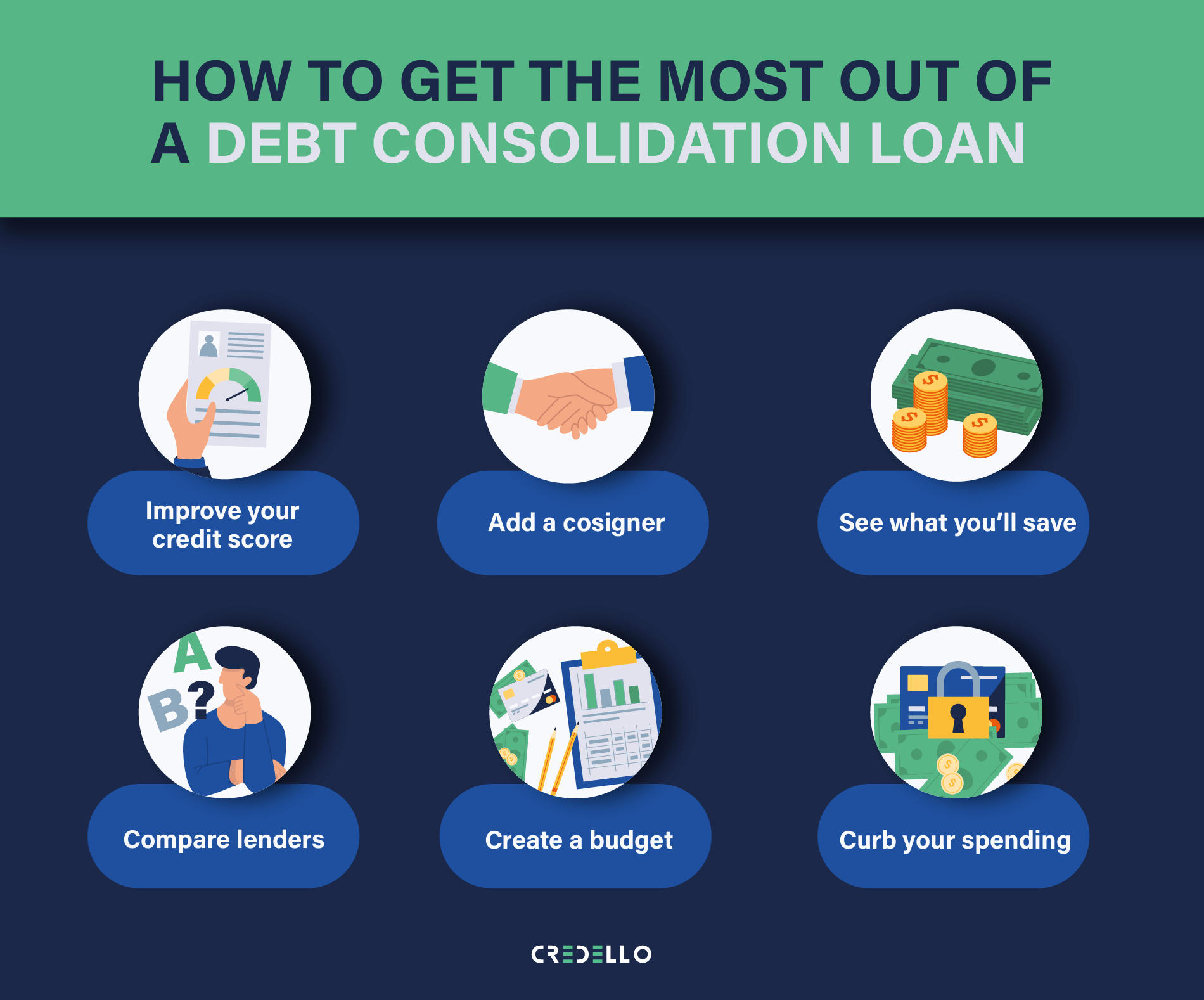

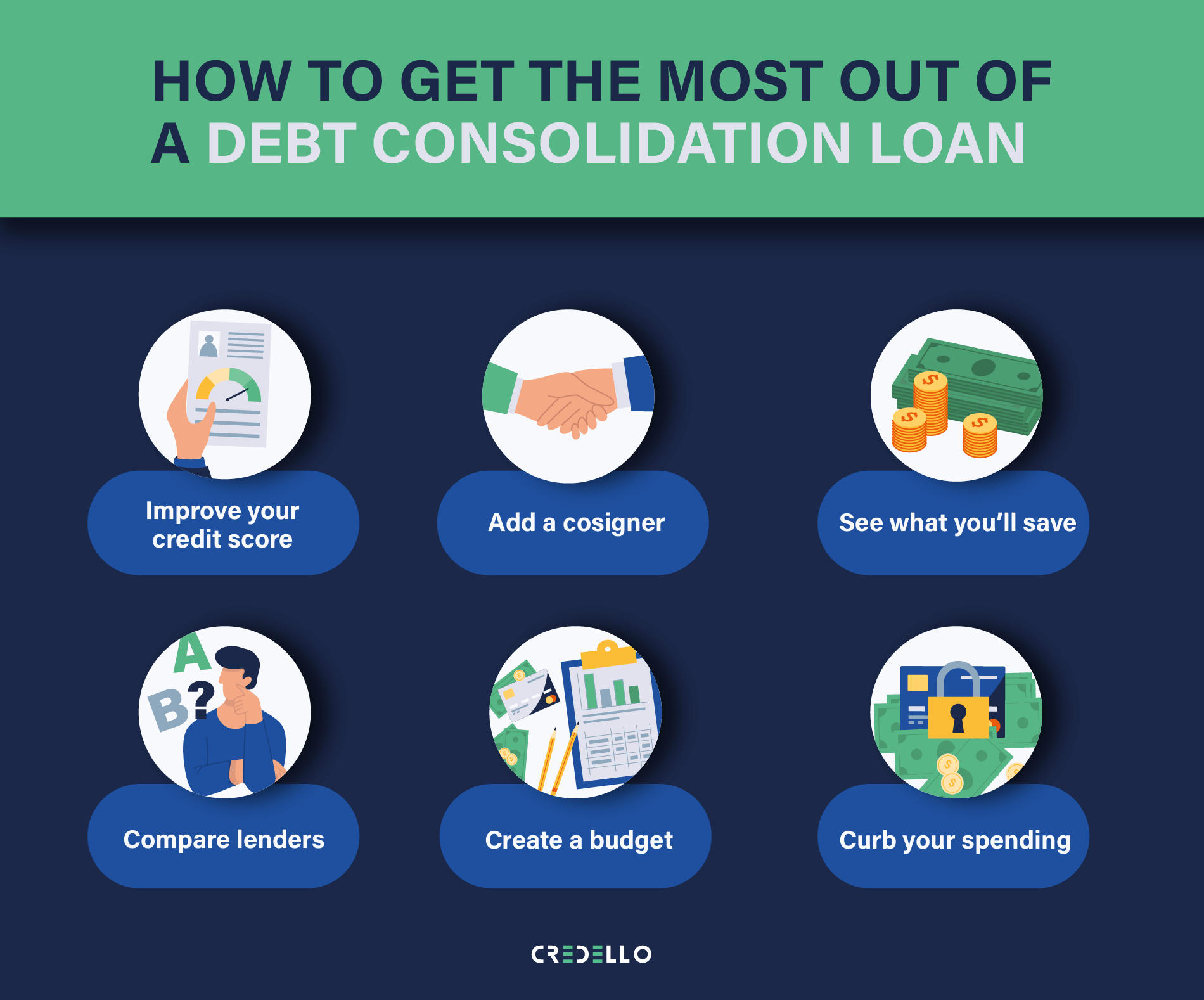

How to get the most out of a debt consolidation loan

Planning ahead can help you get the most of a debt consolidation loan.

- Improve your credit score: There’s no particular credit score required for a debt consolidation loan. But before applying, consider trying to improve your credit score. Approval for these loans is based on your credit score and your ability to repay the loan. The better your credit score, the more likely you’ll be approved, and the better your interest rate will be.

- Add a cosigner: Concerned about qualifying for a debt consolidation loan on your own because of a poor credit score or low income? Consider adding a cosigner.

- See what you’ll save: Determine your interest savings and potential new monthly payment by using our debt consolidation calculator.

- Compare lenders: Shop around with different lenders before committing to one by comparing rates and terms. See if you’re able to pre-qualify for a loan.

- Create a budget: Decide how much of your income you’ll be able to put toward debt repayment. Set a budget using our budget template and stick to it.

- Curb your spending: Try to avoid digging yourself a deeper hole by limiting credit card spending as you pay off your debt.

Benefits of debt consolidation

There are several advantages to debt consolidation loans.

Simplify monthly payments

A debt consolidation loan eliminates multiple creditors so you only make payments to a single lender. This helps to avoid late and missed payments.

Fixed interest rates

Credit cards can have variable interest rates, meaning they can change over time. With a debt consolidation loan, the interest rate is fixed for the duration of the loan.

The interest rate will be determined by your credit score, the length of the loan, and the amount you borrow. Generally, the better your credit score, the better your interest rate.

Can I borrow more?

Loan amounts vary by lender, but some debt consolidation loans have a maximum of $100,000. Most consumers consolidate much less debt. According to a recent U.S. News survey, 60% of consumers consolidated less than $20,000.

Does debt consolidation hurt your credit score?

While debt consolidation can help your credit score if you play your cards right. But be mindful that consolidating debt also can hurt your credit score. If you’re using the loan to consolidate credit card debt, you’ll lower your credit utilization (the amount you owe), which will boost your credit score.

But applying for a debt consolidation requires a hard credit pull, even if you pre-qualify. This can temporarily hurt your credit score. If you continue to rack up new credit card debt, you’ll also hurt your credit score.

Best debt consolidation loans for excellent credit scores

LightStream

- Minimum credit score: 660

- APR: 5.95%-19.99% (rates without autopay are 0.5% higher)

- Loan amount: $5,000-$100,000

- Loan terms: 24-84 months

- Fees and fine print: LightStream does not charge origination, pre-payment, or other fees

Sofi

- Minimum credit score: 680

- APR: 5.99%-19.96% (autopay rates are 0.25% lower)

- Loan amount: $5,000-$100,000

- Loan terms: 24-84 months

- Fees and fine print: Sofi does not charge origination, pre-payment, late, or other fees

Best debt consolidation loans for good credit scores

Best Egg

- Minimum credit score: 640

- APR: 5.99%-29.99%

- Loan amount: $2,000-$35,000

- Loan terms: 36-60 months

- Fees and fine print: To get the best interest rate, you need a minimum FICO score of 700 and a minimum individual income of $100,000.

- Origination fee: 0.99%-5.99%

- Late fee: $15

Marcus

- Minimum credit score: 580 VantageScore 3.0; 690 FICO 9.0

- APR: 6.99%-19.99% (autopay enrollment saves 0.25%)

- Loan amount: $3,500-$40,000

- Loan terms: 36-72 months

- Fees and fine print: Marcus does not charge signup fees, pre-payment fees, late fees, or other fees.

Discover

- Minimum credit score: 660

- APR: 6.99%-24.99%

- Loan amount: $2,500-$35,000

- Loan terms: 36-84 months

- Fees and fine print: Discover does not charge any fees except late fees.

Best debt consolidation loans for fair/average credit score

OneMain Financial

- Minimum credit score: Not specified

- APR: 18%-35.99%

- Loan amount: $1,500-$20,000

- Loan terms: 24-60 months

- Fees and fine print: Origination and late fees vary by state.

Upgrade

- Minimum credit score: 600

- APR: 7.99%-35.97%

- Loan amount: $1,000-$35,000

- Loan terms: 36 months

- Fees and fine print: Upgrade doesn’t charge a pre-payment fee.

- Origination fee: 2.9%-8%

- Late fee: May increase cost of fixed-rate loan

Payoff

- Minimum credit score: 640

- APR: 5.99%-24.99%

- Loan amount: $5,000-$35,000

- Loan terms: 24-60 months

- Fees and fine print: Payoff charges an origination fee ranging from 0%-5% depending on the length and amount of the loan

LendingClub

- Minimum credit score: 600

- APR: 10.68%-35.89%

- Loan amount: $1,000-$40,000

- Loan terms: 36-60 months

- Fees and fine print

- Origination fee: 2-6%

- Late fee: Either $15 or 5% of the payment amount — whichever is greater — following a 15-day grace period

Upstart

- Minimum credit score: 620

- APR: 7%-35.99%

- Loan amount: $1,000-$50,000

- Loan terms: 36 or 60 months

- Fees and fine print

- Origination fee: 0%-8%

- Late fee: Either $15 or 5% of the payment amount — whichever is greater — following a 15-day grace period

Best debt consolidation loans for poor/bad credit scores

Avant

- Minimum credit score: 580

- APR: 9.95%-35.99%

- Loan amount: $2,000-$35,000

- Loan terms: 24-60 months

- Fees and fine print

- Administrative fee: Up to 4.75%

- Late fee: $25 (in most states)

- Returned payment fee: $15 (in most states)