How to Consolidate Student Loan Debt

About Casey

Casey is a reformed sports journalist tackling a new game of financial services writing. Mike Francesa once called her a “great girl.”

Read full bio

At a Glance

If you’re dealing with the burden of multiple student loans, you might be able to consolidate them into one loan with a fixed interest rate that’s based on the average rate of your existing loans to help pay off your debt. The idea is to make student loan debt more manageable, and possibly even less expensive if done right.

Navigating the differences between federal and private student loan debt consolidation:

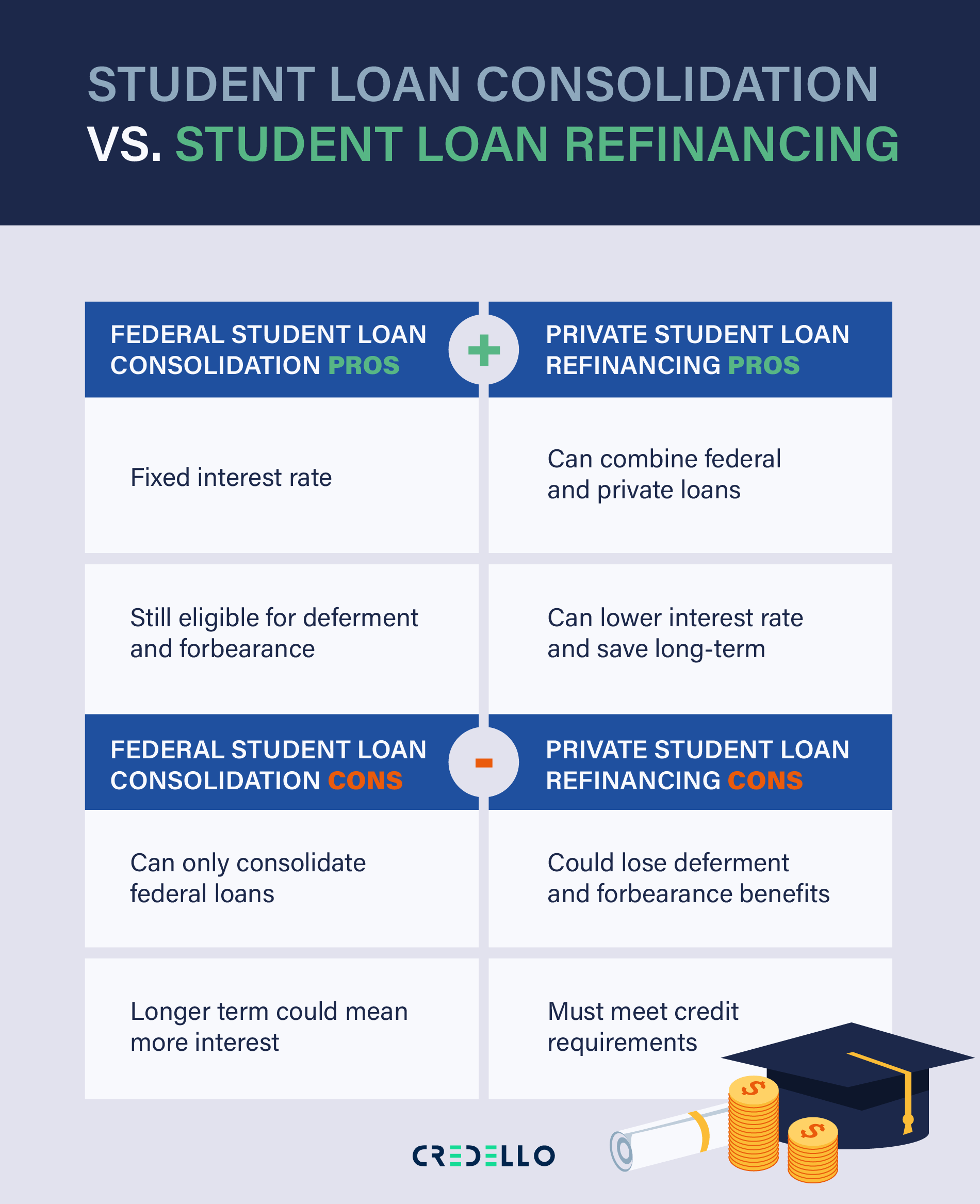

- Student loan consolidation vs. student loan refinancing

- Federal student loan debt consolidation

- How to consolidate federal student loans

- Pros and cons of student loan debt consolidation

- Private student loan debt consolidation

- How to consolidate private student loans

- Pros and cons of private student loan debt consolidation

Student loan consolidation vs. student loan refinancing

There are two types of student loan consolidation that are often confused but vary significantly: student loan consolidation (for federal loans) and student loan refinancing, or private student loan consolidation.

Student loan consolidation

Federal student loan consolidation is when you take multiple federal loans and combine them into one federal loan. This is done via Federal Student Aid, an office of the Department of Education. Your new loan, a direct consolidation loan, is free of charge. Instead of making multiple monthly payments, you’ll have a single monthly payment.

Student loan refinancing

Student loan refinancing is done through a private lender. If you have both federal and private student loans and want to combine them for one monthly payment, refinancing would be your only option. With refinancing, you negotiate a fixed or variable interest rate that should be lower than the individual interest rates on each of your existing loans.

You can’t transfer private loans to the federal government, but you can consolidate both private and federal loans through a private lender. If federal loans are included in your refinancing, you’ll lose the repayment options and forgiveness programs, like deferment and forbearance, that are included.

A deferment temporarily postpones a loan payment under certain circumstances. Interest generally does not accrue on the subsidized part of a direct consolidation loan during this period. Forbearance temporarily suspends or reduces your loan payments for a certain period.

Federal student loan debt consolidation

There’s no credit requirement for consolidating federal student loan debt. But only federal loans can be consolidated this way. This could be a good option for you if:

- You have Federal Family Education, Perkins, or parent PLUS loans as you need to consolidate to be eligible for perks like income-driven repayment (IDR) or public service loan forgiveness (PSLF).

- You want to streamline multiple monthly payments into one payment, but you don’t need the rate to drop significantly

- You defaulted on your student loan and want to work to get out of default

How to consolidate federal student loans

Consolidating a federal student loan is fairly straightforward.

- Visit the Direct Consolidation Loan Application and sign in to your account

- Gather your FSA ID, personal information, and financial information listed in the “What do I need?” section before proceeding to fill out the application. The application process must be completed in one session and reportedly takes most users less than 30 minutes.

- Enter the loans you do and don’t want to consolidate

- Pick a repayment plan. This can be from a timeline based on your loan balance or an income-driven plan. With the latter, you’ll need to fill out an Income-Driven Repayment Plan Request.

- Before submitting, read and review the terms. Keep making your payments as normal until you get confirmation that your consolidation has gone through.

Pros and cons of student loan debt consolidation

Pros

- Single payment instead of multiple payments

- Help you avoid defaulting

- Fixed interest rate

- Longer-term loans for lower payments

- Increase deferment and forbearance options

- No minimum or maximum amount

- Help protect your credit

- Option to set up an automatic payment, which could come with a discount

Cons

- Could pay more interest over time with a longer loan

- Rounded-up interest rate

- Private loans can’t be consolidated through the federal consolidation program

- Could lose some benefits

- Lose grace period

- You can only consolidate once

Private student loan debt consolidation

With private student loan consolidation, or refinancing, your financial history comes into play with the new interest rate you’re getting. Your financial history includes your credit score, income, job history, and educational background.

You generally need at least a good credit score to qualify. Interest rates can range from around 2% to upwards of 13%, depending on the lender and whether it’s a fixed or variable interest rate.1 This can be a good move if:

- You’ve made at least some payments on time since leaving school

- You have good or excellent credit, typically at least 670

- You have a steady job/income

- You can get a cosigner with those credentials

How to consolidate private student loans

The process of consolidating private student loans completely depends on the lender. But online lenders typically offer a web-based application that takes 10 minutes or fewer to fill out and give a response within a few minutes.

Pros and cons of private student loan debt consolidation

Pros

- Lower interest rate and monthly payment

- Less hassle with one monthly payment instead of multiple

- Choice of fixed or variable interest rates

- Remove your cosigner

Cons

- Lose perks or get them reduced

- End up paying more in interest by extending the length of the loan

- Interest rates are already good