Wedding Budget Breakdown: Costs for a Wedding

About Caitlyn

Caitlyn is a freelance writer from the Cincinnati area with clients ranging from digital marketing agencies, insurance/finance companies, and healthcare organizations to travel and technology blogs. She loves reading, traveling, and camping—and hanging with her dogs Coco and Hamilton.

Read full bio

At a Glance

It’s finally happened: You’re engaged. And after all the excitement and celebrations, it’s time to start planning the wedding. As you start diving into what weddings include and all the decisions to be made, you may start to feel overwhelmed. When you factor in how much all the costs are, it can seem daunting. Wedding planning doesn’t have to be as difficult as it may seem to be. There are many things you can do to make planning easier, including building a wedding budget to guide your decisions and spending.

Read on to learn:

Wedding budget breakdown

Before we get into the nitty gritty of your wedding budget here is a fun video on some helpful tips and the most expensive celebrity weddings of all time.

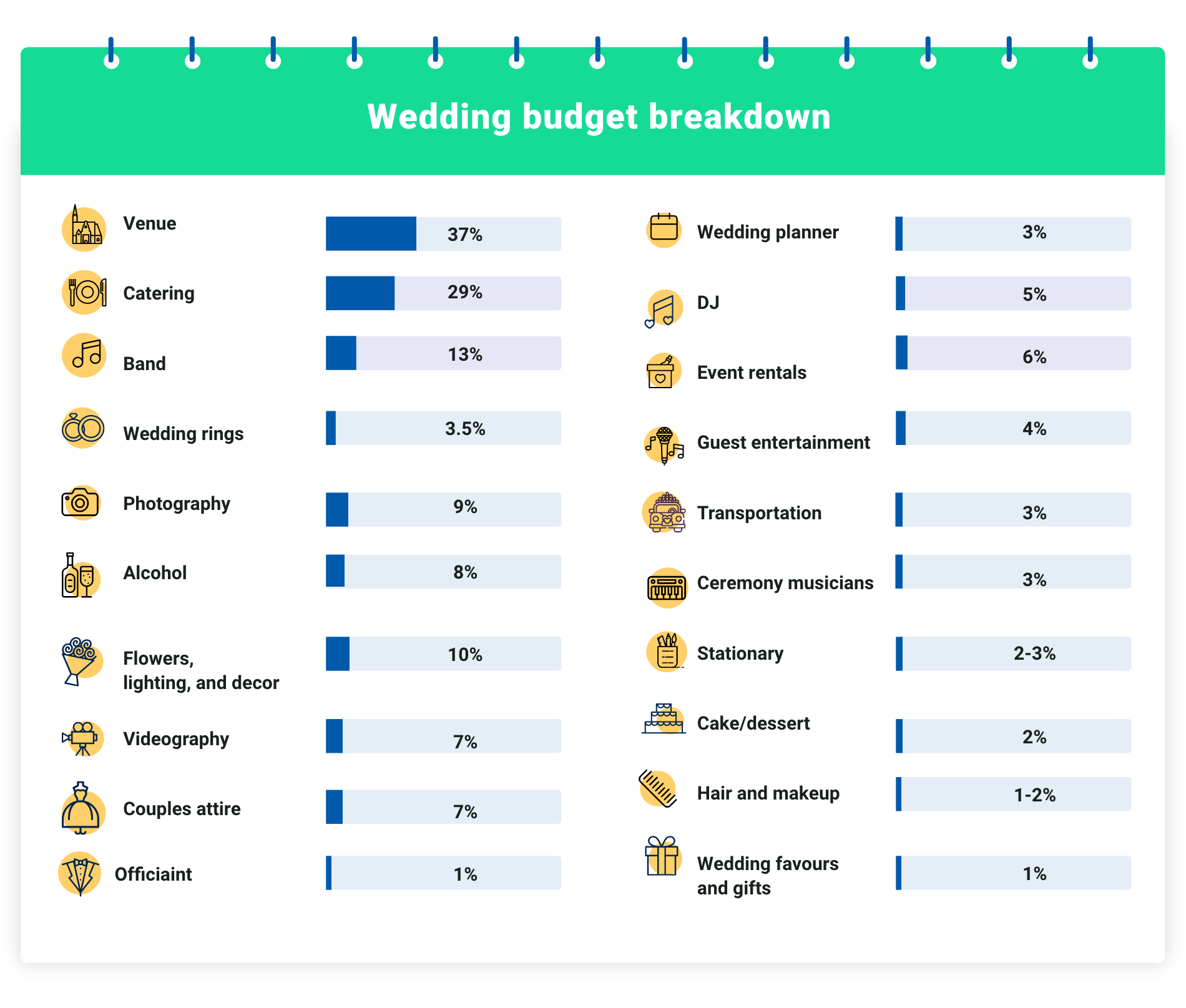

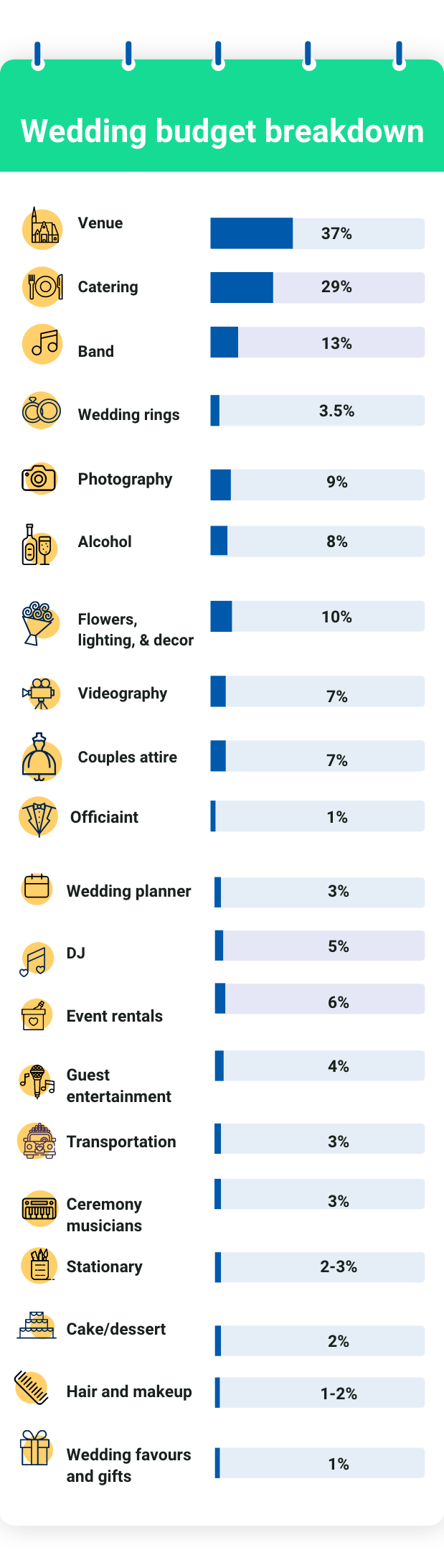

For some, it can be helpful to divide your budget into percentages to cover each spending category. The percentages can vary based on your overall maximum budget, but some examples include:

1. Venue

Percent of budget: 37%

The biggest chunk of your budget will likely need to go to your reception venue rental. Make sure the venue can comfortably fit all of your guests, has options for different weather scenarios, and fits your style and the vibe you’re going for with the wedding.

2. Catering

Percent of budget: 29%

Catering is another expensive but important piece of your budget. Your catering will be calculated by cost-per-head for food items, though depending on packages, it may also include alcohol and a cake and/or dessert. It also typically includes rentals such as flatware, stemware, china, linens, etc. And, it usually also includes charges for preparation, equipment, wait staff, and more.

Check with your catering company to understand exactly what is included with the cost so you know if you need to budget for any items separately.

3. Band

Percent of budget: 13%

If you choose to have live entertainment for your wedding reception, you should allocate about 13% of your budget for this. You’ll usually find that live bands cost more than a DJ, but some couples prefer this to make their wedding day more memorable.

4. Wedding rings

Percent of budget: 2-5%

Don’t forget to include a budget for your wedding rings (excluding the engagement ring). There are a lot of types of rings to choose from to fit any budget, so how much you set aside depends on the type of rings you want. You may want to consider setting funds aside for wedding ring insurance as well.

5. Photography

Percent of budget: 9%

Photography is one of the best and most important investments for your day since these photos will last a lifetime and be cherished keepsakes from your day. Depending on the photographer you hire, this may also include an engagement photography session. Choose a photographer whose work you love and who you enjoy being around since you’ll be spending a lot of time with them leading up to and on your day.

6. Alcohol / liquor

Percent of budget: 8%

If your venue or catering package doesn’t cover alcohol (beer/wine/liquor) and you’re planning on including this as part of your day, make sure you set aside some budget for these costs. You can save money depending on how many options you provide and whether you have liquor.

7. Flowers, lighting, and decor

Percent of budget: 10%

The right flowers, lighting, and decor can transform your space and the look and feel of the wedding. This includes personal flowers (like bouquets and boutonnieres for the wedding party and honored guests), ceremony decorations, centerpieces, and other non-floral decorations. Miscellaneous decor can include a guest book, ring pillow, signage, photos, and more.

Keep in mind that flower costs also include the labor involved with processing, production, supplies, delivery, and more.

Consider saving on some of these costs by renting decor or using fake flowers.

8. Videography

Percent of budget: 7%

Some couples choose to forgo videography, and some photographers also offer this service. However, if you’re considering hiring a separate videographer to memorialize your day, set aside about 7% of your budget for this.

9. Couples attire

Percent of budget: 7%

This includes your wedding dress and/or suit, shoes, and any accessories (like jewelry or cufflinks). You and your partner want to look and feel your best on your wedding day, so also budget for alterations you may need. The good news is there are a lot of wedding dresses and suits to choose from at a variety of price points, just be sure to be upfront about your budget when you start shopping to avoid falling in love with something you can’t afford.

10. Wedding planner

Percent of budget: 3%

Hiring a wedding planner is not a necessity, but there are a lot of advantages to doing so (including they can help save you money!) A wedding planner has a lot of connections in the wedding industry so they can help you find what you need within budget, keep things on schedule, ensure you have a smooth planning experience and help keep things as low stress as possible. They will help you from the time you start planning through your big day, so the cost will reflect that time and effort.

11. Event rentals

Percent of budget: 6%

Many rentals will be covered in your catering budget (such as plates, flatware, and glassware). Other rentals that may or may not be included with your catering company or venue include tables, chairs, and linens. If you’re hosting an outdoor wedding, you may need a tent. Or, you may need a heater if your wedding is during a cooler time of year. In some cases you may need to hire a separate rental company, but either way, you can expect to spend about 6% of your budget on these items.

12. DJ

Percent of budget: 5%

If you choose to hire a DJ for your entertainment (vs. a live band), about 5% of your budget should cover their services and fees. Remember that a DJ is more than someone who plays music. They will help keep the day on schedule, set the tone for your guests, and service as an emcee throughout the night.

13. Guest entertainment

Percent of budget: 4%

These expenses can be totally optional, but can just be an extra element to make the day more exciting for your guests. Examples include dancers or musical performers, photo booths, live painters, dancers, and more. Only include these items in your budget if they are important to you and you can afford it.

14. Transportation

Percent of budget: 3%

Many couples like to hire transportation to help their guests get to and from the venue at the right time and safely. This could be a bus or shuttle service to and from the hotels, a limo or bus for the wedding party, or a fancy getaway car for the couple after the reception. You may also choose to pay for parking for guests depending on where your wedding is.

15. Ceremony musicians

Percent of budget: 3%

Separate from a live band or DJ during your reception, you may want live musicians (such as a string ensemble, harpist, or guitarist) to set the tone for your ceremony. They may also be hired to play during cocktail hour. If you’re already hiring a DJ or live band for your reception, ask if their services will extend to the ceremony/cocktail hour. If not, consider allocating some of your budget to this expense.

16. Stationary

Percent of budget: 2-3%

How much you set aside for stationary can totally depend on your style and preferences. These typically include engagement announcements, save-the-date cards and formal invitation sets (including RSVP and additional details cards), stationery embellishments (like wax seals, vellum, belly bands, etc.) and can also cover ceremony programs, menus, thank you cards, and more. Don’t forget postage! But you can save on some of these costs by forgoing pieces like programs and escort cards, or by setting up a wedding website that will host RSVPs and other information.

17. Cake / dessert

Percent of budget: 2%

If this isn’t included with your catering, it’s something you’ll have to budget for separately. Whether you’re planning a traditional cake, cupcakes, or a spread of other sweets, after-dinner sweets you want to provide should be included with this part of the budget. Cake and dessert costs can vary depending on how elaborate and large you want them to be, so talk with different bakers to get a feel for what the cost will actually be.

18. Hair and makeup

Percent of budget: 1-2%

This should definitely include hair and makeup for yourself, but may also cover this cost for your bridesmaids and/or additional wedding party members. Hiring a professional for this task can help guarantee you (and your loved ones) will look amazing for your entire wedding day, both in person and in photos.

If you are paying for bridesmaids and other party members, you may have to allot a larger portion of your budget depending on how many extra members you have.

19. Wedding favors and gifts

Percent of budget: 1%

Many couples are foregoing the expense of wedding favors, but you may still want to set some budget aside for these and/or gifts for those who made your day special. These small gestures can go a long way, and how much you budget depends on what type of gift you choose.

20. Officiaint

Percent of budget: 1%

If you’re hiring an officiant to legally marry you during the ceremony, allocate about 1% to cover this. An officiant can play a key role in your ceremony and there’s a lot of prep work that goes into this, so be sure to ask about what the officiant’s costs actually include.

If you want to hire a wedding planner or coordinator, this will use about 5-15% of your budget depending on their services. Your honeymoon will likely account for around 5% of your budget.

Again, your budget may look different based on what expenses you plan to include or not. For example, you may not want favors for guests, and you plan to only use the bare minimum stationary. Perhaps you don’t want a videographer, so your photography budget can be less.

There are several steps you should take to build a wedding budget. You can also consider using a wedding budget calculator to help estimate your wedding costs.

Calculate your big day!

Don't just guess how much your big day will cost you! Get a clear picture with our wedding budget calculator.

Budget for your wedding: What you need to consider

When you first start planning a wedding, it can be overwhelming. Many brides and grooms don’t even know where to start planning, let alone how to build and stick to a budget. Here’s a list of the top things you need to consider when thinking about your finances.

1. The guest list size

This may seem obvious, but the larger the guest list, the more you’re going to have to budget. More guests means more rentals, food, and alcohol. It also means you may need a bigger venue and/or ceremony space. On the other hand, a smaller guest list will help you save on these big expenses. You’ll also save on other smaller details like decor, stationery, and favors because you won’t need as many.

2. The venue

One major factor that impacts your venue cost is where you live – some cities/towns are more expensive than others. Large cities, remote destinations, tourist destinations, and destination venues can all be more. Additionally, certain venues are more expensive. For example, a city or state park may have no or low fees, while a grand ballroom may cost you thousands of dollars.

Keep in mind that some venues have a headcount minimums, meaning they won’t host a wedding unless your guest list is a certain size. This can increase the cost.

Also know that some venues include more than others. For example, they may include some rentals like tables, chairs, and linens. They may come with a wedding planner or coordinator, decor, or be all-inclusive and include everything. Likely, the more your venue includes, the more expensive it will be. However, pricing all of these items out individually may actually make the all-inclusive venue costs worth it.

3. Date and time

Peak wedding seasons (May through October) and days of the week (like Saturdays and Sundays) are more expensive than others. An evening reception will likely be more expensive than a brunch or afternoon reception.

4. Your personal savings

Start by looking at your current savings, including what’s in your checking and savings accounts, investments, or another place you may have money. Decide what you can borrow from and what’s off limits. For example, while you may have money invested, you may decide keeping it in that investment is more important than using it for your wedding.

Outline what you can realistically put toward your wedding. For example, you may have $10,000 in savings, but it may not be smart to use all $10,000 just in case an emergency or unexpected expense happens.

When doing this, make sure you leave enough for your emergency fund. This should have enough to cover at least six months’ worth of expenses should something unexpected happen.

5. Upcoming expenses or investments

Oftentimes when you’re getting married, there are other life events happening (or going to happen) too. These can include things like buying a new house or car, taking a vacation, starting a family, and others. Weigh the importance of being able to afford these against having a more expensive wedding.

You also can’t forget about your current expenses such as rent/mortgage, car payments, loan payments, groceries, utilities, and others. It’s important to have enough savings to continue to pay for those; otherwise, you could face falling into debt.

Working all these current and future expenses or investments into your budget considerations will help ensure you have a more realistic wedding budget.

FAQs

In 2021, the average cost of a wedding was $28,000, but a realistic budget will be different for everyone based on their preferences and specific wedding factors. Some experts say this average is inflated, so it should be treated as a benchmark, not an expectation.

The top three costs for a wedding will likely be the ceremony and reception venue, catering and bar/alcohol costs, and the wedding dress (plus alterations and accessories.)

Weddings are expensive because of the time, thought, skill, and artistry that goes into the different aspects of the wedding. They are on a much larger scale than a regular “party” when factoring in the venue, food, drinks, and rentals. Weddings are also time-consuming, both for the soon-to-be-wed couple and the vendors. For example, your photographer may put many hours into editing and sorting your photos, plus the time to take the photos. Additionally, vendors and suppliers know what they are doing and you’re paying for their expertise.

Many couples pay for a wedding with funds they’ve saved over time. They also set budgets and cut costs in everyday spending. Some couples use credit cards to pay for some expenses. Others are given money by parents or family members. Another option is to take out a wedding loan, which can be used to pay for most wedding expenses.

Most people will spend the average ($6,000) or less on wedding rings. However, the maximum you can spend depends. If you’re using a personal loan for financing, you’ll be approved for a loan of a certain amount and that’s the amount you can spend on the ring. If you’re using savings, you can spend as much as you have without compromising your ability to make other debt or monthly payments.

Related: Engagement Ring Loans

When it comes to wedding planning, the budget is one of the most important factors in determining what the engaged couple can afford, including the type of wedding they have, number of guests they can invite, things they can do, catering, music, and other factors. Generally, how much you need to budget for your wedding depends on your personal preferences. The average wedding budget sits between $20,000 and $40,000, but according to The Knot Real Weddings Study, most weddings cost around $28,000.