Expert CFA: Surge in Delinquency Rates Signal Economic Concerns

About Thomas J.

Thomas J. Brock, CFA, CPA, is a well-rounded financial professional, with over 20 years of experience in investments, corporate finance, and accounting. His investment experience includes oversight of a $4 billion portfolio for an insurance group. Varied finance and accounting work includes credit analyses, the development of multiyear financial forecasts, and the evaluation of capital budgeting proposals and investment opportunities. Beyond the corporate setting, he assists individuals and small businesses with accounting, financial planning, and investing matters; lends his financial expertise to a few well-known websites; and tutors students via a virtual forum.

At a Glance

- Thomas Brock, CFA, CPA, with over 20 years of experience, provides us with a concerning analysis looking at the increase in delinquency rates related to consumer debts, particularly credit card obligations and auto loans.

- American household debt is at an all-time high, and delinquency rates on credit card debt and auto loans are soaring.

- The situation is largely attributable to persistent inflationary pressure and rising interest rates.

- The challenges are impacting everyone, but young people are struggling the most, given their relatively limited income-generating potential and heightened reliance on debt to meet day-to-day spending needs.

- To dig yourself out of a debt pit, you must establish a prudent budget and stick to it. You should also employ a debt payoff strategy that aligns with your financial situation and behavioral tendencies.

Throughout 2023, there has been a concerning increase in delinquency rates associated with consumer debts, particularly, credit card obligations and auto loans. The trend actually began in 2021, as many Americans started incurring heavier debt loads to meet spending needs in the face of surging inflation. It was subsequently exacerbated by the Federal Reserve’s aggressive rate-hiking campaign to combat price pressure.

Now, we face a troubling economic situation – an all-time high level of household debt and surging delinquency rates. This article is designed to give you context on things, offer some forward-looking considerations and provide practical advice on how to navigate this challenging environment.

Delinquency rates on consumer debts are soaring

According to the Federal Reserve Bank of New York, total U.S. household debt swelled to an all-time high $17.3 trillion as of September 30, 2023, and includes $1.1 trillion of credit card debt and $1.6 trillion of auto loans. The accumulation of debt is reflective of strong nominal spending and real gross domestic product growth over the past two years, which suggests mounting loan obligations are simply a byproduct of economic prosperity.

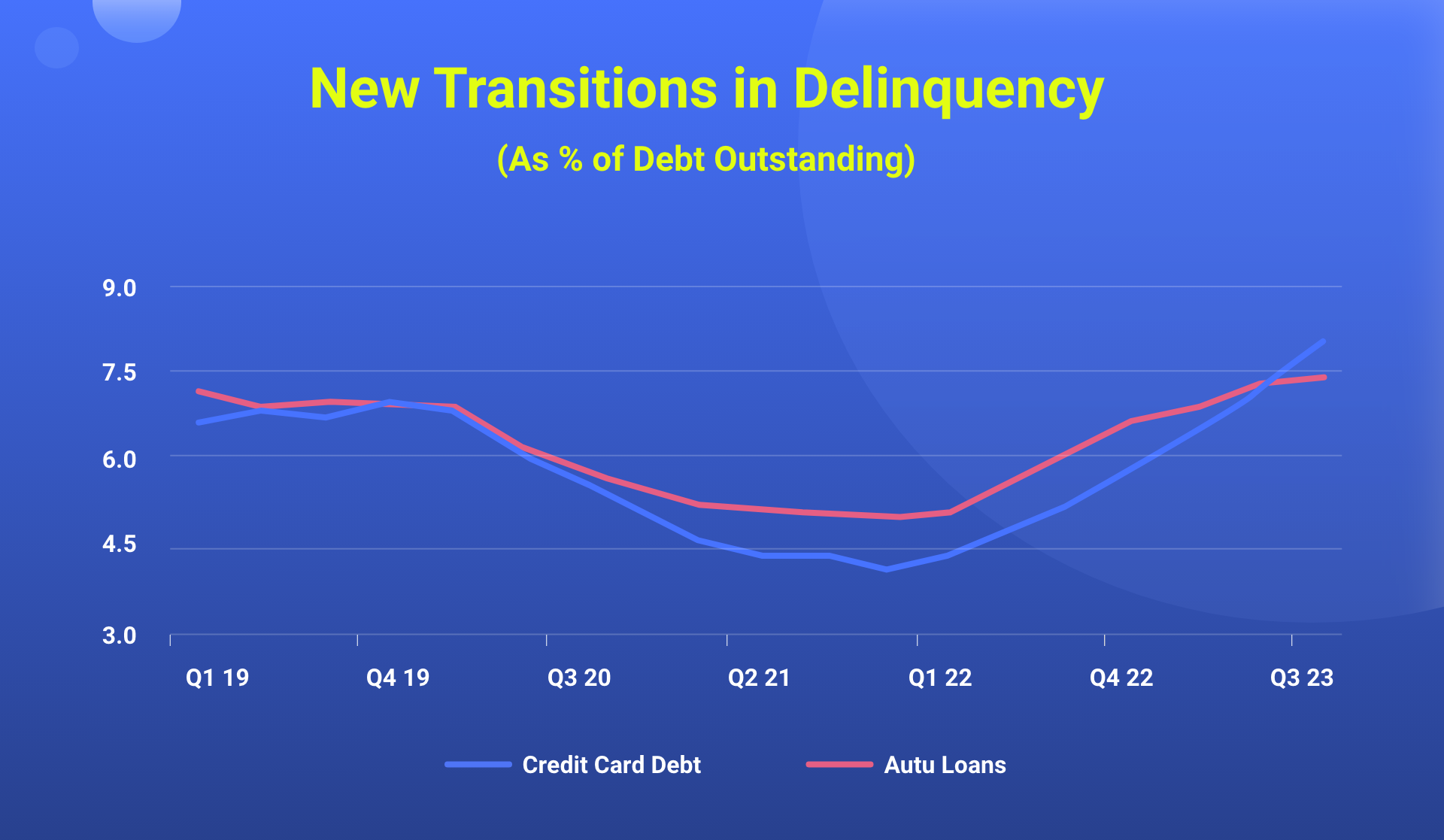

Unfortunately, credit card debt and auto loan delinquencies have risen dramatically from the historic lows of 2021 and have now surpassed pre-pandemic levels. As illustrated below, the seasonally-adjusted increase in new auto loan delinquencies appears to have begun to moderate, but new credit card delinquencies are still climbing sharply.

Source: New York Fed Consumer Credit Panel/Equifax

Clearly, consumers have been experiencing an increasing degree of financial distress. Now, financial institutions are beginning to struggle with the dilemma. From a macroeconomic standpoint, economic instability is growing and the possibility of a recession is increasing. This trend warrants attention.

What Is driving the increase in delinquency rates?

Delinquency rates for all types of loans reached historic lows during 2021, largely due to large massive fiscal transfers, reduced consumption opportunities and broad-based forbearance associated with the COVID-19 pandemic. Since then, delinquency rates have snapped back, with an especially pronounced spike for credit card debt and auto loans.

On the surface, this development seems inevitable, given the suppressive forces outlined above. However, we seem to be experiencing more than a mere reversion to the mean.

The increase in delinquency rates stems from the extreme, post-pandemic inflation that pushed prices for key goods and services to unaffordable levels for many, causing debt balances to balloon. Then, the Federal Reserve’s hawkish endeavor to combat inflation with aggressive rate hikes compounded the problem.

Now, borrowers with diminished ability to service their debts are exhibiting serious financial strain. This has pushed the economy into a precarious position. It is too early to proclaim a recession is imminent, but the probability of a downturn is certainly higher than it was earlier this year.

Younger Americans exhibit the highest delinquency rates

The debt challenges described above impact Americans of all ages, but younger people are struggling the most. Young adults have less income-generating potential than older demographics, and surging inflation has forced many of them to assume unsustainable levels of high-interest credit card debt and auto loans to remain afloat. Those saddled with significant student loan debt face nearly insurmountable financial burdens.

According to the Federal Reserve Bank of New York, new credit card and auto loan delinquencies have reverted to pre-pandemic levels for all age groups, but Generation Z (born between 1995 and 2011) and Millennial (born between 1980 and 1994) borrowers are exhibiting notable signs of distress. For these groups, new transitions into serious credit card delinquency (90+ days overdue) reached 9.3% and 8.2%, respectively, for the quarter ended September 30, 2023, while new transitions into serious auto loan delinquency reached 4.7% and 3.5%, respectively.

Where could delinquency rates go from here?

Forecasting the trajectory of delinquency rates is difficult, given the myriad of interdependent factors underpinning the measure. Holistically, weakening economic conditions will send delinquency rates higher, while strengthening conditions will send rates lower.

Ultimately, for delinquency rates to decline, inflation needs to continue to be moderate, the Federal Reserve needs to cease its rate-hiking campaign (and, possibly, reverse course) and the economy needs to remain resilient. Additionally, distressed borrowers must take proactive measures to improve their situation.

What should borrowers do to improve their situation?

Mounting debt levels and rising delinquency rates are signs of financial distress and indicate an economic recession could be looming. If you have a substantial amount of debt, it is time to do everything you can to improve your financial position.

Striving to eliminate high-cost debt should be your priority. To accomplish this, you must implement a prudent budget, which is a granular financial tool that helps ensure your monthly cash inflows exceed your outflows.

Implementation entails identifying all sources of income and categories of spend, establishing forward-looking monthly estimates for each line item and making refinements to ensure a healthy cash surplus. Then, you need to diligently track and evaluate actual vs. budget deviations to manage spending behavior and optimize your debt paydown and savings potential.

At this stage, there are three popular debt payoff strategies you should explore – the debt avalanche method, the debt snowball method and debt consolidation. Each has pros and cons. The optimal strategy depends on your unique financial situation, behavioral tendencies and priorities. If necessary, a fiduciary financial advisor can help you make sense of things.

FAQs

A delinquency rate is the percentage of a financial institution’s debt that is overdue. It is indicative of the credit quality of the underlying pool of borrowers. Oftentimes, this information is aggregated to express information for a geographical region or entire nation.

A delinquency occurs when a payment is not made by the specified due date. A default occurs when a payment is not made within a contractually specified number of days, such as 90, 120 or 270.

According[TB1] to the U.S. Bureau of Labor Statistics, the rate of inflation, as measured by the Consumer Price Index (CPI), is 3.1% for the twelve-month period ended October 31, 2023.

Sources

- Corporate Finance Institute. (n.d.). Delinquency Rate

- Federal Reserve Bank of New York. (2023, November). Household Debt and Credit Report

- Federal Reserve Bank of New York. (2023, November 7). Liberty Street Economics

- U[TB2] .S. Bureau of Labor Statistics. (2023, November 14). Consumer Price Index

- [TB1]Please update this to reflect the November 30, 2023, reading, which is scheduled to be released on December 12, 2023.

- [TB2]Please update this to reflect the November 30, 2023, reading, which is scheduled to be released on December 12, 2023.