SURVEY: Millennials & Men Are Most Likely to Be Overconfident About Their Tax Expertise

About Casey

Casey is a reformed sports journalist tackling a new game of financial services writing. Mike Francesa once called her a “great girl.”

Read full bio

You remember that one (or multiple) guy(s) from high school who knew everything about everything? Or at least said he did?

Well, if you don’t, you’re probably that guy. (Looking at you, Chad.)

There are plenty of self-purported experts out there, and as the new Tax Day approaches (mark your calendar for May 17), you’re bound to run into someone who knows how to game the system. Of course, they’re the same person who’s probably being audited by the IRS.

So, who really knows a lot about taxes, and who’s just running their mouths (or posting their hot takes on Reddit)?

Credello surveyed 1,000 Americans ages 18 to 56 to learn more about taxes, including testing respondents’ knowledge, understanding their difficulties, determining what influences them, and seeing what their preferred approach to filing is.

Key takeaways on taxes

- Millennials overestimate their tax knowledge more than other generations

- Women seem to know more than men about taxes (even though men think they know more)

- The biggest tax myth centers around how marginal tax rates work

- Many people spend at least $100 to file their taxes

- Family members are the biggest tax influence for more than a third of people

- Nearly a third of respondents said their biggest fear when filing taxes is finding out they owe money

- Paying down debt is the most popular use of tax refunds

You think you know (taxes), but you have no idea

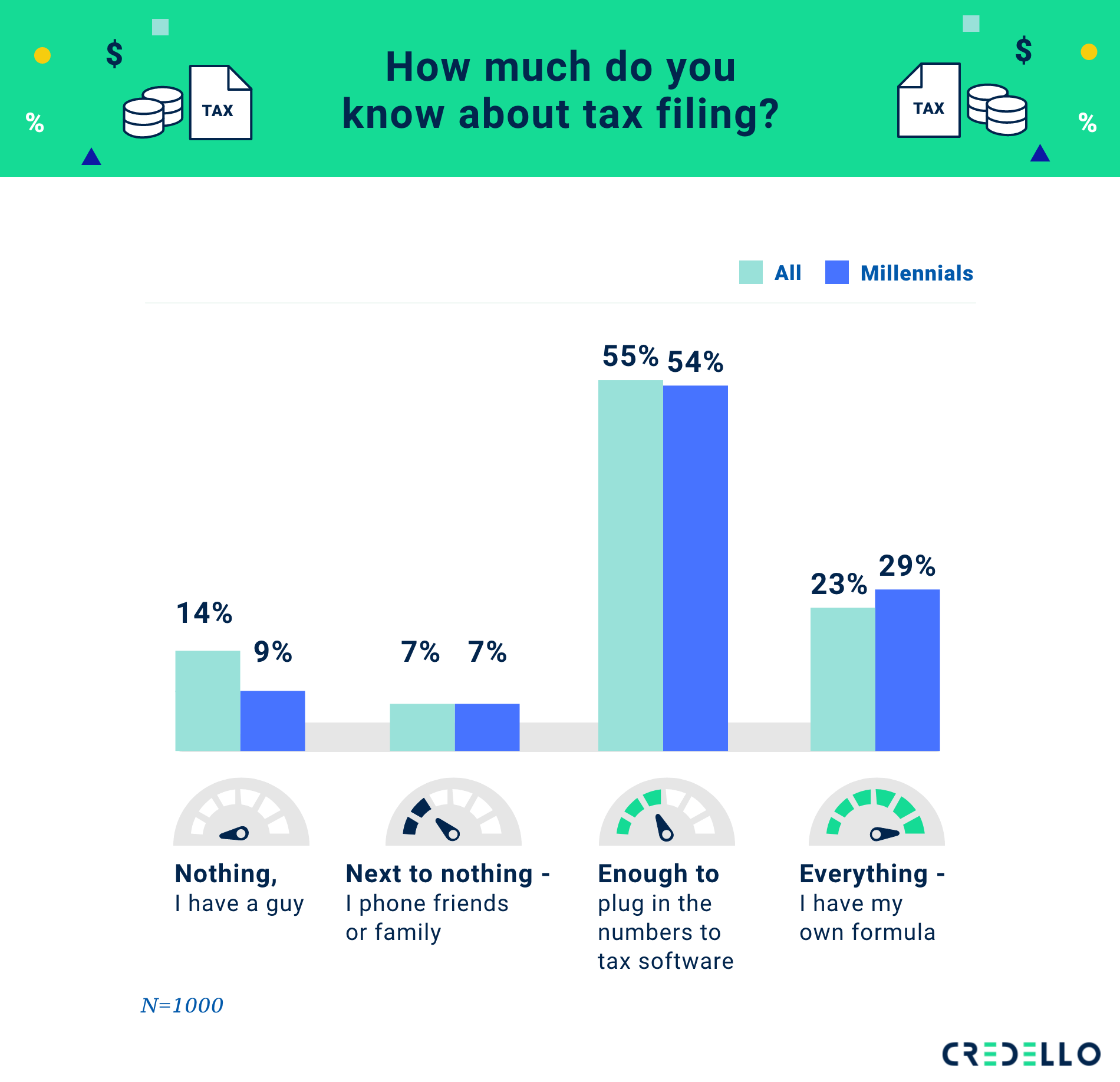

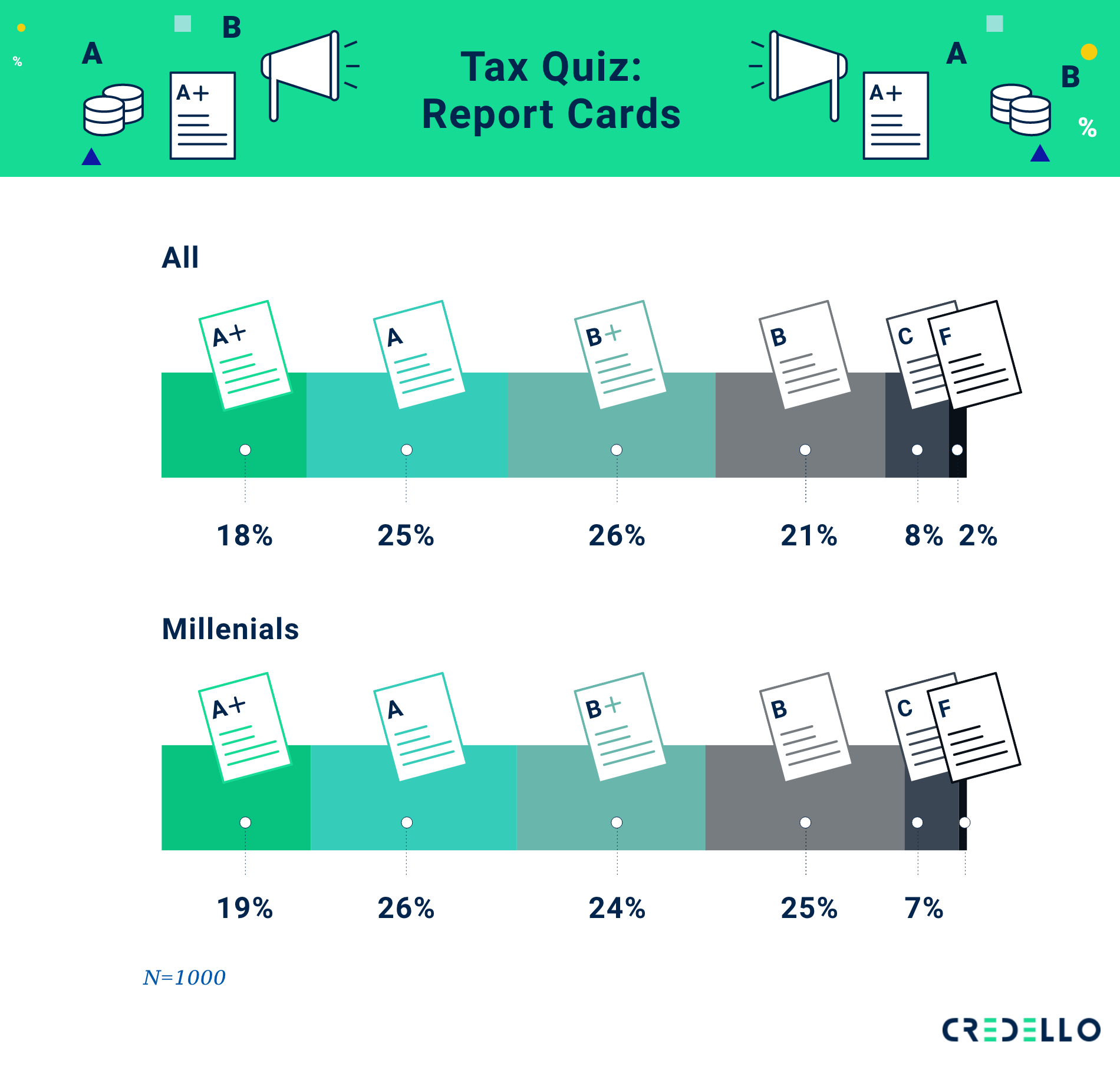

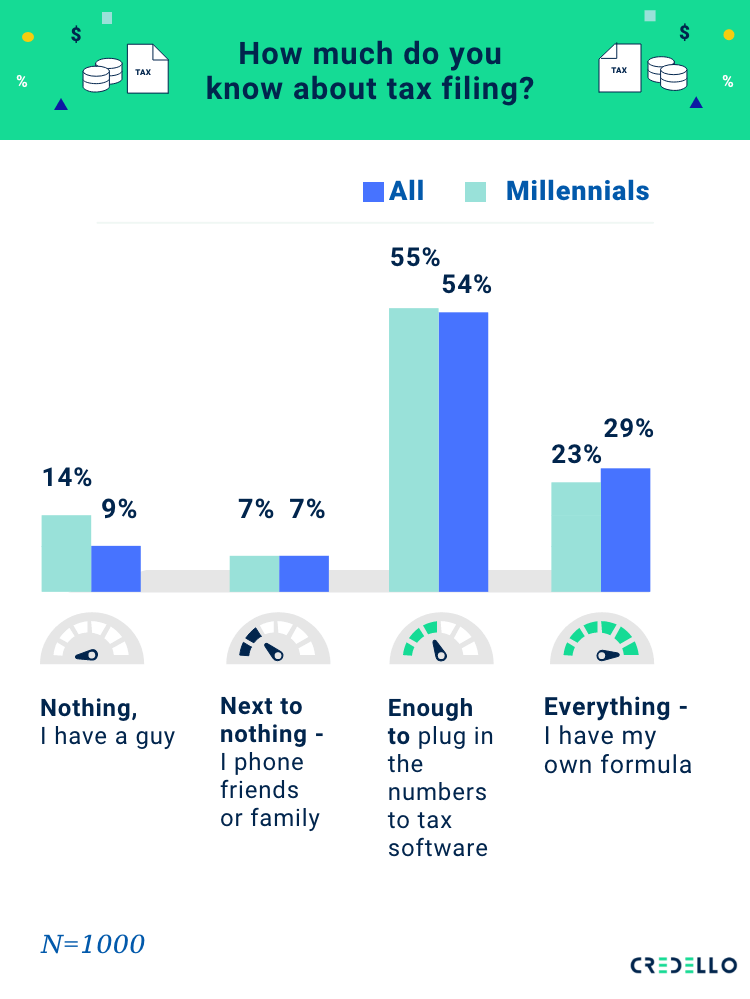

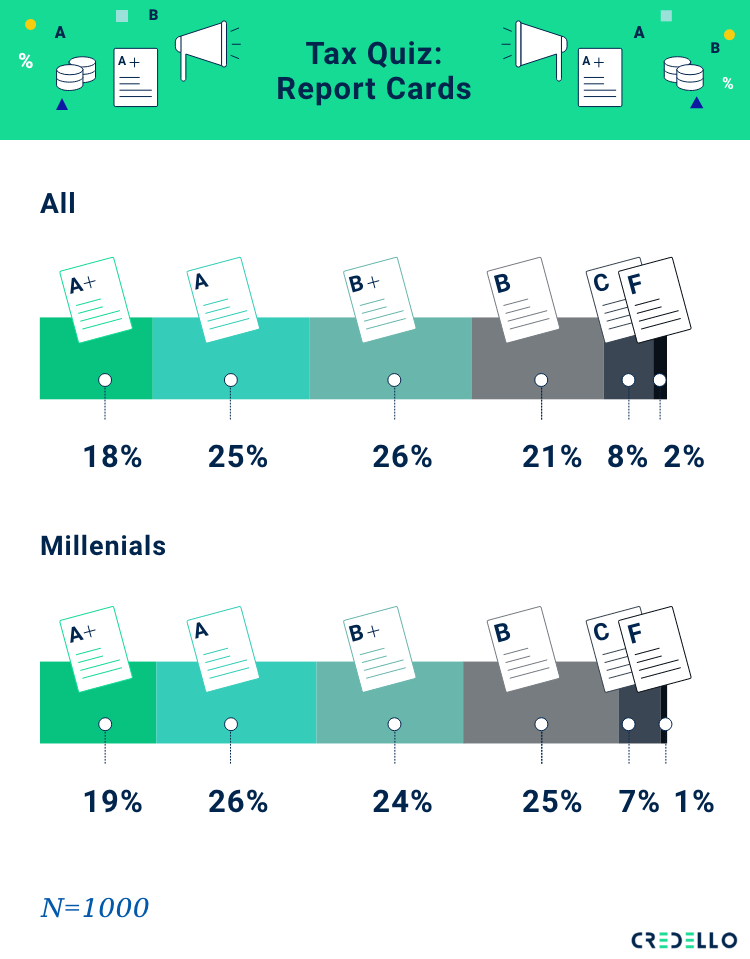

Many respondents claimed to know more about taxes than they actually do. Millennials were particularly overconfident as 83% of Gen Yers surveyed said they know enough or everything about taxes, but about a third of respondents scored a B or lower on a relatively simple tax literacy quiz.

This know-it-all mentality despite lack of actual knowledge has some scientific backing. The Dunning-Kruger effect is a cognitive bias that people with a lower skill level overestimate their ability, thinking they’re smarter or more capable than they really are. In other words, these dummies are too dumb to identify their own incompetence. And on the flip side, their higher-skilled counterparts tend to underestimate their ability.

About 68% of respondents said they claim the standard deduction on their tax returns, while only about 21% said they itemize their deductions. While millennials were the most confident in their tax knowledge, only about 1 in 5 millennials use itemized deductions.

The standard deduction is part of your income that’s not subject to tax. It’s a flat rate that varies based on factors like your income, age, and filing status. The amount changes from year to year, and the Interactive Tax Assistant (ITA) tool from the IRS can help you figure out the amount of your standard deduction.

Certain taxpayers aren’t allowed to use the standard deduction, including a married person filing as married but separately from their spouse who itemizes deductions. Itemized deductions allow you to potentially decrease your taxable income, but the savings will depend on the tax bracket you fall under.

Men vs. women: Who knows more about taxes?

“We’re the weaker sex. Men don’t live as long as women. We get more heart attacks, more strokes, more prostate trouble.” — Freddy Benson, Dirty Rotten Scoundrels (1988)

Dale Launer, Stanley Shapiro, and Paul Henning were ahead of their time when they wrote that line. And I’m not going to argue with them.

In the tax battle of the sexes, it seems men are indeed less knowledgeable than women.

Almost half of women surveyed got an A or A+ on the tax literacy quiz while only about 35% of men scored that high. About 16% of men said they didn’t know what a deduction was compared with just 5% of women.

Women also seemed savvier in figuring out how to file taxes for the least amount of money. About 46% of women said they spend less than $100 to file their taxes, about 14% of whom said they don’t spend anything. Only about 28% of men said they spend less than $100.

Anecdotally, men tend to be lazier than women (see: The Dude in The Big Lebowski and The Guy on the Couch in Half Baked ). But also, several studies have shown that in heterosexual couples, women put in more hours of housework than men, regardless of who the “breadwinner” is.

Nearly 40% of men said their top decider of how they file their taxes was ease/simplicity, while many women—roughly 38%—said getting it right was their top decider. Of course, with women putting in more hours of housework and likely taking the brunt of childcare duties (for those with kids), ease/simplicity is important to them, too. About a third of women said ease/simplicity was the biggest factor for them.

Generationally, the Dunning-Kruger effect seemed most prevalent among millennials, which surely would bring joy to many millennial-hating pundits. But how’d it play out among men and women?

About 27% of men claimed to know everything about taxes, despite their lower performance on the tax literacy quiz, compared with about 20% of women.

This checks out with the origination of the Dunning-Kruger effect. Named for Cornell University psychologist David Dunning and his colleague Justin Kruger, the Dunning-Kruger effect was dubbed after the two performed a study in 2003 that focused on women’s confidence in their own ability as scientists. In this study, and others, the data showed that men overestimated both their abilities and performance, while women underestimated their abilities and performance, despite similar performances by both genders.

Sounds about right.

Tax myth-busting

Paying taxes isn’t as exciting as “Tax Man Max” from Schoolhouse Rock! made it out to be. And while that tune isn’t exactly a full-blown explainer, it’s a decent introduction for kids.

But by some of the answers to our tax literacy survey, it seems like that’s maybe the only tax lesson some of y’all ever got.

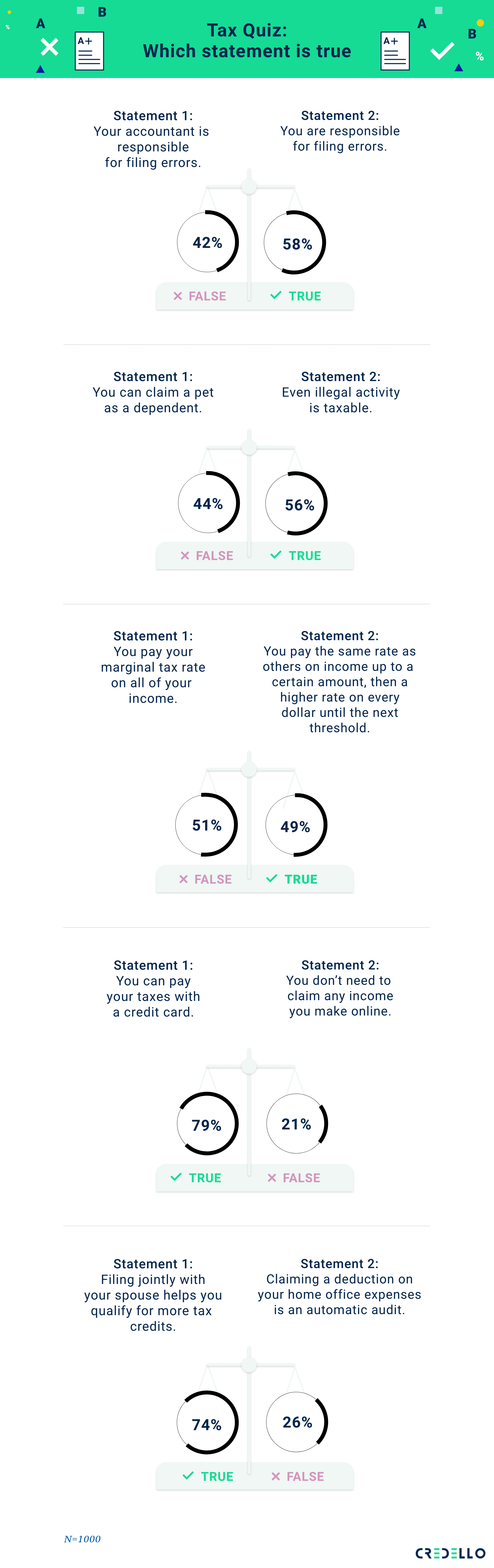

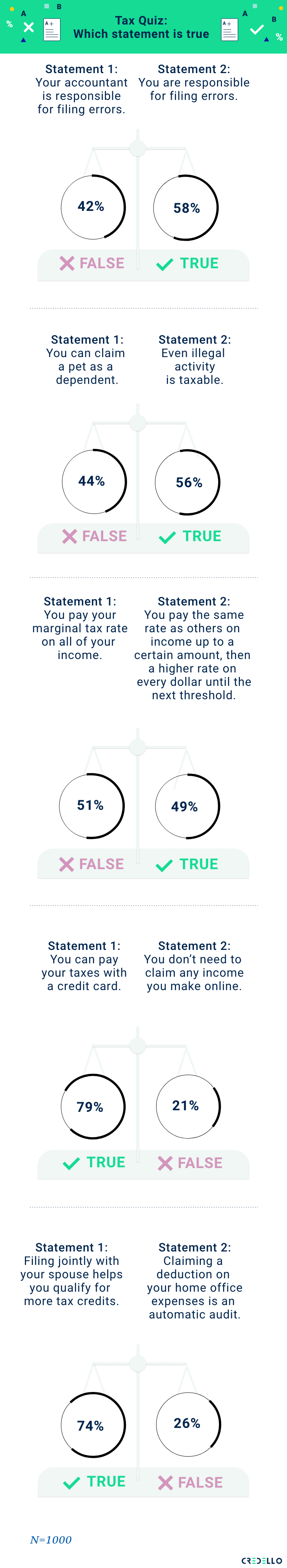

Forty-four percent of respondents thought they could claim a pet as a dependent, including a majority of men and Gen Z. Maybe that’s just wish(bone)ful thinking. We know they’re your fur babies, but no, they don’t equate to an actual human child. Dependents can include a qualifying child or relative, but not dogs, cats, ferrets, turtles, bunnies, and the like.

Almost 26% of respondents thought claiming a deduction on home office expenses would result in an automatic audit. Unless you’re running Donald Trump’s home office, you should be good. Common mistakes that result in getting audited include entering your Social Security number incorrectly, spelling your name wrong, and similar clerical errors. So, try not to be overconfident in your typing ability—make sure you double-check your work.

Perhaps the trickiest question related to the marginal tax rate system. The marginal tax rate, also known as progressive taxation, taxes lower-income earners at a lower rate than higher-income earners. The marginal tax rate is the amount you’re taxed on your last dollar earned. But your effective tax rate is the actual percentage of taxes you pay on your entire income. It’s confusing, right?

That applies to individuals. Don’t get us started on corporate taxes.

About 51% of respondents incorrectly thought you pay your marginal tax rate on your entire income. In reality, if you’re a single person making $52,000 a year, you’d fall into the 22% marginal tax rate bracket ($40,126 to $85,525). But you’d only be taxed at 22% on $11,874 of your income—i.e., the money you make above the $40,126 threshold. The rest of your income would be taxed at the lower marginal rate, which is 12%.

In other words, you pay the same rate as others on income up to a certain amount, then pay a higher amount on every dollar until the next threshold. Congrats to the 49% of smarty-pants who got that one right.

How much does it cost to file your taxes?

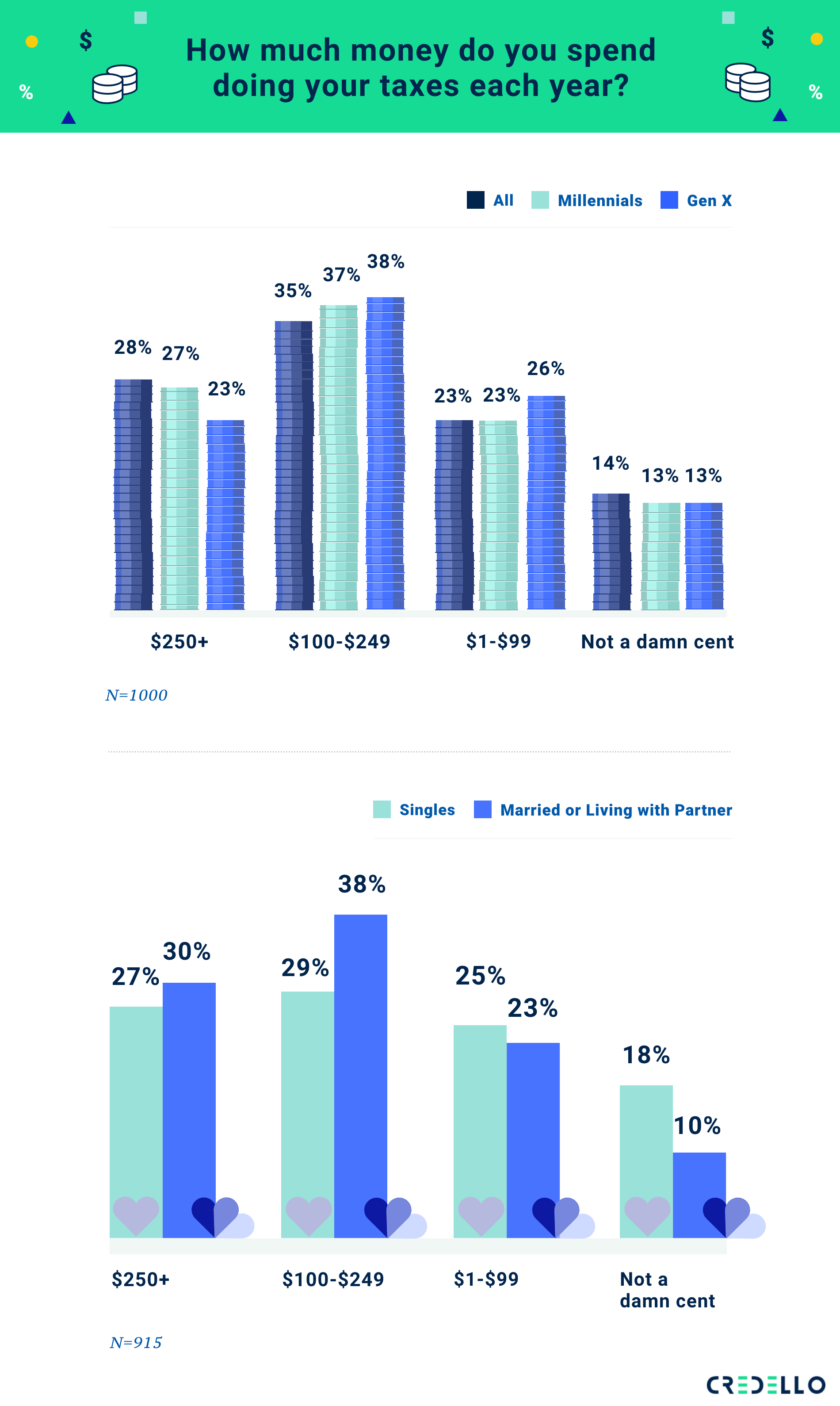

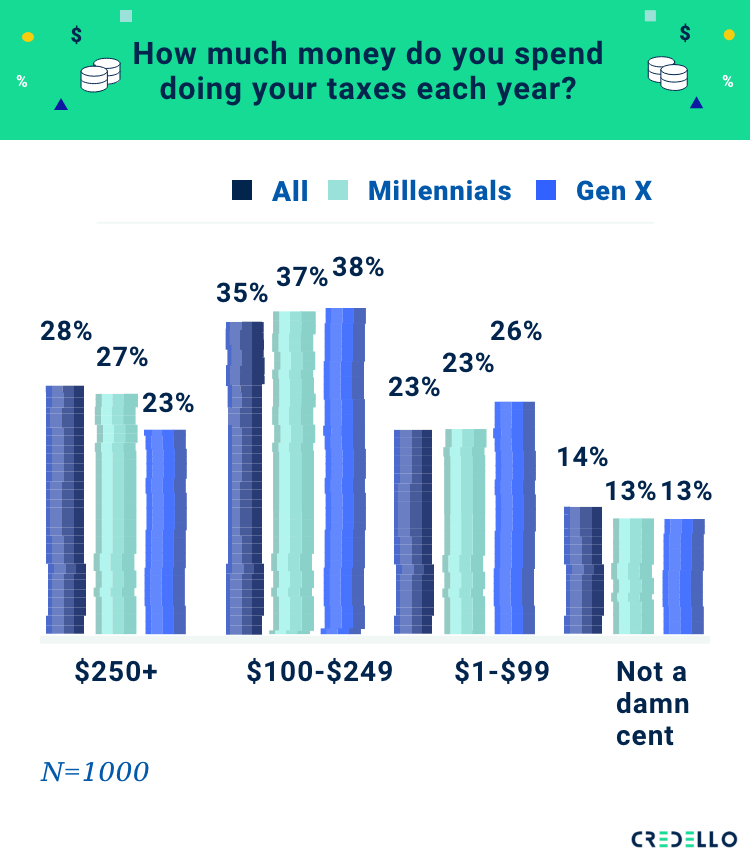

We already know women are better at saving money on filing their taxes than men are. But how much are most people spending to file their taxes?

The IRS allows people making $72,000 or less—which accounts for 70% of Americans—to file for free using the Free File form an IRS partner site.

But if you’re getting help with tax preparation, it can cost you a pretty penny. Getting tax prep for itemized personal deductions for a federal and state income tax return is a flat fee of nearly $300, according to the National Society of Accountants. If you’re taking the standard deduction, it costs an average of almost $200.

About 35% of survey respondents said they spend between $100 and $249 to file their taxes. About 28% of respondents said they spend more than $250.

Married folks or those living with a partner tend to spend more than single folks, with about 68% of these couples saying they spend $100 or more to file. About 56% of single people said they spent that much to file.

When you file can also theoretically affect how much you spend. Earlier on, you may be able to find deals from different tax filing software, but when it gets closer to Tax Day, you’ll probably have to pay full price. Early bird gets the worm, right?

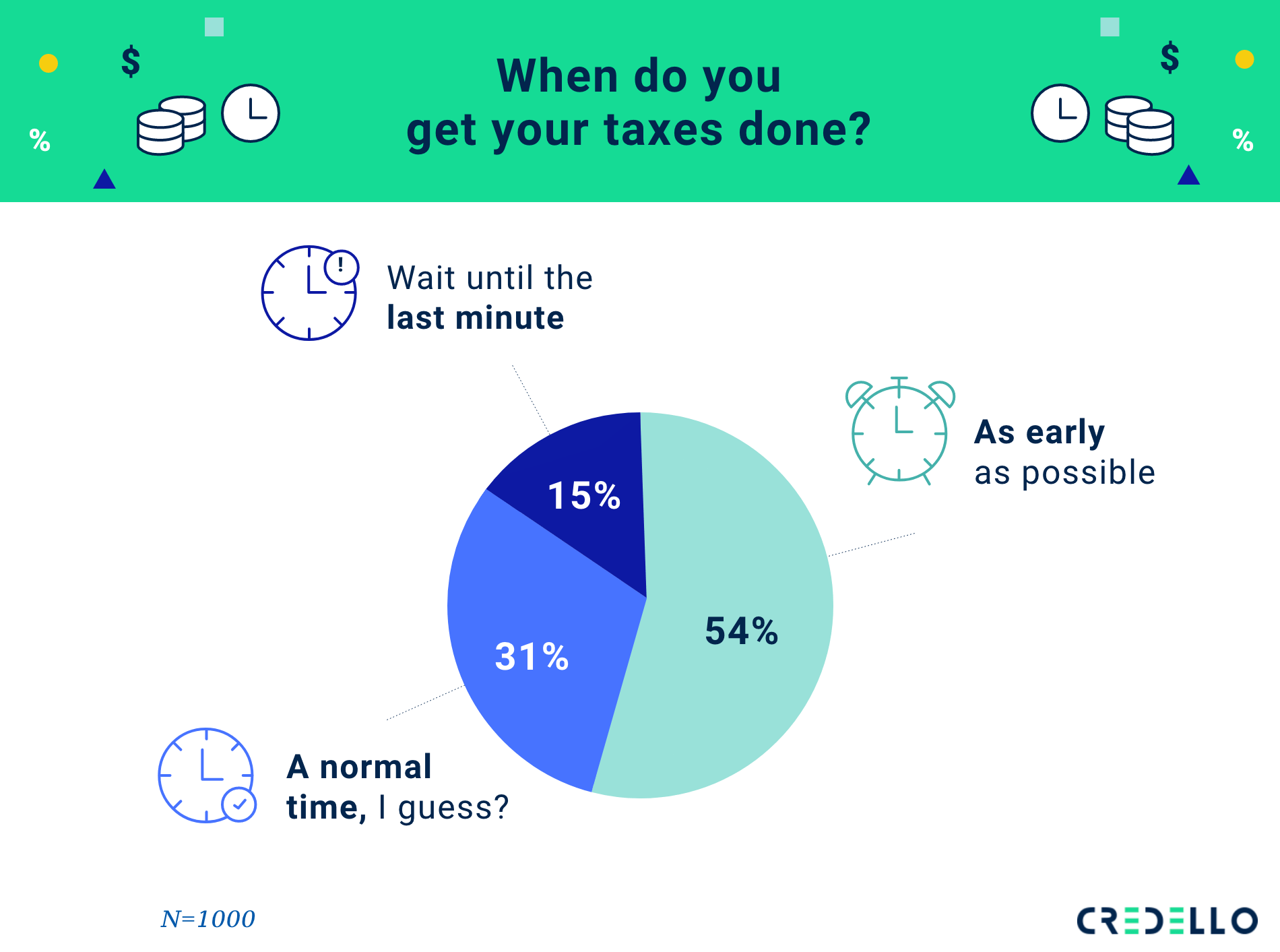

About 54% of survey respondents said they file their taxes as early as possible, while roughly 15% said they wait until the last minute. Friendly reminder: the deadline to file your 2020 taxes was extended to May 17, so make sure you get that done, procrastinators.

The influencers become the influencees

You might not agree with your parents on a range of things (i.e., politics, what to watch on TV), but their fiscally conservative mentality might be your best resource when it comes to filing your taxes.

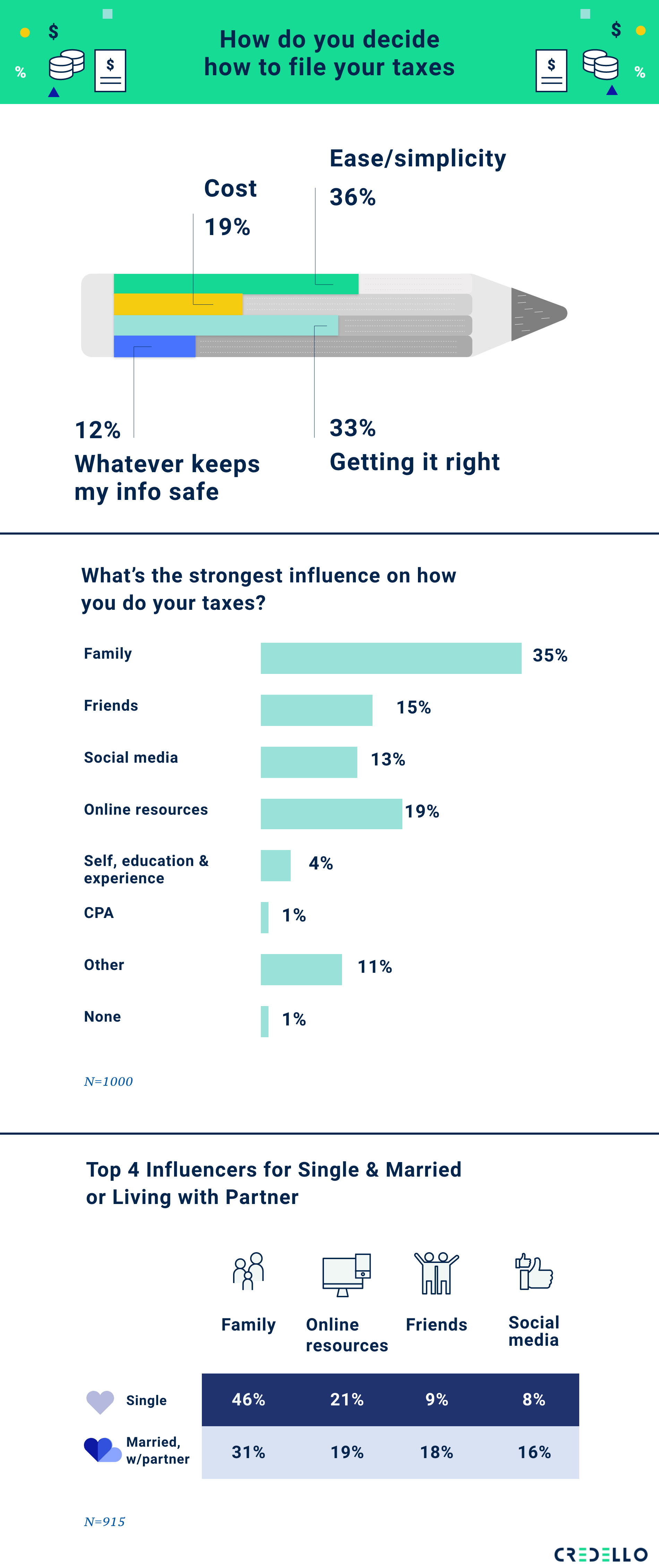

Family members are the biggest influence on how 35% of people file their taxes. Online resources and tax software (19%) and friends (15%) were the next-biggest influences.

Single people relied on their families at a higher clip, with about 46% of single people saying their strongest influence was their families, compared with about 31% of married people.

Most people ultimately decided on how they went about filing their taxes based on ease/simplicity (about 36%) or getting it right (about 33%).

Your biggest tax fears and questions

As Benjamin Franklin once said: “In this world, nothing can be said to be certain, except death and taxes.” And filing your taxes might even be scarier than death.

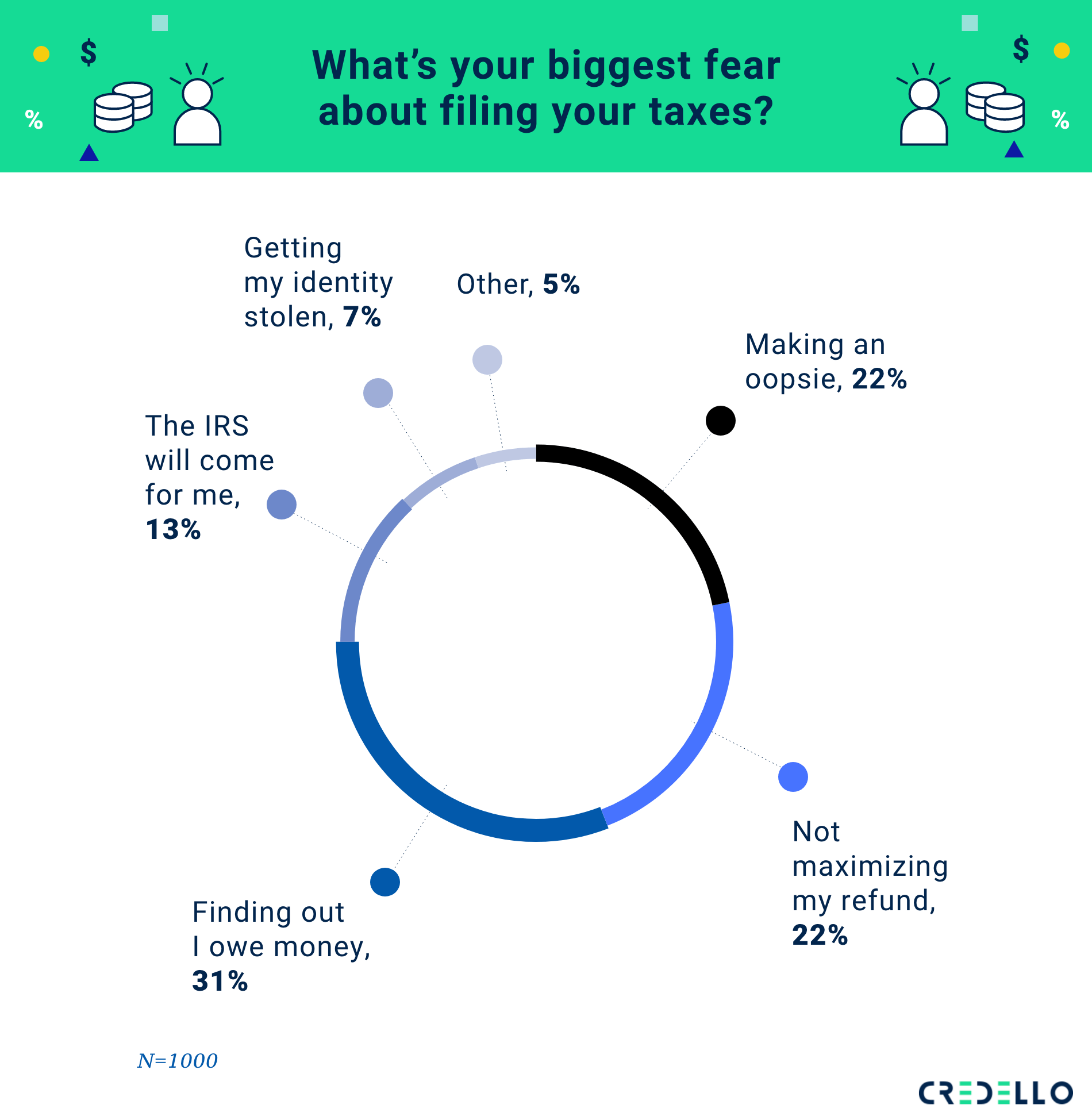

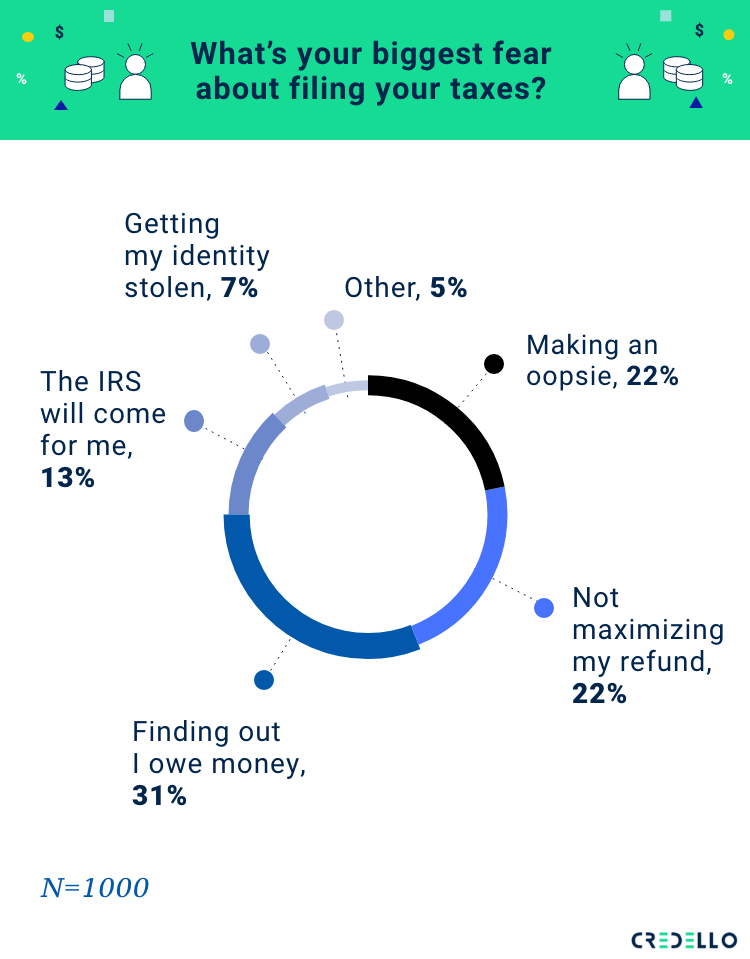

Nearly a third of respondents said their biggest fear about filing their taxes was finding out that they owe money. About 22% of people were most concerned about making a mistake, while about 13% of people were most worried about the IRS coming after them. About 22% of people said their biggest fear was not maximizing their refund.

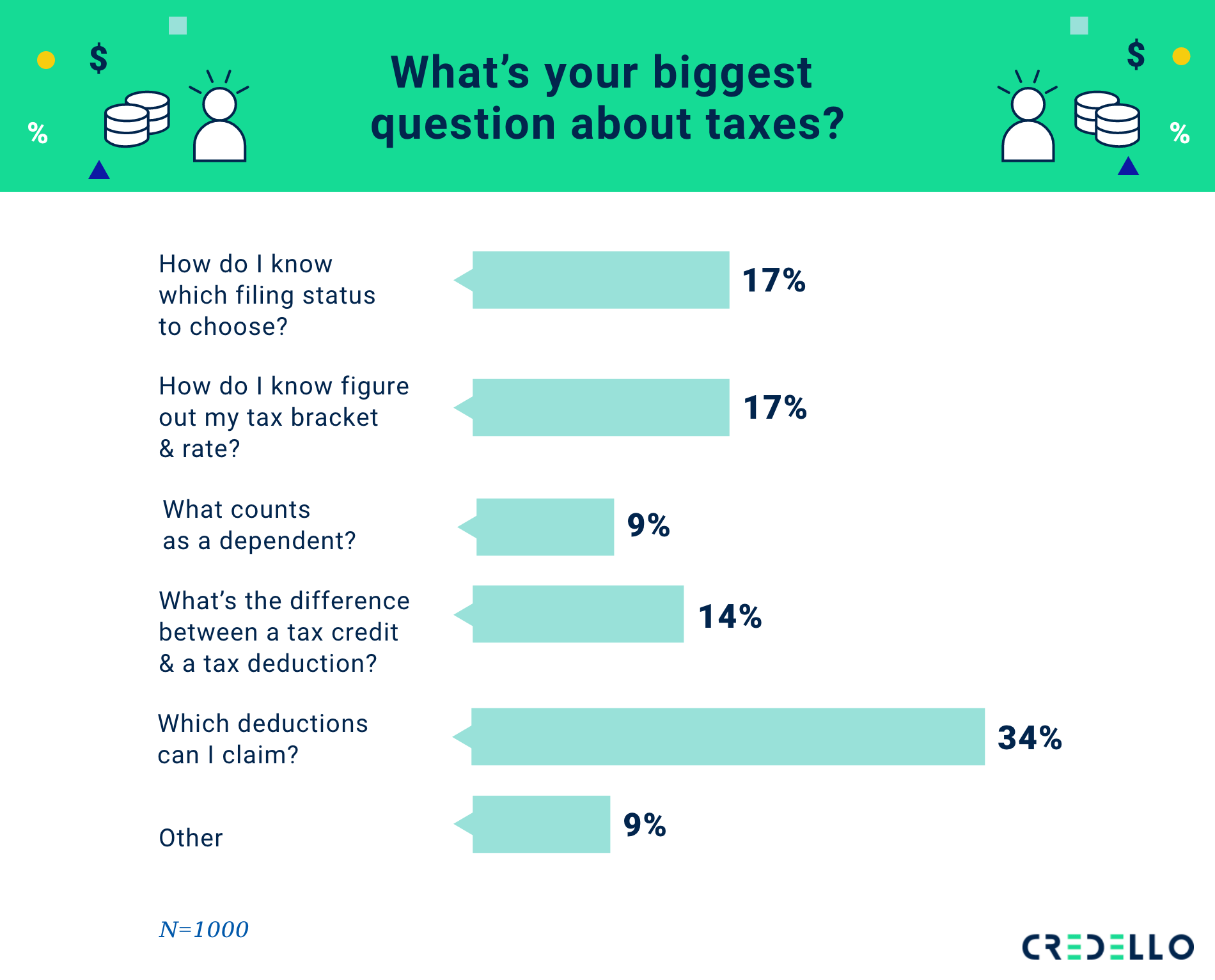

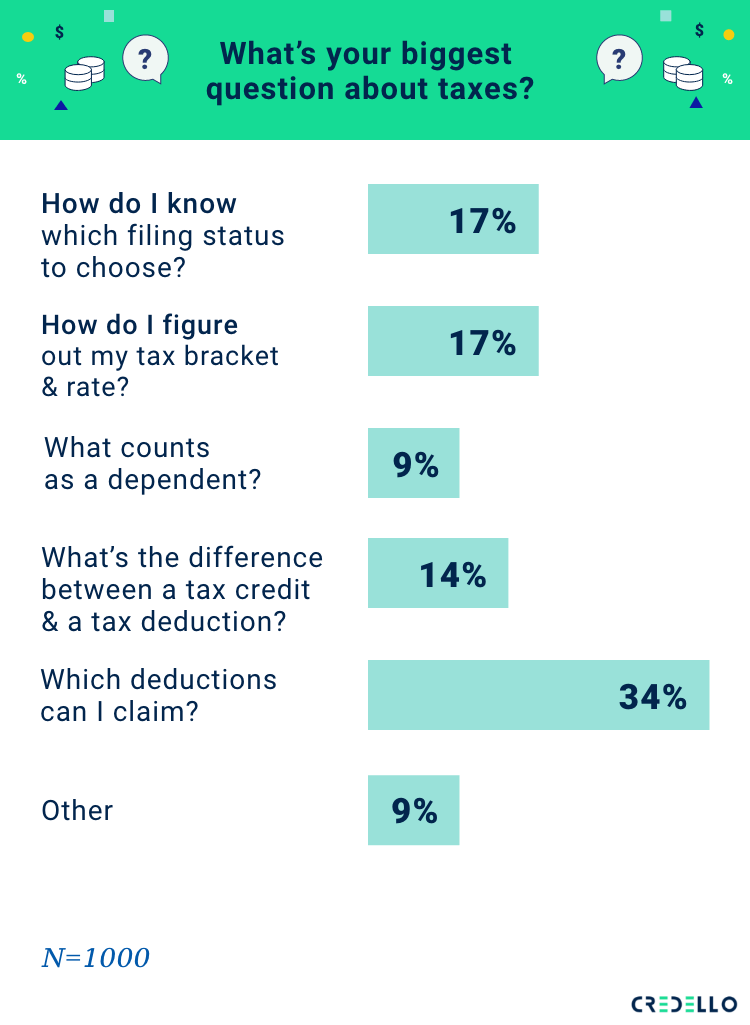

More than one-third of respondents said their biggest question about filing their taxes is what deductions they can claim. About 17% each said their biggest question was around figuring out what their tax bracket and rate are or which filing status to choose.

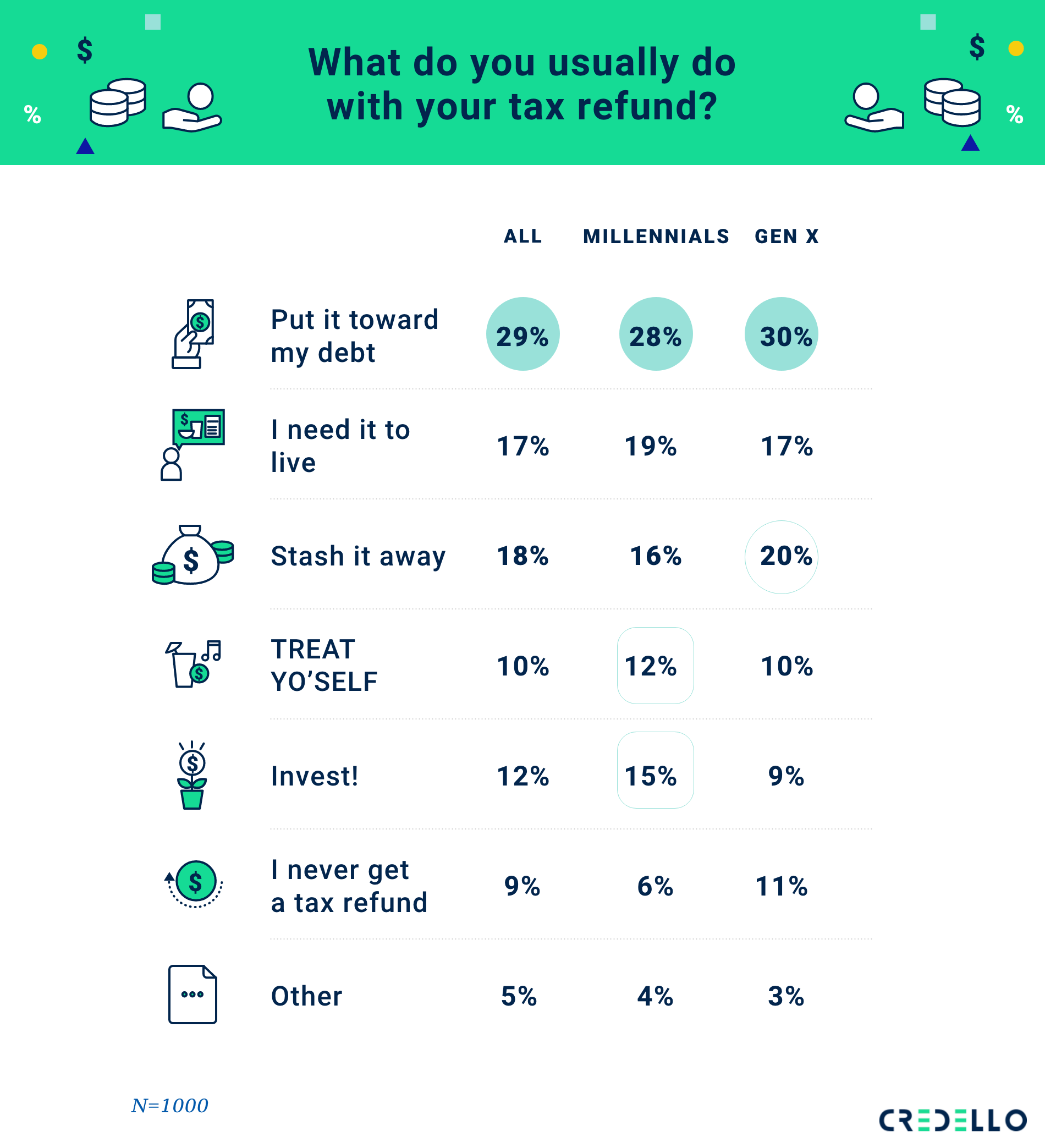

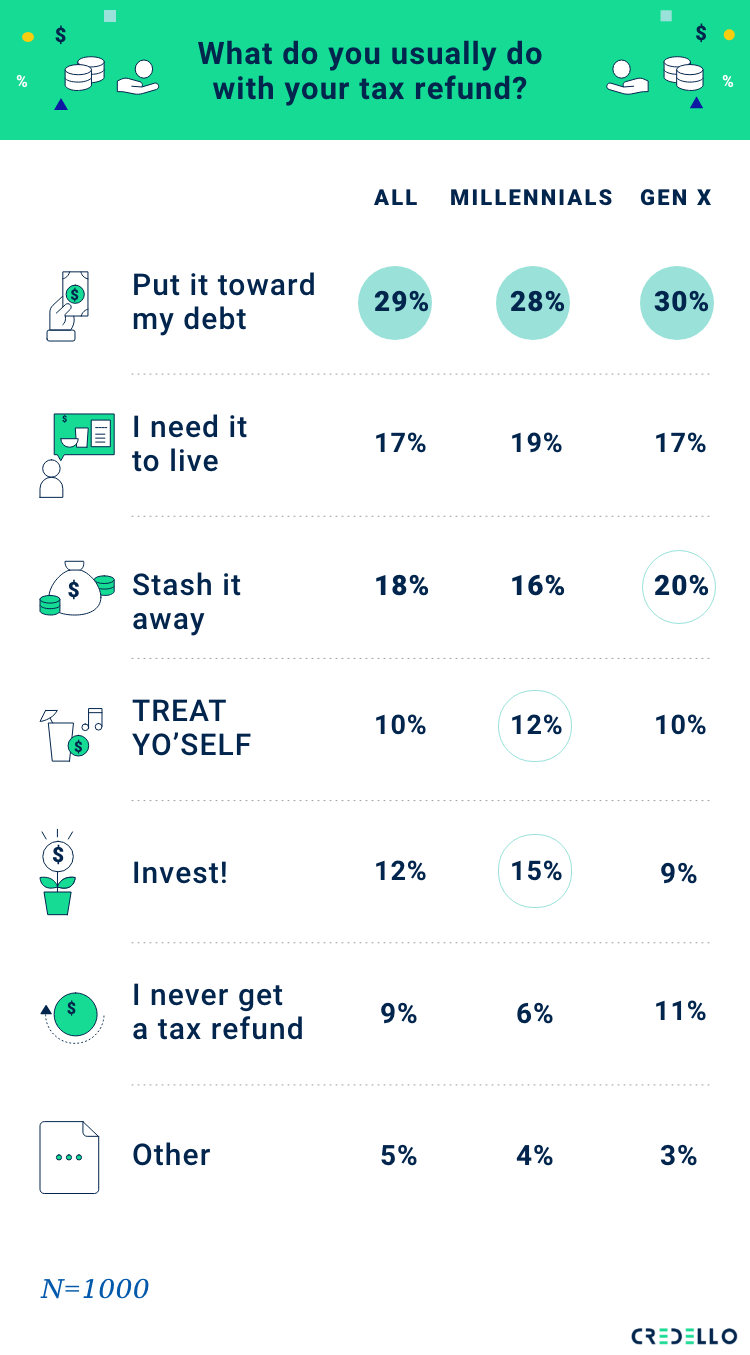

How do people use their tax refunds?

According to IRS data, about 75% of Americans get a tax refund every year—meaning they overpaid on taxes over the course of the year and the government owes them money. The average amount of those refunds is about $3,000. That’s a decent chunk of change for a lot of people.

All in all, Americans make relatively responsible choices with their tax refunds. About 29% of respondents said they put their refund toward paying down debt, while only about 10% of respondents took a page out of Tom Haverford and Donna Meagle’s book and went with “TREAT YO’SELF!” And after the past year or so, we can’t blame you.

Methodology

This survey was commissioned by Credello and was conducted using the online survey platform Pollfish. The sample of 1,000 people (ages 18 to 56 and employed, self-employed, or looking for work) in the United States was surveyed on April 18, 2021. The results have been weighted to balance responses to census statistics on the dimensions of age and gender. Generations mentioned in the survey results are categorized as:

- Gen Z: Age 18-24

- Millennials: Age 25-40

- Gen X: Age 41-56

For complete survey methodology, please contact support@credello.com.