FICO Score vs. Credit Score: What’s the Difference?

About Stefanie

Stefanie began her career as a journalist, reporting on options, futures, and pension funds, and most recently worked as a writer and SEO content strategist at a digital marketing agency. In her free time, she enjoys teaching Pilates and spending time with her daughter and Siberian Husky.

Read full bio

At a Glance

While the terms “FICO score” and “credit score” are often used interchangeably, they are not the same thing. A FICO score is just one type of credit score. You actually have many credit scores across different credit bureaus and credit products. This article will cover:

- What is FICO Score?

- FICO score vs. credit score

- Reason why FICO score is lower than credit score

- Reasons for different scores from different credit bureaus

- Importance of FICO and other credit scores

- What is the FICO score range

- How is a FICO score calculated

- What affects FICO score

- How to improve credit score

- FAQs

What is FICO Score?

FICO stands for Fair Isaac Corporation, which was the first company to ever create a credit score. The FICO score launched in 1989 and is the most widely used credit scoring metric.

There are dozens of FICO score models that fall under two main categories: base scores and industry-specific scores. Industry-specific scores are tailored to certain credit products, like mortgages or auto loans.

FICO scores also vary according to their updates, with the newest version being FICO Score 9 (released in 2016).

FICO score vs. credit score

There are several key differences between your FICO score and credit score. When comparing FICO vs credit score, reference this chart:

| Category | FICO Score | Credit Score |

|---|---|---|

| Scoring Model | Scale between 300-850 | Scale may vary depending on the company issuing the credit score |

| Industry Adoption | Used by 90% of lenders | Often referred to as “educational” scores, not formally adopted by the majority of lenders |

| Excellent (720-850) | Consistent and easy to understand scoring | Can differ from FICO score by up to 100 points |

| How long to create a score | At least six months of data required | Depending on the company, could receive a score after only one month |

Why is my FICO score lower than my credit score?

Because each of the three credit reporting bureaus doesn’t always have the same information, you could see a difference at each bureau depending on when you access your score. That means your FICO score could show lower than a VantageScore or other credit scoring option that is pulling slightly different information.

Why do I have different scores from different credit bureaus?

FICO and other credit bureaus all use different mathematical algorithms and criteria to determine their scores. In addition, not all lenders send reports to the same credit bureaus. If you pay a credit card bill late, and that credit card company only sends its report to one bureau, your score would be lowered on just that bureau’s credit report.

Why are FICO and other credit scores important?

When you apply for a loan, such as a mortgage or auto loan, the lender examines your credit score to assess risk and determine how likely you’ll be able to repay your loan. Credit scores allow lenders to quickly make decisions based on data that is both impartial and consistent, and reduces their chance of losing money to unreliable borrowers.

Borrowers with good credit scores are rewarded with access to loans and favorable interest rates. Borrowers with bad credit scores are often unable to get a loan or receive loans with high interest rates.

Did you find yourself in the bad credit scores group? It’s not too late. Simplify and strategize and you can get that number up.

What is the FICO score range?

The FICO score range is typically 300 to 850. The higher the score, the better the credit and the lower the risk the borrower is to a lender.

Additionally, FICO offers industry-specific scores for credit cards and auto loans. These scores range from 250 to 900.

How is a FICO score calculated?

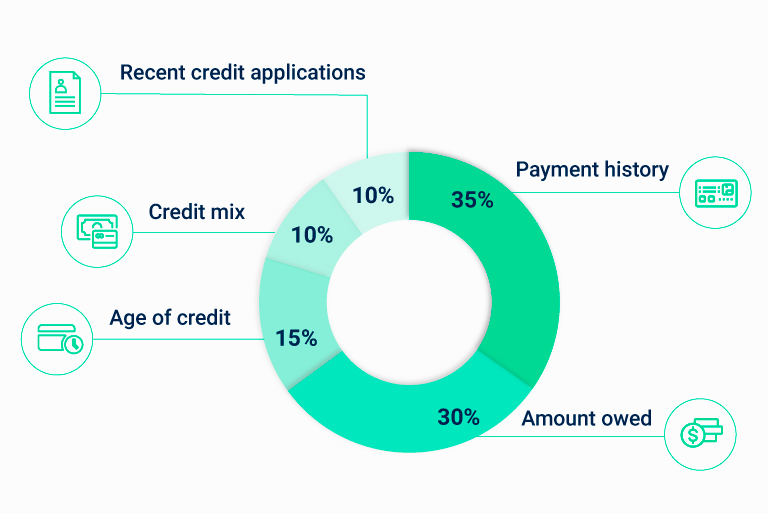

To calculate your creditworthiness, FICO uses five different factors:

Source: Myfico.com

What affects your FICO score?

While FICO hasn’t shared its exact scoring model, there are factors that are more important than others when it comes to calculating a score.

- Payment history makes up 35% of your score, so making payments on time each month can help improve your score. Alternatively, late or missed payments can hurt your score, especially if they are sent to collections.

- Your credit utilization rate is the amount of debt you have relative to your credit limits, or how much of your available credit that you’re using. The lower, the better. Experts recommend keeping your utilization rate below 30%.

- The age of credit refers to how long you’ve had credit as well as the average age of your credit accounts. The longer the age, the better. Therefore you should consider leaving some credit accounts open, such as credit cards, instead of closing them.

- Recent credit applications trigger hard inquiries, which can decrease your score by up to five points per inquiry. These only affect your score for a short period of time, but they stay on your credit report for two years.

- Credit mix is the type of credit you have. Having a mix of installment loans and revolving credit can help improve your score.

How to improve your credit score?

Here are some different steps you can take to improve your credit score:

- Avoid late payments: Your payment history is the biggest factor considered with almost every credit score.

- Don’t close out old accounts: Don’t close out old accounts once you’ve paid your balance off. While this might seem counter-intuitive, closing accounts will raise your credit utilization rate and lower your overall score.

- Check your credit report frequently: Your credit scores are all based on your credit report. Make sure to check your report for errors frequently.

- Ask for a higher credit limit: A higher credit limit will improve your score by lowering your credit utilization rate.

FAQs

FICO and VantageScore both operate on a credit range between 300-850. How high borrowers fall on this range reflects their ability to take on and repay credit effectively. Generally, lenders are more likely to issue a loan or line of credit to borrowers with a higher credit score.

New changes implemented in 2020 mean that those with high debt utilization (compared to available credit), personal loans, and late payments could see their score dip. But scores could improve for those who keep a timely payment history and use only the credit they need.

FICO scores can be the same as credit scores in some instances. But it’s worth noting a FICO score is only one type of credit score. FICO is the most popular credit score reporter, often used instead of or alongside VantageScore, another credit scoring option.

90% of lenders use the FICO credit score when determining whether to approve your credit application, as well as your interest rate and terms or credit limit. While Experian is the largest credit bureau, Equifax and TransUnion are just as accurate.

FICO scores are the most widely used credit scores and have been an industry standard for 30 years, with about 90% of the top lenders using them. These scores help lenders better understand a borrower’s creditworthiness and credit risks so that they can feel confident in their decision to approve or deny an application.

Loan payoff calculatorCompare payoff methods by savings & more

Debt snowball calculatorEstimate your savings and debt-free date