What Is a Bad Credit Score?

About Casey

Casey is a reformed sports journalist tackling a new game of financial services writing. Mike Francesa once called her a “great girl.”

Read full bio

At a Glance

A bad credit score is relative to what you’re trying to accomplish, like getting approved for a credit card or securing an auto loan. Various factors contribute to your credit score, so you can build and repair your credit over time.

What is a bad or poor FICO score?

Your FICO score ranges from 300 to 850, with 850 being the best. Generally, a score between 300 and 579 is considered very poor, while 580 to 669 is considered fair. The “good” mark starts at 670. The Fair Isaac Corporation calculates your score based on creditworthiness, or your ability to repay what you owe.

What is a bad or poor VantageScore?

VantageScore is another credit score model used by the three major credit reporting companies: Equifax, Experian, and TransUnion. In previous iterations, VantageScore ranged from 501 to 990. Now, the VantageScore 3.0 model uses the same 300 to 850 range that FICO uses.

In the updated model, scores from 300 to 499 are considered very poor. Scores from 500 to 600 are considered poor, and scores from 601 to 660 are considered fair. The 661 mark is where “good” scores begin.

Who determines what makes a credit score bad?

The companies that develop credit scores don’t actually decide which scores are good or bad. Neither do the major credit reporting agencies. Ultimately, individual lenders make these decisions. If you’re targeting a high-end credit card, you’ll likely need a score over 750. If you’re looking to get a mortgage, 620 is usually thought to be the minimum.

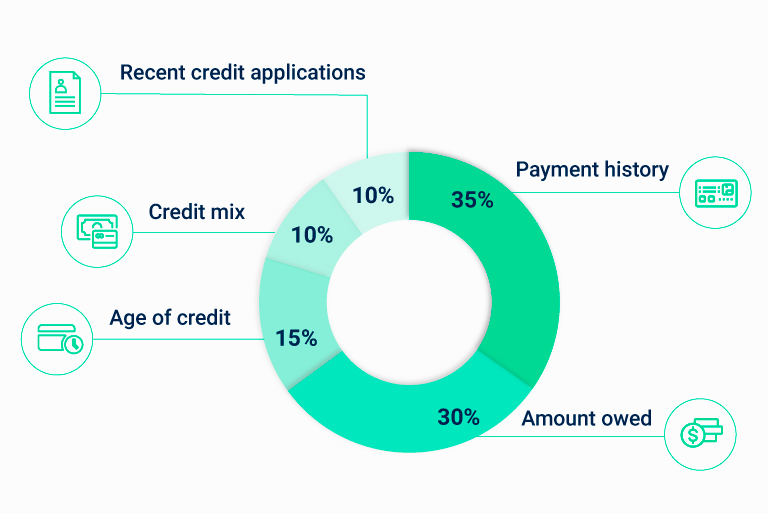

What factors affect your credit score?

The two most important factors that help determine your credit score are payment history and credit utilization, or how much of your available credit you use. These five factors are what affect your FICO credit score:

Source: Myfico.com

Payment history

Your payment history has the greatest weight when it comes to your credit score. Showing your ability to pay off your debts on time lets creditors know that you’re reliable. This can also help boost your credit score.

Credit utilization

The amount of debt you owe is worth a significant chunk of your credit score, too. Ideally, you want to use as little of your credit limit as possible. The general rule of thumb floated on the internet is to not use more than 30% of your credit limit. But the reality is, to have a really good credit score, you’ll want to use significantly less: closer to 10% or lower.

Length of credit history

The longer you have credit accounts open, the better. This shows creditors that you have a handle on things. Don’t rush to close an account once you’ve paid it off. Keeping older accounts open shows a longer credit history, which can increase your score.

Credit mix

Having a variety of credit shows that you can responsibly use credit. For example, different types include credit cards, student loans, and car loans.

New credit

Opening several new credit accounts in a short window can be alarming to creditors. This can especially hurt your credit score if you don’t have a strong length of credit history.

Finding out where your credit score stands

The Fair Isaac Corporation offers a free FICO score estimator. This tool gives you a rough idea of where you stand after filling out a series of financial questions.

Many credit card companies offer a free look at your precise FICO score or VantageScore. The Fair Credit Reporting Act also requires the three major credit reporting agencies to provide you with a free copy of your credit report once a year, upon request.

How can a poor or bad credit score hurt you?

There are a lot of ways a poor or bad credit score can work against you:

- Higher interest rates

- Difficulty getting a mortgage

- Possibility of being denied credit

- Trouble getting approved to rent an apartment

- Risk of missing out on a small business loan

- Potential of dealing with higher insurance premiums

How to improve a bad credit score

Once you’ve reviewed your current credit score, you can start to make improvements. Figure out the areas that most need your attention and start there. Some useful ways to bump your score:

- Pay your bills on time. Even if you’re just a few days late, that can hurt your score. Set up autopay on recurring payments if you’re able to or set yourself a reminder of the due date. And pay more than the minimum if you can.

- Keep your credit card balance low. Try to avoid making large purchases on your credit card that you wouldn’t otherwise be able to pay for.

- Pay off debts; don’t move them. It’s generally better to owe a certain amount on a single account rather than owing the same amount across several accounts.

- Don’t open a new credit account unless you need to. And if you do, consider a secured credit card. With this type of card, you make an initial deposit, which typically serves as your credit limit. From there, secured cards are like regular credit cards. Make payments on time and keep your balance low.

- Apply for a credit-builder loan. These are most often offered by smaller financial institutions, like community banks or credit unions. The amount you borrow is held in a bank account while you pay off the loan. With payment history being the biggest weight of your credit score, this can be a big help if you have bad credit.

- Become an authorized user. If you’re close with someone who has a good credit history and is willing to add you to their account, this could boost your credit.

- Watch out for scams advertising quick fixes to your credit score. “There is no quick way to fix a credit score,” FICO says.1

- Hire someone to help. A financial advisor can set you on the right path if you’re having difficulty navigating your credit situation on your own.

Bad credit can seem like an impossible hole to dig out of, but if you follow these guidelines, in time you’ll see your score take off.

Sources