How Do Over 50% of Americans Use AI-Chatbots for Money Guidance?

About Anouare

Anouare is a seasoned writer, editor and content strategist who started her career as a lifestyle journalist before stepping into leadership roles at publications such as AskMen and Goalcast. From editorial strategy to content marketing and project-management, she has tackled various challenges in digital media and discovered her passion for mentoring others in the process. She loves a good money mindset book and believes you can create your dream lifestyle by being yourself.

Read full bio

At a Glance

First, there were virtual assistants like Siri and Alexa. And then OpenAI’s ChatGPT came along as well as Microsoft and Google competitors, turning sci-fi plotlines into a not-so-far-fetched reality. The open access chatbot can write articles and social media posts, answer complex questions, and sound eerily human while doing it. Ever since its launch in November 2022, it has been making waves and sparking debates about ethics, privacy and intellectual property.

All the controversy hasn’t stopped both individuals and businesses from embracing this form of AI – according to Similarweb, the ChatGPT website had 1.6 billion visits in June 2023. A new Credello survey of 1,000 people aged 18 to 54-years-old just revealed that people are now also using AI-chatbots to manage their money including helping them with budgeting and stock recommendations. But how far will they go when it comes to money management and AI? Here’s what you need to know.

Key takeaways on AI-Chatbots and personal finance:

- Half of Americans, 52%, in the age group (18-54 years old) surveyed have used AI-chatbots for a money matter.

- An additional 32% of those surveyed said they will consider using AI-chatbots for money management in the future.

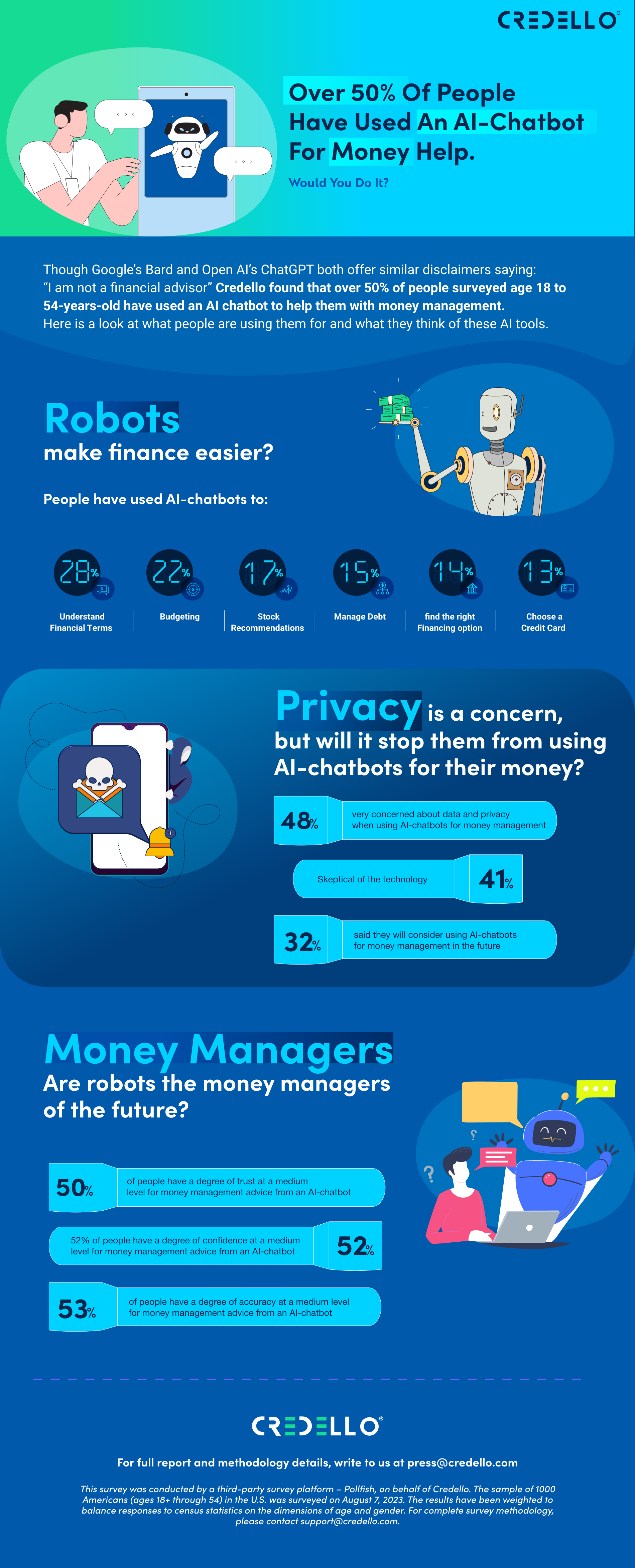

- People have used AI-chatbots to help understand financial terms (28% of respondents), for budgeting (22% of respondents), and for stock recommendations (17% of respondents).

- Nearly half of people surveyed (48%) are highly concerned about data and privacy when it comes to using AI-chatbots for money management and 41% are highly skeptical about the newness/experimental nature of this technology.

- However, 50% said their degree of trustworthiness was medium when it came to the information they are being given.

- Women are using AI-chatbots for personal finance less than men (about 46% of women use it vs. 53% of men).

How and why people use AI-chatbots for personal finance

With over 50% of those surveyed using AI-chatbots to help with their money management, you may be wondering what they are specifically finding it useful for. The top three tasks are to help understand financial terms (28% of respondents), for budgeting (22% of respondents), and for stock recommendations (17% of respondents). Several people are also using it to help manage debt (15%), find the right financing option (14%), or shop for a credit card (13%).

When asked about the positive aspects of using AI-chatbots for money advice over other methods, two-thirds of people said that AI-chatbots trump other personal finance methods when it comes to faster and quicker access to information.

People are concerned about privacy with AI, but they also trust it

Privacy has been one of the top concerns with many people as these AI-chatbots continue to grow smarter and become more ubiquitous. Not surprisingly, nearly half of the people Credello surveyed (48%) are very concerned about data and privacy when it comes to using an AI-chatbot for money management. “The privacy considerations with something like ChatGPT cannot be overstated,” Mark McCreary, the co-chair of the privacy and data security practice at law firm Fox Rothschild LLP, told CNN recently. “It’s like a black box.” Even when just using a chatbot to help construct a quick email for work, employees may be inadvertently disclosing sensitive information about their company. Now imagine sharing information about your finances.

However, the concerns over privacy aren’t stopping them from using AI-chatbots altogether. Despite 41% of those surveyed being skeptical of this type of technology, 50% are only concerned at a medium level of trustworthiness of this information. This indicates that half the people surveyed think financial advice from an AI-chatbot is pretty reliable.

Men are more enthusiastic about managing money with AI-chatbots

Interestingly, women are using AI-chatbots for personal finance less than men (about 43% of women use it vs. 69% of men). How come? The women who are staying away from using ChatGPT for personal finance listed being unsure about how it works (48%), preferring human interaction (47%), and having data privacy concerns (43%) as factors behind their decision.

On the other hand, men who have used ChatGPT to manage their money have more confidence in the platform than women (nearly 33% of men have high confidence in the results vs. 23% of women).

There are also generational differences at play

Perhaps unsurprisingly, younger people are using ChatGPT to manage their money more than older generations: 64% of people between 25 and 34 have used it while only 36% of people between 45 and 54 have tried it. You can blame these differences on the fact that over half of respondents aged 45-54 reported avoiding ChatGPT for personal finance because they are unsure about how it works.

Bottom line

It’s too early to tell exactly how new forms of AI like ChatGPT are going to continue disrupting our lives, but one thing is for sure: People are already using it for personal finance even though the way they approach it and think about it slightly differs depending on gender and age group.

This survey was conducted by a third-party survey platform – Pollfish, on behalf of Credello. The sample of 1000 Americans (ages 18+ through 54) in the U.S. was surveyed on August 7, 2023. The results have been weighted to balance responses to census statistics on the dimensions of age and gender. For complete survey methodology, please contact support@credello.com.