Pros and Cons of Debt Settlement

About Casey

Casey is a reformed sports journalist tackling a new game of financial services writing. Mike Francesa once called her a “great girl.”

Read full bio

At a Glance

As with any approach to eliminating debt, there are benefits and disadvantages of debt settlement. Settling your debt isn’t the best approach for everyone. The pros and cons of debt settlement can help you decide if settling your debt makes sense for you.

Before deciding, learn:

How debt settlement works

Debt settlement typically is done by a third-party debt settlement company. These can also be referred to as debt relief companies. Typically, these companies will contact your creditors for you to negotiate a settlement. The debt relief organization likely will charge a fee for their service, but be mindful that they can’t charge you before settling your debt.

Investigate any debt relief service before getting involved with them and be sure to get everything in writing. Check them out with your state’s Attorney General1 and local consumer protection agency to see if there are any complaints against them on file.

Debt services organizations must give you the following information before you sign up:

- Price and terms: The company has to disclose any fees and conditions involved in its services

- Results: The company has to tell you how long it will take for it to make an offer to each creditor for a settlement

- Offers: The organization has to reveal how much money you have to save before it will make an offer to creditors on behalf of you

- Non-payment: If the organization requests that you stop making payments on your credit card bills, this is a red flag. The company must tell you about any possible negative consequences you may face if you stop making payments.

A debt settlement company may require you to make regular deposits into a special, escrow-like savings account designed to go toward your lump-sum payment. These organizations also might encourage you to stop making monthly payments to other creditors while they negotiate for you. This can be detrimental to your credit score.

If and when the debt settlement company reaches an agreement with your creditor, you’ll need to agree to the settled amount. That’s when the debt relief company can start charging you for their service. But bear in mind, there’s no guarantee that a debt relief company will be able to reach a debt settlement agreement for all your debt.

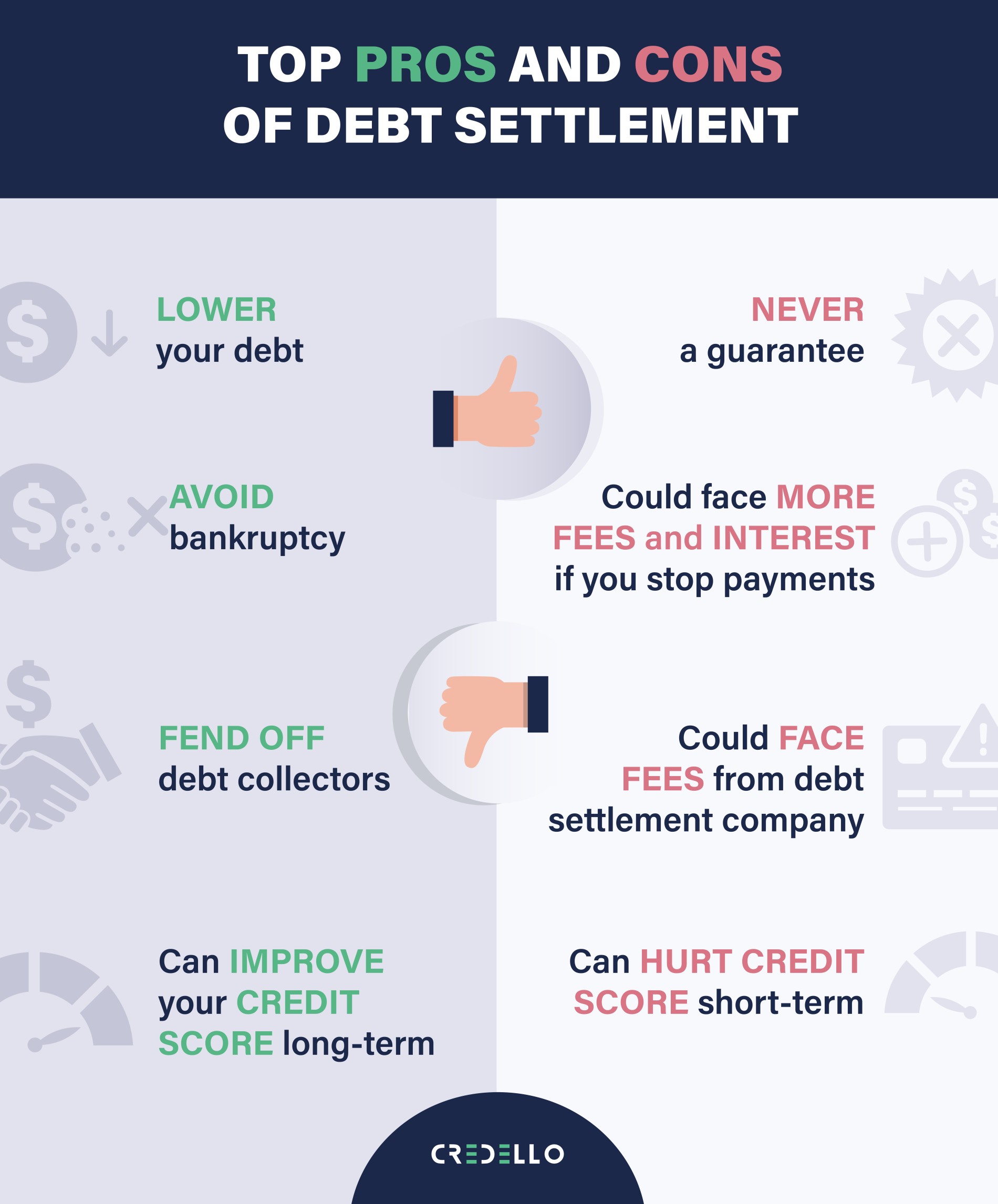

Debt settlement pros and cons

While there are a handful of benefits of debt settlement, be aware that there are plenty of risks involved as well.

Benefits of debt settlement

Using a debt settlement company to settle your debt could:

- Lower the amount of debt you have

- Prevent you from having to file bankruptcy

- Get rid of debt collectors and creditors

- Could improve credit score in the long term: While your credit score will take a hit in the immediate, your score should improve over time because you’ll lower your outstanding debt as well as your credit utilization ratio

Disadvantages of debt settlement

On the flip side, the disadvantages of debt settlement could overshadow any potential positives.

- There’s no guarantee your creditors will agree to negotiate

- You could find yourself in more debt from late fees or interest if you stop making payments on your initial debt

- You could face fees from the debt settlement company, regardless of whether they’re able to settle your whole debt

- Your credit score could take a negative hit in the process

- Forgiven debt could be taxable

- Can be time-consuming

Is debt settlement worth it?

So, is debt settlement a good idea? There certainly are more cons than pros. There are alternatives like talking to your creditor on your own behalf, balance transfer credit cards, and credit counseling that you should consider before plunging into debt settlement.

Debt settlement essentially is the last stop before considering filing for bankruptcy.

Balance transfer recommendationsCompare balance transfer cards

Debt consolidation recommendationsExplore how consolidation can help