How to Check Your FICO Score for Free

About Stefanie

Stefanie began her career as a journalist, reporting on options, futures, and pension funds, and most recently worked as a writer and SEO content strategist at a digital marketing agency. In her free time, she enjoys teaching Pilates and spending time with her daughter and Siberian Husky.

Read full bio

If you’re looking for a loan, it’s important to check your FICO score before you apply. There are a number of free ways to find out what your score is.

What is a FICO score?

“FICO” stands for the Fair Isaac Corporation, the company that developed the score in 1989.

Your FICO credit score is a three-digit score calculated using the information in your credit report maintained by the three main credit bureaus (Equifax, Experian, and TransUnion).

The score gives lenders a sense of your ability to repay a loan, and helps determine how much money you’re allowed to borrow and how long you’ll have to pay back your loan.

Why FICO scores matter

A bad FICO score could prevent you from getting a loan or leave you with a higher premium. Some banks even have a FICO score minimum you need to meet to qualify for a loan. A good score, on the other hand, can qualify you for loans and save you money with favorable interest rates.

5 ways to check your FICO score for free

While you’ve probably seen plenty of advertisements for free credit reports, they are not the same as getting your FICO score.

Here are 5 ways to check your FICO score for free:

- Banks: Many larger banks give customers FICO scores as part of the FICO Open Access Program. If you’re a customer of a participating bank, your FICO score might appear on your loan/credit card statement, or you may be able to view it by logging in to your account.

- Credit card companies: Similar to banks, some credit card companies provide FICO scores as a benefit to their customers. Check with your credit card company to see if they participate.

- Financial counselors: If you are using a credit counseling service, which helps individuals with their financial health, you can usually obtain your FICO score for free. Your score will be used as a reference point to improve your finances.

- Credit unions: Some credit unions also give free scores to members.

- Lenders: If you have student loans, auto loans, or a mortgage, you might be able to get a FICO score for free from your lender. For example, if you have a loan from Sallie Mae, you may be able to receive a free quarterly FICO score.

If none of the above work, you can always purchase your score from the credit report companies themselves or through a credit scoring service.

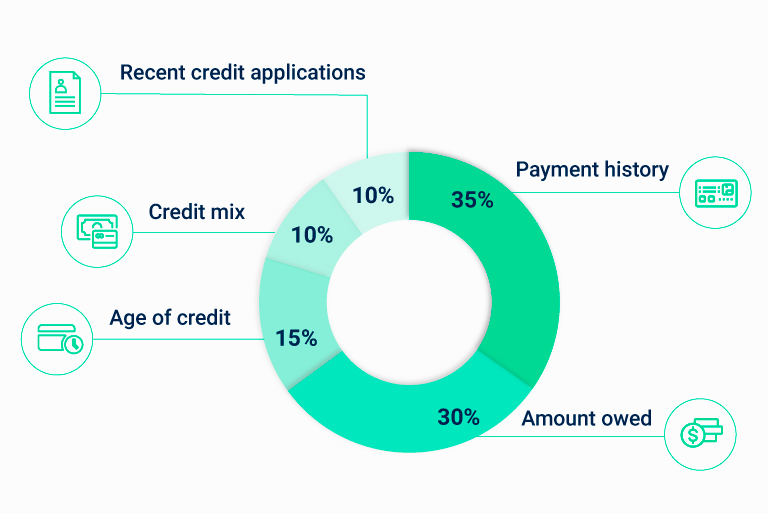

How is my FICO score calculated?

Your FICO score is calculated using :

Source: Myfico.com

FICO score ranges

FICO scores range from 300 to 850. The better your credit, the higher the score.

FICO score vs credit report

While the terms “FICO score” and “credit score” are often used interchangeably, a FICO score is actually a type of credit score.

How to improve your score

To improve your FICO score, try the following strategies:

- Pay bills on time: Paying bills on time is the most important factor determining your credit score. Set up payment reminders or automatic payments on your accounts to avoid falling behind.

- Check credit report on a regular basis: Make sure to check your credit report at least once a year (though more often is better). Look for inaccuracies that could be affecting your score.

- Keep old cards open: Don’t close an account once it’s paid off. This can raise your credit utilization rate and in turn lower your score.

- Request a higher credit limit: A higher credit limit will lower your credit utilization rate and boost your score.

- Apply for new cards sparingly: Only apply for a new card if you really need it, and avoid paying a credit card bill with another card.

Sources

Loan payoff calculatorCompare payoff methods by savings & more

Debt snowball calculatorEstimate your savings and debt-free date