Credit Score Guide: Learn, Check, and Improve Credit Score

About Harrison

Harrison Pierce is a writer and a digital nomad, specializing in personal finance with a focus on credit cards. He is a graduate of the University of North Carolina at Chapel Hill with a major in sociology and is currently traveling the world.

Read full bio

At a Glance

A good credit score is an important key to unlocking great financial opportunities, from buying a home or car to accessing the best loan rates. An excellent credit score is one of the most crucial indicators lenders will use when looking at you as a potential candidate for any type of loan. It’s essential to learn the basics, check your score, and make improvements when required. There are many free services available that can help you monitor your credit score. Additionally, there are simple steps this article will discuss that can lead to long-term improvements in your credit rating. Implementing these strategies will pay off and bring significant advantages in lower interest rates, better terms, and higher amounts you can borrow, resulting in increased chances of being approved by lenders.

In this article, you’ll learn:

- Credit score ranges

- How to check and monitor credit score

- What is a good credit score

- How to improve credit score

- Importance of credit score

- How credit scores work

- Types of credit score

- Factors that affect credit score

- Factors that don’t affect your credit score

- How credit score is calculated

- Credit score vs. credit rating

- Credit score vs. credit limit

- Credit scores vs. credit reports

- Understanding credit inquiries

- Credit score myths to be beware of

- FAQs

54% of adults

never check their credit score.

A credit score is a three-digit number that reflects your creditworthiness. It is calculated based on the information in your credit report, including your credit history, payment history, outstanding debts, and other financial information. Credit scores are used by lenders, landlords, and other creditors to evaluate your ability to repay debts on time and to determine whether to extend credit and at what interest rate.

What are credit score ranges?

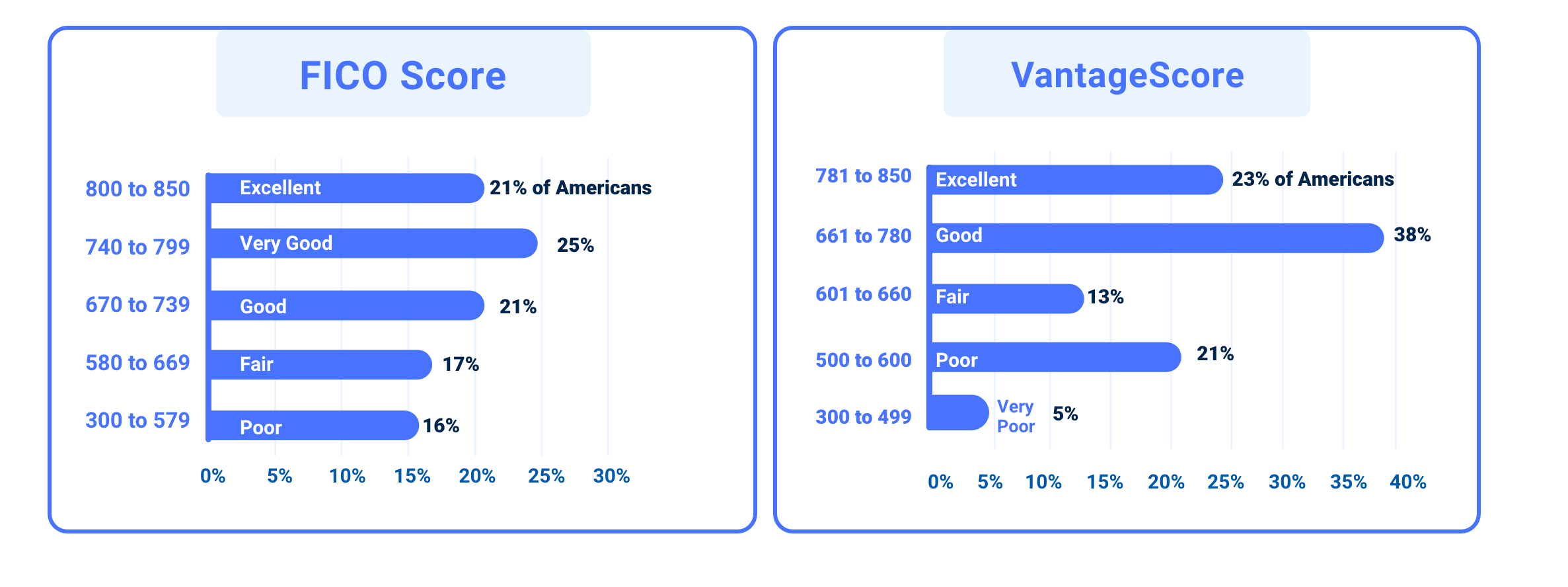

Credit score ranges typically vary depending on the credit scoring model being used, but the most commonly used credit score model is the FICO score, which ranges from 300 to 850.

Keep in mind that different lenders and creditors may have different standards for what they consider to be a “good” credit score. Additionally, some credit scoring models may have different ranges or ways of calculating credit scores. However, a higher credit score generally indicates better creditworthiness and may lead to more favorable loan terms and interest rates.

Learn more: Credit Score Ranges

How to check & monitor your credit score?

You can check and monitor your credit score by following these steps:

- Obtain a copy of your credit report from one or more of the three major credit bureaus: Equifax, Experian, and TransUnion. You are entitled to a free copy of your credit report from each credit bureau once a year. You can request your free credit report at AnnualCreditReport.com.

- Review your credit report carefully for errors or inaccuracies that may negatively affect your credit score. If you find any errors, dispute them with the credit bureau(s) in writing.

- Consider signing up for a credit monitoring service, which can provide regular updates on changes to your credit report and credit score. Some credit monitoring services are free, while others may charge a fee.

- You can check your VantageScore any time using Credello’s new free credit monitoring tool as well as access to tools to help you get organized and be disciplined on your financial fitness journey.

- Check your credit card or loan statements regularly for unauthorized charges or suspicious activity. Report any fraudulent activity to the creditor and the credit bureau(s) immediately.

Related: Does Checking Your Credit Score Lower It?

What is a good credit score?

A good credit score is generally considered to be a score that is in the range of 670 to 739 on the FICO credit scoring scale. A higher credit score indicates better creditworthiness and may lead to more favorable loan terms and interest rates. For example, a credit score in the “excellent” range of 800 to 850 may qualify you for the lowest interest rates and most favorable loan terms, while a credit score in the “fair” range of 580 to 669 may result in higher interest rates and less favorable loan terms.

Learn more: What is a Good Credit Score?

How to improve your credit score?

Improving your credit score can seem like a daunting task, but with a few simple steps, it doesn’t have to be difficult. One of the most important things you can do to increase your score is to pay your bills on time. If you know that you have payments coming up, it may be helpful to set reminders to avoid late fees or missed deadlines. Additionally, limit the amount of money you are borrowing, as too much debt can strain your credit report. Furthermore, an excellent way to improve your credit score is by regularly checking and fixing errors. This helps ensure that inaccurate information is not hurting your overall report. Finally, creating spending limits and sticking to them is another great way to ensure that your finances stay under control while still allowing for improvement in your credit score.

Learn more: How to Improve Your Credit Score?

Tips to achieve an excellent credit score

Here are some tips to help achieve an excellent credit score:

- Pay bills on time: Late payments can significantly negatively impact your credit score. Paying bills on time and in full is one of the most important factors in maintaining a good credit score.

- Keep balances low: Try to keep your credit card balances low, ideally less than 30% of your credit limit. High balances can negatively impact your credit utilization ratio, another important factor in calculating your credit score.

- Avoid opening too many accounts at once: Opening too many credit accounts in a short period can negatively impact your credit score. Space out applications for credit over a longer period of time to avoid too many hard inquiries on your credit report.

- Keep old accounts open: The length of your credit history is a factor in determining your credit score. Keeping old accounts open can help to establish a longer credit history and improve your score.

- Monitor your credit report: Regularly review your credit report to make sure that there are no errors or inaccuracies that could negatively impact your score. Dispute any errors with the credit bureau(s) in writing.

- Use credit responsibly: Only borrow what you can afford to repay and use credit responsibly. Showing a history of responsible borrowing and repayment can help to build and maintain a good credit score over time.

Steps to fix a poor credit score

A poor credit score can make getting approved for loans, credit cards, and even rental agreements difficult. However, there are steps you can take to improve your credit score. Here are some of the most effective steps to fix a poor credit score:

- Check your credit report: The first step is to obtain a copy of your credit report from all three major credit bureaus and review it for errors or inaccuracies. If you find any errors, dispute them with the credit bureau.

- Pay bills on time: Late payments are one of the most significant factors that can lower your credit score. Make sure you pay all bills on time, including credit card bills, rent, and utilities.

- Reduce credit card balances: High credit card balances can also lower your credit score. Try to keep your balances below 30% of your available credit limit.

- Avoid opening new credit accounts: Opening multiple new credit accounts within a short period can negatively impact your credit score. It is better to wait to improve your credit score before applying for new credit.

- Consider a debt consolidation loan: If you have multiple debts with high-interest rates, consider consolidating them into a single loan with a lower interest rate. This can help you pay off your debts faster and improve your credit score.

- Seek professional help: If you are struggling to manage your debt, consider seeking help from a credit counseling agency or a financial advisor.

Why are credit scores important?

Credit scores are important because they are used by lenders, banks, and other financial institutions to assess a borrower’s creditworthiness. A good credit score increases the chances of getting approved for a loan or credit card. A poor credit score may result in loan or credit card denials, higher interest rates, or less favorable loan terms.

When approved for a loan, the interest rate offered by lenders is based on your credit score. A higher credit score usually results in a lower interest rate, while a lower credit score can lead to higher interest rates and monthly payments.

Also, some employers may check applicants’ credit scores during hiring. A low credit score may affect job prospects, especially for positions requiring money handling. Similarly, landlords may check a tenant’s credit score before approving a rental application. A low credit score may lead to rejection or require a higher deposit.

How does credit score work?

Lenders and other financial institutions evaluate a borrower’s credit risk using credit scores. When a person applies for a loan or credit card, the lender checks their credit score to determine the likelihood of the borrower repaying the loan on time. If the credit score is high, the lender is more likely to approve the loan or credit card application and offer favorable terms and interest rates.

Learn more: How Does Credit Score Work?

Types of credit score

There are three main types of credit scores used in the United States: FICO Score by Fair Isaac Corporation, VantageScore Solutions, and Experian National Equivalency Score. Of these, the most widely accepted score is the FICO Score. This score measures factors such as payment history, credit utilization ratio, length of credit history, recent applications for new credit accounts, and any derogatory information. Additionally, VantageScore Solutions considers more than just payment data from trade lines and provides a snapshot view of all available consumer credit information. Finally, Experian National Equivalency Score draws on repayment history from public records and non-traditional sources (rental or utility payments). Understanding which type of score affects you can help ensure you remain in control of your financial future.

FICO score

The FICO score is a credit score that lenders and financial institutions widely use to evaluate your creditworthiness. It is a three-digit number that ranges from 300 to 850 and is based on the information found in your credit report. The FICO score considers several factors when calculating the score, including payment history, credit utilization, length of credit history, types of credit used, and recent credit inquiries.

Related: FICO Score vs. Credit Score

VantageScore

The VantageScore is another type of credit score used by lenders and financial institutions to evaluate your creditworthiness. Like the FICO score, the VantageScore is a three-digit number that ranges from 300 to 850 and is based on the information found in your credit report.

The VantageScore considers similar factors as the FICO score when calculating the score, including payment history, credit utilization, length of credit history, types of credit used, and recent credit inquiries. However, the VantageScore emphasizes recent credit behavior and can provide a more accurate representation of your current creditworthiness.

Learn more: Types of Credit Scores

Factors that affect credit score

- Payment history: The most significant factor affecting your credit score, it refers to how well a person has made payments in the past, including the frequency of missed or late payments.

- Credit utilization: The amount of credit a person uses compared to their available credit limit. Higher credit utilization can negatively impact the credit score.

- Length of credit history: The length of time a person has had credit can positively affect their credit score. A longer credit history demonstrates your creditworthiness and responsible use of credit over time.

- Types of credit used: A diverse credit mix can positively impact your credit score. A combination of credit types, such as installment loans and credit cards, can demonstrate your ability to handle different types of credit.

- Recent credit inquiries: Applying for new credit can lead to a temporary decrease in the credit score. This can indicate that a person is taking on more debt or experiencing financial difficulty.

- Negative marks on credit report: This includes accounts in collections, bankruptcies, foreclosures, and other negative items on the credit report. These marks can significantly impact your credit score and may remain on the credit report for several years.

Factors that don’t affect your credit score

There are several factors that do not directly affect your credit score, including:

- Income: your income is not included in your credit report and does not affect your credit score. However, income can indirectly impact your creditworthiness by affecting your ability to repay debts.

- Age: Age is not a factor in determining your credit score. However, the length of your credit history can impact your credit score.

- Gender: Gender is not a factor in determining your credit score.

- Marital status: Marital status is not included in your credit report and does not affect your credit score.

- Employment status: Employment status is not a factor in determining your credit score. However, having a stable income source can indirectly impact your creditworthiness.

- Race or ethnicity: Race or ethnicity is not a factor in determining your credit score.

Learn more: Factors that don’t affect your credit

How is credit score calculated?

The exact calculation of a credit score can vary depending on the scoring model being used. However, both FICO and VantageScore use similar factors when calculating a credit score, although the weight given to each factor may differ slightly.

The FICO score is calculated based on five main factors:

- Payment history (35%)

- Credit utilization (30%)

- Length of credit history (15%)

- Types of credit used (10%)

- New credit inquiries (10%)

The VantageScore is calculated based on similar factors, but the weight given to each factor may differ:

- Payment history (40%)

- Credit utilization (20%)

- Credit balances (11%)

- Depth of credit (21%)

- Recent credit (5%)

- Available credit (3%)

Learn more: How is Your Credit Score Calculated?

Credit score vs. credit rating

A credit rating is an assessment of a borrower’s creditworthiness that a credit rating agency gives. Credit rating agencies, such as Moody’s, Standard & Poor’s, and Fitch Ratings, provide credit ratings for companies and governments based on their ability to repay debts. A credit rating is usually expressed as a letter grade, such as AAA or B, and is used by investors to assess the risk associated with a particular investment.

While credit score and credit rating both assess your creditworthiness, different entities calculate and use them for different purposes. A credit score is a number that is used by lenders to determine the likelihood of a borrower repaying a debt, while a credit rating is an assessment of a borrower’s creditworthiness that is used by investors to assess the risk associated with a particular investment.

Learn more: Difference between Credit score and Credit rating

Credit score vs. credit limit

A credit limit is the maximum amount of credit that a lender is willing to extend to a borrower. It is usually determined based on income, credit score, and credit history. The credit limit can vary depending on the type of credit account, such as a credit card, a personal loan, or a line of credit.

While your credit score can influence your credit limit, it is not the only factor that is considered. Other factors, such as income, employment history, and debt-to-income ratio, can also play a role in determining your credit limit.

Learn more: Credit Score vs. Credit Limit

Credit score vs. credit report

Your credit report provides the underlying data used to calculate your credit score, and the score itself is a simplified representation of that data. Both your credit report and credit score are important for understanding your credit history and managing your finances effectively.

Learn more: Credit Score vs. Credit Report

Understanding credit inquiries

1. Hard credit inquiry

A hard credit inquiry, also known as a hard pull, is a type of credit inquiry that occurs when a lender or financial institution checks your credit report in order to make a lending decision. Hard inquiries are typically initiated by a person applying for credit, such as a credit card, loan, or mortgage.

Hard inquiries can impact your credit score, as they are recorded on your credit report and can be seen by other lenders. Multiple hard inquiries over a short period of time can be interpreted as a sign that a person is seeking a lot of credit, which can be seen as a red flag by lenders and could potentially lower their credit score.

Learn more: Hard Credit Inquiry

2. Soft credit inquiry

A soft credit inquiry, also known as a soft pull, is a type of credit inquiry that occurs when a person or entity checks your credit report for informational purposes. Soft inquiries do not affect your credit score and are not visible to other lenders or financial institutions.

Soft inquiries can occur for various reasons, such as when a person checks their credit report, when a lender pre-approves a person for credit, or when an employer checks your credit report as part of a background check. Soft inquiries can also occur when a person receives pre-approved credit offers in the mail.

Unlike hard ones, soft inquiries are not included in your credit score calculation. As a result, individuals can check their credit reports as often as they like without worrying about the impact on their credit scores.

Related: Do Credit Inquiries Affect Your Credit Score?

Beware of these top credit score myths

There are several common myths about credit scores that can mislead people and harm their credit. Some of the top credit score myths include believing that checking your credit score will lower it, closing credit card accounts will improve your score, and carrying a balance on your credit card will help build credit. In reality, checking your score will not harm it. Closing accounts can hurt your score, and carrying a balance can incur unnecessary interest charges. Understanding the facts about credit scores and taking steps to build and maintain good credit habits is essential.

FAQs

If you have no credit history, you won’t have a credit score. In this case, you must start building your credit history by applying for credit and making timely payments.

Learn more: What credit score do you start with?

The highest credit score anyone can get is 850. This score is typically referred to as a perfect credit score. It is achieved by having an exceptional credit history with a long track record of responsible credit use and on-time payments. However, it’s important to note that achieving a perfect credit score is very difficult, and very few people have a score of 850.

In reality, credit scores above 800 are considered excellent and are typically sufficient to qualify for the best interest rates and credit offers available. It’s also worth noting that different credit scoring models may have different ranges and scoring criteria, so the highest possible score may vary depending on the model used.

Learn more: What is the Highest Credit Score?

The lowest possible credit score is 300. This score is typically considered a very poor credit score and indicates a high risk of defaulting on credit obligations. It’s important to note that a score of 300 is extremely rare, as most credit scoring models have a minimum score threshold higher than 300.

Most credit scoring models have a minimum score threshold typically between 350 and 500, depending on the model being used. Scores in this range are still considered very poor and may make it difficult to qualify for credit or result in high interest rates and fees.

Learn more: Lowest Possible Credit Score

As of 2021, the average credit score in the United States is around 710. This score is considered to be in the “good” range, meaning that most US people have decent credit and are likely to qualify for credit products at reasonable interest rates.

However, it’s important to note that credit scores can vary widely depending on factors such as age, income, geographic location, and other demographic factors. Additionally, credit scores can fluctuate over time due to changes in credit utilization, payment history, and other factors.

It’s also worth noting that different credit bureaus and credit scoring models may have slightly different average credit scores. For example, one credit bureau may report an average score of 710, while another may report an average score of 680. Regardless of the exact number, having a good credit score is important for accessing credit at favorable terms and rates.

Having credit can be necessary for a variety of reasons, including:

- Qualifying for loans and credit cards: If you want to borrow money for a car, a house, or other large purchases, having a good credit score can help you qualify for loans with better terms and lower interest rates.

- Renting an apartment or getting utilities: Many landlords and utility companies require a credit check before approving a lease or setting up a service. Having good credit can make renting an apartment or getting utilities in your name easier.

- Employment opportunities: Some employers may review your credit history as part of the hiring process, especially for positions that involve handling money or financial responsibilities.

- Insurance rates: In some cases, insurance companies may use credit information to determine your rates for auto, homeowner’s, or renter’s insurance.

- Building financial stability: Building and maintaining good credit can help you establish a solid financial foundation and pave the way for future financial goals.

Overall, having good credit can provide you with more financial options and opportunities, while poor credit can limit your options and make it harder to achieve your financial goals.

Technically, it is possible to live without a credit score. However, having a credit score can make it much easier to access credit and financial products, which can be important for certain aspects of modern life.

If you don’t have a credit score, you may find it challenging to qualify for loans, credit cards, or other financial products. This can make it harder to finance large purchases, such as a car or a home. It can also make it harder to rent an apartment or get utilities in your name, as many landlords and utility companies require a credit check.

Additionally, having a credit score can be beneficial even if you don’t plan to use credit. For example, some employers may review credit history as part of the hiring process. Having a good credit score can make you a more attractive candidate for jobs involving financial responsibilities.

No, your income does not directly affect your credit score. Your credit score is calculated based on several factors related to your credit history, such as your payment history, credit utilization, length of credit history, and types of credit accounts.

However, your income can indirectly affect your credit score in a few ways. For example:

- Ability to pay debts: Your income can impact your ability to pay your debts, affecting your credit score. Having a high income and making all your payments on time can help you maintain a good credit score. On the other hand, having a low income and struggling to make payments can negatively impact your credit score.

- Credit utilization: Your income can impact your credit utilization, which is the amount of credit you’re using compared to the amount of available credit. Having a high income and low credit utilization can help boost your credit score. Conversely, low income and high credit utilization can negatively impact your credit score.

- Credit applications: Your income can also impact your ability to qualify for credit products, indirectly affecting your credit score. Having a high income and qualifying for credit products with reasonable terms and rates can help you maintain a good credit score. However, having a low income and cannot qualify for credit products can negatively impact your credit score over time.

Learn more: Does Income Affect Credit Score?