U.S. Bank Smartly Checking Account Review – Earn Up to $500 and Waive Maintenance Fees

Zina Kumock is a personal finance writer whose byline has appeared in Indianapolis Monthly, the Commercial Appeal and the Associated Press. As a finance expert, she has been featured in the Washington Post, Fox Business, and Time. She is a Certified Financial Health Counselor and Student Loan Counselor, and a three-time finalist for Best Personal Finance Contributor/Freelancer at the Plutus Awards. She has bachelor's degree in journalism from Indiana University and has worked for newspapers, magazines and wire services. She currently lives in Indianapolis, IN with her husband and two dogs.

About Caitlyn

Caitlyn is a freelance writer from the Cincinnati area with clients ranging from digital marketing agencies, insurance/finance companies, and healthcare organizations to travel and technology blogs. She loves reading, traveling, and camping—and hanging with her dogs Coco and Hamilton.

Read full bio

Zina Kumock, Certified Financial Health Counselor, Student Loan Health Counselor

At a Glance

In the ever-evolving landscape of banking, U.S. Bank continues to stay at the forefront. Among its offerings, the Smartly Checking Account stands out as a testament to modern banking convenience. This review explores the account’s features, advantages, and distinctive qualities, making it an attractive option for those desiring a streamlined and technology-driven banking experience.

From digital tools that redefine financial management to a fee structure designed for cost-effectiveness, discover how U.S. Bank’s Smartly Checking Account is shaping the future of personal banking.

Read on to learn more:

This review of the U.S. Bank Smartly Checking account was written on January 19, 2024, and is updated regularly to reflect any changes in features, fees, or promotions.

U.S. Bank Smartly Checking overview

The Smartly Checking Account leverages cutting-edge digital tools, providing customers with a modern and efficient banking experience. Accessible through online and mobile platforms, customers can manage their accounts, track expenses, and set financial goals easily.

The account comes equipped with advanced budgeting features, empowering users to take control of their finances. Customizable budgeting tools help users plan, save, and spend wisely, all within the convenience of their digital devices.

The Smartly Checking Account easily integrates with other U.S. Bank services, providing a comprehensive approach to managing finances. Customers can connect accounts, transfer funds, and utilize the complete range of U.S. Bank’s services within a unified platform.

Apply now: U.S. Bank Smartly Checking Account

The basics

APY

The interest rate you can expect from your checking account depends on the daily balance you have:

| Daily Balance | APY | Interest Rate |

|---|---|---|

| $0 – $24,999.99 | 0.001% | 0.001% |

| $25,000 – $500,000+ | 0.005% | 0.005% |

More: U.S. Bank Interest Rates

Minimum deposit

The minimum deposit required to open the U.S. Bank Smartly Checking Account is $25

Fees

- Monthly maintenance fee: $6.95 (waived if you have an average account balance of $1,500 or greater, have an open qualifying U.S. Bank consumer credit card, combined monthly direct deposits totaling $1,000+, or are a member of the military)

- Monthly service fee: $6.95 (waived if certain requirements are met)

- Overdraft fees: $36 per transaction (unless you have overdraft protection)

- Other fees: Charges may apply for using out-of-network ATMs, letting your account go dormant, opting for paper statements, and sending or receiving wire transfers.

Stay in the know: Keep in mind that while the absence of these fees is a definite plus (if you qualify for the waiver), some users may find the lack of ATM fee reimbursements to be a downside, especially for those who frequently use out-of-network ATMs.

Bonus

Earn up to $500 (or $700 if you also open a U.S. Bank savings account) by following these steps:

1. Open a new U.S. Bank Smartly Checking account.

2. Enroll in online banking or the U.S. Bank Mobile App within 90 days.

3. You do not need to hit all three requirements to earn some bonus from the U.S. Bank Smartly Checking account promotion. It’s a tiered system based on the amount of your direct deposits:

- Minimum $3,000 to $4,999.99 in direct deposits: You earn $100.

- Minimum $5,000 to $9,999.99 in direct deposits: You earn $300.

- Minimum $10,000+ in direct deposits: You earn $500.

However, to earn the maximum bonus of $800, you do need to fulfill all three requirements:

Stay in the Know: To qualify, you must be at least 18 years old, must be a legal U.S. resident, and cannot be an existing U.S. Bank customer or have had a U.S. Bank account within the past 24 months.

More: U.S Bank Promotions in 2024

Pros and cons

| Pros | Cons |

|---|---|

| Can earn Smart Rewards perks | Only available in 26 states |

| Excellent mobile and online banking | Can be difficult to avoid fees |

| Thousands of branch locations | Interest rate is not competitive |

| Option to waive some fees | |

| New customers can earn a bonus |

Deposit options

- Checks

- Cash

- ACH transfers

- Direct deposit

- Wire transfer

- Zelle

Withdrawal methods

- Check

- Cash

- Debit card

- Zelle

- ACH transfer

- Wire transfer

- Money order

Key features of the U.S. Bank Smartly Checking account

1. Account opening opportunity

Bonus amount: Up to $500

Promotion Expiration: March 31, 2024

Qualifications:

- Must be at least 18 years old

- Must be a legal U.S. resident

- Cannot be an existing U.S. Bank customer or have had a U.S. Bank account within the past 24 months

Why the U.S. Bank bonus is a good opportunity

- Higher bonus potential: The U.S. Bank Smartly Checking account offers a lucrative bonus of up to $500, which exceeds the bonuses typically offered by many other banks.

- Extended promotion period: With a promotion expiration date of March 31, 2024, the U.S. Bank offer provides applicants with a longer window to qualify for the bonus compared to other banks, allowing for more time to take advantage of the opportunity.

- Inclusive eligibility requirements: The qualifications for the U.S. Bank bonus, such as being 18 years old, a legal U.S. resident, and not having an existing U.S. Bank account within the past 24 months, are relatively standard and accessible, making it easier for a broader range of individuals to qualify compared to some other banks’ stringent requirements.

- Minimum deposit: The minimum deposit to qualify for the U.S. Bank bonus is lower than some other banks.

- Varied bonus tiers: While some banks may offer similar or higher bonuses, the U.S. Bank Smartly Checking account bonus allows for tiered earning potential, potentially providing greater flexibility and customization based on the customer’s preferences and banking needs.

Compared to other banks offering signup bonuses for opening new checking accounts, with varying requirements and rewards, U.S. Bank comes out ahead:

- Chase Total Checking: $200 bonus for depositing $1,500 within 60 days and maintaining a $1,500 balance for 90 days.

- Discover Cashback Checking: $150 bonus for depositing $1,500 within 30 days and completing 10 debit card purchases within 3 months.

- Ally Bank Interest Checking: $100 bonus for depositing $100 or more within 90 days of opening.

- PNC Bank Virtual Wallet Checking: $200 bonus for setting up direct deposit and completing 10 debit card purchases within 60 days.

2. Maintenance fee waiver options

The monthly maintenance fee of $6.95 can be waived with one or more of these:

- Average account balance of $1,500 or greater

- Have an open qualifying U.S. Bank consumer credit card

- Combined monthly direct deposits totaling $1,000+

- Are a member of the military

3. Minimum deposit and geographic requirements

The minimum deposit for the Smartly Checking account is $25.

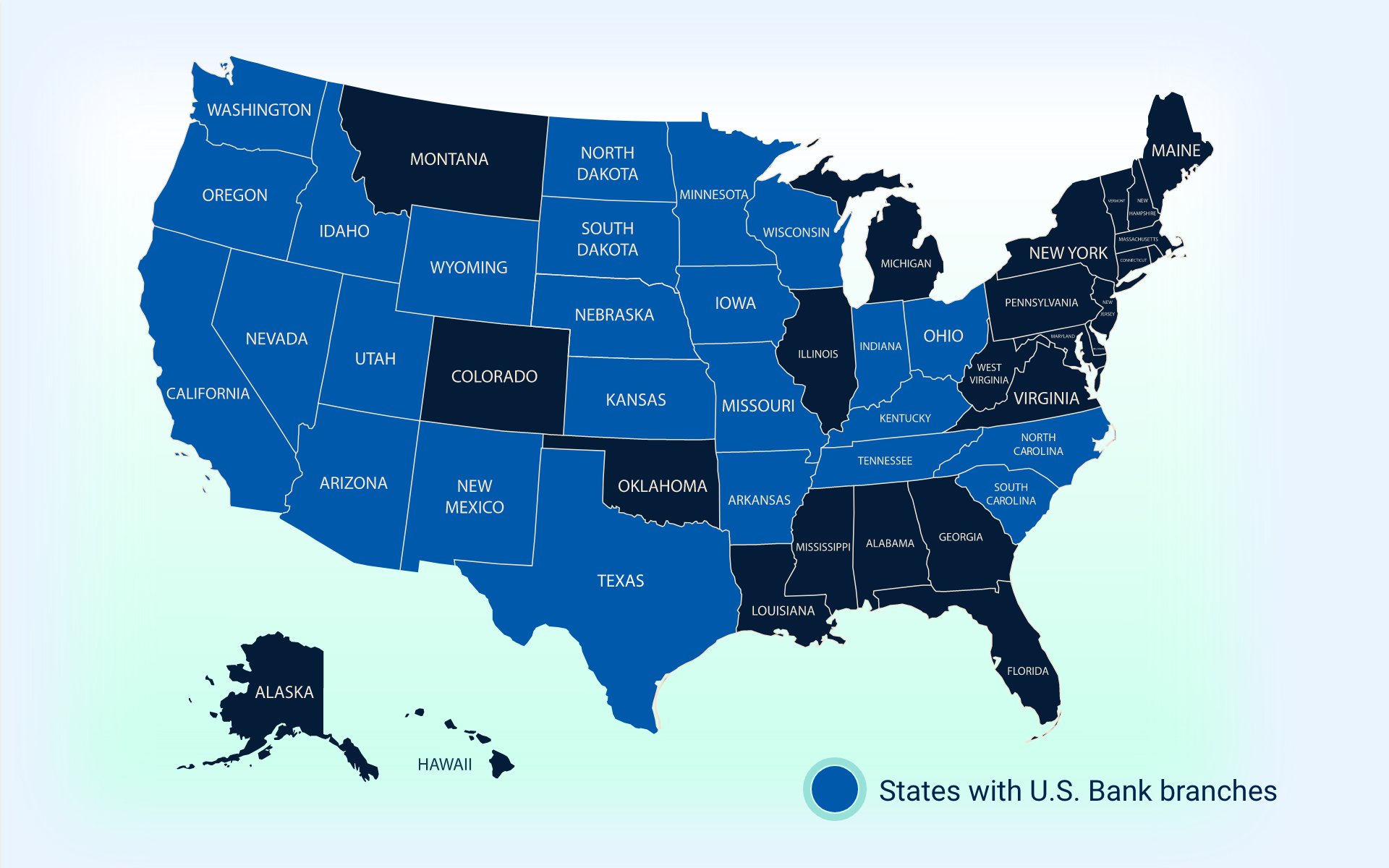

You can bank digitally with U.S. Bank anywhere in the country. If you prefer banking in person, it’s worth noting that U.S. Bank has branches primarily in the West and Midwest, with a recent expansion to the East Coast. States that have U.S. Bank branches are:

That said, the number of branches varies heavily from state to state, so even if there’s a branch in your state, it might not be close to you.

4. Banking rewards

You can enroll in Smart Rewards after opening a U.S. Bank Smartly Checking account. All account holders enjoy

- Interest earned on checking

- No overdraft fee if the balance overdrawn is $50 or less

- Overdraft fee forgiven for overdrawn balances over $50

- No ATM transaction fees at U.S. Bank ATMs

- Increased interest opportunities

- Other waived fees

- Discounts

As you maintain balances in your checking, savings, Money Market, CDs, and IRAs, you automatically progress through the four Smart Rewards® tiers (Primary, Plus, Premium or Pinnacle).

5. Overdraft protection

If your balance is overdrawn under $50, you will not pay an overdraft fee.

That said, if your Smartly Checking account’s available balance is overdrawn by more than $50 or you were charged an overdraft paid fee, the Overdraft Fee Forgiven program gives you some time to take action and have the fee waived. If you fund your account with qualifying deposits to cover the overdraft by 11 p.m. ET the business day you were charged with the fee, you may qualify to get the fee waived.

There are also several ways you can stay informed to avoid an overdraft with your account, including setting up your email, text, or push notifications for Overdraft Fee Forgiven.

6. ATM access

U.S. Bank has more than 4,500 ATMs for customers. This is one of the largest ATM networks in America. You can find an ATM near you online or in the mobile app.

7. Deposit insurance

U.S. Bank is an FDIC-insured bank, so customers know that their money is safe. For single checking accounts owned by one person, the coverage limit is $250,000. For joint checking accounts, the coverage limit is $250,000 per co-owner.

8. Helpful financial tools

U.S. Bank offers a variety of helpful financial tools including investment management, wealth planning, trusts and estate support, business owner advisory services, and more. Whether you are planning for retirement, a child’s college fund or another major life event, U.S. Bank offers financial advisors and wealth specialists to help you reach your goals.

9. Mobile features

The award-winning U.S. Bank mobile app lets you:

- Deposit checks

- Pay monthly bills

- Transfer money

- Pay using a digital wallet

- Check your balances

- Lock or unlock your card

- Send and receive money with Zelle

- Monitor your credit score

- Create a budget

- Track your spending

- Set financial goals, and more

The app also has a U.S. Bank Smart Assistant to help you save time and get personalized insights on saving and spending.

What makes U.S. Bank Smartly Checking stand out?

1. Highly rated mobile app

- Intuitive user interface: The Smartly Checking Account boasts a highly-rated mobile app, providing users with a seamless and intuitive interface for managing their finances on the go.

- Advanced features: Enjoy the convenience of cutting-edge features, including mobile check deposit, real-time transaction tracking, and personalized notifications for a comprehensive mobile banking experience.

2. Overdraft protection options

- Flexible overdraft solutions: U.S. Bank Smartly Checking goes beyond the ordinary by offering flexible overdraft protection options. Customers can choose from a range of solutions to tailor their account to their specific needs.

- Transparent policies: Clear and transparent policies ensure that users can manage their accounts responsibly, with the added security of overdraft protection when necessary.

3. Built-in Smart Rewards program

- Earning rewards made easy: The Smartly Checking Account includes a built-in Smart Rewards program, allowing users to earn rewards effortlessly as they manage their day-to-day finances.

- Redeemable benefits: Accrued rewards can be redeemed for various benefits, creating an additional layer of value for Smartly account holders.

4. Account opening bonus

- Incentives for new customers: U.S. Bank entices new customers with an attractive account opening bonus for those who choose the Smartly Checking Account.

- Promotional offers: The bonus serves as a welcome gesture, providing an immediate incentive for individuals looking to experience the unique features and benefits of the Smartly account.

Is U.S. Bank a good bank for checking accounts?

U.S. Bank is generally considered a reputable and well-established bank, offering a range of financial products, including checking accounts. However, whether U.S. Bank is a good choice for a checking account depends on individual preferences, financial needs, and priorities.

For example, U.S. Bank offers an extensive network of branches and ATMs, award-winning digital services, innovative features, and a variety of features within the checking accounts such as Smart Rewards and the ability to earn interest.

However, it’s important to review the fees and charges associated with the account, and while you can earn interest, these rates are relatively low compared to some other institutions.

U.S. Bank vs. other checking accounts

U.S. Bank vs. Bank of America

Comparing U.S. Bank Smartly Checking and Bank of America SafeBalance Banking:

| U.S. Bank | Bank of America | |

|---|---|---|

| Types of checking accounts | Smartly Checking

Safe Debit |

SafeBalance Banking

Advantage Plus Banking Advantage Relationship Banking |

| Number of branches | More than 2,400 branches in 28 states

More than 4,500 ATMs nationwide |

More than 3,800 branches in 39 states

More than 16,000 ATMs nationwide |

| Monthly maintenance fee | $6.95 or $0 | $4.95 or $0 |

| Minimum deposit | $25 | $25 |

| APY | 0.001% – 0.005% | SafeBalance Banking: Earns interest on balances up to $15,000.

Advantage Relationship Banking: Earns tiered interest rates on balances. The interest rates for Bank of America’s checking accounts can vary depending on your location. |

| Overdraft protection | Yes | No |

| Notable features | Smart Rewards program, overdraft protection tools, ability to waive monthly maintenance fees | Spending and Budgeting tool, mobile deposits, custom alerts, ability to waive monthly maintenance fees |

| Apply now | Apply now |

U.S. Bank vs. Chase

Comparing U.S. Bank Smartly Checking and Chase Bank Total Checking:

| U.S. Bank | Chase | |

|---|---|---|

| Types of checking accounts | Smartly Checking

Safe Debit |

Total Checking

Secure Banking |

| Number of branches | More than 2,400 branches in 28 states

More than 4,500 ATMs nationwide |

More than 4,700 branches across 48 states

More than 15,000 ATMs nationwide |

| Monthly maintenance fee | $6.95 or $0 | $12 or $0 |

| Minimum deposit | $25 | N/A |

| APY | 0.001% – 0.005% | N/A |

| Overdraft protection | Yes | Yes |

| Notable features | Smart Rewards program, overdraft protection tools, ability to waive monthly maintenance fees | Free credit score, QuickDeposit, overdraft protection, ability to waive monthly maintenance fee |

| Apply now | Apply now |

Methodology

In conducting our review of the U.S. Bank Smartly Checking Account, we employ a comprehensive methodology that considers various critical aspects to provide readers with an informed assessment. Our overall rating is derived from a weighted average of several key categories, including checking account features, fees, accessibility, account limits, technological capabilities, customer service quality, and innovative offerings. Depending on the category, we take into account factors such as interest rates, fees, ATM and branch availability, account features, and user experience.

FAQs

U.S. Bank Smartly® Checking: This account has a monthly fee of $6.95, but you can avoid it by meeting at least one of these conditions:

- Having combined monthly direct deposits totaling $1,000 or more.

- Keeping an average account balance of $1,500 or greater.

- Having an eligible U.S. Bank credit card in good standing and being an account owner.

Safe Debit Account: This account has a flat monthly fee of $4.95, and there are no options to waive it.

The fees associated with withdrawing money can vary depending on the type of account you have and the ATM you use. U.S. Bank may charge a fee for using ATMs outside their network. You’ll pay $0 at U.S. Bank ATMs.

The daily withdrawal limit for U.S. Bank accounts can vary based on the type of account and other factors. Generally, banks set daily withdrawal limits to protect against fraud and ensure the security of account holders. U.S. Bank has daily ATM withdrawal limits of $500 and daily debit purchase limits of $10,000.