Best Buy Now, Pay Later Apps

About Caitlyn

Caitlyn is a freelance writer from the Cincinnati area with clients ranging from digital marketing agencies, insurance/finance companies, and healthcare organizations to travel and technology blogs. She loves reading, traveling, and camping—and hanging with her dogs Coco and Hamilton.

Read full bio

At a Glance

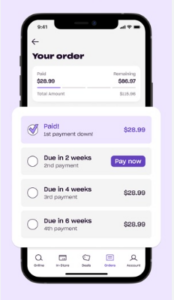

Buy now, pay later (BNPL) apps are similar to credit cards in that they allow you to buy something today and pay for it over time, but many do not charge interest as long as you make scheduled payments. Many retailers partner with BNPL apps to make it easier for people to make purchases online, and these apps are easy to use, have low fees and interest rates, and credit limits allow for the most common purchases.

BNPL is definitely growing in popularity as a credit card alternative. A recent Credello survey found that 43% of BNPL shoppers use BNPL apps such as Klarna during the holiday season and 23% of BNPL shoppers strongly agree that if a store or online shop doesn’t offer BNPL, they would be less likely to shop there. This article will include:

$150 billion

Is the market worth of BNPL.

Comparing the best buy now pay later apps

| App | Best For | APR | Loan Amounts | Terms | Availability |

|---|---|---|---|---|---|

| Affirm | Long-term financing | 0% to 36% | $50 – $17,500 | Four interest-free payments every 2 weeks

3, 6, or 12 month terms |

Apple

|

| Sezzle | Rescheduling payments | 0% to 34.00% | Up to $2,500 | 4 installments over 6 weeks (0% interest)

Monthly (3 to 48 months) |

Apple

|

| Afterpay | Zero interest | 0% to 35.99% | $400 – TBD | 4 interest-free, bi-weekly payments

6 or 12 months |

Apple

|

| PayPal | No late fees | 0% to 29.99% | $30 – $10,000 | 4 interest-free, bi-weekly payments

6, 12, or 24 months |

Apple

|

| Klarna | Variety of payment plans | 0% to 29.99% | Dependent on credit | 4 interest-free, bi-weekly payments

30 days Up to 24 months |

Apple

|

| Zip | No credit checks | 0% | Typically $25 – $1,500, but vary by retailer | 4 interest-free, bi-weekly payments | Apple

|

A closer look at the top BNPL apps and sites

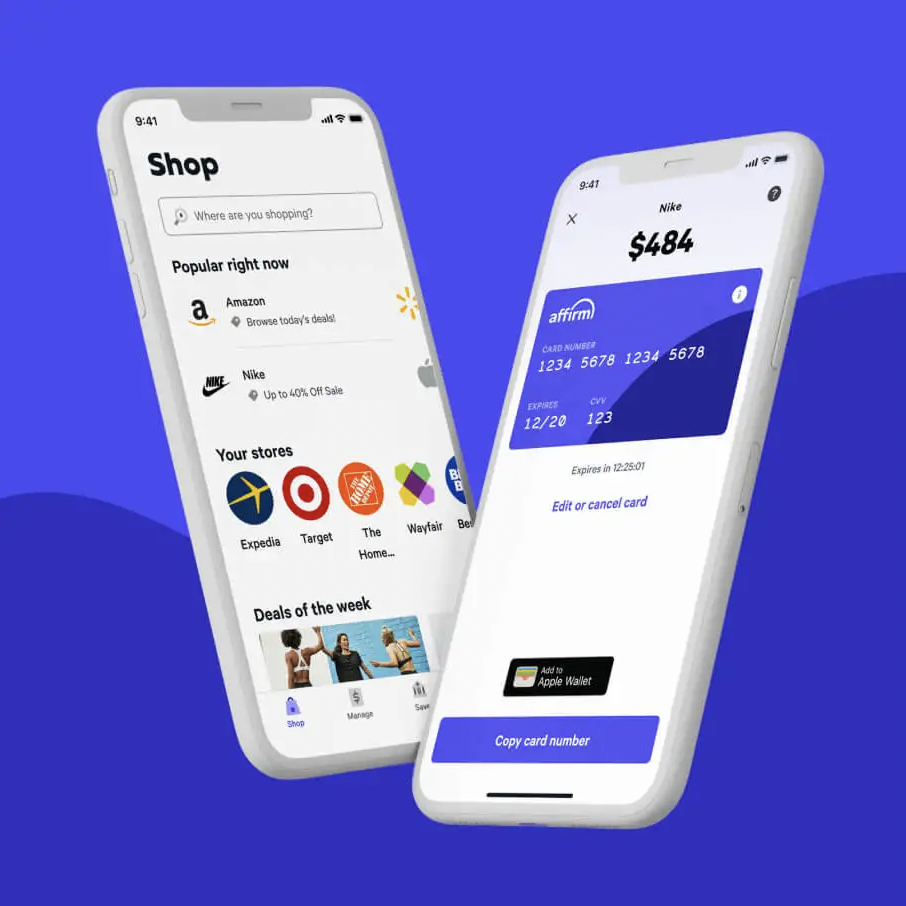

Affirm

APR: 0% to 36%

Fees: None

Purchase limit: $17,500

Amount due at purchase: Pay in full or split on orders over $50 (including discounts, shipping, taxes)

Payment schedule:

- Shop Pay Installments (purchase is split into four, bi-weekly payments)

- Monthly payments

Apple Store rating: 4.9/5

Google Play rating: 4.8/5

Our verdict: If you’re using a BNPL app, Affirm can be a great option with no fees, no or simple interest, and easy repayment terms. With Affirm, you can make four interest-free payments every two weeks with no interest or fees and no impact on your credit score. Or, choose monthly installments (three, six, or 12 months). Use Affirm during online checkout or request a one-time-use virtual card and you can shop online or in-store.

Purchases between $50 and $17,500 are eligible, and APR depends on the store, your purchase, and your repayment plan. When you make a purchase, you know exactly what you’re paying and when the payments will be done. With the mobile app, you can get special deals and discounts, discover new brands, and get prequalified with just a few taps. And, you can shop and make payments directly in the app.

| Pros | Cons |

|---|---|

| Shop online and in-store. | Depending on the size of the purchase and where you’re shopping, payment plans may include interest. |

| No fees. | Up to 36% APR. |

| Creating an account doesn’t impact your credit score. | Credit score can be impacted depending on payment history, how much credit you’ve used, and how long you’ve had credit. |

| You’ll never owe more interest than you agree to on day 1. | Partial or late payments can affect your ability to use Shop Pay Installments. |

| Choose the payment schedule that works for you. | Some restricted items. |

| Purchases up to $17,500. | Most transactions require a credit check. |

| Mobile-only discounts and deals. | Only two payment options. |

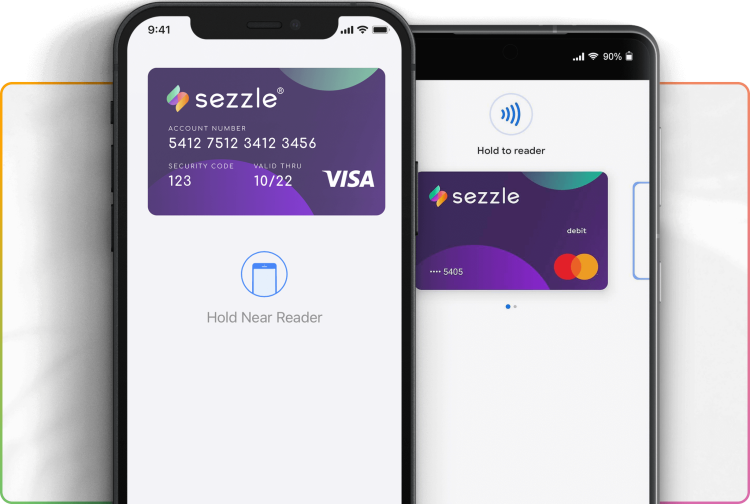

Sezzle

APR: 0% to 34.99%

Fees:

- Failed payment fees: $10 (depending on state)

- Reschedule fee: $5 (depending on state)

Purchase limit: $2,500

Amount due at purchase: 25% (counts as first installment payment)

Payment schedule:

- 4 installments over 6 weeks (0% interest)

- Monthly (3 to 48 months)

Apple Store rating: 4.9/5

Google Play rating: 4.7/5

Our verdict: While a 25% down payment is required for purchases, you can then break the remaining payments up to three additional payments every two weeks for 0% interest. There is only one type of payment plan (other than monthly), but there are more than 47,000 active merchants on the platform and users can shop online and in person. One major bonus with Sezzle is that you can reschedule your payments up to three times.

| Pros | Cons |

|---|---|

| Shop more than 47k brands (online and in person). | Down payment may be required (up to 25%). |

| App-exclusive deals. | Additional payments aren’t rescheduled if you don’t choose the “reschedule” option. |

| Virtual card option for tap-and-pay (later) in-store. | Fees for additional reschedules. |

| Manage existing orders, reschedule future payments, change payment methods, and get notifications. | Failed payment fees. |

| 4 installments over 6 weeks with 0% interest. | Maximum open order limit of two. |

| On-time payments can improve credit score. | Account deactivated after 48 hours when you miss a payment; reactivation fee of $15. |

| Can reschedule payments up to three times (without fees). | First-time customers may have a smaller limit ($50 to $200). |

| Doesn’t affect credit to apply. |

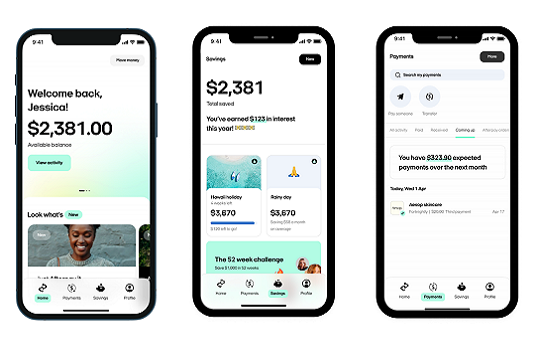

Afterpay

APR: 0% – 35.99%

Fees:

- Up to $8; the aggregate sum of late fees up to 25% of the order value at the time of purchase

Purchase limit: Depends on how long you’ve been a customer, payment history, and creditworthiness.

Amount due at purchase: Dependent on plan

Payment schedule:

- 6 months

- 12 months

- 4 interest-free payments

Apple Store rating: 4.9/5

Google Play rating: 3.9/5

Our verdict: When using Afterpay, simply shop select stores online (or at a store that accepts Afterpay), pick Pay Monthly at checkout, choose your payment plan (and see interest rates up front) and then make monthly payments over six or 12 months or four interest-free payments. There are no late fees and no origination fees if you make payments on time, but you may be charged up to $8 if the payment isn’t received within 10 days of the due date (the aggregate sum of late fees associated with a particular order could reach 25% of the order value at the time of the purchase). Interest accrues daily based on the outstanding principal balance.

Afterpay has no minimum and the amount of credit you can access depends on how long you’ve been a customer, your payment history, and your creditworthiness (typically starts at $600.)

| Pros | Cons |

|---|---|

| App-exclusive brands and offers. | Credit limit depends on your time as a customer, payment history, and creditworthiness. |

| 100,000+ of brands and millions of products online and in-store (online checkout and virtual card available). | Poor customer service reviews (according to Better Business Bureau) |

| Three payment plans to choose from. | Does not always approve refunds. |

| No credit checks and does not impact credit score. | High late fees. |

| 0% interest available. | Purchase could be declined if the retailer has a specific spending limit. |

| Online checkout or virtual card available. | Spending limits can change over time based on use. |

| Spending limits can change over time based on use. | |

| No fees if you pay on time. |

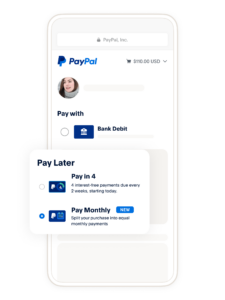

PayPal

APR: 0% – 29.99%

Fees:

- No late fees when you choose Pay in 4 or Pay Monthly

Purchase limit:

- Pay in 4: $1,500

- Pay Monthly: $10,000

Amount due at purchase:

- Pay in 4: 25% of payment

- Pay Monthly: $0

Payment schedule:

- 4 bi-weekly payments (0% interest)

- 6 months

- 12 months

- 24 months

Apple Store rating: 4.4/5

Google Play rating: 4.2/5

Our verdict: With PayPal, you can split purchases between $30 and $1,500 into four interest-free, bi-weekly payments without worrying about late fees. Or, you can set up payment plans over six, twelve, or 24 months with $0 down and no sign-up or late fees (with interest 9.99% to 29.99%), and you’ll receive your approval decision within seconds. You may be automatically enrolled in autopay, use a debit or credit card or confirmed bank account for payment (depending on the repayment plan) and purchase protection is included.

If you’re wanting to make a small purchase, the Pay in 4 plan can be a good option. However, larger purchases can accrue interest at a much higher rate. That said, no late fees and the fact that activity isn’t reported to the credit bureaus set PayPal apart from other BNPL providers.

| Pros | Cons |

|---|---|

| Shop anywhere PayPal is accepted (millions of retailers). | Not available in stores or with merchants who do not accept PayPal. |

| 0% interest available. | Not available in all states. |

| No late fees. | Not reported to credit bureaus, so won’t help your credit score. |

| Pay in 4 automatically enrolls you in autopay. | Pay in 4 (0% interest) has a low order value. |

| High purchase amounts (depending on plan). | |

| Up to 24 payments available. . | |

| Purchase protection included. | |

| Approval decision within seconds. | |

| Mobile app allows you to manage your payments anywhere, anytime. | |

| Not reported to credit bureaus, so won’t hurt your credit score. |

Klarna

APR: 0% – 29.99%

Fees:

- None (if payments made on time)

- Late fee up to $7 charged if payment is unpaid after 10 days (or 25% of the installment, depending on which is less)

Purchase limit: Not disclosed (depends on payment history and outstanding balance)

Amount due at purchase:

Pay in 4: 25%

Payment schedule:

- Pay in 4 (4 payments every 2 weeks)

- Pay in 30 days

- Monthly financing

Apple Store rating: 4.8/5

Google Play rating: 4.5/5

Our verdict: Klarna has one of the most flexible payment plans available with BNPL apps, which makes this a good option for many customers. During checkout, create a virtual card in the Klarna app and use that number to complete the purchase. You can then either pay off your purchase in four equal payments (first due immediately and the rest paid every 3 weeks), pay the balance off within 30 days (with 0% interest), or use up to 24-month financing for larger purchases.

With the Pay in 30 days option, you’ll receive a digital invoice due in 30 days. If you’re happy with the order, you pay your final balance. Simply return what you don’t want and you won’t have to pay for it.

The monthly financing (up to 24 months) is offered in partnership with WebBank with interest rates up to 24.99%.

Plus, Klarna has a rewards club that you can join for free and earn points on your shopping (excluding Klarna Card purchases). Earn 1 point for every $1 spent with Klarna and turn those points into rewards from popular brands. The mobile app also offers price comparison tools, price drop notifications, auto-tracking, and more.

| Pros | Cons |

|---|---|

| Rewards club available. | Hard credit check may be required for one of the financing options. |

| Pay in 4 doesn’t require a hard credit check. | Each purchase must be approved by Klarna. |

| 500,000+ total merchants; virtual card numbers can be used online or in-person. | Late fees charged for payments 10+ days late. |

| Up to 24 months of financing available. | No option to build credit. |

| No fees (when payments are made on time). | May be charged higher interest rates on monthly financing. |

| 0% interest with Pay in 4 and 30-day financing plans. | |

| Mobile app features include price notifications, price comparisons, auto-tracking, and rewards. | |

| No early-payoff penalty. |

Zip

APR: 0%

Fees:

- $6 installment fee

Purchase limit: Varies by retailer

Amount due at purchase: 25%

Payment schedule: 4 interest-free, bi-weekly payments

Apple Store rating: 4.9/5

Google Play rating: 4.6/5

Our verdict: Zip, previously Quadpay, lets buyers break purchases down into four equal payments over a six-week time frame. There’s only one payment plan available, but it doesn’t charge interest and doesn’t impact your credit score. Shop thousands of retailers online, and with a digital card, you can also pay later in a physical store (wherever major credit cards are accepted).

There are late fees and installment fees up to $6 depending on your purchase size. However, if a payment is one day late or you have a delayed paycheck, Zip may be willing to move your payment due date.

If you’re planning a larger purchase, Zip may not be the best option, but it may work well for smaller purchases and does provide more flexibility with the ability to shop online and in stores.

| Pros | Cons |

|---|---|

| No impact to your credit score. | Does not improve credit. |

| 50,000+ online and in-store brands. | Installment and late fees. |

| Offers both physical and digital cards. | Only offers one payment plan. |

| Flexibility with payment due dates. | Late fees. |

| 0% interest. | |

| Use the mobile app or browser extension to shop at retailers that are not integrated with Zip. |

How to choose the best buy now, pay later app

There are several BNPL apps to choose from, each with both pros and cons. Some retailers only partner with one BNPL app, so the easiest way to choose is to pick the one that works with your favorite retailers.

If you have multiple options, other things to consider include:

- Your credit score. Some BNPL apps check your credit score and base your APR and purchase limit on your creditworthiness. Additionally, some report your activity to the credit bureaus while others don’t. If you don’t have a great credit score, it may make sense to choose a BNPL app that doesn’t check or impact your score.

If you want the activity to be reported to the credit bureaus, choose one that does this.

- Availability. Choose one that’s accepted at the stores you shop at. This will ensure you can use the BNPL program on large purchases. This will also help prevent you from opening multiple accounts and managing several different payment plans.

Keep in mind that some BNPL apps are only accepted online while others give the option to shop both online and in stores.

- The credit limit.These vary from company to company and depend on other factors like the size of your purchase, your creditworthiness, your history and payment history with the BNPL provider, and more. Make sure you qualify for the credit limit you need to complete your purchase.

- Fees and interest. Know the fees for using the service, including installment fees and late fees, as well as interest charged on your payments (if any).

- Payment plan options. Most BNPL apps have a variety of ‘pay in 4,’ meaning you pay off the purchase in four payments over a six-week period. However, some apps also offer additional options such as paying in 30 days, 6 months, 12 months, or even 24 months. Depending on the size of your purchase and financial situation, you may need to choose a program that offers more options.

When should you use a BNPL app?

You may choose to use a BNPL app when:

- You want to pay for a purchase over time.

- You want the option to pay off a purchase over time without being charged interest.

- You want to build credit without getting a secured credit card.

- You want to make/finance purchases without impacting your credit.

- There are few or no fees.

- The retailer you’re shopping at accepts BNPL services.

Learn More: Survey Reveals BNPL Shoppers are Redefining Bargain Hunting and Have No Store Loyalty

The product information provided here is based on research conducted up to a specific date and may have changed. For the latest and most accurate information, we recommend you to visit the respective app’s website before proceeding.

FAQs

Some BNPL apps do a hard credit inquiry to determine your creditworthiness, which can impact your score. Additionally, some do report your activity to the credit bureaus, which can help or hurt your score. However, there are some BNPL apps that do not report your activity and therefore do not affect your score.

There’s no set credit score required to use a BNPL app, though some use your credit score to determine your purchase limit and APR.

Virtual cards are a one-time use digital card created via BNPL apps and stored in virtual wallets (like Apple Pay and Google Pay). They can be used at select online and in-person retailers. Virtual cards are also considered safer than physical credit cards.