10 Possible Benefits of Obtaining a Personal Loan

Zina Kumock is a personal finance writer whose byline has appeared in Indianapolis Monthly, the Commercial Appeal and the Associated Press. As a finance expert, she has been featured in the Washington Post, Fox Business, and Time. She is a Certified Financial Health Counselor and Student Loan Counselor, and a three-time finalist for Best Personal Finance Contributor/Freelancer at the Plutus Awards. She has bachelor's degree in journalism from Indiana University and has worked for newspapers, magazines and wire services. She currently lives in Indianapolis, IN with her husband and two dogs.

About Caitlyn

Caitlyn is a freelance writer from the Cincinnati area with clients ranging from digital marketing agencies, insurance/finance companies, and healthcare organizations to travel and technology blogs. She loves reading, traveling, and camping—and hanging with her dogs Coco and Hamilton.

Read full bio

At a Glance

Personal loans are one way to help fund expensive purchases, projects, and goals, among other expenses, and, when used responsibly, can offer some great benefits, especially compared to other types of financing. If you carefully consider your needs and create a plan for repayment before taking out a personal loan, you may be able to both fund your goal and improve your credit score while doing so. That said, not everyone will benefit from personal loans. Anyone with limited income or who is already struggling to pay off debt or manage their finances should avoid taking out a personal loan.

In this article, you’ll learn:

While it is a type of debt and should be borrowed responsibly, there are several uses and benefits that can make personal loans a good option for borrowers, especially those with good or excellent credit scores.

There are various types of personal loans available from banks, credit unions, and online lenders with various terms and conditions. For these reasons, it’s important to thoroughly research your options and compare lenders to find the best personal loan for your needs.

Learn more: Everything You Need to Know About Personal Loans

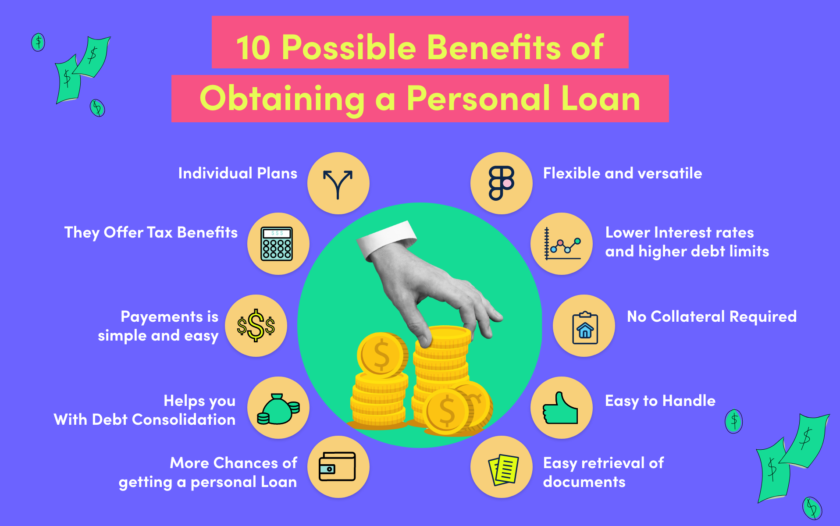

Benefits of getting a personal loan

A personal loan can be used for various purposes, including debt consolidation, home repairs, emergency medical expenses, and more. Because of this, personal loans can be a great choice for borrowers who need financing for something other than a home or vehicle. However, it’s important to note that many of the following benefits will depend on your personal situation and factors including your credit score, income, debt-to-income ratio, and more. For example, borrowers with good credit and income will qualify for the lowest interest rates and best terms, whereas those with bad credit or low income will see higher rates and less favorable terms.

Here are a few benefits of getting a personal loan, especially for well-qualified borrowers.

1. Higher borrowing limits than other debt

Personal loan amounts can range from $1,000 to $100,000 depending on the lender, your credit score, debt-to-income ratio, and other factors. While the average loan amount ranges based on credit score ($2,817.03 for less than 560 and $18,812.69 for more than 720), personal loan borrowing limits tend to be higher than credit card or other alternative limits. Thus, personal loans can be a good option for those who need access to greater funds than their credit limit provides, or who don’t want to max out their credit cards.

2. Lower interest rates

Personal loan interest rates are typically lower than other alternatives, especially credit card interest rates. For example, unsecured personal loan rates can be as low as 7.99%, though most average around 10% or 11% for well-qualified borrowers. On the other hand, credit card interest rates average 24% APR. For most borrowers, the higher your credit score, the lower the interest rate you’ll qualify for.

3. No collateral required

Most personal loans are unsecured, meaning you do not need to have assets to use as collateral. This is unlike mortgage loans or auto loans where your home or vehicle secures the loan, respectively. If you default on a secured loan, you risk losing those assets. If you risk defaulting on an unsecured loan, you could be sent to a collections agency and your credit score may suffer, but you won’t lose collateral.

4. Easier to track and manage

Personal loans are funded in one lump sum and have a fixed monthly payment. This makes it easier to manage, especially compared to having multiple credit cards with different spending limits, interest rates, payment dates, companies, etc. This can also make it easier to budget each month, knowing exactly how much you’ll owe and when.

5. Predictable repayment schedule

Personal loans usually come with fixed interest rates and fixed repayment terms. This means you’ll typically owe the same amount on the same day each month for the lifetime of the loan. You’ll also be able to easily calculate how much you’ll end up owing in interest, and when the loan will be completely repaid.

This is different from revolving lines of credit, like credit cards. While your payment due date is the same each month, your minimum monthly payment can vary and how much you owe in interest is subject to change depending on your outstanding balance.

6. Longer repayment terms compared to other loans

Personal loan repayment terms can vary from lender to lender. While the average is two to five years, you can have a term of seven to ten years depending on how much you borrow and how much you want to pay each month. Compared to payday loans and pawn shop loans, which have repayment terms of a few weeks, or revolving credit, which is typically repaid every month, these longer repayment terms can make having a personal loan more manageable.

7. Builds credit history

If managed responsibly, a personal loan can help improve your credit score. By making payments on time each month, you can help build your payment history, which makes up 35% of your score. However, by missing monthly payments, you can significantly damage your score. Additionally, if you’re taking out a personal loan to consolidate debt, it can lower your credit utilization, which can also help boost your score. Finally, having a personal loan may also improve your credit mix, which is another factor contributing to your overall score.

It’s important to note, however, that a personal loan will also cause your debt-to-income ratio to increase, which can make it more difficult to qualify for other types of loans, i.e., a mortgage. As there are many factors that go into a credit score, it’s important to consider your current situation, financial habits, and financial goals to understand how a personal loan could help or hurt you.

Related: How to Improve Credit with a Personal Loan

8. Easy to apply

Applying for a personal loan is relatively easy, especially if you prepare ahead of time and gather the appropriate information and documentation. You will likely need to provide bank account information, your desired loan amount and term, personal information, and proof of income. The steps to apply include:

- Estimate your loan amount.

- Check your credit score.

- Consider your options and shop around for the best rates.

- Fill out the application, most of which can be easily completed online.

- If approved, accept the loan and start making payments.

Most lenders offer loan applications online, and approval can happen in less than 24 hours.

Related: How to Apply for a Personal Loan

Find and compare the best loan options.

Advertiser Disclosure

Credello receives compensation from lenders and other providers of various products featured on this site. The compensation Credello receives does not influence a consumer’s ‘Match Score’ calculation, but it may influence how offers are ranked. The calculation of the ‘Match Score’ shown with some product listings is based on information provided by the consumer along with which lenders and/or products match the provided information. To maintain transparency, any product ranking influenced by compensation is called out as “promoted” or “sponsored.” To learn more about our recommendations and reviews, as well as how Credello makes money, read our full advertiser disclosure

Credello receives compensation from lenders and other providers of various products featured on this site. The compensation Credello receives does not influence a consumer’s ‘Match Score’ calculation, but it may influence how offers are ranked. The calculation of the ‘Match Score’ shown with some product listings is based on information provided by the consumer along with which lenders and/or products match the provided information. To maintain transparency, any product ranking influenced by compensation is called out as “promoted” or “sponsored.” To learn more about our recommendations and reviews, as well as how Credello makes money, read our full advertiser disclosure

Use the filters below to refine your search

Use the filters below to refine your search

Sorry, we didn’t find any options that meet your requirements. Please try modifying your preferences.

Congratulations! You’re close to seeing your offers!

Please take a second to review the details you shared earlier

![]()

Sorry, we didn’t find any options that meet your requirements. Please try modifying your preferences.

Find and compare the best loan options.

Use the filters below to refine your search

Sorry, we didn’t find any options that meet your requirements. Please try modifying your preferences.

Congratulations! You’re close to seeing your offers!

Please take a second to review the details you shared earlier

Sorry, we didn’t find any options that meet your requirements. Please try modifying your preferences.

9. Fixed interest rates

A fixed interest rate means the interest rate will not change over time unlike variable interest rates, which are subject to change based on economic factors. As most personal loans offer fixed interest rates, it’s easy to budget your monthly payment and calculate how much interest you’ll end up paying over the life of the loan.

10. Personal loans can be used for many purposes

As noted above, there are several reasons you can take out a personal loan. A personal loan can be used for emergency expenses or unexpected costs, a wedding, home repairs, medical bills, or to consolidate outstanding debt. And while it can be used for almost anything, a personal loan should be reserved for essential expenses that you can’t afford to pay cash for upfront, but can pay off over time. It’s not a good idea to take out a personal loan for something you want but can’t afford, i.e., a lavish vacation or new exercise equipment.

Reasons to get a personal loan

While you should carefully consider your financial situation and needs before taking out a loan, it can be helpful to know what personal loans can be used for. Just a few potential reasons to get a personal loan include:

- Consolidating debt.

- Completing home improvements / renovations.

- Funding further education or professional development.

- Paying medical expenses.

- Covering essential moving costs.

- Financing a large purchase, such as a boat.

- Funding a large event, like a wedding.

- Covering emergency or unexpected expenses.

Learn more: Reasons to Get a Personal Loan

Alternatives to personal loans

There are many alternatives to personal loans depending on your specific needs, though some of them are not recommended due to their high interest rates and other factors.

For example, you may want to consider a debt consolidation loan or a balance transfer credit card for consolidating and paying off outstanding debt. Additionally, a personal line of credit and credit card can be good alternatives for financing large purchases. You might also consider a home equity loan or home equity line of credit (HELOC) if you own your home and are willing to put it up as collateral.

A few alternatives to avoid due to their potential downsides include payday loans, pawn shop loans, 401(k) loans, and credit card cash advances. For those struggling with debt repayment, debt settlement can be another option as a last resort.

Learn more: Alternatives to Personal Loans

FAQs

Taking out a personal loan can be a good idea, but it’s important to consider all of your options and do research to find the best for you. Personal loans are great for borrowers with good to excellent credit scores who have a steady income, low debt-to-income ratio, and can fit the payments into their monthly budget. If you won’t qualify for a lower interest rate or can’t afford the monthly payment, it may not be a good idea.

Personal loan interest rates vary based on your credit score, income, debt-to-income ratio, the lender, the loan amount, and other factors. As of 2023, rates can range from about 7% to 36%, though the average is around 10.99%. The average interest rate based on credit score is:

| Excellent credit (720+) | 10.3% – 12.5% |

| Good credit (690 – 719) | 13.5% – 15.5% |

| Average credit (630 – 689) | 17.8% – 19.9% |

| Bad credit (below 629) | 28.5% – 32.0% |

How long it takes to get a personal loan depends on the lender. For example, banks tend to take the longest, followed by credit unions, and online lenders are usually the fastest. In fact, some online lenders approve an application as soon as the same business day, with funding times between one and four days. It’s important to fill out the loan application completely and provide all the requested information and documentation to help the process go faster.

Learn more: How Long Does It Take to Get a Personal Loan

The minimum credit score to qualify for a personal loan is 560 to 660, though some lenders won’t accept borrowers with scores lower than 670. Lenders that do accept applicants with lower scores will likely offer higher interest rates.

Getting a personal loan can be good for your credit if you make your payments on time (35% of FICO score). It can also help improve your credit mix, or different types of credit accounts you have (10% of your FICO score). Consolidating debts into a personal loan can lower your credit utilization ratio (30% of FICO score). However, missing payments or otherwise managing the loan improperly can damage your score.

Yes, sometimes. Lenders make interest rate determinations based on factors like your credit score and history, loan amount and loan term, and other factors. They may also consider what the money will be used for when determining the rate. However, personal loan funds can be used for just about anything, so some lenders may not take purpose into consideration.