Fill Out Your Bracket: How Will You Use Your Stimulus Money?

About Ryan

Ryan is a seasoned copywriter whose clients have included big banks, credit card companies, and financial services firms. In his spare time, he writes fiction and roams around looking for dogs to pet.

March Madness is back. After a COVID cancellation in 2020, the NCAA Tournament is happening in 2021—with the NCAA allowing teams to play even if they only have five healthy players for a game.

Needless to say, filling out your March Madness bracket this year was more of a nightmare than usual. The first round itself was upset city. But, here’s a fun alternative.

Vote on how you’ll use your stimulus money

Through the “American Rescue Plan,” people have started receiving their stimulus payments of up to $1,400.

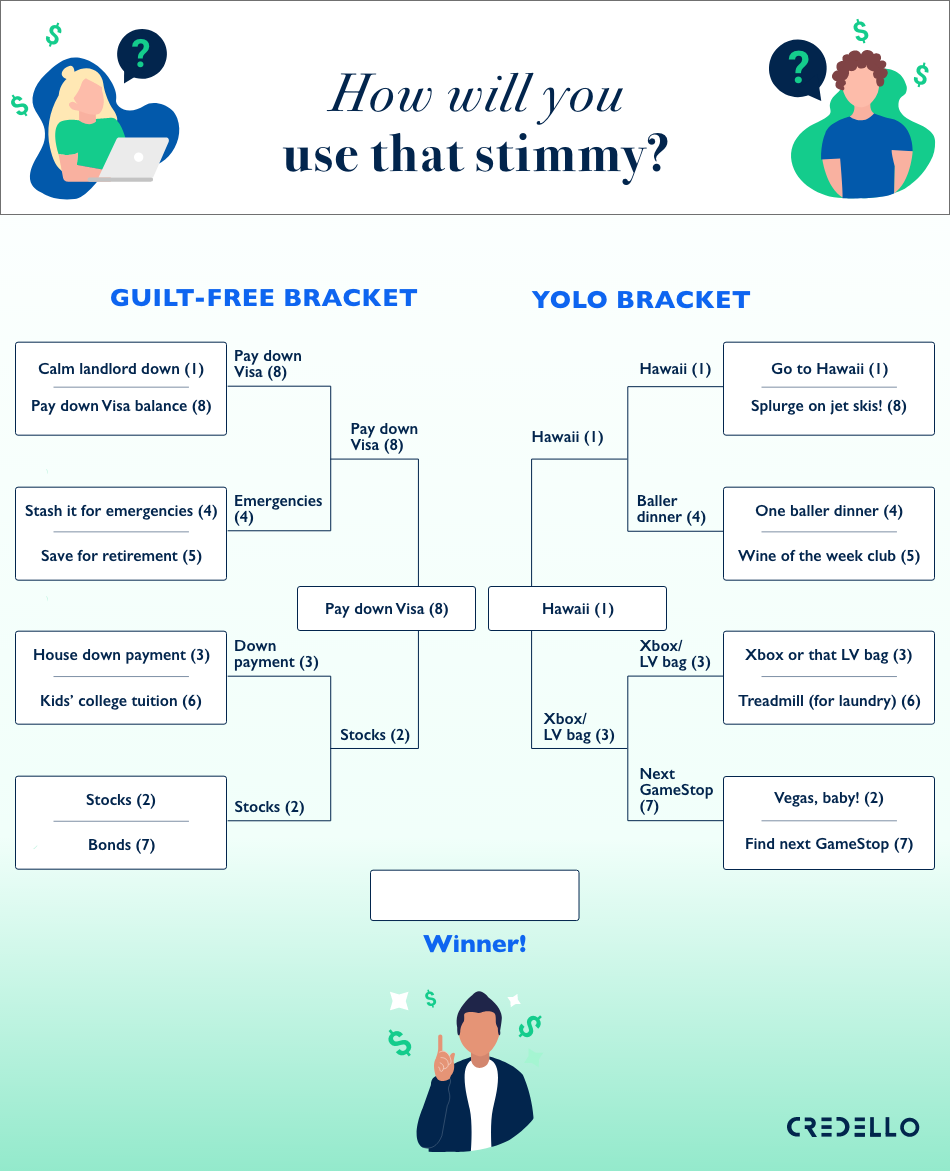

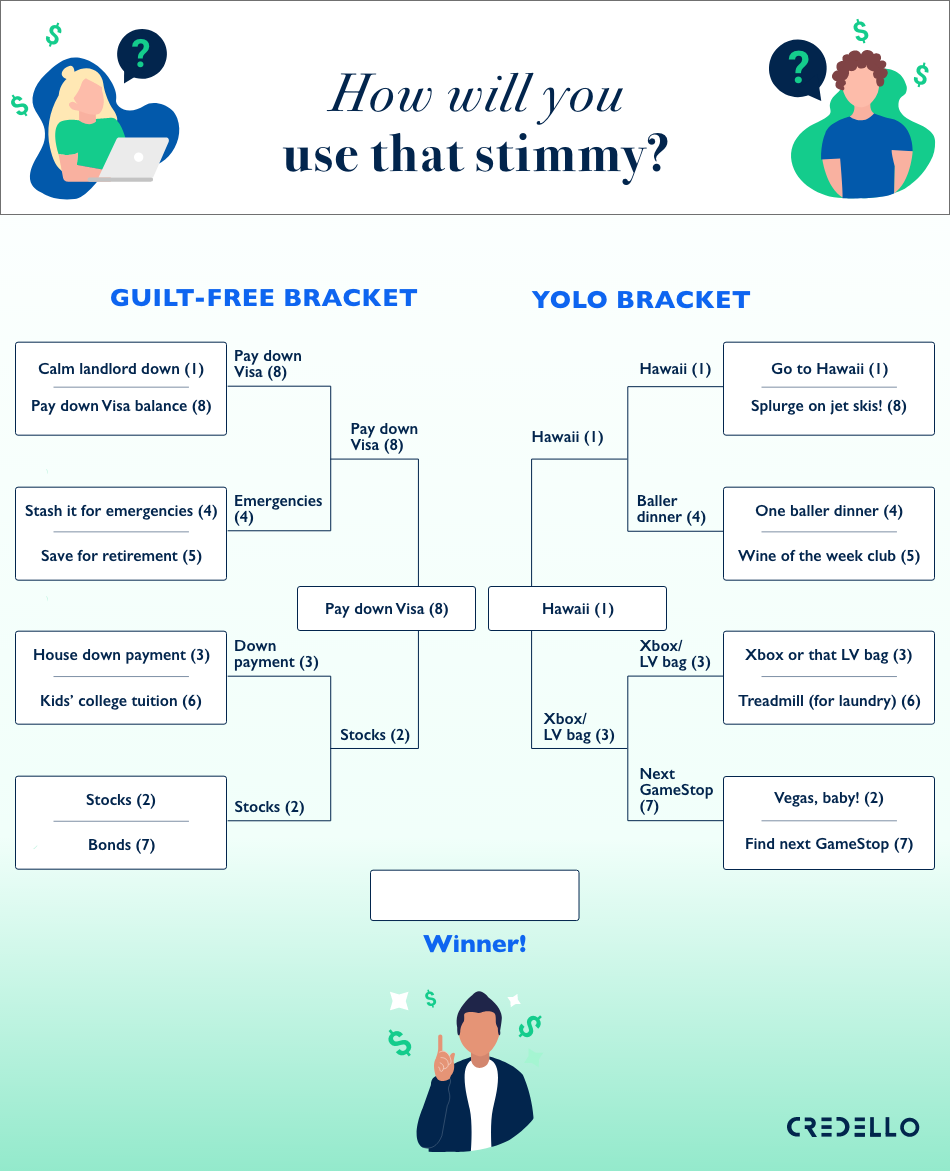

If you can’t decide what you want to do with your direct payment, we’ve created a bracket of 16 popular options you can mull over. Vote for your favorites to help us determine the definitive BEST way to use your stimulus money—whether it’s to pay off debt with the debt snowball method, invest it, or spend it on something you don’t need to “stimulate the economy.”

So, will you use the money in a way your parents would approve, or will you treat yo’self? Time for some stimmy bracketology.

THE CHAMPIONSHIP SHOWDOWN:

For all the marbles, what’s the best way to spend your stimulus money?

— Credello (@CredelloUS) April 5, 2021

The Stimulus Bracket

Because some Americans will actually use the relief money to relieve their financial burdens, we’ve divided our bracket into two “regions”: one with 8 responsible options, the other with 8… less responsible ones. To each their own.

The championship showdown

Go to Hawaii (1) vs. Pay down Visa balance (8)

More people would prefer to use their stimulus checks to pay down credit card debt than to invest in stocks. Likewise, a trip to Hawaii has run over its competition in the #YOLO bracket. For all the marbles, would you rather use your stimmy to take that exotic (and hopefully affordable) vacation to Hawaii or get rid of that credit card debt once and for all?

If you’re leaning toward paying off credit card debt, consider the debt snowball method—a do-it-yourself debt payoff strategy that prioritizes your smallest balances first.

Estimate your savings with this debt snowball calculator

How Many Debt Accounts Do You Have?

Include credit cards and all loans except mortgage. Snowball method is applicable if you have at least two of these.

Keep your credit and loan statements handy to fill in balance, payment and rate details.