How To Pay Off $30,000 in Student Loans in 7 Years

About Harrison

Harrison Pierce is a writer and a digital nomad, specializing in personal finance with a focus on credit cards. He is a graduate of the University of North Carolina at Chapel Hill with a major in sociology and is currently traveling the world.

Read full bio

At a Glance

Student loans are an unfortunate reality for many college students. More than 43 million Americans currently have federal student loans. To put that into perspective, there are around 258 million adults aged 18 or older in the U.S., meaning almost 17% of Americans are working on paying off their student loans. If this is the case for you, it’s important to have a plan as to how you repay your debts. Read on for a complete guide on how to pay off $30,000 in student loans in seven years.

$28,950

The national average student loan debt per borrower.

Adjust your mindset

Before you develop a repayment plan, you need to mentally prepare to pay off your student loans. $30,000 is a lot of money, and it will require a significant financial investment to pay off in seven years. You’re paying interest on these loans as well, so the longer you take to pay off your loans, the more you end up paying. You will likely need to sacrifice to pay off your loans in such a short time frame, but the sacrifice will be worth it when you are debt-free.

Gather your information

You need to know exactly how much you owe, what your interest rate is, who your loan servicer is, and what your minimum monthly payment is. Then, you need to look at your budget – how much you earn each month, how much you spend on fixed bills (rent, utilities, car payment, etc), and how much you spend on variable expenses. Once you have all the information, you can start developing your plan.

Come up with your plan

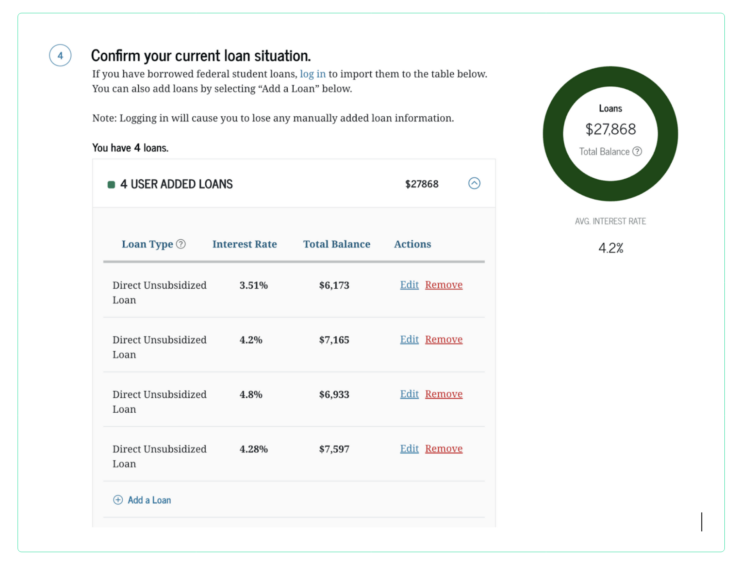

Assuming you have federal student loans, one of the best tools you can use is the loan simulator. To start, you put in the state you live in, your annual salary, how much you expect your salary to grow each year, and your loan data. I recommend entering your loans manually so you can put in the exact amount you owe and the interest rates. I put my loan information in so you can see what it looks like below.

You can select your repayment goal from the following options:

- Pay off my loans as fast as possible

- Have a low monthly payment

- Pay the lowest total amount over time

- Choose my monthly payment

- Pay off by a certain date

- I don’t have a specific goal

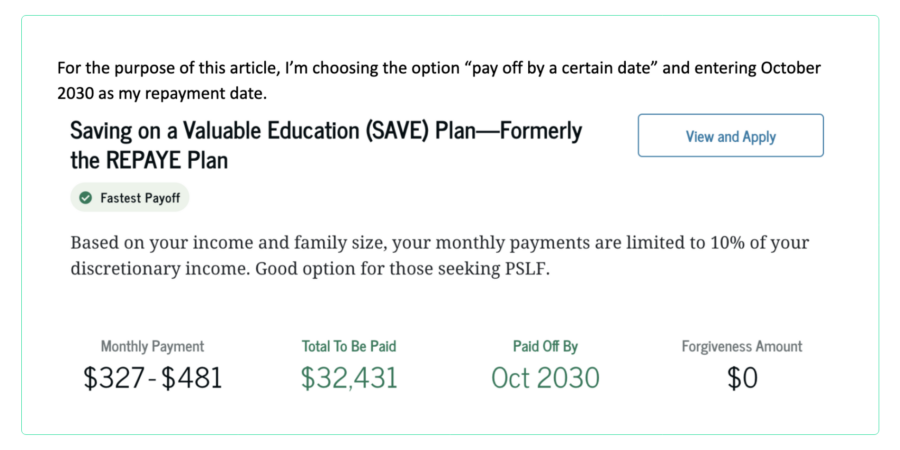

For the purpose of this article, I’m choosing the option “pay off by a certain date” and entering October 2030 as my repayment date.

As you can see, under this plan, I will start paying $327 per month. By 2030, I’m paying $481 per month, ultimately paying my student loans completely by October 2030. Adding a $327 payment to my current monthly budget isn’t easy, but it is possible by shifting some things around.

Adjust your budget

Unless you’re already pretty frugal with your spending, you will need to adjust your monthly budget to compensate for an additional $400 monthly payment. Whether you use an app like Mint or just go through your credit card and bank statements, find every possible way to lower your expenses. Cancel subscriptions you don’t need, negotiate your bills, scout out cheaper grocery stores, or whatever you need to do to comfortably afford this new payment. You can also consider getting a side hustle to make some extra money you can put toward your student loans.

Regularly review your plan

After you know how much you need to pay each month to meet your goal (in this case, $327-$481 to pay off my $28,000 loans in seven years), you should regularly look for options to pay off your debts quicker.

Consider refinancing or consolidating your loans

I am lucky and have a relatively low interest rate – the current interest rate on new federal student loans is 5.50%. If your interest rates are high, it could be worth refinancing your loans to get a lower rate, which means you’ll pay less interest over the life of your loan. When you refinance, a private lender will pay off your student loans and issue a brand new loan with entirely new terms. Although this can lower your interest rate, it also makes you ineligible for federal repayment plans or forgiveness if it were to happen. You can also consider consolidating your loans so you only have to keep track of one monthly payment.

Compare methods

There are two popular debt repayment methods – the avalanche method and the snowball method. If you follow the avalanche method, you will focus repayment on your student loan with the highest interest rate. If I followed this method, I’d pay the minimum on three of my loans and pay as much as possible on my $6,933 loan with a 4.8% interest rate. Once that loan is fully paid off, I’d focus on my $7,957 loan with a 4.28% interest rate while still paying the minimum on the other two loans.

The snowball method pays off the smallest loan first, then the next smallest, and so on. If I followed this method, I’d focus on paying off my $6,173 loan before moving to my $6,933 loan while still making the minimum payments on the others. This method doesn’t save quite as much on interest, but it does give borrowers a sense of accomplishment by fully paying off a loan.

As you can see, these methods differ from using a federal repayment plan. Under these plans, you’re paying off each loan in tandem.

Pay extra whenever you’re able

If you’re serious about paying off your student loans in seven years, every penny toward your goal can help. If you get a bonus, put that money toward your student loans. If you get a raise or a job with a higher salary, adjust your monthly budget to increase the amount you’re paying.

Bottom line

If you get discouraged, remember that this is only temporary. Following this repayment plan means you’ll be completely free of student loans in seven years. 2030 sounds far away, but it’s right around the corner. If you still have student loans, it can be challenging to buy a house, start a family, or accomplish your other financial goals. Focusing on repayment now means you can reach financial freedom sooner.