Changes in home values for the 50 Biggest Metros in the U.S.

City living isn’t for everyone as it can come with quite a high-cost factor. Here is a look at the most expensive cities in the U.S. based on various life costs.

What is a lifestyle? Well, that can mean different things to different people.

Are you looking through the eyes of an aspiring Kim Kardashian or somebody who has $50,000 of student loan debt to pay off? This infographic will walk you through the concept of what a lifestyle is and how much it costs to have one in America today for different generations and income levels.

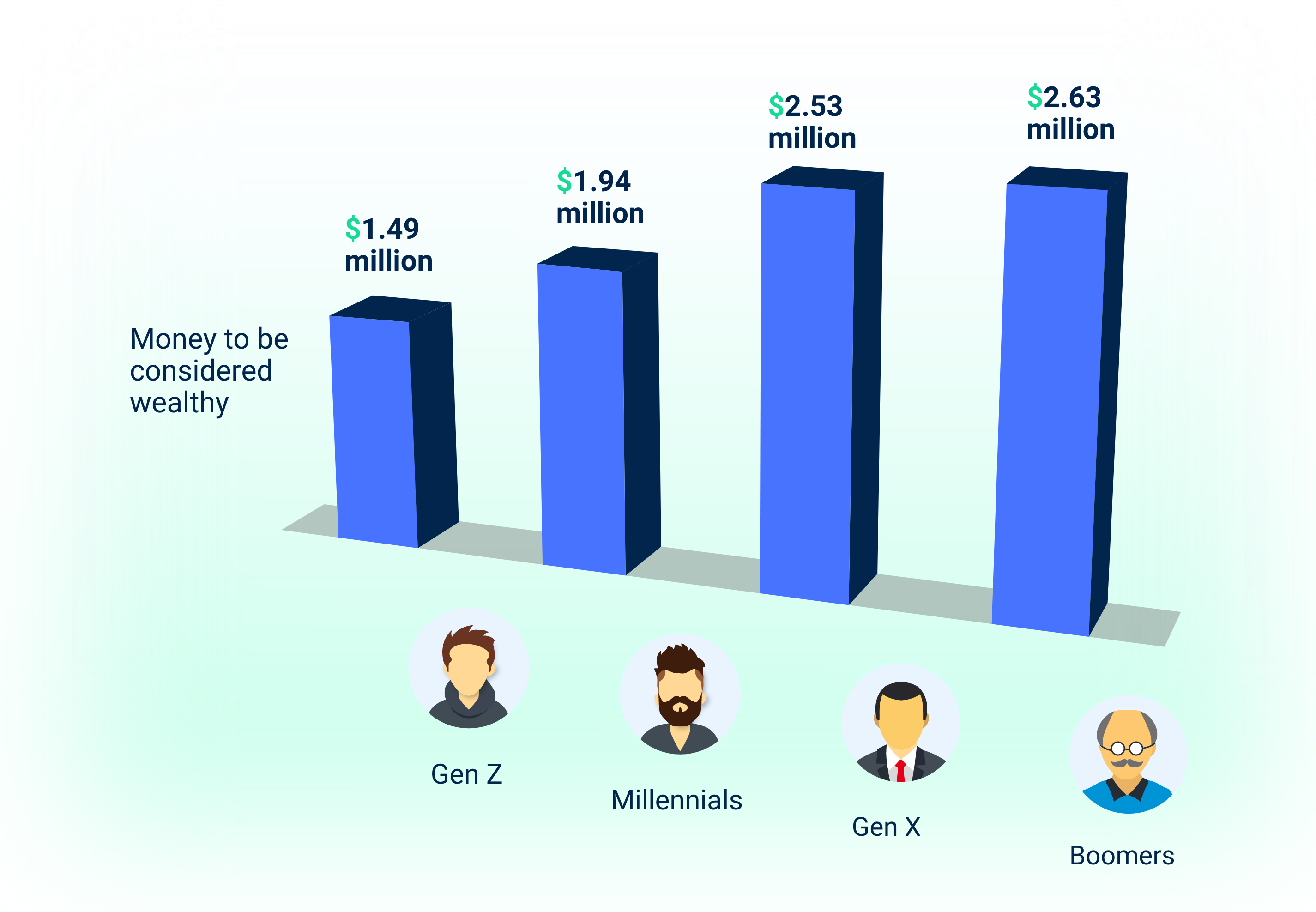

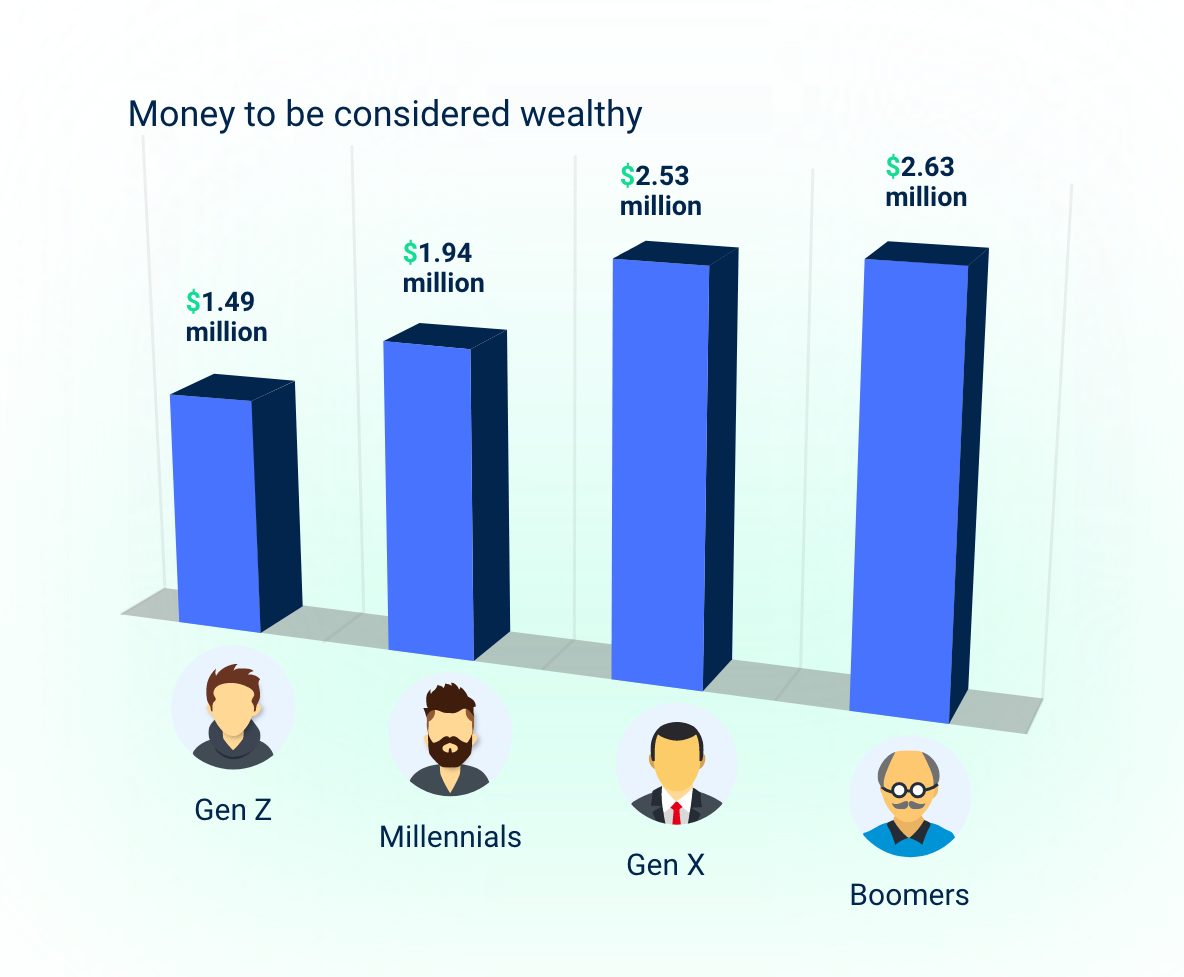

What people consider to be wealthy can mean very

different things for different people at different stages of life

|

|

happy |

|

|

|---|---|---|---|

| 2020Pre-Pandemic | $2.6M | $1.75M | $934K |

| 2021Post-Pandemic | $1.9M | $1.1M | $624K |

As you can imagine, the definition of wealth changes as you age.

For the average American that sweet spot of $2.27 million makes you truly wealthy according to the research

What are the basic things we need to get through each day? Several expenses contribute to the cost of living calculation, let’s examine the index to examine the affordability of all the states.

Here is a detailed look at the basic costs of living in

different states across the country.

Before we get to the fun part of lifestyle we need to talk about the cost of having food and shelter in the U.S. The cost of living in this country varies depending on location, but on average it is considered high compared to the rest of the world.

City living isn’t for everyone as it can come with quite a high-cost factor. Here is a look at the most expensive cities in the U.S. based on various life costs.

Are you keeping up with the Joneses? The original phrase came about in 1913 in a comic strip of the same name by Arthur R. Pop Momand and about a family of social climbers who try to keep up with their more financially fortunate neighbours. And now not only do we see know well the Joneses are doing, but they are making TikTok videos about it.

From coupon cutting to dining at the finest of restaurants costs can vary widely when it comes to your food budget.

From coupon cutting to dining at the finest of restaurants costs can vary widely when it comes to your food budget.

If we are lucky enough to be healthy, many people are trying to figure out how to live even longer and look good while doing it, no matter the cost.

Revenue in the Beauty & Personal Care market reached $571.1 billion in 2023 and is expected to grow by 3.8% through 2027. People are willing to shell out a lot of cash to be “healthy.” Just ask Gwyneth Paltrow.

Some people view clothes as a necessity, for others it is an art form that costs quite a lot of money.

Thanks to social media you can now see all the fabulous trips the Joneses are taking and for younger generations, experiences are worth more than money.

Except these experiences cost money so you do the math.

Thanks to social media you can now see all the fabulous trips the Joneses are taking and for younger generations, experiences are worth more than money.

Except these experiences cost money so you do the math.

Travel means different things to different generations and this shows in how much they spend.

Inflation is certainly having an impact on travel hiking up airfare prices causing many Americans to moderate or completely cancel travel plans.

Plans for post-pandemic revenge travel may be seeing a slowdown depending on how old you are.

Millennials are racking up debt due to skyrocketing inflation in the last few years. People ages 30 to 38 account for nearly $4 trillion of total household debt in the U.S.

More than 33% (those earning at least

$250,000 annually) are living paycheck-to-

paycheck

36% put all their income toward

household expenses

53% don’t have any extra cash left over after

paying their bills each month

Millennials, approaching their

40s, have no money left after paying

their bills each month.

Pressure to have the elevated lifestyle is strong which means credit cards

are getting a lot of activity.

Racking up credit card debt to have the perfect lifestyle?

Get in check and hit your goals starting now with MyCredello.

Thanks to social media you can now see all the fabulous trips the Joneses are taking and for younger generations, experiences are worth more than money. Except these experiences cost money so you do the math.

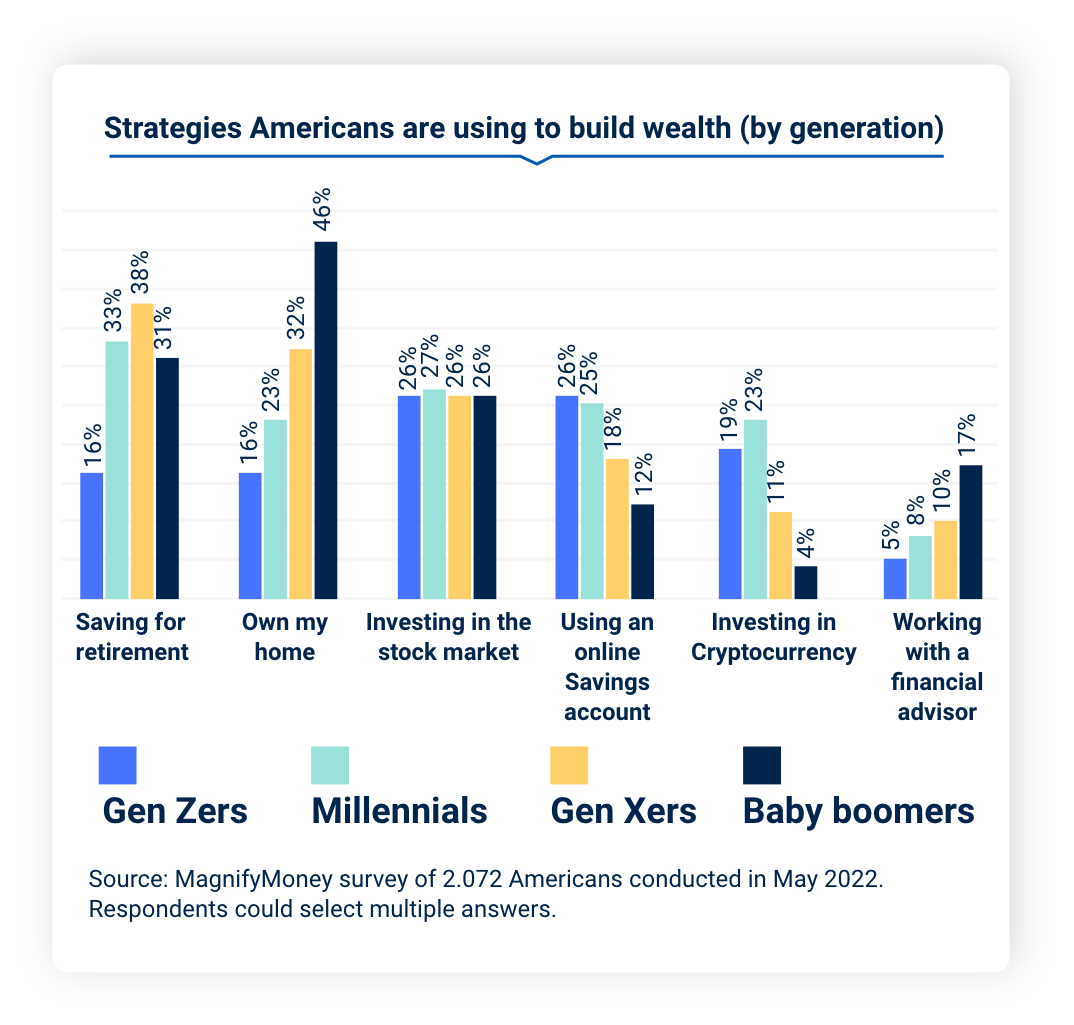

27% thinks owning a home is

the best way to build wealth

31% think saving for retirement

is the best wealth-building strategy

26% Gen Z are more likely to put

the money

in an online savings account

51% of high earners consumers have money

in stocks, which ties it with owning a home

Most Americans just want to be happy.

But money, whether we like it or not, can be a big part of helping people attain a lifestyle. Though luxury items, travel, real estate, cars, etc., have always been part of the American dream, social media has only given us more access to what that life could be, and it has driven people to covet these things even more.

For some, they are even going into debt to attain a lifestyle. If you are struggling with debt or just want to get a better handle on your finances, there are options.

MyCredello is a free personal finance tool that helps relieve those debt pain points and help you do much more to be financially fit. Enter training mode to build your financial fitness and be well on your way to financial freedom.

Create Your Free Account