SURVEY: Millennials Still Have No Regrets About Going into Travel Debt

About Casey

Casey is a reformed sports journalist tackling a new game of financial services writing. Mike Francesa once called her a “great girl.”

Read full bio

At a Glance

Millennials love traveling more than they love posting photos of their meals on Instagram. Posting photos of a meal that they’re about to eat while on a trip? Fuhgeddaboudit.

Prepare for your feed to be full of that this summer as folks have spent the past 15 months building up their airline miles and stashing away cash. They’re eager to take to the skies and hit the road for summer travel 2021.

And if they haven’t prepared financially for a getaway, that likely won’t stop them. Let’s just say millennials know a lot more about going into summer travel debt than they do about filing their taxes.

Key takeaways on summer travel 2021:

- Most millennials are willing to take on at least $500 in debt for summer travel plans

- More than three-quarters of millennials are only traveling domestically, with about a third staying within driving distance of home

- Married couples and couples who live together are more inclined to take on summer travel debt than single people are

- Millennials with kids are more likely than their childless counterparts to take on travel debt

Watch out world: the millennials are coming

In a Credello summer travel survey of 500 American millennials—a.k.a. people ages 25-40—63% said they’re planning to travel during ‘Shot Girl Summer,’ or whatever we’re calling the Summer of 2021.

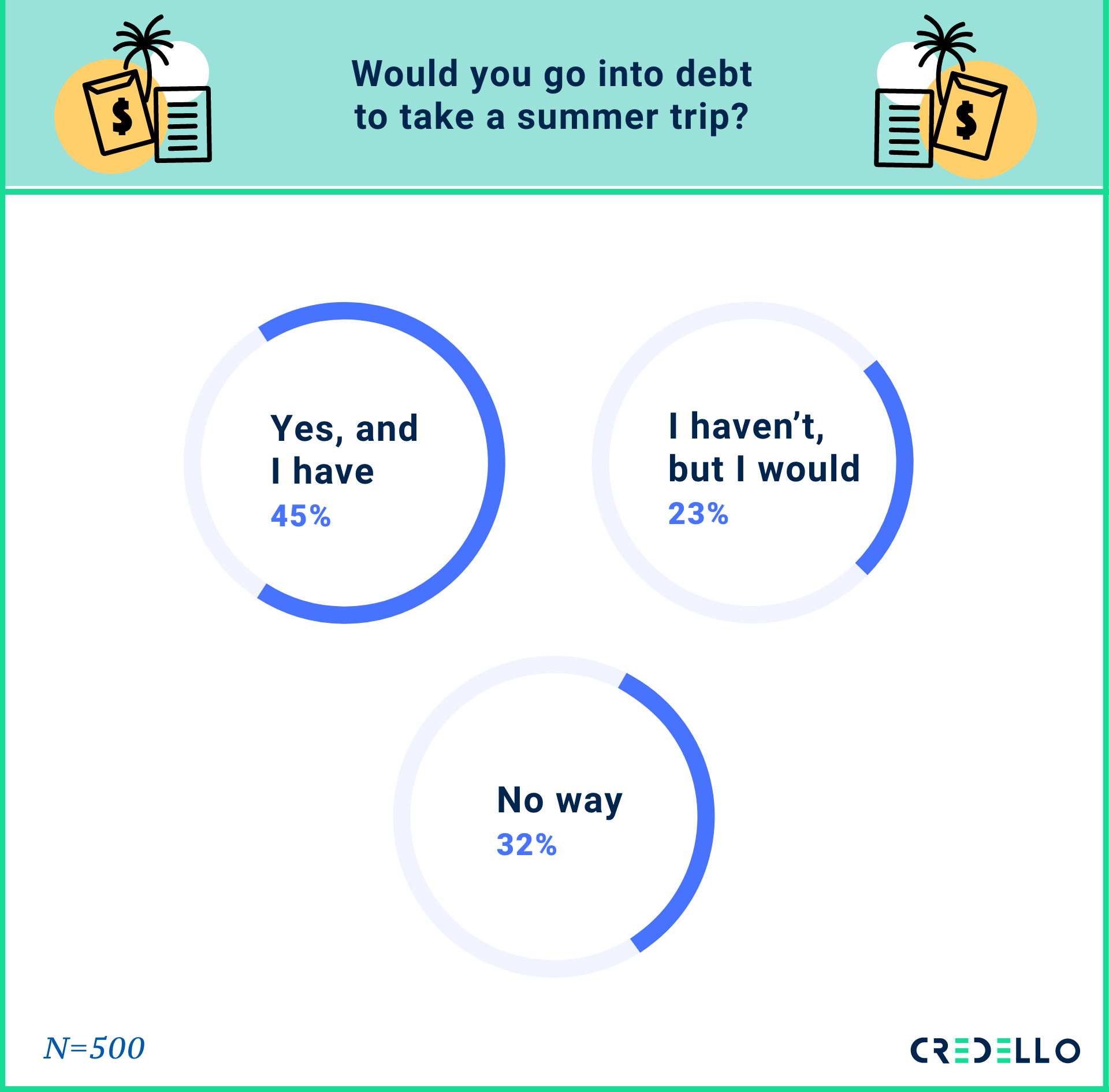

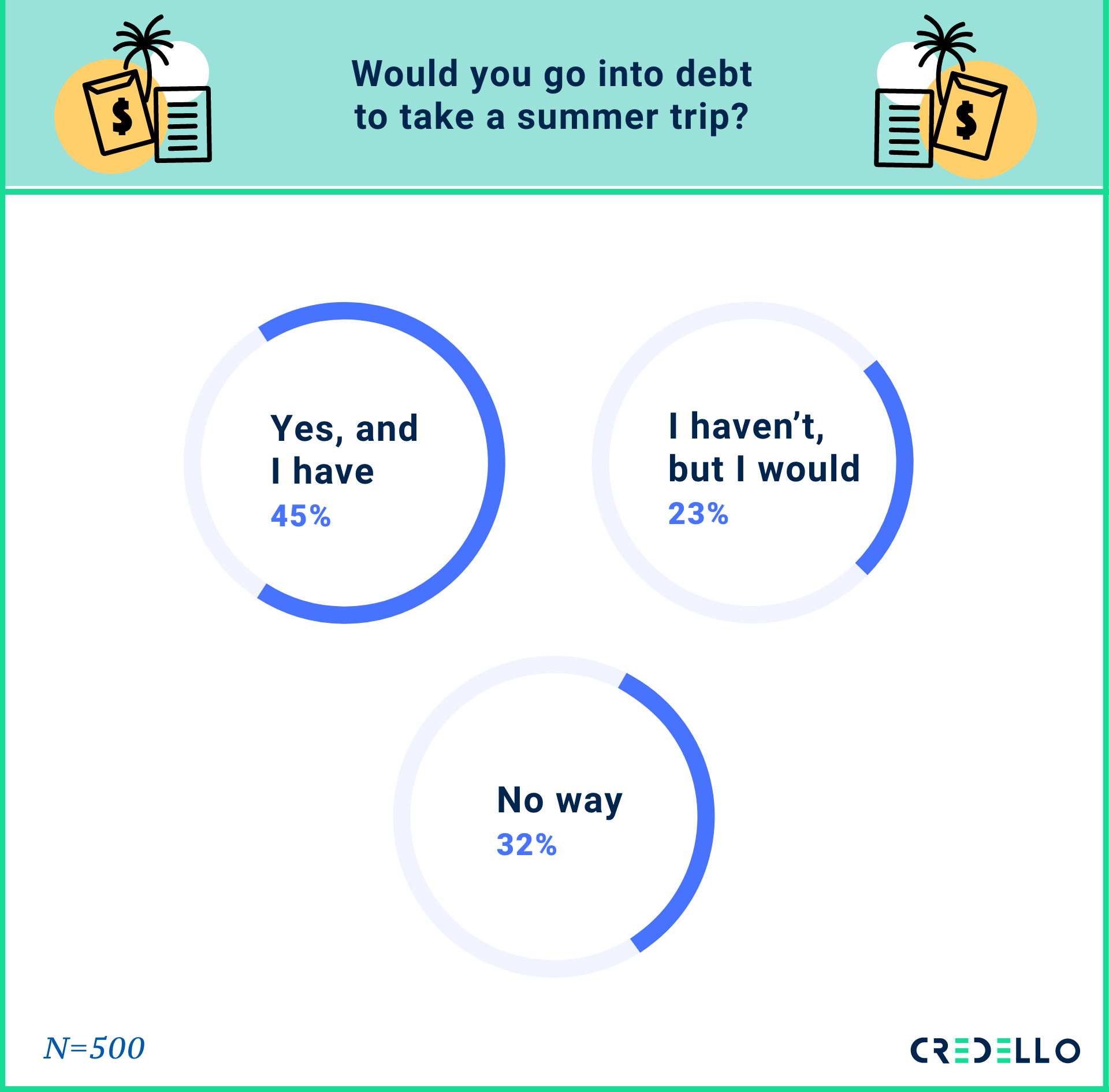

Of those surveyed, 45% said they’ve gone into debt for summer travel and would do it again, while 23% said they haven’t gone into debt for summer travel in the past but would. Only about a third of respondents said there’s no way they’d go into debt for a summer trip.

Despite a devastating year-plus because of COVID-19—which has led to the death of more than 600,000 Americans, unprecedented job loss, and the worst blow to the global economy since World War II— these numbers are not all that different from the pre-pandemic travel and debt figures among millennials.

According to a 2019 Credit Karma survey, 42% of all Americans were willing to go into debt for travel, and 56% were like Katy Perry this Friday night: ready to do it all again. Among millennials surveyed, about 51% said they had gone into debt for summer travel, and 76% had no ragrets—not even a single letter—about going into debt for travel.

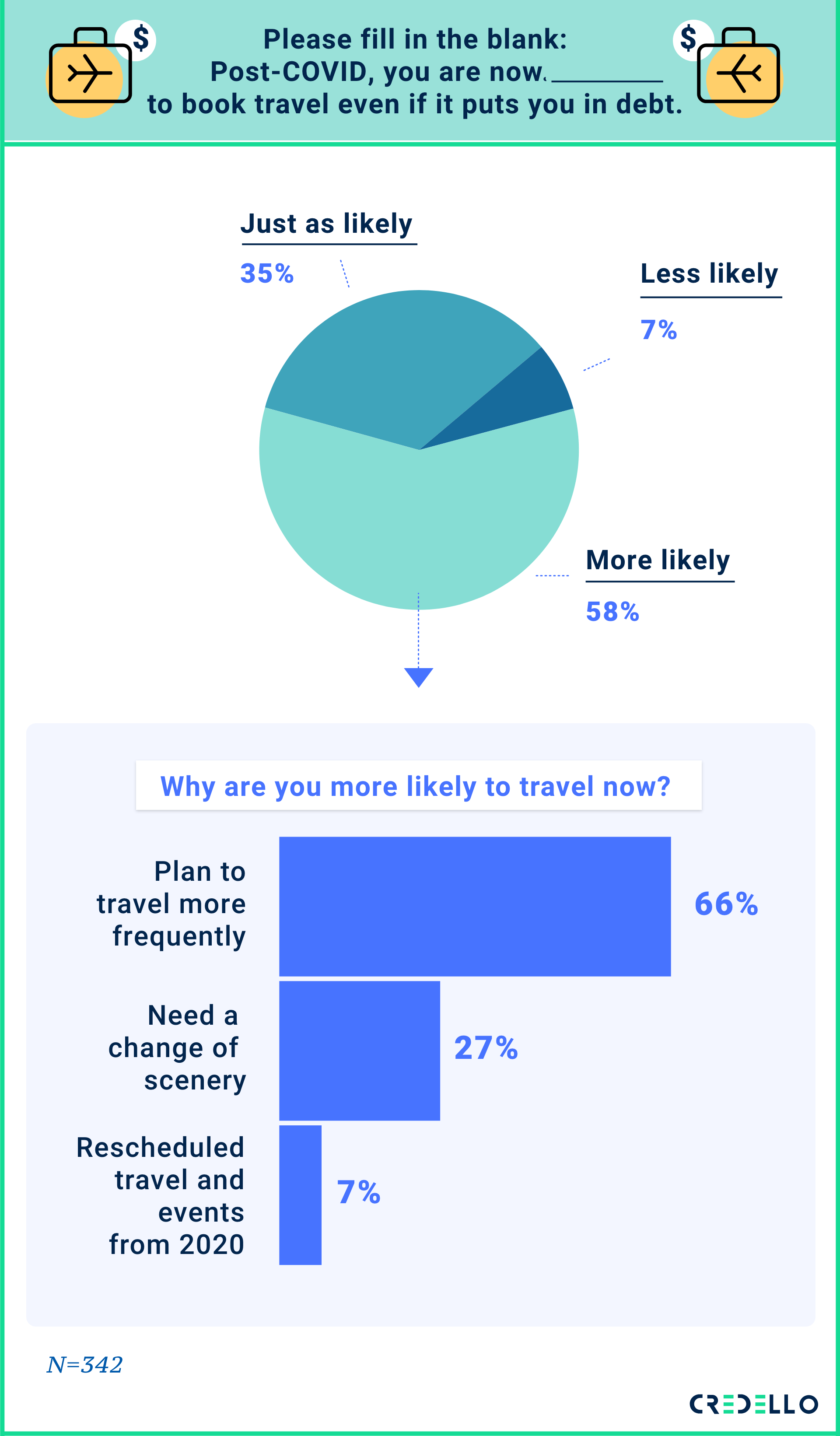

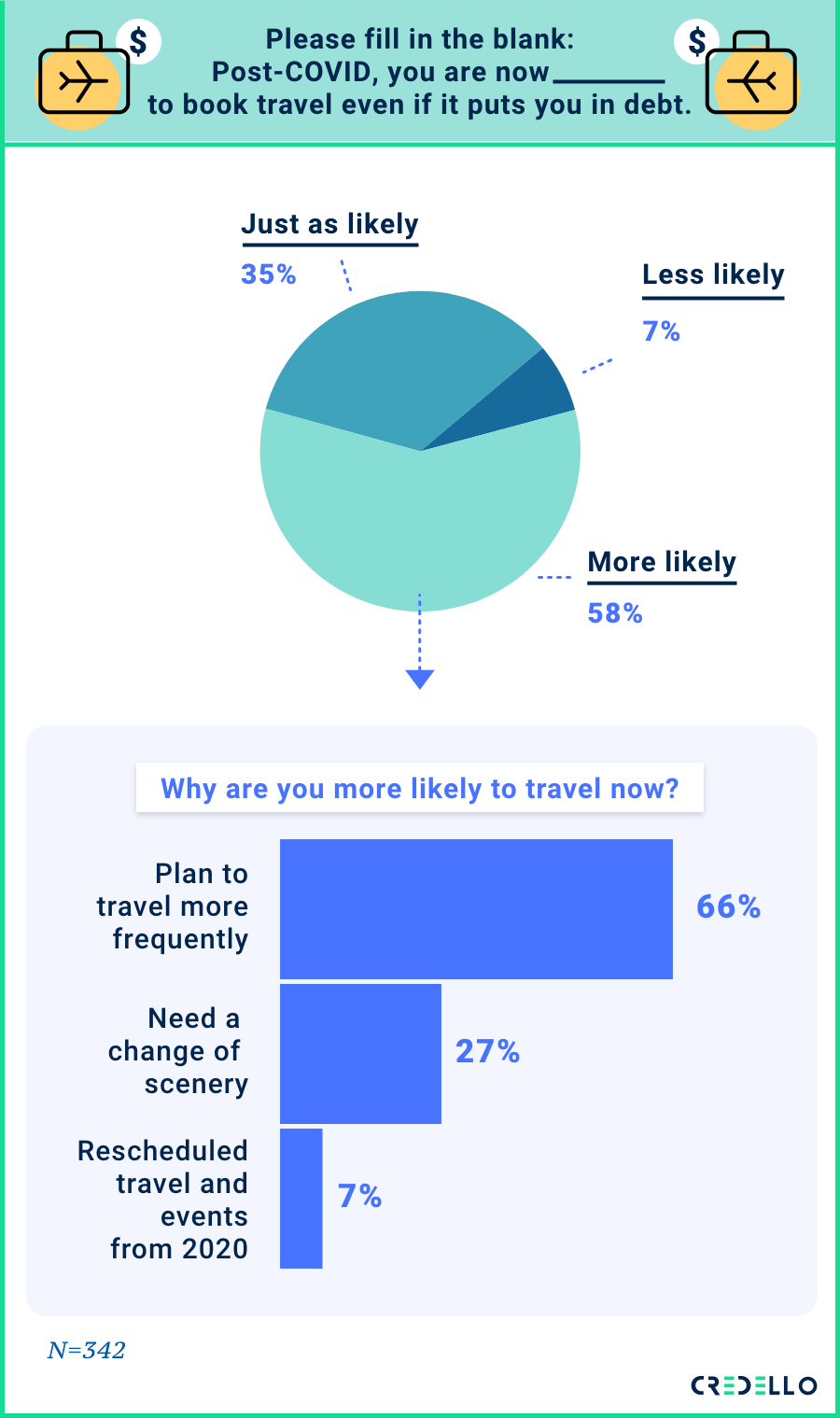

In fact, a majority of Credello survey respondents say they’re more likely or just as likely to book travel post-COVID, even if it puts them in debt. More than 58% said more likely, 35% said just as likely, and just 7% said less likely.

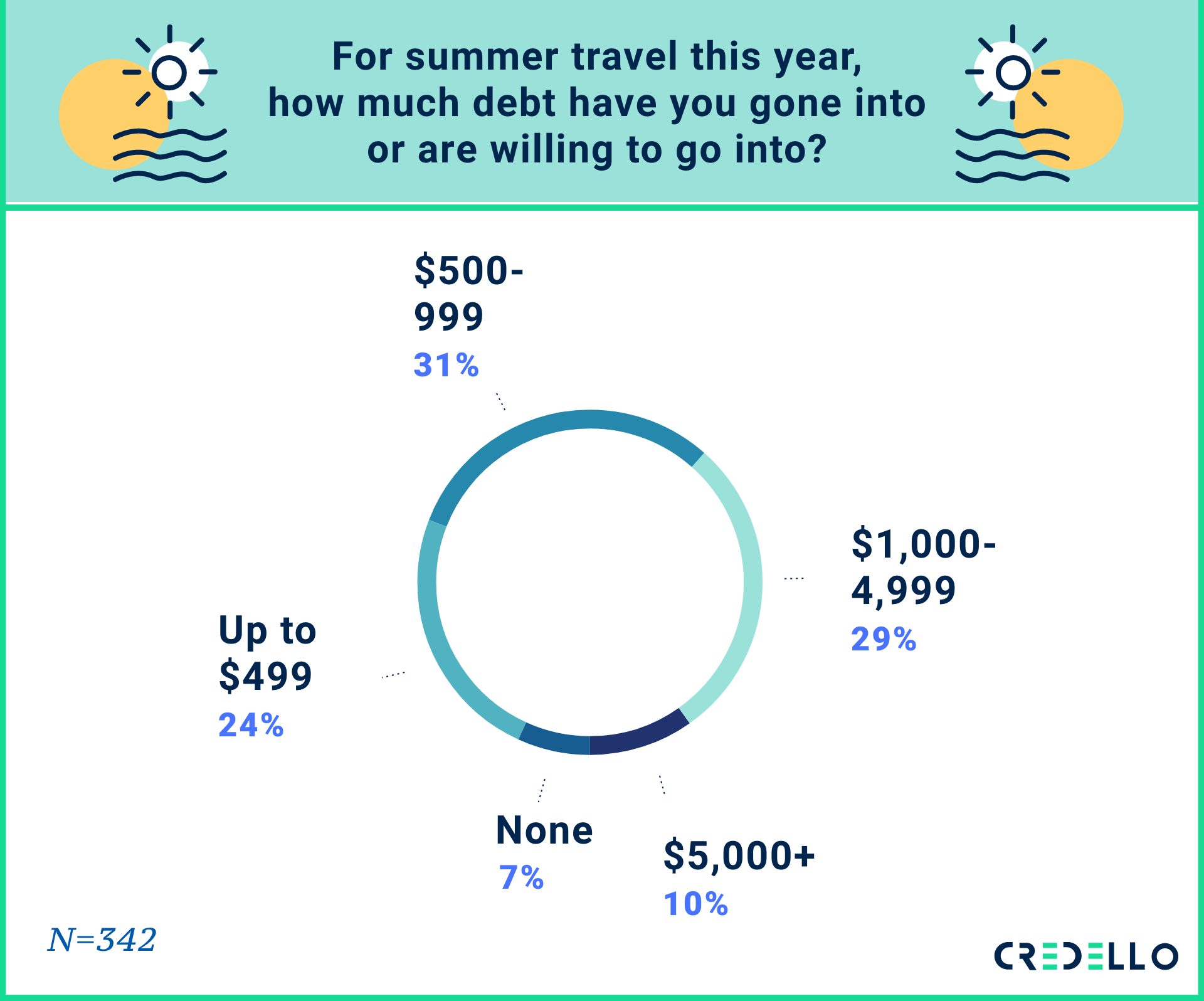

How much debt are millennials willing to go into to travel?

Debt exists on a spectrum. There’s good debt and bad debt, and certainly the amount of existing debt you have is a big ol’ factor in how much you’re willing to take on.

More than 30% of respondents say $500-$999 of debt is acceptable for summer travel. Another 29% were willing to up the ante (Vegas, baby!) to $1,000-$4,999, while 24% wouldn’t go deeper in debt than $499. Only 10% say they have or would take on more than $5,000 in debt for a summer trip.

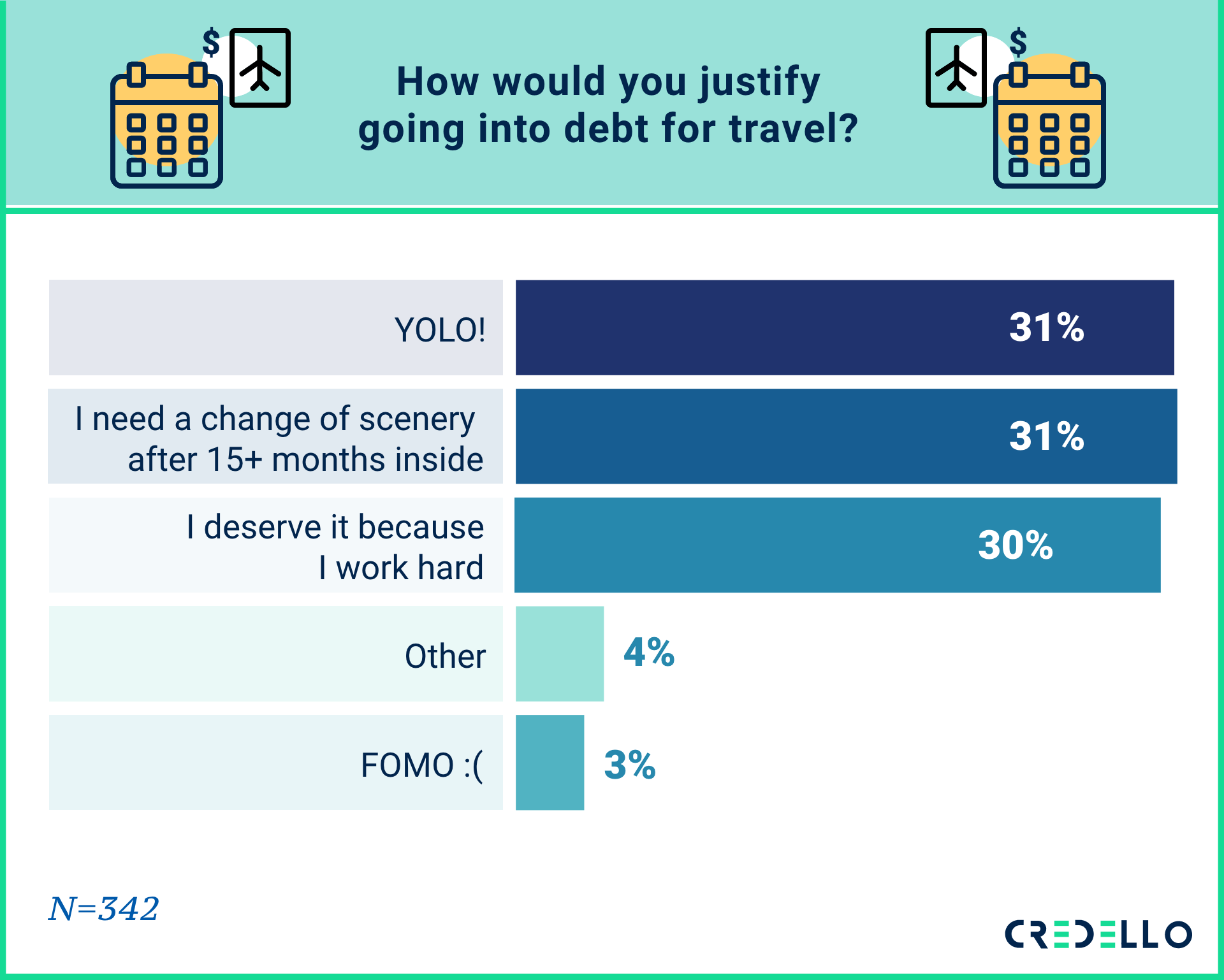

Why are millennials going into debt to travel?

People’s top reasons for taking on debt to travel can be broken into three simple categories:

- “The Motto”

- “Cabin Fever”

- “She Works Hard for the Money”

That’s to say that 31% of respondents justified going into debt to travel because YOLO!, while another 31% wanted a change of scenery after COVID-19, and another 30% said they work hard and deserve it.

Those figures aren’t all that different from 2019’s Credit Karma survey, sans pandemic. The same percentage (31%) said YOLO!, while 25% were singing Donna Summer’s tune about their hard-earned money.

Where are they going for summer travel in 2021?

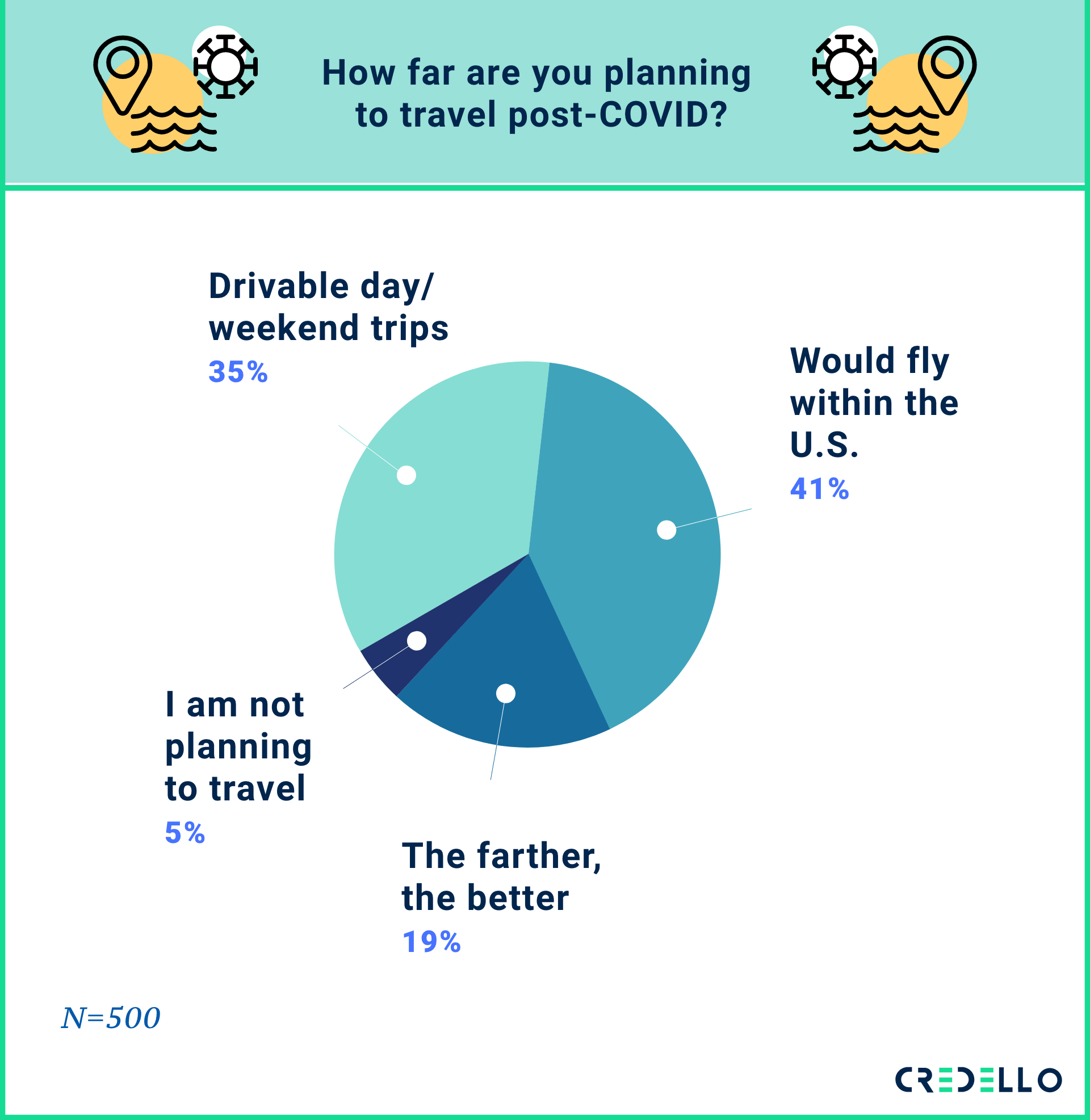

Most millennials aren’t going far: More than 41% of respondents said they would only fly within the U.S., while another 35% say they’d only travel to drivable destinations for the day or weekend. (That means more than three-quarters of respondents want to travel but don’t want to leave the country. Only 5% are not planning to travel at all.) FWIW, 19% said “the farther, the better.” Ramble on, wanderlusters.

In theory, the closer you stay to home, the less debt you’ll accrue.

What types of trips are they willing to go into debt for?

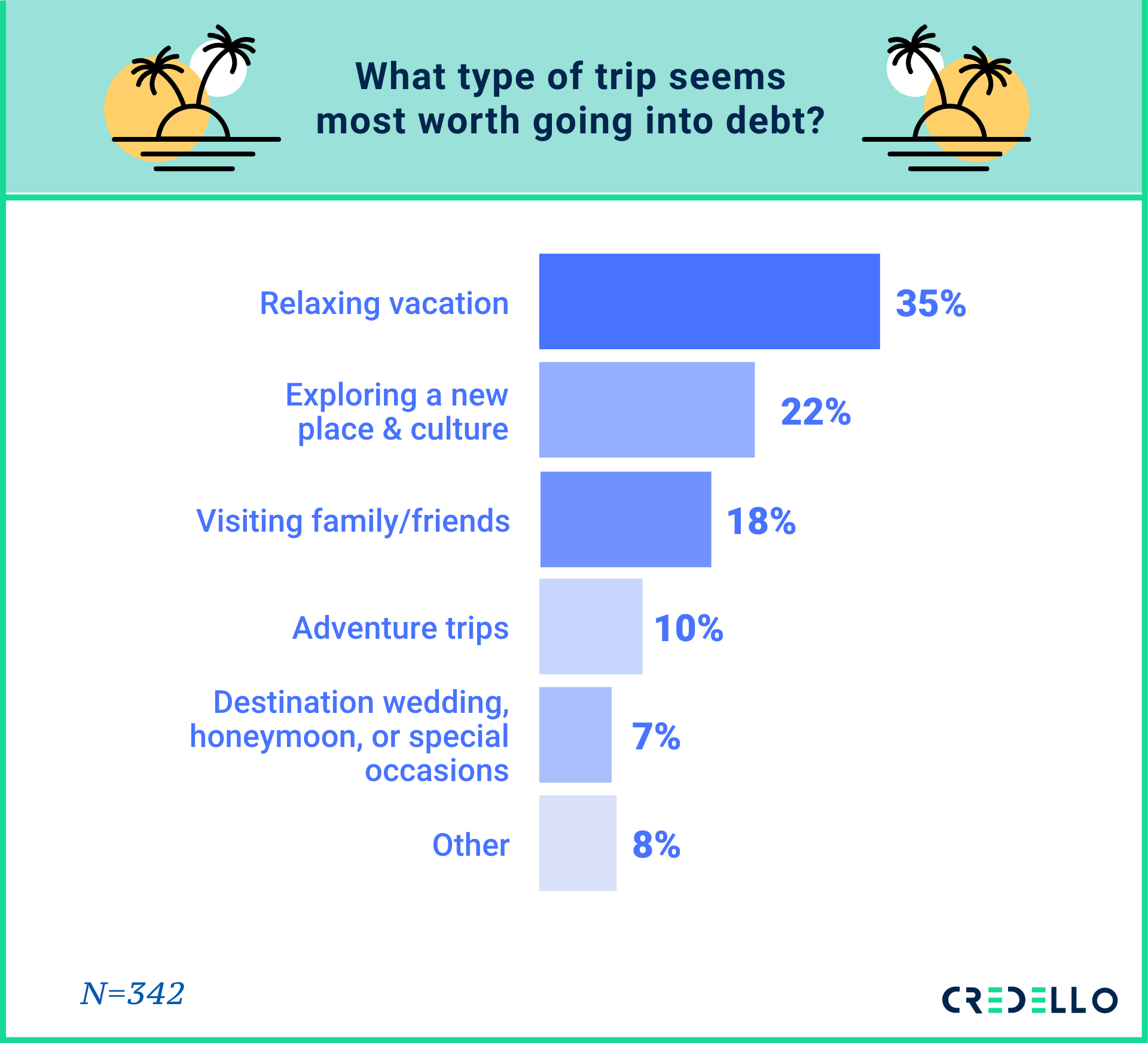

The most common reason respondents were willing to go into travel debt was for a relaxing vacation, with 35% opting for that (makes sense after the stressful 2020 and 2021 we’ve had). Another 32% said they were most likely to take on travel debt for an opportunity to explore new places or cultures, or take an adventurous trip.

Perhaps surprisingly, only 18% of respondents were most willing to go into travel debt to visit family and friends. Vaccines have been available in the U.S. for about six months now, so it could be that many millennials have already made trips to see family and friends and now want that vacay.

Just 7% of people were most willing to go into debt for special occasions like weddings and honeymoons. Totally fair. Even though the divorce rate reached a 50-year low in 2019—there’s no guarantee it’s going to last forever. But your trip to Hawaii and that Spam sandwich will live in your mind till you leave this Earth.

Millennial travel spending and budgeting habits

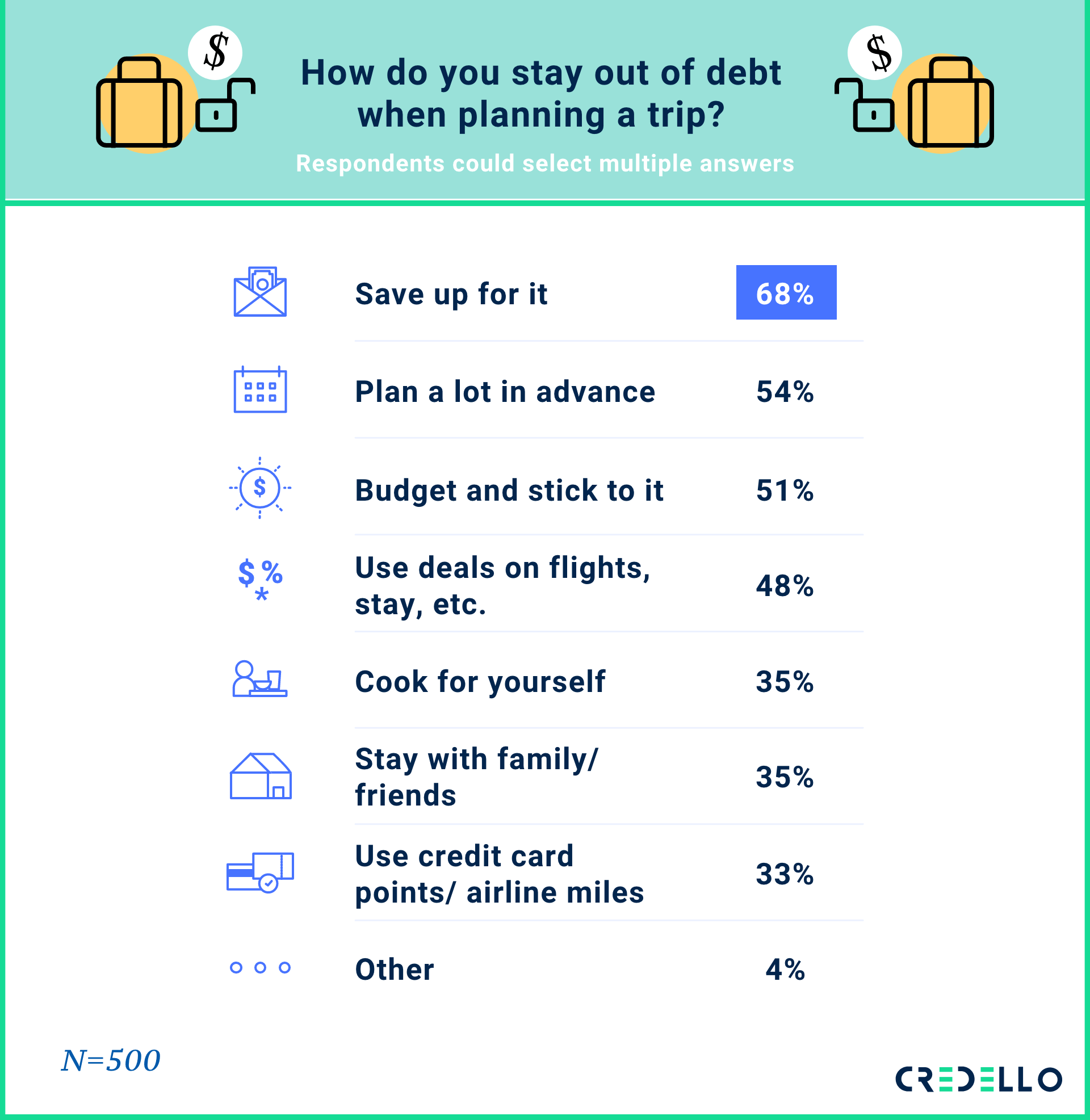

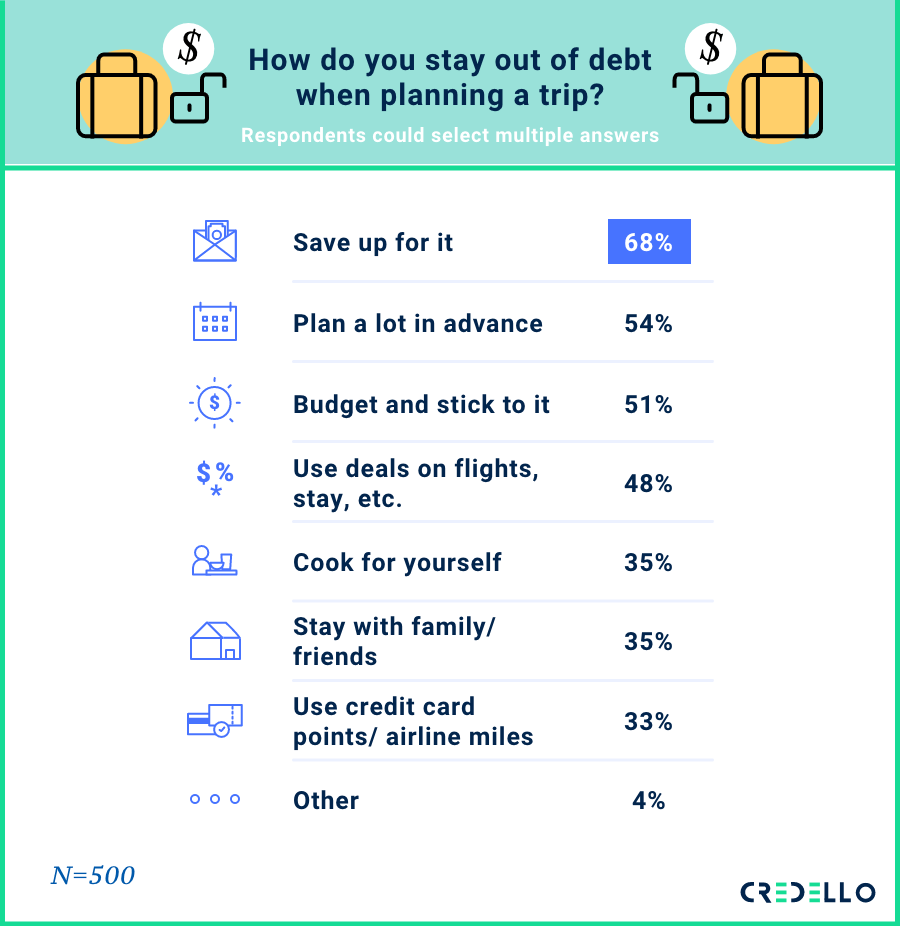

Staying debt-free when traveling isn’t exactly rocket science. The No. 1 way to do so? Save up ahead of time. Most respondents (68%) said that’s their approach to staying out of debt when planning a trip. Other popular methods included doing a significant amount of planning in advance (54%), sticking to a budget (51%), and hunting for deals (48%).

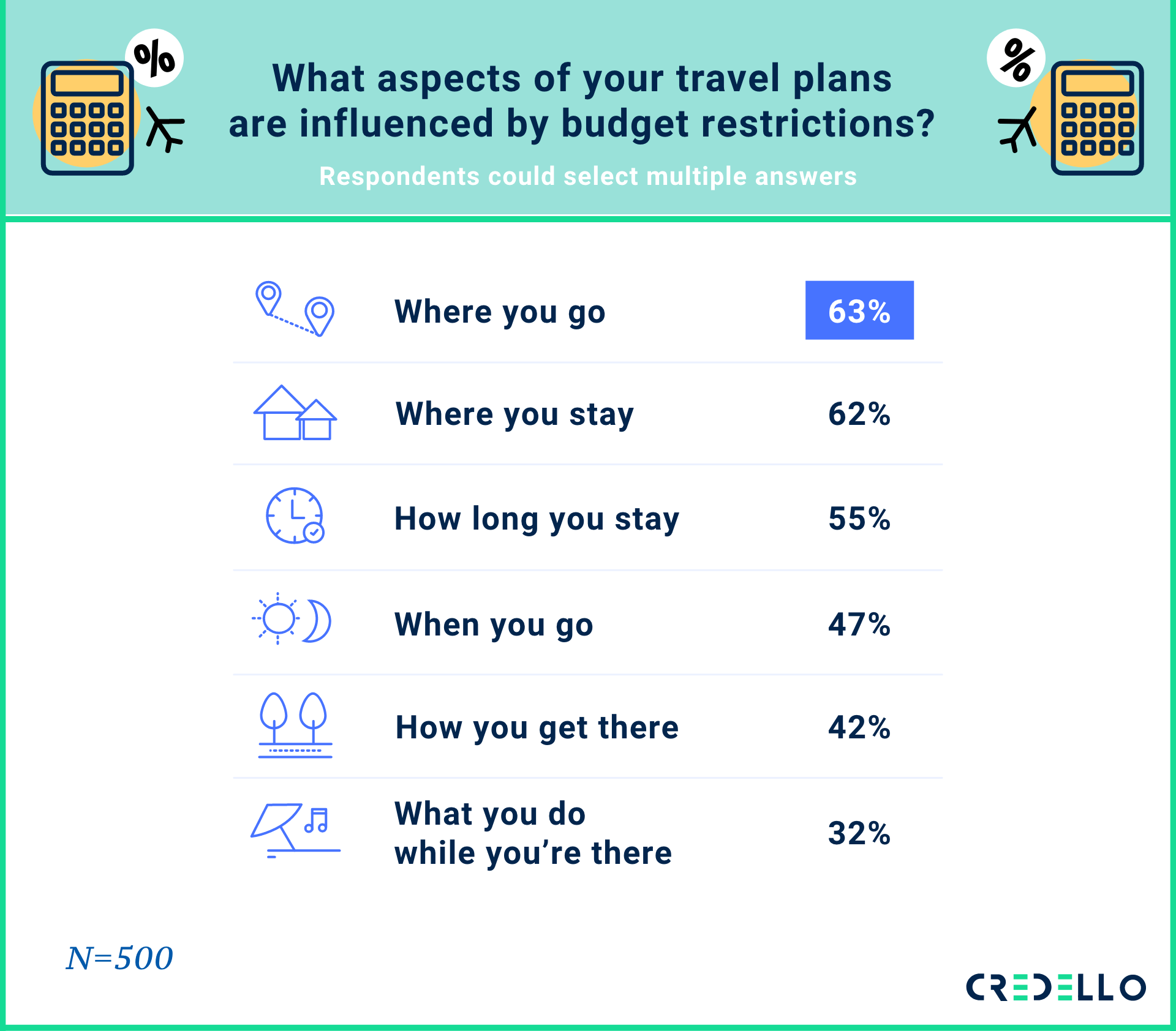

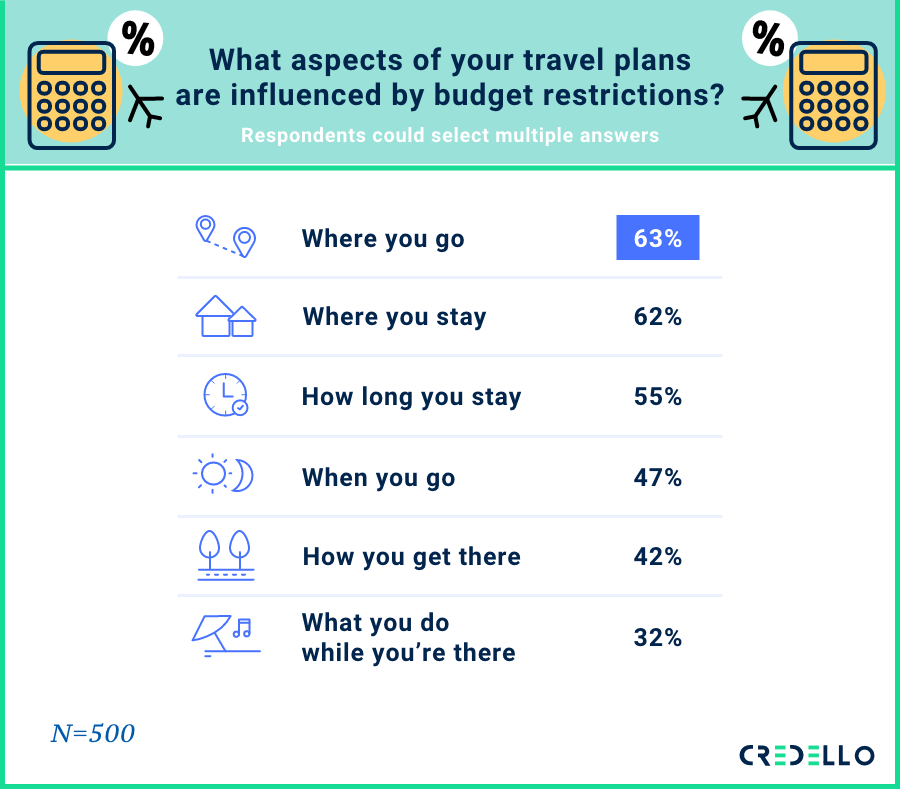

It’s those budget restrictions that can most have an impact on millennial travel plans. According to our survey findings, the aspects that financial limitations hit hardest are destination (63%) and accommodations (62%). But length of stay (55%), when you go (47%), how you get there (42%), and what you do when you get there (32%) also were hindered by budget restrictions.

No matter how strict of a budgeter you are, you’re bound to spend the most on something. And for a quarter of millennials, it’s simply getting to their destination (and back) that they spend the most on when traveling. This makes sense as planes are filling back up—no more empty middle seat—and flight prices are at or in some cases above pre-pandemic levels, per the country’s major airlines.

The survey says millennials also spend a decent amount on activities once they’re at their destination (24%), accommodations (20%), and food/drink (19%).

In Credit Karma’s 2019 travel survey, 49% of respondents said they spent the most on accommodations, though it wasn’t not clear if that included getting there AND lodging but definitely at least lodging). Another 45% said they spent the most on food, and 27% said they spent the most on shopping and souvenirs.

Single people are less willing to take on summer travel debt

Speaking of mawwiage, those with spouses or live-in partners were more willing to take on summer travel debt than us single folks. If you like it, then you should’ve put a budget on it, amirite?

Among married couples and couples living together, 53% have taken on debt to travel and would again, 21% haven’t but would, and 26% said they would not. (And if you narrow that down to only the married millennials, even more of them have gone into debt to take a summer trip at 58%.)

Divorced and separated respondents are much more likely not to go into debt for summer travel, with 52% saying no way. In case you forgot, getting a divorce is pricey. According to a nationwide survey from legal publisher Nolo, the median total cost for a divorce when hiring a full-scope divorce attorney is about $7,500.

Meanwhile, 40% of single millennials said they would not go into debt to take a summer trip, while 30% have gone into debt for a summer trip and would again, and 30% haven’t but would.

How does that fit with single vs. married people’s usual capacity for taking on debt?

Generally, married millennials have a higher tolerance for debt than singles.

About 36% of married folks said they’d go into $500-$999 worth of debt for a summer trip, while 32% said they take on $1,000-$4,999, and 15% were on the highest and lowest ends at up to $499 and $5,000 or more.

On the flip side, 37% of single people were willing to take on up to $499 for summer travel, 27% would take on $500-$999, 23% would take on $1,000-$4,999, and just 3% would take on $5,000 or more.

The type of trips married folks want to take compared with the types of trips single folks want to take could also factor into the cost, and thus, the debt.

Married folks tend to take the YOLO! approach while single folks lean toward a change of scenery. There are only so many options on Bumble and Hinge in rural Montana.

About 39% of married respondents said they justify summer travel debt with Drake’s motto, compared with 21% of single folks. On the flip side, 39% of single people may or may not be doing a Muppets sing-along of “Cabin Fever” with change of scenery as their justification for taking on summer travel debt, compared with 32% of married folks.

Traveling with debt AND kids? Millennials are on board

While the overall birthrate in the U.S. was down 4% in 2020, according to federal government data, many millennials became first-time moms and dads during the coronavirus pandemic.

And as the new parents on the block, that’s not holding millennials back from making travel plans, or going into debt to do it.

Millennials with kids are much more willing to go into debt and to have gone into debt to travel than their childless counterparts. Roughly 54% of respondents with kids said they had gone into debt to travel and would again, while just 31% of respondents without children said they have and would. Comparatively, one-quarter of respondents with children said they would never go into debt for travel, while 41% of childless respondents said “no way, José” to travel debt.

Single millennial parents were more in line with childless respondents: 59% of those surveyed said they would not go into debt for a summer trip. Surely, they have enough to worry about with keeping food on the table and a roof over their family’s head on one income.

The COVID implications for summer travel in 2021

The pandemic largely hasn’t been a deterrent for travelers, and as younger children become eligible for vaccines, that could increase millennial parents’ desire to travel with their young ones. As of mid-June, 65% of millennial parents surveyed said they are more likely to book post-COVID travel even if it puts them in debt.

Currently, children ages 12 and up are eligible for the Pfizer vaccine under the FDA’s emergency use authorization, and experts say that a vaccine could be available for kids under 12 by September or October—just in time for potential Thanksgiving travel.

Mo’ kids, mo’ debt, mo’… problems, I assume?

The more kids people have, the more debt they are willing to (or expect to) accrue when booking travel.

Of respondents with three or more children (trying to start a basketball team or what?) 47% have or are willing to go into $1,000-$4,999 of debt for summer travel. Compare that with 33% of millennials with one or two children and 18% of millennials with no kids.

Childless millennials expect to take on less debt, as 36% of those respondents said they would take on up to $499 in debt for summer travel, while 79% of respondents with kids have taken on or expect to take on at least $500 of debt for summer travel.

And that doesn’t account for the increased stress, anxiety, noise, and “stop touching your sister” that comes with traveling with multiple kids.

Methodology

This survey was commissioned by Credello and was conducted using the online survey platform Pollfish. The sample of 500 millennials (ages 25 to 40) in the United States was surveyed on June 19, 2021. Only respondents who have traveled or are planning to travel this year were included in this study. The results have been weighted to balance responses to census statistics on the dimensions of age and gender.

For complete survey methodology, please contact support@credello.com.

Sources