What Is a Good Credit Score?

About Molly

Molly is a finance writer based in Portland, Oregon. She also covers software and environmental issues and is always on the lookout for a good vegan donut.

Read full bio

Having a good credit score is very important. This number affects whether you can borrow money, how much you can borrow, your interest rates, and how soon you’ll have to pay it back. But what is a good credit score? And why do lenders care?

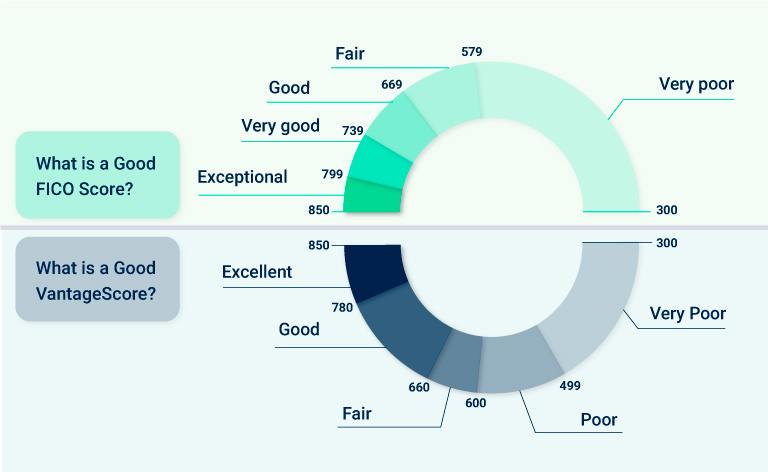

Your credit score gives lenders an idea of how likely you’ll be able to repay a loan. FICO and VantageScore are the most common credit-scoring systems and use the same three-digit range, from 300 to 850. The higher your score, the better your credit. For both systems, a good score is around 690 and up.

What is the difference between FICO and VantageScore?

There isn’t one “credit score”. You have many credit scores across different credit bureaus and credit products. FICO and VantageScore are the most popular. The biggest difference is that FICO covers credit histories of six months or longer. VantageScore covers borrowers with a shorter credit history.

Why does my credit score matter?

When you apply for a credit card or loan, the lender checks your credit score to assess risk. Credit scores help lenders lessen the chance of losing money to an unreliable borrower. For example, data shows only 8% of applicants with a “Good” FICO score become delinquent. With reliable numbers like these, lenders can make impartial, consistent decisions, fast.

Borrowers with bad credit scores

Borrowers with Fair to Very Poor FICO scores or a Poor to Very Poor VantageScore are often unable to get a loan. If they do, they receive loans with high-interest rates. Borrowers may also have to pay a fee or deposit or make larger down payments.

Borrowers with good credit scores

A good/very good FICO score or a good VantageScore rewards borrowers with access to loans and favorable interest rates.

Borrowers with top credit scores

Borrowers with an Exceptional FICO score or an Excellent VantageScoreget the best rates and most favorable terms.

Where does my credit score come from?

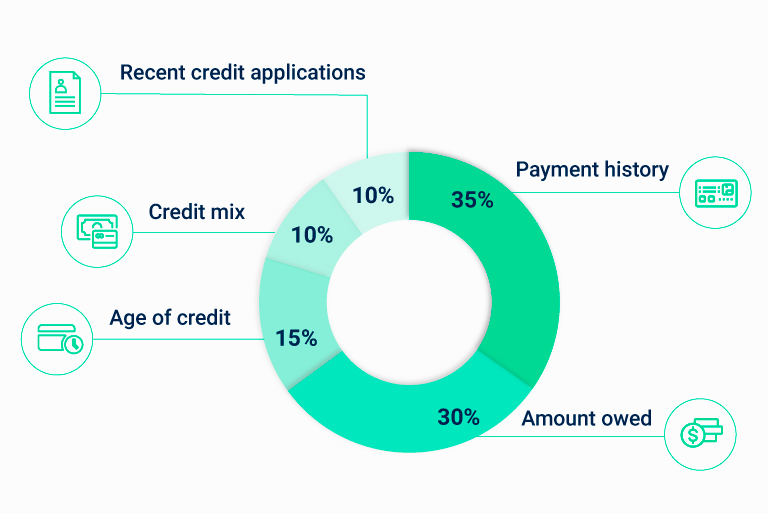

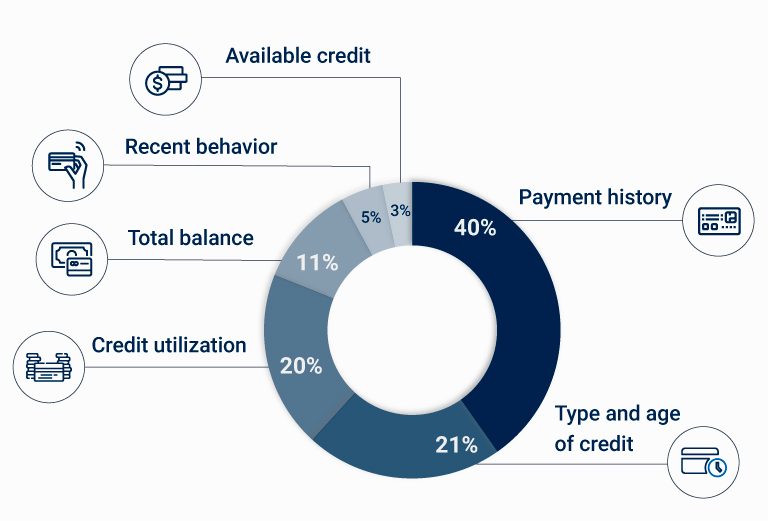

Every 45 days, creditors report your activity to the credit bureaus. This includes credit card balances, payments made, amount of debt, and credit applications. FICO and VantageScore determine your credit score using similar factors.

Factors affecting your FICO score

Source: Myfico.com

Factors affecting your VantageScore

Source: Your.vantagescore.com

How to improve your credit score?

Here are eight ways to improve your credit score:

- Check your credit report frequently. Your credit scores are all based on your credit report. Make sure to check your report for errors and dispute any inaccuracies.

- Always pay on time. Set up automatic payments whenever possible. Use calendar reminders to keep yourself on schedule.

- Repay past-due bills and settle accounts taken to collections.

- Don’t close out paid-off accounts: As long as there isn’t an annual fee, keep accounts open. Older credit accounts show a longer credit history and decrease your credit utilization ratio.

- Maintain a low credit card balance. You want to use as little of your credit limit as possible. For a good credit score, you’ll want to use 10% or less of your total credit limit.

- Ask for a higher credit limit. A higher credit limit will improve your score by lowering your credit utilization rate.

- Have a mix of credit. Vary your blend of credit with credit cards, student loans, and car loans. This shows that you can responsibly use credit.

- Don’t borrow more than you need. Applying for new credit creates a hard inquiry. Too many hard inquiries raise flags to lenders that you’re in financial trouble.

How long will it take to get a good credit score?

If you’re starting out, earning a good credit score takes time. History plays a vital role in determining your credit score. As such, young people will always have a lower score.

If you’re rebuilding your credit, time is your ally. Negative info won’t stay on your credit report forever. Hard inquiries remain on your credit report for two years, late payments for seven years, and public record items (bankruptcy, judgments, liens, lawsuits, foreclosures) for 7-10 years. Learn how to improve your FICO score.

Related: How to pay off debt