VantageScore 4.0 – What You Need to Know

About Harrison

Harrison Pierce is a writer and a digital nomad, specializing in personal finance with a focus on credit cards. He is a graduate of the University of North Carolina at Chapel Hill with a major in sociology and is currently traveling the world.

Read full bio

At a Glance

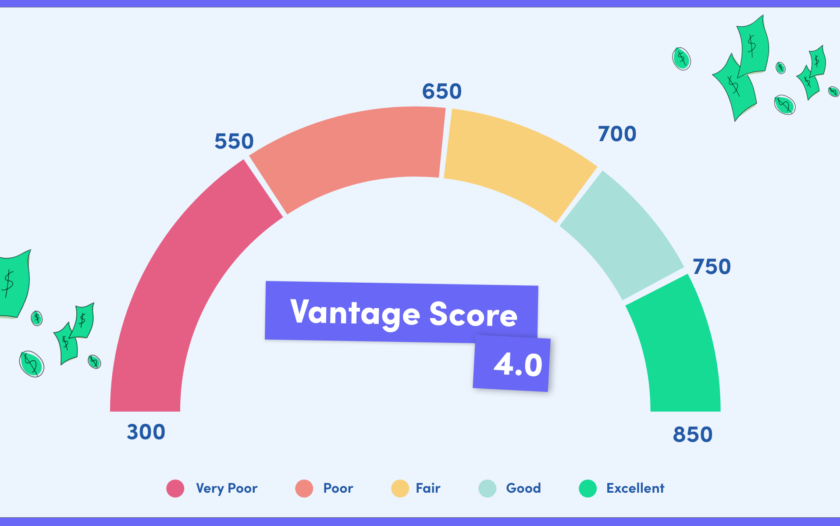

Credit scores play a crucial role in determining one’s eligibility for loans, credit cards, and other forms of credit. One widely recognized credit scoring model is VantageScore, and its latest version, VantageScore 4.0, has generated significant interest and discussion among consumers and lenders alike.

In this article, you’ll learn:

714 vs.697

The average FICO Score is 8 compared to the average VantageScore 4.0, respectively.

What is VantageScore 4.0?

VantageScore 4.0 is the latest iteration of the VantageScore credit scoring model. It was introduced to provide lenders and consumers with a more accurate and predictive assessment of creditworthiness. Developed by the three major credit reporting agencies (Equifax, Experian, and TransUnion), VantageScore 4.0 incorporates several updates and refinements to enhance its effectiveness in evaluating credit risk.

VantageScore 4.0 vs VantageScore 3.0

VantageScore 4.0 builds upon the foundation laid by its predecessor, VantageScore 3.0. One significant improvement in VantageScore 4.0 is its expanded data set, which includes trended credit data. This means lenders can now analyze how borrowers’ credit behavior has changed over time, providing a more comprehensive picture of their creditworthiness. Additionally, VantageScore 4.0 employs machine learning techniques to better assess credit risk, allowing for more accurate predictions.

VantageScore 4.0 vs. FICO scoring models

While VantageScore is gaining recognition in the credit scoring industry, FICO remains the dominant player. There are notable differences between VantageScore 4.0 and FICO scoring models. VantageScore 4.0 places greater emphasis on consumers with limited credit histories, providing a more inclusive approach to credit assessment. FICO, on the other hand, may penalize individuals with limited credit history. Additionally, VantageScore 4.0 disregards collections accounts with a zero balance, differentiating it from certain FICO models. It is important to note that lenders may have preferences regarding credit scoring models, so it is always beneficial to know which model they utilize.

Who uses VantageScore 4.0?

Many lenders and financial institutions, including banks, credit unions, credit card issuers, and mortgage lenders, use VantageScore 4.0. Many lenders have embraced VantageScore 4.0 because it provides a more holistic evaluation of creditworthiness, particularly for individuals with limited credit histories or those who have undergone significant credit improvements over time. As the adoption of VantageScore 4.0 continues to grow, it is becoming increasingly relevant for consumers to understand and monitor their VantageScore.

How to check your VantageScore 4.0

To check your VantageScore 4.0, you can utilize various credit monitoring services or access it directly from the VantageScore website. It is important to review your credit report regularly and ensure its accuracy, as any errors or discrepancies can harm your credit score. By monitoring your VantageScore 4.0, you can track your credit progress and take the necessary steps to improve it.

FAQs

As of August 2022, the average VantageScore 4.0 is 697. This is considered a good/prime credit score.

A good VantageScore range typically falls between 700 and 749, while an excellent range is 750 or above. However, it is important to remember that the definition of a good or excellent score may vary depending on the lender and the specific credit product you seek. Different lenders have different credit score thresholds for approval, so it is advisable to inquire about their requirements directly.

Related: Credit Score Ranges

The credit score most lenders commonly look at is the FICO Score, specifically the FICO Score 8. However, the adoption of VantageScore 4.0 and other credit scoring models is increasing, and many lenders now consider these scores as well. It is beneficial to be aware of your FICO Score and VantageScore 4.0 to gauge your creditworthiness from different perspectives.