Democratic vs. Republican States Debt and Credit Scores

About Ryan

Ryan is a seasoned copywriter whose clients have included big banks, credit card companies, and financial services firms. In his spare time, he writes fiction and roams around looking for dogs to pet.

In these times of great divisiveness, something as apolitical as credit card balances and credit scores surely can’t pit us against one another. Right?

Everyone wants to pay off credit card debt, for which-according to Experian’s 2019 Consumer Credit Review-the average American owes $6,194.

However, of the 17 states whose average credit card debts are higher than the national average, an overwhelming majority leans left.

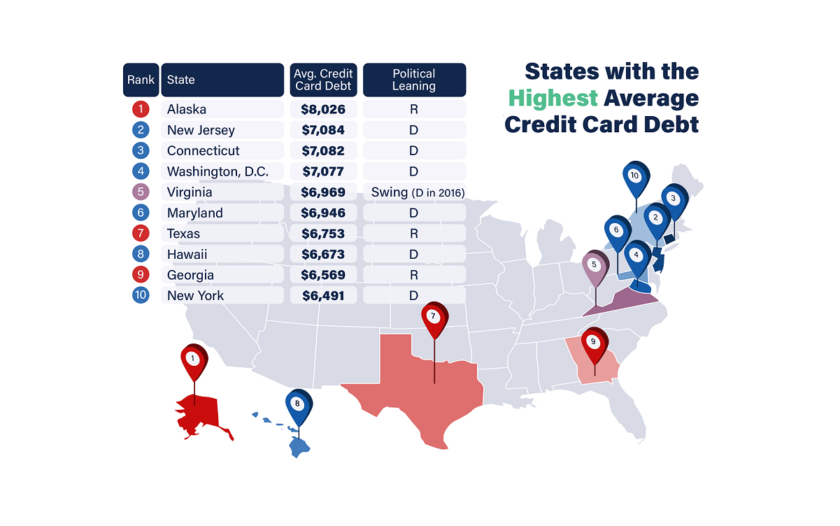

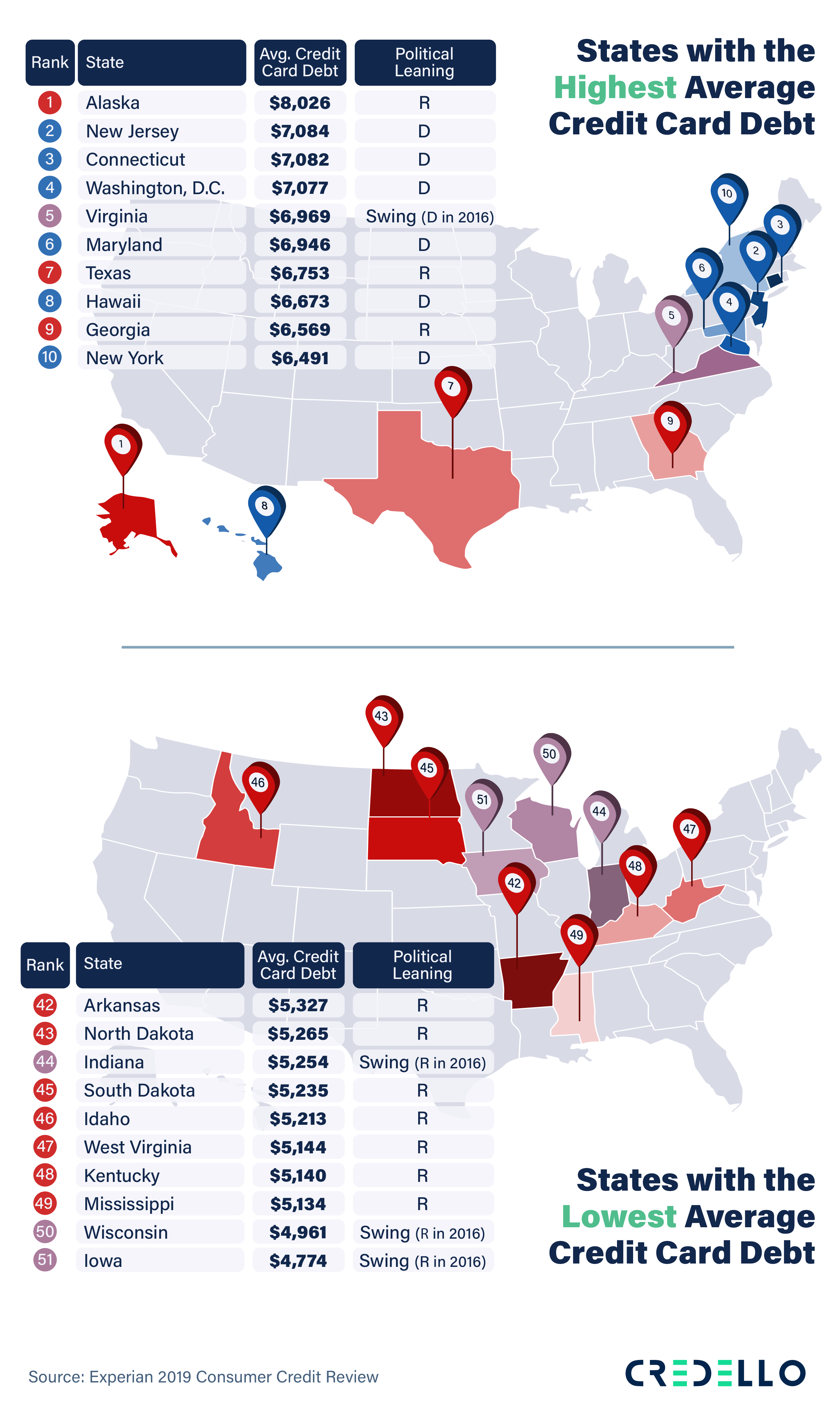

Credit card debt in red states vs. blue states

In fact, 14 of those 17 high-debt states (15 of 18 if you include Washington, D.C.) went blue in the 2016 presidential election, with Alaska, Texas, and Georgia being the only red outliers. For what it’s worth, Alaska actually has the highest average credit card debt in the country, which is nearly $1,000 more than the second-highest (New Jersey).

More specifically, six of the top 10 states (including D.C.) are Democratic-leaning, while only two are strongly Republican. The other two states in the top 10 are Virginia-a swing state that voted blue in 2016 and is polling in favor of Democratic candidate Joe Biden in 2020-and Texas-a historically red state that appears to be more competitive than expected in 2020, according to polls.

In stark contrast, of the 10 states with the lowest average credit card debt, all 10 voted for Republican candidate Donald Trump in 2016. The bottom two-Iowa and Wisconsin (the only states whose credit card debts average below $5,000)-are swing states. Both voted Democrat in 2012 but went Republican in 2016.

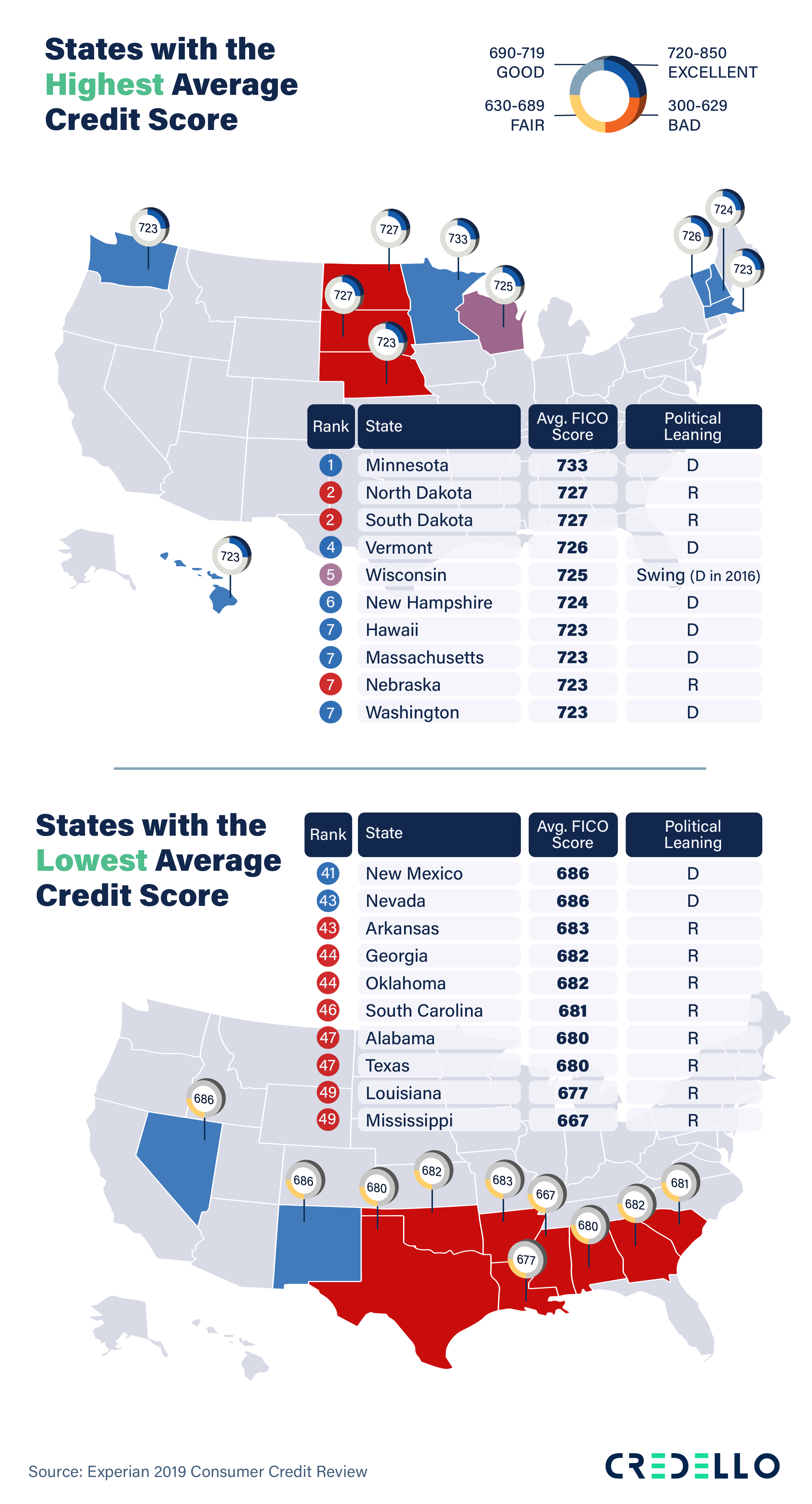

Credit scores in Democratic states vs. Republican states

Now, let’s take a look at credit scores. According to the Experian 2019 Consumer Credit Review, the average FICO score in the U.S. is 703.

While Democratic-leaning states tend to have higher credit card debt, they also tend to have higher credit scores. Out of the top 10 states with the highest average FICO scores, six lean liberal and three lean conservative. Wisconsin, a swing state that voted Republican in 2016, is also in the mix.

However, out of the 10 states with the lowest FICO scores, eight are Republican strongholds. The only two Democratic-leaning outliers in the bottom 10 are Nevada and New Mexico.

Is there a correlation between politics and credit scores or debt?

Stats are stats, but just because the numbers exist doesn’t mean they tell a complete story. There are plenty of other factors at play, so it’s tough to say whether political leanings and credit card debt or credit scores are directly related.

For starters, the cost of living is much higher in the top 10 indebted states than in the bottom 10. Plus, two big East Coast cities-New York and Washington, D.C.-drive up the cost of living in surrounding states like New Jersey, Connecticut, Virginia, and Maryland. Of course, both greater metropolitan areas happen to lean heavily Democratic.

It is fascinating that geography and political affiliation can factor into your credit score health. However, you can live anywhere and still work on improving your credit score with simple habits and reminders.

Another factor at play regarding debt could be that Republicans are traditionally known as more conservative with money than Democrats. If citizens of red states spend less, then it only makes sense that those states would boast lower credit card balances.

When it comes to credit scores, a big determining factor is late payments. The data tells us that the states with the lowest ratio of delinquent credit accounts have the highest average credit scores. So, states like Minnesota, South Dakota, and Vermont-which have the lowest percentage of delinquent accounts-have among the highest average credit scores. On the other hand, states like Louisiana, Mississippi, and Oklahoma-which have the highest percentage of late payments-unfortunately average among the lowest credit scores in the country.

Related: How to pay off debt

Okay, so maybe credit scores and debt aren’t as safe and apolitical as we thought. But here’s something we can all agree on: Regardless of where you live or how you vote, racking up credit card debt stinks and so does having a bad credit score. Improving your FICO score and living debt-free sound like American dreams worth pursuing.