Is 700 a Good Credit Score?

About Harrison

Harrison Pierce is a writer and a digital nomad, specializing in personal finance with a focus on credit cards. He is a graduate of the University of North Carolina at Chapel Hill with a major in sociology and is currently traveling the world.

Read full bio

At a Glance

A credit score of 700 falls within the “good” range, meaning you have a history of responsible credit behavior and will likely be approved for loans and credit cards with favorable terms. Of course, there’s always room for improvement, but a score of 700 is definitely something to be pleased with.

In this article, you’ll learn:

6 out of 10

Americans have a FICO score above 700.

Where does a 700 credit score fall?

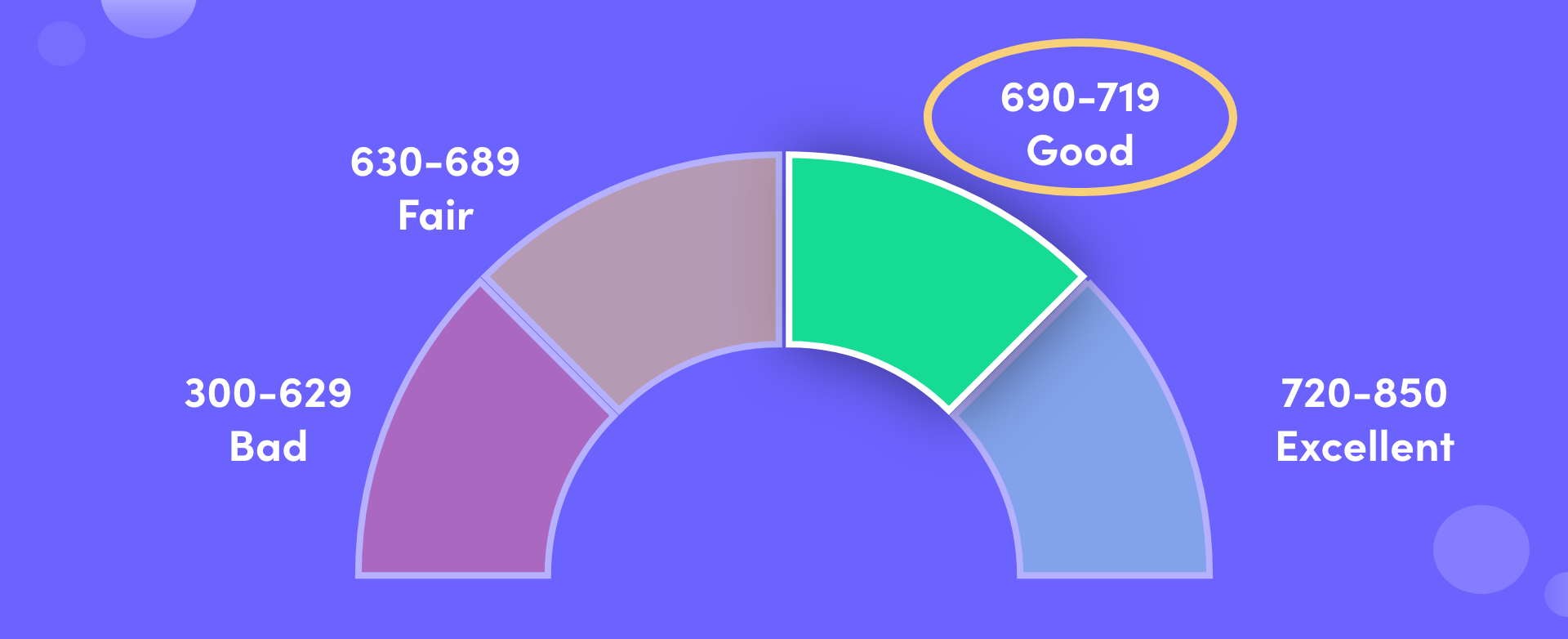

A 700 credit score falls within the “good” range of credit scores. Credit scores range from 300 to 850, with higher scores indicating better creditworthiness. Lenders typically consider a score of 700 or above to be a good indicator that a borrower is likely to be able to manage credit responsibly and pay back loans on time. However, it’s important to note that lenders may have their own criteria for evaluating creditworthiness and may consider other factors in addition to credit score when making lending decisions.

Related: Credit Score Ranges

What can a credit score of 700 get you?

A good credit score can increase your odds of getting approved for a number of loans or credit cards.

1. Personal loans

With a 700 credit score, you might qualify for a personal loan with favorable loan terms and interest rates. However, the approval of a personal loan also depends on a number of other factors, including the purpose of the loan and the amount requested. Make sure you meet the other eligibility requirements and provide all the necessary documentation to support your loan application.

Find and compare the best loan options.

Use the filters below to refine your search

Sorry, we didn’t find any options that meet your requirements. Please try modifying your preferences.

Congratulations! You’re close to seeing your offers!

Please take a second to review the details you shared earlier

Sorry, we didn’t find any options that meet your requirements. Please try modifying your preferences.

2. Credit cards

A credit score of 700 means you have a relatively low credit risk, so you would likely be able to get approved for a new credit card. However, some credit card companies may require a higher credit score for their premium rewards cards or cards with higher credit limits.

3. Home loans

A 700 credit score can be a good starting point if you are looking to get a home loan, but it’s important to shop around and compare offers from multiple lenders to find the best terms and interest rates for your individual financial situation.

4. Car loans

If you have a 700 credit score, a stable income, and a reasonable debt-to-income ratio, you may be offered competitive interest rates and terms on a car loan. However, if your income is low or your debt-to-income ratio is high, you may be offered less favorable terms or may not qualify for a loan at all. Lenders will also consider the value of the car when determining whether to approve your application. It’s important to shop around and compare offers from different lenders to find the best deal.

How can you get your score to 700 and beyond?

Here are some tips to help improve your credit score to 700 or higher:

- Pay your bills on time: Payment history makes up the biggest portion of your credit score. Make sure you pay your bills on time, every time.

- Keep your credit card balances low: Credit utilization is the second most important factor in determining your credit score. Try to keep your credit card balances below 30% of your credit limit.

- Don’t close old credit accounts: Length of credit history is also a factor in your credit score. Keep your old credit accounts open, even if you’re not using them.

- Limit credit inquiries: Each time you apply for credit, it can negatively impact your credit score. Try to limit credit inquiries and only apply for credit when you need it.

- Monitor your credit report: Regularly check your credit report to ensure that it is accurate and that there are no errors or fraudulent activities that could be dragging down your score.

- Diversify your credit: Having a mix of credit types, such as credit cards, a car loan, and a mortgage, can help improve your credit score.

Related: How to Improve Your Credit Score?

What happens to a 700 credit score with a late payment?

If you have a 700 credit score and you miss a payment, your credit score is likely to drop. The exact amount depends on several factors, including how late the payment is, how much you owe, and how many other late payments you have had in the past.

Typically, a late payment can stay on your credit report for up to seven years, although its impact on your credit score may lessen over time as you demonstrate good credit behavior. In general, the later the payment, the more significant the impact on your credit score.

If you have a single late payment on an otherwise strong credit history, the impact may be relatively small, and you may be able to recover your credit score quickly by making on-time payments going forward. However, if you have a history of late payments or miss multiple payments, your credit score may drop more significantly, and it may take longer to recover.

To avoid late payments, set up automatic payments or reminders, and always pay at least the minimum amount due on time. If you do miss a payment, contact your lender as soon as possible to make arrangements and avoid further damage to your credit score.

Related: Late Payments on Your Credit Report

Why is it important to have a good credit score?

Having a good credit score is important for several reasons:

- Access to credit: A good credit score is essential to access credit. Banks, credit unions, and other financial institutions use your credit score to determine your creditworthiness, which determines whether they will lend you money and at what interest rate.

- Lower interest rates: With a good credit score, you are more likely to qualify for lower interest rates on credit cards, loans, and mortgages. This can save you thousands of dollars in interest charges over time.

- Better credit card offers: With a good credit score, you may be eligible for credit cards with better rewards programs and other perks, such as cashback, travel rewards, and low or no annual fees.

- Employment: Some employers check credit scores as part of the hiring process, particularly for jobs that involve financial responsibility. A good credit score may improve your chances of getting hired for such positions.

- Insurance rates: Insurance companies may use credit scores as a factor in determining insurance rates. A good credit score may help you get better rates on auto, home, and other insurance policies.

Related: Why a Good Credit Score Matters?

FAQs

Your credit score is just one of many factors that lenders use to determine how much you can borrow. Other factors include your income, employment history, debt-to-income ratio, and the type of loan you are applying for.

With a 700 credit score, you may qualify for a variety of loans, including personal loans, auto loans, and mortgages, depending on the lender’s requirements. The exact amount you can borrow will depend on your personal financial situation and the specific loan terms.

For example, with a 700 credit score, you may be able to qualify for a mortgage with a favorable interest rate and a down payment as low as 3%. The maximum amount you can borrow will depend on your income, debt-to-income ratio, and other factors.

Similarly, with a 700 credit score, you may be able to qualify for a personal loan with a favorable interest rate and loan terms. The maximum amount you can borrow will depend on the lender’s requirements and your ability to repay the loan.

According to FICO, about 59% of the U.S. population has a credit score of 700 or above.

The benchmark for being able to buy a home, at least in terms of credit scores, is actually quite low. A person with a score as low as 580 can qualify for certain specialty loans, such as a VA loan, which means that a person with a 700 credit score should be able to purchase a home. Be sure you have a positive history with credit to give yourself the best chance possible.

In reality, a person’s credit score is only one of many factors that go into determining their credit limit. Generally, though, the average credit limit a person will be issued when they first open a credit card with a 700-credit score is around $5,000. With healthy credit habits, though, this amount can be increased slowly over time.

When considering how long to get 700 credit score rankings to be raised, the answer is entirely dependent on a person’s personal credit habits. Should a person practice healthy habits by making on-time and in-full payments regularly, there’s no reason that their score shouldn’t increase by a couple of points every month. Considering this slow rise, however, it may take years to reach a coveted score of 800 or above.