Can You Use Discover Credit Card for International travel

About Trevor

Trevor Mahoney is a financial services writer and content creator based out of Los Angeles, California. He holds a Bachelors of Science in Finance from Santa Clara University. In his free time, he enjoys hiking and lounging on the beach.

Read full bio

At a Glance

Discover credit cards are widely used in the U.S., but what about when you’re jet-setting across the globe? In this article, we’ll explore using Discover cards for international travel, where they’re accepted, potential drawbacks, and valuable tips for a smooth experience. We might even discover some card-worthy travel tales along the way!

In this article, you’ll learn:

Can you use your Discover credit card overseas?

When embarking on international travel, it’s natural to wonder if your Discover card will be accepted. Rest assured, Discover cards are like your travel companion, they want to go wherever you go. But, to ensure a smooth experience, it’s a good practice to notify Discover of your international travel plans in advance. Think of it as giving your card a heads-up, “Hey, I’m off on an adventure!”. While your card issuer may not decline transactions, it’s better to be safe than sorry.

Who accepts Discover cards?

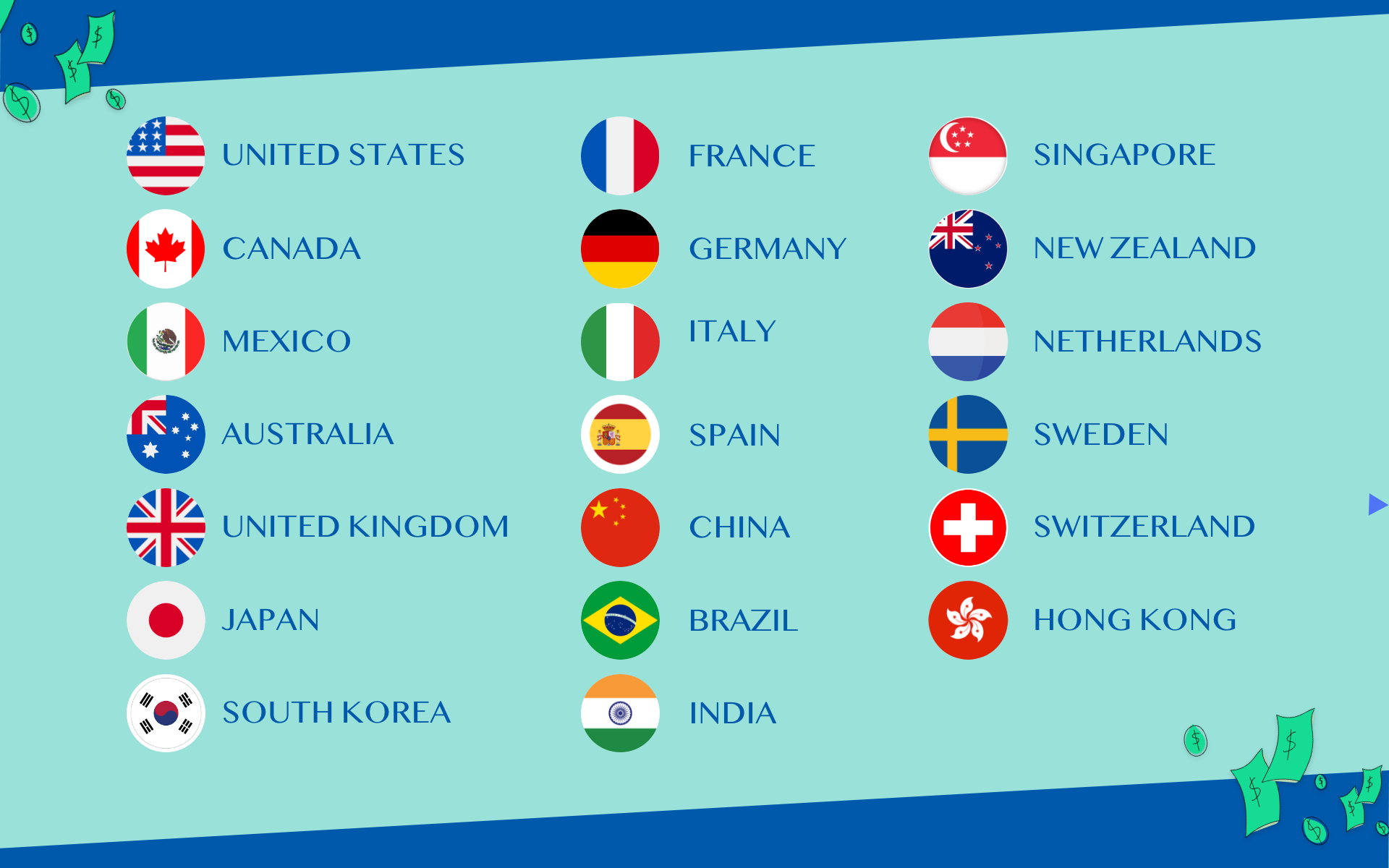

Discover cards are generally accepted in several countries around the world, making them your passport to payment in many destinations. To help you plan your Discover international trip and avoid payment pitfalls, here’s are some of the most common countries where Discover cards are accepted:

Please note that this list is not exhaustive for Discover card international travel, and Discover cards are accepted in numerous other countries as well. To help you plan your international adventure with Discover, research the specific part of the country you are going to for your trip.

Reasons why Discover credit card is not acceptable everywhere

While Discover cards are eager travellers, they might not always be the best travel buddy. Some merchants and countries may not have the necessary infrastructure to process Discover cards, leaving you with a perplexed cashier and a less humorous travel tale. So, it’s a good idea to have a backup payment method on hand, just in case.

Foreign transaction costs for Discover credit cards

When using your Discover card internationally, it’s essential to be aware of potential fees and charges. These may include Discover foreign transaction fees, ATM fees, dynamic currency conversion, and credit card interest rates. Think of it as budgeting for your “international snack fund.” These transaction costs will vary, or not be present at all, depending on the Discover card you use, so take the time to research the terms and conditions of your card. However, diving a little deeper into some of the costs to expect when using your Discover card traveling internationally reveals the following:

1. Foreign exchange rate

Foreign exchange rates are the conversion rates used when making transactions in a foreign currency. When you use your Discover card abroad, the foreign exchange rate applied to your purchase is typically competitive. Discover provides exchange rates that are close to market rates, which means you’ll get good value for your money when making international purchases. It’s a transparent process, so you’ll see the rate used for each transaction on your statement.

2. ATM charges

When using ATMs abroad with your Discover card, you might incur ATM charges. These charges can include fees imposed by the local ATM operator and additional fees from Discover. To minimize costs, it’s a good idea to use ATMs that are within the Discover network’s partner banks. This way, you can avoid some of these extra charges.

3. Dynamic currency conversion

Dynamic Currency Conversion (DCC) is a service offered by some overseas merchants and ATMs. With DCC, you have the option to pay in your home currency instead of the local currency. While this may seem convenient, it often comes with unfavorable exchange rates and additional fees. To save on your international purchases, it’s usually better to decline DCC and choose to pay in the local currency.

4. Credit card interest rate

The credit card interest rate for your Discover card typically applies to outstanding balances. It’s important to note that this rate remains the same, whether you’re making purchases domestically or internationally. To avoid accruing interest, make sure to pay your balance in full and on time each month. This way, you can enjoy your international adventures without worrying about interest charges on your card.

Tips for using your Discover card internationally

To make the most of your Discover card while abroad, consider the following tips:

1. Report lost credit card

If your Discover card is lost or stolen during your overseas trip, don’t panic. Report it immediately. Discover provides robust security measures, ensuring you’re not left explaining mysterious vacation expenses.

2. Not liable for fraud

Discover offers protection against fraud, ensuring your peace of mind when using your card overseas. So, you can focus on your travel photos rather than your credit card statements.

3. Prior registration for international travel plan

To avoid any disruptions in card usage and make your Discover card feel like an international superstar, notify Discover of your travel plans. This simple step can help you enjoy a hassle-free experience abroad.

4. Look for merchants accepting Discover cards

Before making a purchase, check if the merchant accepts Discover cards. Think of it as a treasure hunt, but instead of gold, you’re hunting for cashless convenience.

FAQs

In case your Discover card is lost or stolen abroad, follow these steps: Yes, discover cards are suitable for international travel. They don’t charge foreign transaction fees, making them cost-effective and widely accepted in many countries. It’s wise to inform Discover about your travel plans to avoid usage issues. However, depending upon the country you are traveling to, it may not be necessary. Still, issuing a Discover international travel notice should always be a rule of thumb. The Discover it card typically does not charge international fees, which means you can use it abroad without extra costs.