What’s a Normal Amount of Debt and What’s Too Much?

About Molly

Molly is a finance writer based in Portland, Oregon. She also covers software and environmental issues and is always on the lookout for a good vegan donut.

Read full bio

At a Glance

On average, over a third1 of Americans’ monthly income goes toward paying off debt. From mortgages and student loans to credit cards, car loans, and personal loans, debt is definitely normal. Good debt, in fact, can boost our earnings potential and increase our net worth.

If you’re not comfortable about your debt, you’re not alone. According to Northwestern Mutual’s 2019 Planning Progress Study, 45% of adults admit debt makes them feel anxious on a monthly basis.2 Read on to see what debt looks like for the average American, see how yours measures up, and discover ways to settle problem debt.

Things to consider:

How much debt does the average American have?

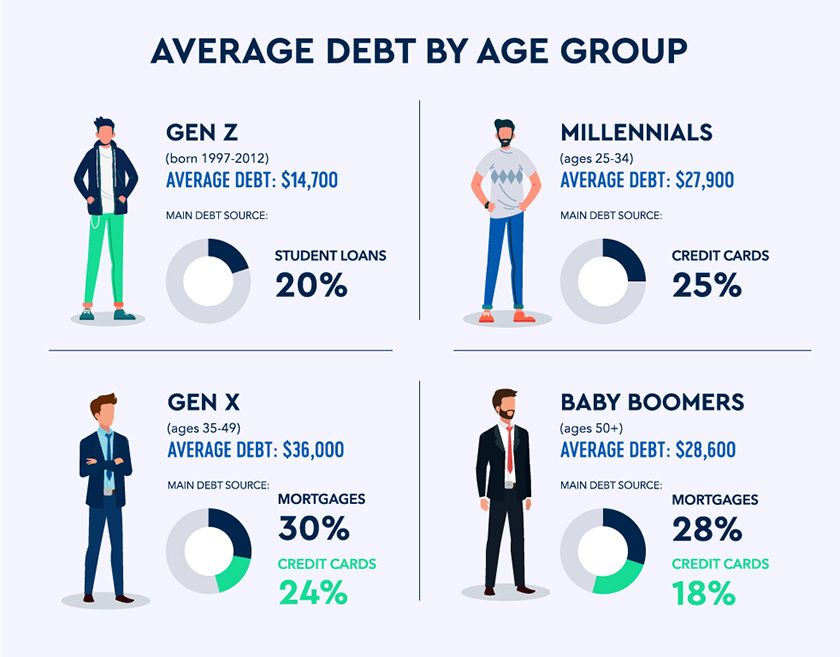

Americans carried an average of $29,800 in personal debt in 2019,3 excluding mortgages. This is down from $38,000 in 2018. An equal 22% of Americans cited both mortgages and credit cards as their leading source of debt (only 9% cited car loans and 8% personal education loans). However, what’s normal depends on age, as does the source of debt, which can change depending on stage of life.

Source: Northwesternmutual.com

Source: Northwesternmutual.com

Good debt vs. bad debt

Debt may be normal for the average American, but not all debt is equal.

The good

Examples of good debt include student loans, business loans, and mortgages. These loans offer low or fixed interest rates and increase your net worth, boost earnings, or offer future value. Often, interest rates on good debt are also tax-deductible.

The bad

High-interest credit cards with increasing balances (especially used to buy items like vacations or other discretionary items) and extended car loans (five years or more) are both examples of bad debt. These loans have high or variable interest rates and are used to purchase goods or services with no lasting value.

The toxic

A step beyond bad debt is toxic debt, made up of loans that have little chance of being paid back, or of being paid back with interest. Payday, car title, and no-credit-check loans are common examples of toxic debt, offering short repayment terms, sky-high-interest rates, and sometimes demanding valuable collateral (like your car).

Find your debt-to-income ratio

Your debt-to-income ratio (DTI) is all your monthly debt payments divided by your gross monthly income. The result is the percentage of your income that goes to making your monthly payments. Knowing this number is important to help determine next steps for tackling your debt.

If you’d like to do the math by hand:

- Add up your monthly debt payments (mortgage, student loans, car loans, credit cards, etc.)

- Divide your total monthly debt by your month gross income

- Multiply the resulting decimal by 100 to get your DTI percentage

DTI = Total of monthly debt payments Gross monthly income

- Less than 35%: This debt load is normal and within the range that’s considered manageable). You likely have money left over after paying your bills.

- 36% – 49%: This debt load is okay, but there’s room for improvement. Consider paying down debts to reduce this number.

- 50%+: This debt load is high. You have limited money to save or spend, making it harder to weather unexpected events or emergencies. Take action now.

How to reduce or pay off debt

Maybe you’re making regular payments, but your debt isn’t going down. Maybe you’re unable to save for retirement or set aside money for an emergency. While these are common signs of problem debt, there are many ways to tackle it.

Try a do-it-yourself plan to reduce your debt If most of your debt load is from credit cards, high-interest loans, or medical bills, consider these two basic DIY strategies:

- High-interest rate (also known as debt avalanche): Pay off your debts with the highest rate of interest as quickly as possible. This method can save you money in the long run.

- Debt snowball: Pay your smallest debts first, with the goal of paying them off as soon as possible, while paying the minimum on all your debts. This method can be extremely motivating, though you may pay more in the long run due to interest on larger debts. But seeing it in action may be just the motivation you need. Try using a debt snowball calculator to test whether this method is a good fit for you.

Try a debt management plan

If the majority of your debt comes from credit cards, and you’re finding it hard to reduce on your own, consider getting help from a nonprofit credit counseling agency. They can provide a debt management plan, which can cut interest rates (generally by half), consolidate payments, and extend your debt-payoff timeline.

Try to consolidate your debt

A personal loan or balance transfer can consolidate several debts into one at a lower interest rate. This requires good credit to qualify. Is Consolidating Your Debt a Good Idea?.

Negotiate a lower Annual Percentage Rate (APR) Every day, people regularly negotiate lower credit card interest rates. While this may seem intimidating, remember that your credit card wants to keep you as a customer. Get negotiating tips.

A debt consolidation loan could be the right method for you to become debt-free faster.

Find and compare the best loan options.

Use the filters below to refine your search

Sorry, we didn’t find any options that meet your requirements. Please try modifying your preferences.

Congratulations! You’re close to seeing your offers!

Please take a second to review the details you shared earlier

Sorry, we didn’t find any options that meet your requirements. Please try modifying your preferences.

When debt is too much

If your debt feels overwhelming, you’re not alone. To learn about your options for debt relief, including debt settlement, or bankruptcy, reach out to a nonprofit credit counseling agency. And remember: while debt can feel scary, addressing is the first step to getting back to normal.

Sources

Debt consolidation recommendationsExplore how consolidation can help

Loan payoff calculatorCompare DIY debt payoff methods

Source:

Source: